Monthly Housing Market Update

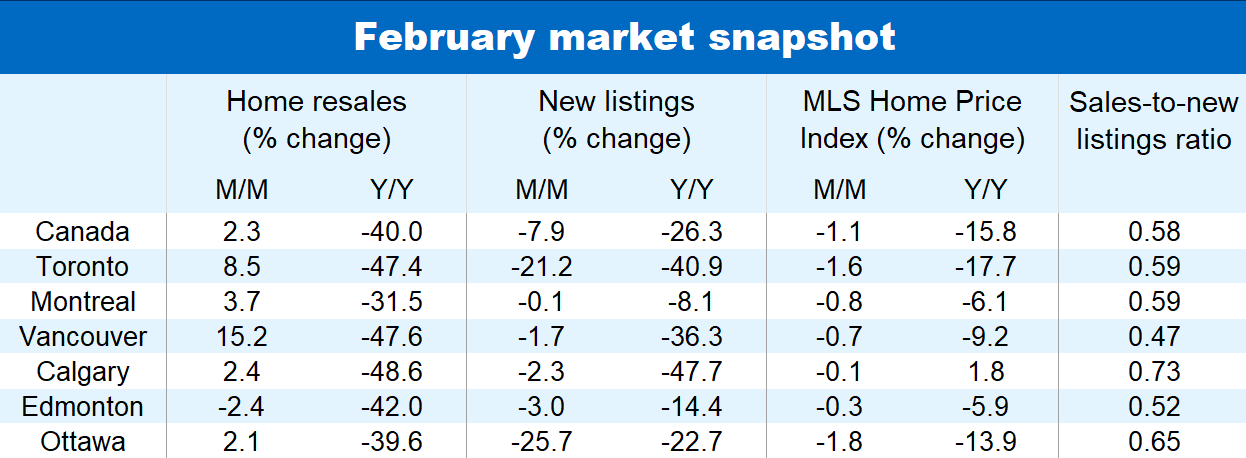

It increasingly looks like Canada’s housing market is finally finding its footing—at least from a transaction volume perspective. The precipitous slide in home resales has been easing significantly in recent months. February results even showed a slight 2.3% increase from January to 403,400 units (annualized). We think it points to a nearby bottom in many local markets.

This isn’t stopping the price correction for now, though. The national composite MLS Home Price Index fell another 1.1% m/m in February, marking the 12th-straight monthly decline. The pace did ease a little from an average of -1.5% in the previous six months but for the most part the trajectory is still unambiguously down, especially in Ontario and British Columbia.

A sharp drop in new listings and concomitant tightening in demand-supply conditions in February could signal a moderation in price declines over the coming months. If sustained, it would support our view that prices will bottom sometime in the summer or shortly thereafter (with the timing varying by market).

Market isn’t flooding with properties for sale, quite the contrary

The 7.9% plunge in the number of homes put up for sale last month was striking. It certainly ran counter to fears that soaring interest rates would trigger a wave of sellers. More to the point, it was markets in Ontario and British Columbia (which are likely under the more intense pressure from higher interest rates) that recorded the larger drops. While this was a continuation of a well established downward trend over the past year, we suspect the magnitude of the swing in February was an anomaly.

Activity still depressed despite monthly advance

Buyers shrugged off any supply dip last month. Resales rose in all major markets, including Vancouver (up 15.2% m/m), Calgary (up 2.4%), Regina (up 6.8%), Toronto (up 8.5%), Ottawa (up 2.1%), Montreal (up 3.7%) and Halifax (up 2.3%). Still, these increases did little to alter the bigger picture: activity remains generally depressed—at decades low levels (excluding the shutdown period) in some cases.

Widespread price declines

Price trends were largely unchanged in February. Property values continued to fall in the vast majority of local markets. The correction so far has been strongest in Ontario and British Columbia. Since the peak a year ago, the MLS HPI has plummeted 19% in Ontario and almost 13% in BC—both exceeding the 16% decline nationally. Smaller Ontario markets have led the way, namely London (-25%), Cambridge (-25%), Kitchener-Waterloo (-24%), Brantford (-23%), the Niagara region (-23%), Hamilton (-22%) and Barrie (-22%). The index is off 18% since the peak in the Toronto area.

The Fraser Valley (-20%), Okanagan Valley (-12%) and the Vancouver area (-10%) experienced material price drops in BC.

Most markets in the rest of Canada continue to face mildly declining prices. Calgary is among the few bucking that trend—albeit just barely—with the MLS HPI remaining largely flat over the past year (up a slight 1.8%).

Bottom in sight but no snapback

Our view is that home resale activity will be first to stabilize followed by prices a few months later—provided the Bank of Canada is done raising interest rates (our base case). What happens next will disappoint housing bulls. We see the recovery phase starting slowly later this year as affordability issues and a weaker economy continue to hold back buyers. The pace should progressively pick up in 2024 once the economy clears its soft patch, inflation returns to target and the Bank of Canada reverses part of the massive rate increases it’s imposed since March 2020.

Booming immigration will fuel demand through the medium term (and possibly beyond), raising the odds of deep supply shortages in the future if homebuilding fails to pick up materially. See Canada’s housing market outlook: The bottom of the downturn is in sight for our latest housing market forecast.

See PDF with complete charts

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More