Monthly Housing Market Update

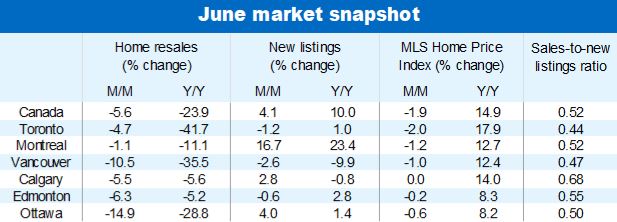

Canadian home prices are dropping faster and faster, especially in Ontario and parts of British Columbia as big interest rate hikes increasingly take a toll on buyers. The national aggregate MLS Home Price Index recorded its largest-ever one-month decline (-1.9%) in June, following drops of 1.0% in April and 0.5% in May. The price correction is concentrated in Ontario where the MLS HPI fell in all markets last month—significantly so in cottage country, London, Woodstock, Kitchener-Waterloo and other areas that saw tremendous appreciation during the pandemic. Property values are also trending down more rapidly in British Columbia’s Interior and Lower Mainland regions with June marking the steeper drop in the MLS HPI of the past three months.

Price correction is spreading

Other parts of the country are now beginning to see softening prices. The MLS HPI fell in Winnipeg, Montreal and Quebec City from May to June, which we think will mark a turning point. Calgary and Halifax may not be far behind with the index largely flat last month. These developments fit our view that property values will come under increasing downward pressure across Canada over the coming months with pricier markets on the front line of that trend.

Activity continues to moderate

Earlier (super) tight demand-supply conditions are easing rapidly. Home resales in Canada are down 27% since February, including a 5.6% m/m drop in June. This occurred while the number of homes put up for sale increased slightly, giving buyers more options to pick from—and significantly reducing the degree of competition between them. Resale activity fell in the vast majority of markets between May and June with the few exceptions mainly found in Quebec and parts of Atlantic Canada. Declines were strongest in Ontario and British Columbia—as was the case in previous months—where buyers are most sensitive to the rise in interest rates.

More cooling on the way

The outsized 100 basis-point rate increase the Bank of Canada delivered on July 13 will no doubt chill the market even more in the coming months. Higher mortgage rates will spoil or delay homeownership plans for many buyers, especially in British Columbia and Ontario where affordability is particularly stretched. The prospects for further rate hikes—we believe our central bank will raise its policy rate to restrictive levels by the fall—will deepen the correction in both provinces, and broaden it to other parts of the country. We project home resales to fall 34% and benchmark prices by close to 13% by early next year in Canada.

Uneven impact of higher interest rates

The local market impact of higher rates will be uneven, though. We expect the pricier—and more interest-sensitive—markets (e.g. Vancouver and Toronto) and housing categories (e.g. single-detached homes) to face larger declines, while relatively affordable areas (e.g. Calgary, much of Atlantic Canada) and options (e.g. condos) to show greater resilience. On a provincial basis, we think Ontario and British Columbia could record peak-to-trough benchmark price declines exceeding 14%, and see Alberta and Saskatchewan at the other end of the scale with drops of less than 3%.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More