Monthly Housing Market Update

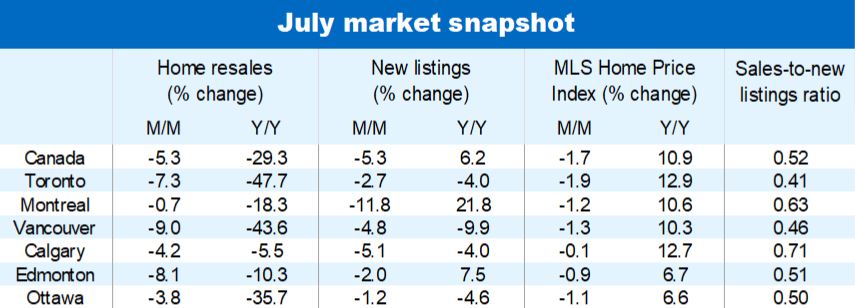

The pandemic may not be over but the pandemic-era housing market boom certainly is. Since the Bank of Canada began hiking its policy rate in March, home resales have fallen 31% and (benchmark) prices almost 6% nationwide, including monthly declines of 5.3% and 1.7%, respectively, in July. Most of Ontario and British Columbia have seen even greater drops. And the bottom is likely many months away still as our central bank has more work to do—we expect a further 100 basis-point rate increase to 3.5% by the fall. With the balance of power having dramatically shifted in their favour, buyers will be in a position to continue extracting price concessions from sellers for some time to come.

Ontario and BC: from hot spots to… downturn epicentre

Formerly overheating markets in Ontario and parts of the BC Lower Mainland have been the epicentre of the downturn to date. Cambridge (-17%), Kitchener-Waterloo (-16%), Brantford (-14%), London (-14%) and Guelph (-10%) have experienced the biggest declines in the composite MLS Home Price Index since the February peak. In dollar terms, the loss in value is striking, varying from $95,000 (Guelph) to $166,000 (Cambridge). Prices are also under heavy pressure in the Greater Toronto Area where the composite MLS HPI in down 7% (or $89,000) in the past five months. The Fraser Valley is leading the correction in British Columbia with the composite benchmark price falling 5.6% (or $65,000) since March, slightly more than twice the decline in the Vancouver area.

Cracks in other regions of the country…

In Quebec, gradually moderating activity is now taking the edge off prices. The composite MLS HPI fell slightly in the past two months in both Montreal and Quebec City, suggesting peak prices are likely behind us. It’s a similar story in parts of Alberta, Manitoba and Nova Scotia where the softening in prices began two or three months ago. We think these provide growing evidence a generalized downturn is underway in Canada.

…though market balance persists

Still, markets outside Ontario and British Columbia generally face a milder correction. As buyers in relatively affordable markets are less sensitive to interest rate hikes, we expect demand to be more resilient. The fact that home resales have so far remained above pre-pandemic levels in the Prairie Provinces and most of Atlantic Canada is a case in point. While likely to soften modestly, demand-supply conditions are well anchored in balanced territory in these regions.

Activity to cool further nationwide

The Bank of Canada’s outsized 100 basis-point rate hike delivered on July 13 threw ice-cold water on the market—disqualifying some buyers from obtaining a mortgage and shrinking the size of a mortgage others can qualify for. Our expectation for an additional 100 basis-point rate increase over the next two rate announcements in September and October will no doubt keep chilling things. We project home resales to fall 23% in Canada this year and a further 15% next year.

Bottom next spring?

We believe the market will adjust to higher interest rates by early 2023. Any recovery will likely take a few months to tighten demand-supply conditions, placing the bottom for prices around spring time (overall for Canada). We expect benchmark prices will be down approximately 12% from the recent peak nationwide. On a provincial basis, we think Ontario and British Columbia could record peak-to-trough declines exceeding 14%, and see Alberta and Saskatchewan at the other end of the scale with drops of less than 3%.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More