As expected, last month marked a further moderation in home resale activity in Canada, falling for a third-straight month. Though we can’t really talk about cooler conditions yet. Resales were the strongest ever for June, demand-supply conditions still heavily favoured sellers—with multiple bids common across much of the country—and prices continued to rise broadly. The moderation said more about the unsustainable, sky-high levels of activity earlier this year than a return to normalcy in the market. Moreover, new listings have also dipped in the last three months, suggesting some supply constraint might be contributing to this slowdown. This winter’s epic wave of bidding wars has no doubt fatigued or discouraged many buyers but there are still a record number of them ready to pounce on the right opportunity. Exceptionally low interest rates, changing housing needs and high household savings continue to stoke homebuyer demand at this stage.

Home prices keep going up…

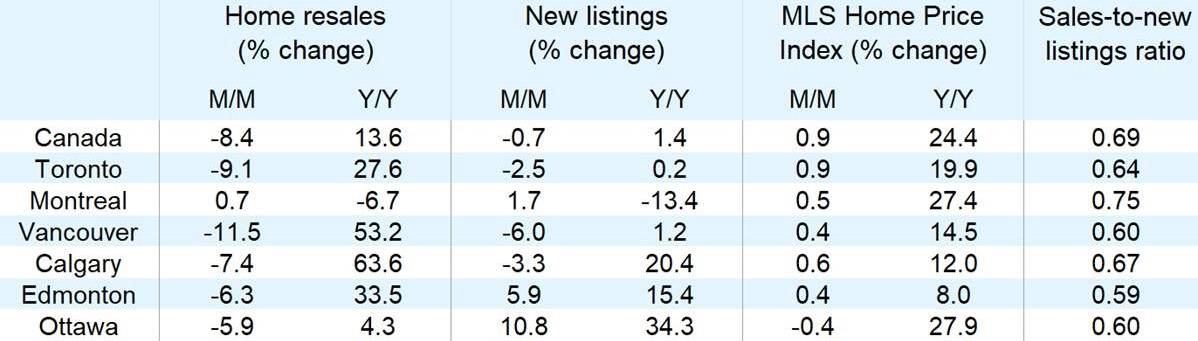

While bidding wars are reportedly attracting fewer participants in some parts of the country, competition between buyers remains fierce. This maintains significant upward pressure on prices. The composite MLS Home Price Index (HPI) for Canada rose again in June. It was up 0.9% from May and an astounding 24.4% from June 2020. The good news, perhaps, is the monthly rate of increase was the slowest in the past year. It’s been easing successively since reaching an all-time high of 3.0% in February. We expect this will temper year-over-year gains later this year.

…with some markets potentially seeing some resistance

Properties got pricier in the vast majority of markets in June. Areas known as cottage country recorded some of the stronger monthly increases, including Bancroft (up 5.9% m/m), Kawartha Lakes (up 2.6%) and Peterborough (up 2.1%)—possibly reflecting some buyers’ desire to access seasonal getaways in the face of continued travel restrictions. Home prices also climbed solidly in many markets in New Brunswick, British Columbia, southern Ontario and Manitoba. These latest advances drove year-over-year gains above the 30% mark in half the markets tracked by the Canadian Real Estate Association—and several exceeded 40% in Ontario, including Bancroft, Brantford, North Bay, Quinte, Southern Georgian Bay, Tillsonburg and Woodstock-Ingersoll. Still, buyers in some markets may be starting to resist further appreciation. The MLS HPI slipped month-over-month in Woodstock-Ingersoll (-0.4%), Ottawa (-0.4%), Saint John (-0.3%) and St. John’s (-0.1%). These could be early signs prices are approaching cyclical peaks.

Generalized slowing in activity

Resales fell from May to June in all but one major market (Montreal). The breadth of the slowing was entirely expected given record-high levels reached earlier this year were across the board—a rarely-seen phenomenon in real estate, where local conditions tend to vary widely. This was accompanied by (or partly resulted from) a drop in sellers in most cases. The Fraser Valley area was a good illustration of this where resales (-28.6% m/m) and new listings (-16.7%) fell markedly last month. It was a similar—albeit less dramatic—story in Vancouver and Toronto. Montreal bucked the trend with small rises in both. The upshot of congruent movements in demand and supply is that sellers remain in command across the country. This will maintain upward pressure on prices in the coming months. It will be interesting to see whether more sellers will show up in the coming months as pandemic restrictions ease and higher prices make for a sweeter inducement to sell.

June Market Highlights

- Third-straight moderation in home resales: They fell 8.4% in Canada from May to 609,700 units (seasonally adjusted and annualized). The pullback was widespread, led by the Fraser Valley (-28.6% m/m), Hamilton-Burlington (-16.2%), Kitchener-Waterloo (-11.6%), Vancouver (-11.5%) and Halifax-Dartmouth (-10.7%). Montreal bucked the trend with a modest 0.7% increase.

- Fewer homes listed for sales: New listings dipped for a third-consecutive time by 0.7% nationwide. Declines were recorded in a majority of markets, including Quebec City (-28.1% m/m), the Fraser Valley (-16.7%) and Saskatoon (-11.4%). Halifax-Dartmouth (up 53.9%), Ottawa (up 10.8%) and Edmonton (up 5.9%) were among those posting increases.

- Still a seller’s market… everywhere in the country: The sales-to-new listings ratio in Canada (0.69 in June) continues to heavily favour sellers, though it eased from May (0.75). The ratio depicted a seller’s market in every local market.

- Property values to generally rise further in the near term: Canada’s composite MLS Home Price Index increased 0.9% in June to $726,900. The index was up 24.4% from a year ago, the strongest rate of increase ever for the index, and a further acceleration from 24.2% in May. We expect tight demand-supply conditions will keep property values appreciating in the coming months though a few markets show tentative signs of topping up.

See PDF with complete charts

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.