Monthly Housing Market Update

Highlights:

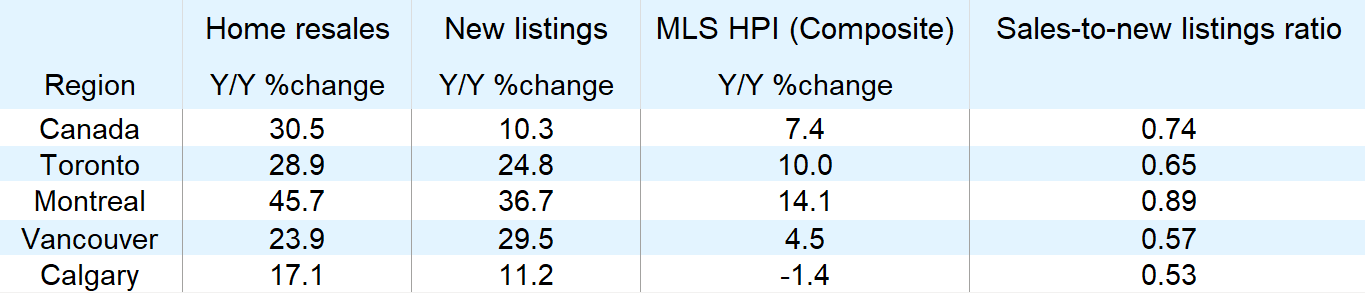

- Home resales surpassed pre-COVID levels… by a mile: Activity surged 26% month over month (and 30.5% year over year) across Canada to a new all-time high of 637,000 units (annualized) in July. Virtually all local markets recorded strong increases—albeit from weak levels in June—fueled in large part by pent-up demand created by COVID-19 lockdowns this spring.

- Demand-supply conditions the tightest in almost two decades: Buyers far exceeded sellers last month. The sales-to-new listings ratio jumped to 0.74 Canada-wide—the highest it’s been in 18 years. If sustained at this level, it would signal intense upward pressure on prices. Sellers were firmly in control in almost all markets east of Saskatchewan. Supply was especially low relative to demand in Ontario and Quebec.

- Prices heating up: Canada’s MLS Home Price Index (HPI) rose 7.4% year over year—the fastest rate of increase in more than 30 months. Ottawa (up 18.4%) and Montreal (up 14.1%) continued to lead the country though most of southern Ontario, including the Greater Toronto Area, narrowed the gap with double-digit increases. Calgary (-1.4%) and Edmonton (-1.2) are the only major markets where the MLS HPI is still down relative to a year ago.

- COVID-19 turned seasonal patterns upside down: The pandemic muted this year’s spring market and shifted activity into the summer, a traditionally slower period. We expect further unwinding of pent-up demand to keep sales brisk in August and perhaps September before cooling later this year.

Delayed spring activity fires up the summer market

The answer came in loud and clear: COVID-19 did not destroy this year’s spring market—it mostly delayed it. Until now, it was unclear how many of the historic drop in transactions in March through May would be lost permanently. July housing market figures published today by the Canadian Real Estate Association suggest possibly half of them took place last month alone. We estimate COVID-19 created pent-up demand for possibly up to 70,000 units across Canada this spring. The shifting of activity has supercharged virtually all local markets last month. Toronto (+49.5% m/m), Vancouver (+43.9%), Montreal (+39.1%) and Ottawa (+28.7%) recorded huge sales increases relative to June. Ottawa and Montreal, in fact, reached record-high levels. So did Regina and Moncton. Toronto came close. July was the strongest month in almost three years in Vancouver, Calgary and Edmonton—closer to six years in Saskatoon. Smaller markets from coast to coast also were unusually busy.

RBC Senior Economist Robert Hogue joins the 10-Minute Take podcast to share his outlook on the housing market.

Listen on Apple Podcasts, Google Podcasts or Spotify.

Sellers generally in control

Demand-supply conditions got a lot tighter Canada-wide. A solid 7.6% month-over-month increase in new listings last month came in well short of surging demand. The sales-to-listings ratio—a reliable gauge of price pressure—jumped to a record-high 0.74. Sellers gained the upper hand in almost all markets east of Saskatchewan, and in parts of British Columbia. The remaining markets showed generally balanced conditions. There is nothing to indicate any imminent slump in prices. On the contrary, super tight conditions in Halifax, Montreal, Ottawa, most of southern Ontario, Winnipeg and Victoria, if sustained, are likely to lead to a further price acceleration in the near term.

How long can pent-up demand drive the market?

We believe there’s still pent-up demand left to satisfy. This is poised to keep the market humming in August and possibly September. We expect the phasing out of CERB and other financial support programs, high unemployment and lower in-migration to cool housing demand later this year, however. From that point on, we expect activity to track a lower baseline in many markets.

COVID-19 has altered local market dynamics

We’re also likely to see trends diverging across local markets. We expect greater resilience in lower density markets outside Canada’s large urban cores. The pandemic has boosted demand for properties offering more space for working from home. Smaller markets where such properties are more affordable will particularly benefit from this trend. There might be diverging trends even within urban cores, where the condo segment’s prospects could be adversely affected by a drop in immigration. The recent softness in the rental market in Toronto, for example, is in part due to weaker immigration (newcomers to Canada typically rent during their first few years in this country).

Price outlook: near term versus longer term

We see little that can stop the appreciation in property values near term. If anything, many markets are likely to experience further acceleration. That said, we continue to believe the eventual shift to a lower demand baseline later this year will have a cooling effect on prices—most likely by the early stages of 2021. We expect lower immigration and increased condo supply in core urban areas to concentrate any weakness on the high-rise condo segment. Other segments could also come under downward pressure if the pandemic worsens or the economic recovery runs into trouble.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More