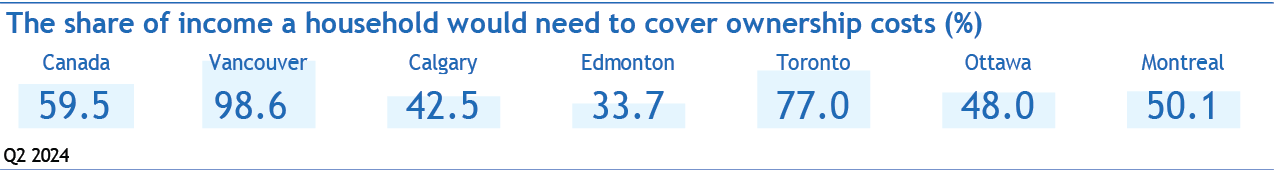

- Interest rate cuts reduced ownership costs in the second quarter. Mortgage payments, property taxes and utilities fell as a share of median household income in Canada to 59.5% from 61% in Q1 and 63.7% in Q4 2023.

- The slight improvement was broad based. RBC’s affordability measures inched lower in all markets we track except Saint John. (A decline in the measure represents a gain in affordability.) Victoria, Vancouver and Toronto recorded the largest drops.

- Intense affordability strains persist despite modest relief this year. Buyers continue to struggle to find a home they can afford in the aftermath of massive price escalation and spike in interest rates during the pandemic. Recent declines barely moved RBC’s affordability measures off worst-ever levels nationally and in many major markets.

- Improving trend likely to persist. The Bank of Canada is firmly engaged in normalizing monetary policy, and we expect further rate cuts will bring more relief to homebuyers in the coming months. Steady gains in household income will also help, along with upcoming regulatory changes allowing first-time homebuyers to choose 30-year amortization on insured mortgages.

Worst is behind us

The start of 2024 marked a turning point for housing affordability in Canada. Home prices flattened (or fell marginally in some markets), while fixed mortgage rates eased in anticipation of central bank rate cuts and workers sustained solid wage increases. These developments finally halted the historic runup in homeownership costs that took place during the pandemic.

The launch of BoC’s rate cutting mission in June solidified the inflection in Q2. For buyers, it meant that qualifying for a mortgage on the purchase of a home at the market price got a little easier. Nationwide, it took an income of $155,000 to carry a mortgage on the $810,200 price tag of an average (benchmark) home in Canada (assuming a 20% downpayment, 25-year amortization and 39% gross debt service ratio). That’s down from $161,000 at the end of 2023.

While encouraging, it’s still a giant hurdle to clear. The income needed in 2019 just before than pandemic hit was $96,000—or 38% lower (in nominal terms). That $155,000 in Q2 is almost double what the median household in Canada earned (which we estimate at $87,000). No wonder home resales have generally stayed dormant this year.

The qualifying income varies enormously across the country, reflecting the wide range of local home prices. Unsurprisingly, the toughest hurdles are in Vancouver ($273,000), Toronto ($226,000) and Victoria ($210,000) where property values are dearest.

The bar is significantly lower in Atlantic Canada and parts of the Prairies. To purchase an average home in Saint John (requiring an income of $75,000), Regina ($77,000), St. John’s ($79,000) and Winnipeg ($81,000), for example, buyers need an income that’s relatively close to what the median local household earn.

More progress on the way

The good news is ownership costs are poised to fall further in the period ahead. We expect the BoC to cut its policy rate by another 125 basis points to 3% by spring, which will pressure mortgage rates lower. In our base case scenario, home prices will see small increases, longer-term interest rates will moderately drop and household income will grow steadily but see diminishing gains until the end of 2025. This will lead to the reversal of more than a third of the massive deterioration in RBC’s aggregate affordability measure that happened during the pandemic.

Mortgage rule changes will offer new options to first-time homebuyers

The federal government’s recent announcement that all first-time homebuyers will soon (starting Dec. 15) be eligible to amortize an insured mortgage over 30 years (up from a maximum 25 years) could further ease monthly payment strains for some. Extending the amortization from 25 to 30 years would reduce monthly mortgage payments by approximately 8% on the purchase of a home at the national benchmark price. This means first-time homebuyers who opt for the longer repayment period could see more than half of the loss of affordability being restored by the end of 2025 under our base case scenario.

The downside, of course, is borrowers would carry their mortgage debt for longer, and pay more in interest (and insurance premiums) over the life of the mortgage. Not reducing the principal as quickly would also raise the sensitivity to interest rate changes in the future.

Any large scale take up of this new option could potentially heat up prices in some market segments—and ultimately, defeat some of the hoped-for benefits of the measure. First-time homebuyers represented 44% of mortgaged home purchases in Q1.

Victoria: Big drop in ownership costs comes well short

Ownership costs came down the most they ever have in the first half of 2024. But at 71.3% of the median household income, they remain sky high. RBC’s aggregate affordability measure is still the third-worst among the markets we track. And, this extremely tough situation for buyers continues to heavily constrain the volume of transactions taking place. Home resales are undershooting pre-pandemic levels by some 13% and recovering from cyclical lows only gradually. Meanwhile, inventories are rebuilding fast (from low a starting point). We expect balance between supply and demand will keep price trends relatively flat in the near term.

Vancouver area: Still in crisis territory

Vancouver is another market where sizable improvements in its affordability measure in the first two quarters failed to ease the plight of priced-out buyers. Back-to-back drops totaling 6.8 percentage points in the aggregate measure reversed just a fraction of the massive 41 percentage-point run-up during the pandemic, maintaining its level (an astounding 98.6% in Q2) in crisis territory. It’s no surprise that market activity hasn’t carried any momentum to speak of this year, trending sideways just above cyclical lows. We think prices could come under pressure in the latter stages of 2024 with inventories having largely renormalized to 2019 levels and supply-demand conditions tilting in buyers’ favour.

Calgary: Cooling signs creeping up

Calgary is one of the stronger housing markets in the country this year. Explosive population growth keeps the volume of sales transactions hovering near pre-pandemic peaks and property values appreciating solidly. Still, there have been cooling signs creeping up. The sharp loss of affordability since 2020 no doubt is weighing on a growing number of buyers. RBC’s aggregate measure reached a 15-year high in 2023, and small declines since then haven’t altered the picture much. The latest reading for the aggregate measure (42.5%) indicates ownership costs pose greater-than-usual stress—albeit it still compares favourably to most other major markets.

Edmonton: The vitality of the market stands out

Edmonton stands out even more among the larger Canadian markets. Home resales are pushing closer to all-time highs, while ownership costs pose limited issues. RBC’s aggregate affordability measure (33.7%) is just over half the national average (59.5%) and only slightly above the area’s long-run average (32.3%). Rapid turnover keeps inventories on a downward trajectory, and the balance between supply and demand is tight and favourable to sellers. We see these conditions persisting in the near term as in-migration stays strong, which is likely to drive home prices upwards.

Saskatoon: Carrying impressive momentum

This Prairie market is sustaining impressive momentum thanks in large part to a booming population. Resale activity this year is up 5% from a year ago and, more importantly, up about 25% from the levels just before the pandemic. Manageable ownership costs are also likely a factor fueling demand. After edging lower in the first two quarters, RBC’s aggregate affordability measure (32.2%) has returned closer to the area’s historical norms—suggesting moderate barriers to entry. We expect relatively tight supply will keep the stage set for further solid price gains in the period ahead.

Regina: Driven by solid fundamentals

Strong population growth and relatively affordable housing costs are also driving up demand significantly in Regina. The volume of resale transactions this year rose within an earshot of (frenzied) early-pandemic levels. RBC’s aggregate affordability measure for Regina (27.1%) is the best among the markets we track and in line with the long-run average (27.3%). But exceptionally tight supply-demand conditions could heat up prices and take some of the shine off affordability in the coming months.

Winnipeg: Fully recovered but stretched affordability an issue

The market has largely recovered from the interest rate shock. Home resales have returned to pre-pandemic levels since spring and prices have risen solidly all year. A massive inflow of newcomers is fueling demand, though stretched affordability may be sending many potential buyers to the sidelines. RBC’s aggregate measure—while improving slightly in Q2—stands close to its worst level in more than 30 years at 32.2%. Buyers could stay there for a while longer if low supply persists and further heats up prices.

Toronto area: Sky-high costs keep market lethargic

Owning a home got more affordable this year but that failed to energize the market. The reason is simple: ownership costs are still prohibitive for most potential homebuyers. It would take an ordinary (median) household 77% of its income to cover the costs for a home at the aggregate benchmark price. Such strains are holding back the market’s recovery. Home resales have stood still since spring. Yet, more options are becoming available for buyers. A growing number of properties are being listed for sale (especially condos) and inventories are rising. With the supply-demand balance tipping in buyers’ favour, prices have largely stalled. Condo values are even eroding somewhat. We expect downward price pressure to persist in the near term.

Ottawa: Speed of affordability improvement may disappoint

It’s a slow grind this year in the Ottawa market. Home resales are recovering only gradually from their 2023 cyclical low—and still running about 10% below pre-pandemic levels—while price action has been largely muted. Demand is soft as homebuyers contend with some of the toughest affordability conditions on record, despite welcome relief in the past two quarters. RBC’s aggregate measure eased to 48% in Q2 from an all-time high of 52.1% at the end of 2023. Lower interest rates, and the balance between demand and supply are poised to further improve affordability in the year ahead. The extent and speed at which it will occur, however, may disappoint many potential homebuyers.

Montreal area: Some progress but long road ahead

The market recovery is back on track. After stalling this spring, the volume of transactions picked up in recent months, thanks in part to lower interest rates. But, there’s still a long road ahead. Home resales have so far reversed less than half their slide triggered by the BoC’s earlier rate hikes. Further progress is likely to be measured as elevated ownership costs pose a significant obstacle to many homebuyers for some time to come. While inching lower this year, RBC’s aggregate affordability measure (50.1%) has been firmly stuck near a decades high since early-2023. At least, buyers have increasing options to choose from as sellers enter the market in healthy numbers and inventories rebuild.

Quebec City: Buyers not fretting much about high housing costs

Homebuyers aren’t fretting much about the past three years’ increases in housing costs in the Quebec City area. The number of transactions made in Q2 was up 8% from a year earlier—extending an ascending trend that started in 2023. Tight supply demand conditions continue to propel prices modestly higher, which limits the improvement in affordability to date. RBC’s aggregate measure (33.6%) is still close to a three-decade high.

Saint John: Stuck in a rut

The market has been stuck in a rut since the start of 2023 with the volume of transactions consistently running between 20% and 30% below pre-pandemic levels. This isn’t for a lack of potential demand. The flow of newcomers in the past two years has been exceptionally strong. Rather, we think the significant loss of affordability since the pandemic is weighing heavily on the mind of would-be buyers. Ownership costs aren’t exorbitant per say—they’re still at the lower end of the markets we track. But, they just came off their highest point in decades at the end of 2023 as a percentage of median household income, down only slightly since then. RBC’s aggregate measure stood at 33.6% in Q2, little changed from Q1.

Halifax: Market recovery on a slow track

It’s a similar situation in Halifax where challenging affordability conditions trump strong demographic drivers, which is keeping the market recovery on a slow track. Local homebuyers face near record-high ownership costs—and some of the steepest in Canada (though far behind It’s a similar situation in Halifax where challenging affordability conditions trump strong demographic drivers, which is keeping the market recovery on a slow track. Local homebuyers face near record-high ownership costs—and some of the steepest in Canada (though far behind Vancouver, Victoria and Toronto). They also struggle to find homes for sale as new listings and inventories are running historically low. The resulting scarcity of supply during the unprecedented population boom Halifax is experiencing is keeping home prices largely afloat. This trend is bound to persist until either inventories rise materially or migration inflows abate. RBC’s aggregate affordability measure eased modestly by 1.4 percentage points to 45.5% in Q2.

St. John’s: Riding a giant in-migration wave

St. John’s housing market continues to ride a giant in-migration wave that has boosted population growth to its fastest pace in memory. The number of sales transactions this year exceeded pre-pandemic levels by more than 35%. Activity could be even stronger if it weren’t for low supply. New listings have sagged this year and inventories hover near decades lows, leaving many buyers starved for more options. Higher ownership costs are pinching, but much less than in other markets. RBC’s aggregate affordability measure was 28.9% in Q2—the second lowest among the markets we track. We expect prices to continue to appreciate modestly in the period ahead.

Read the full Housing Trends and Affordability report for extensive market-by-market analysis.

Download the Report

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.