Highlights:

- Home resales tumble to a generational low: They plunged 57% nationwide from March amid lockdowns and other measures to contain the spread of COVID-19. All markets but Newfoundland and Labrador experienced 40% to 80% monthly declines. The 199,000 units sold (seasonally-adjusted and annualized) in Canada in April were the smallest tally since September 1984 when our country’s population was one-third lower.

- April likely to be a cyclical low point: Preliminary data for early-May show a modest uptick in activity. An easing of restrictions in parts of the country will support further gradual recovery.

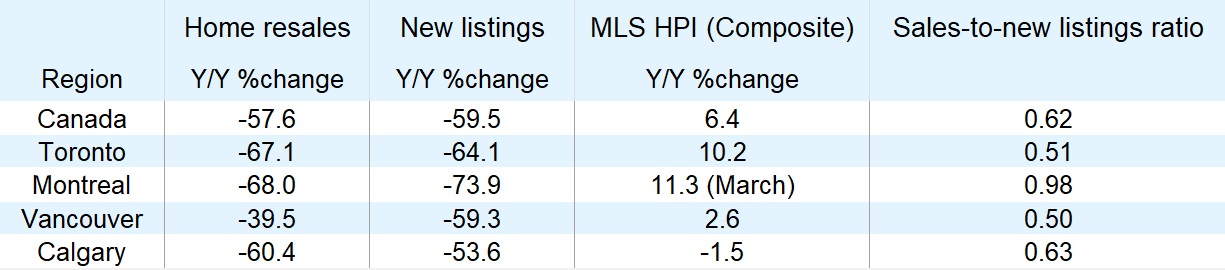

- COVID-19 hasn’t created imbalances… so far: That’s because supply fell in line with demand. New listings plummeted 56% between March and April in Canada, keeping the sales-to-new listings ratio little changed at 0.62—a level consistent with steady support for prices.

- Property values still holding up for the most part: Though there were early signs of softening in April with the rate of increase in Canada’s MLS Home Price Index slowing slightly to 6.4% y/y from 7.1% in March. Modest decelerations were recorded in several markets including Toronto, Ottawa and Victoria. The rate of price decline accelerated in Calgary and Edmonton.

- Downward price pressure likely to build: The severe economic shock is upsetting the plans of many Canadians to own a home at a time when a growing number of sellers could be running out of options once extraordinary financial support measures end in a few months.

- Market entering the recovery phase but activity won’t snap back: Authorities will proceed cautiously in reopening the economy. The housing market is poised to parallel the economic recovery—gradual and uneven.

A huge hit but not for demand-supply conditions

Lockdowns and strict social distancing measures put in place mid-March across Canada were in full force during the entire month of April. So it wasn’t a surprise the housing market experienced unprecedented disruptions last month—despite the real estate industry not being shut down outright in most provinces. Buyers and sellers moved to, or stayed on the sidelines in large numbers, as they had done in the second half of March. The fact both sides of the demand-supply equation fell in virtually equal proportions—resales plummeted 57% from March and new listings 56%—revealed an important characteristic of COVID-19. To date it hasn’t created market imbalances. In fact, the relationship between demand and supply has changed little since February both nationally and in most local markets. What was tight remains generally tight and the few soft markets didn’t get much softer. This explains why home prices haven’t cratered in the face of generational low levels of activity.

This is as bad as things will get for resales…

The Canadian Real Estate Association said early results for first half of May show small increases in both resales and new listings. This is in line with our view that April will be the cyclical low point in terms of activity. Provinces are beginning to relax some restrictions—including Quebec earlier this week lifting its lockdown orders on the real estate industry—which will help house hunting function a little more normally going forward in parts of the country. Exceptionally low interest rates will also contribute to a gradual recovery taking hold in most markets across Canada.

…though there’s more to come on the pricing story

We see little risk of a widespread collapse in property values near term. Most markets started in a position of strength (tight demand-supply conditions), which provides some cushion against a sudden correction. Still, the severity of the economic shock threatens to erode market balances later this year. The shock is likely taking an enormous toll on the next cohort of first-time homebuyers, whose ability to save for a down payment has been impaired. Many of them have lost their job or seen their work hours reduced significantly. Economic hardship is also no doubt taking a toll on a number of current homeowners. Some of them might run out of options once government support programs and mortgage payment deferrals end, and be compelled to sell their property. We expect demand-supply conditions to deteriorate and downward price pressure to build somewhat despite the economy and labour market being projected to improve gradually over the second half of 2020.

Oil-producing regions most at risk

The outlook is bleaker for markets in oil-producing regions of the country. The collapse in oil prices compounds the economic impact of COVID-19 and will significantly restrain the recovery in the period ahead. We expect unemployment will remain higher for longer in these regions, which will erode demand-supply conditions more significantly. Property values in Calgary and Edmonton were already trending lower prior to this crisis. They’re at risk of falling more precipitously in the period ahead.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More