There continues to be few signs Canada’s housing market is about to pause or even slow down in a material way. The back-to-back monthly home resales declines in October and November totaling 2.2% hardly register as a softening. They came off an all-time high in September. Last month—a normally quieter time of year—was the strongest November on record by a long-shot, exceeding the previous mark (set in 2018) by more than 30%.

Unrelenting demand for detached homes

Rock-bottom interest rates and changing housing needs triggered by the pandemic are still driving many Canadians to buy a home. Not just in major markets but almost everywhere across the country—suburbs and small towns included. Supercharged demand is bumping up against limited supply. Bidding wars are commonplace, and have become fiercer. Prices for coveted single-detached homes are rising fast and we see little that will rein them in anytime soon. Some of the stronger price increases are taking place in smaller markets one- or two-hours’ drive (or more) from major cities, which are attracting buyers who can work from home or are looking for a vacation property.

Downtown condo market is soft

The downtown condo market remains a weak spot. As we noted in previous commentaries, many condo investors have been hit hard by the downturn in the rental market (both long-term and short-term) and are offloading their units. Soaring supply caused condo prices to plateau since the start of the pandemic in the Greater Toronto region and Vancouver with declines seen in some downtown locations. We expect prices to weaken further in the near term. With immigration largely stalled and unemployment remaining high among lower-income Canadians, we see little that will boost rental demand in short order.

Smaller markets’ heat could pose affordability challenges

We expect detached-home supply will tighten further over the coming year as the Covid-induced churn in the market fades. This will increasingly restrain activity and sustain upward pressure on prices. As smaller markets become pricier, issues of affordability are poised to surface outside Canada’s biggest cities. The potential degree of affordability strain in smaller markets will depend on the speed with which home builders will be able to respond to increased demand.

Vaccines are unequivocally positive news but uncertainty remains

Vaccinations are getting underway and this is unequivocally good news. We believe it will lead to a gradual easing of restrictions and an acceleration of the economic recovery. A stronger economic environment will benefit Canada’s housing market. Still, a high degree of uncertainty will persist for some time. We see both upside and downside risks depending on how work-from-home trends, interest rates, immigration, mortgage payment deferrals and COVID-19’s second wave unfold.

November market highlights

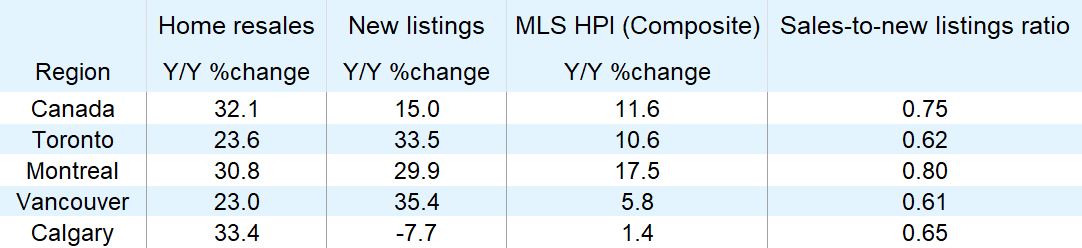

- Home resales still sky-high: They lost just a bit of altitude Canada-wide in November relative to October (down 1.6%) but stayed 32% above year-ago levels. The story was the same across the country. Almost all major markets recorded declines from October—including Ottawa (-8.4% m/m), Vancouver (-4.7%), Toronto (-2.1%), Calgary (-2.0%) and Montreal (-1.8%)—yet this reversed just a fraction of earlier gains. Activity remained 23% to 33% above where it was in November 2019. Halifax-Dartmouth (+0.9% m/m), Saskatoon (+0.9%) and Quebec City (+0.6%) were among the few bucking the trend.

- Lack of supply was a constraint: A 1.6% m/m drop in new listings across the country likely held back activity last month. Despite rising significantly in the past year (up 15%), new listings have come short of soaring demand, leaving limited options for buyers. The main exception was the downtown condo segment of major cities where exiting investors have put plenty of units up for sale.

- Demand-supply conditions are as tight as ever: Total inventories represented just 2.4 months of supply in November—the lowest level in at least two decades. The sales-to-new listings ratio nationwide stood at 0.75, barely off the record high (0.77) set in September. Sellers clearly maintain a strong hand in negotiating prices, except those selling downtown condo units who are facing substantial competition.

- Detached home prices keep escalating: They surged 14.1% y/y or nearly triple the 4.8% rate for condo prices. Canada’s composite MLS Home Price Index (HPI) climbed 11.6%, led by strong appreciation in Ontario, Quebec and parts of Atlantic Canada. Prices have turned a corner in Alberta with MLS HPIs above year-ago levels in both Calgary and Edmonton. Condo prices have flattened in Vancouver and Toronto since the pandemic began.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More