Canadian GDP stronger in January ahead of escalating trade risks

By Nathan Janzen

The Bottom Line:

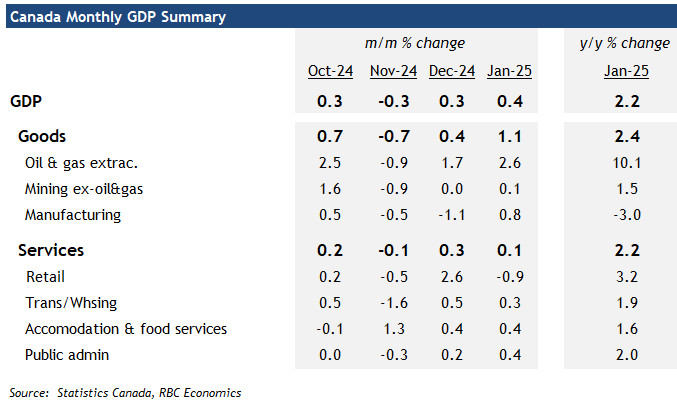

The 0.4% jump in January GDP broadly confirmed the economy started 2025 on a firmer footing, and leaves Q1 GDP growth tracking close to double our own forecast for a 1.1% annualized growth rate. The monthly increase was the largest gain since April 2024, and with population growth slowing, it was the first time per-capita output (per population 15+) has increased in two straight months in 2 1/2 years.

Better looking backward data is less relevant given escalating trade risks and plunging consumer confidence into March. Most available measures of actual economic activity haven’t yet looked as weak as those sentiment readings. The early estimate for February GDP today is “essentially unchanged” after the rise in January. Our own tracking of card transactions does not yet show a sharp pull-back in spending to mid-March, and job openings still look better than late last year in March.

But international trade risks continue to cloud the outlook with the details behind another round of expected tariff announcements next week having the potential to significantly impact the Canadian economic growth outlook (see here for more).

The Details:

There were some one-off factors that boosted January output. Some of the increase may have reflected inventory building ahead of escalating international trade risks. Manufacturing output rose 0.8% to partially retrace declines in the two prior months.

A bounce-back in postal services after earlier labour disruptions boosted transportation activity. And utilities output rose on colder than usual weather in parts of the country and an easing in drought conditions that limited hydro power generation in earlier months.

But gains were relatively broadly based across other industries as well.

Household spending indicators were mixed but broadly still positive. The retail sector pulled back 0.9% but that only partially retraced a 2.6% surge in December and activity in accommodation and food services (+0.4%) and arts, entertainment, and recreation (+1.1%) continued to rise in January. A drop in home resales weighed on the real estate sector.

Mining output jumped 1.8%, boosted by a 2.6% rise in oil & gas extraction. And construction activity expanded by 0.7%, with gains in both residential and nonresidential buildings.

See previous versions:

By Abbey Xu

The Bottom Line:

-

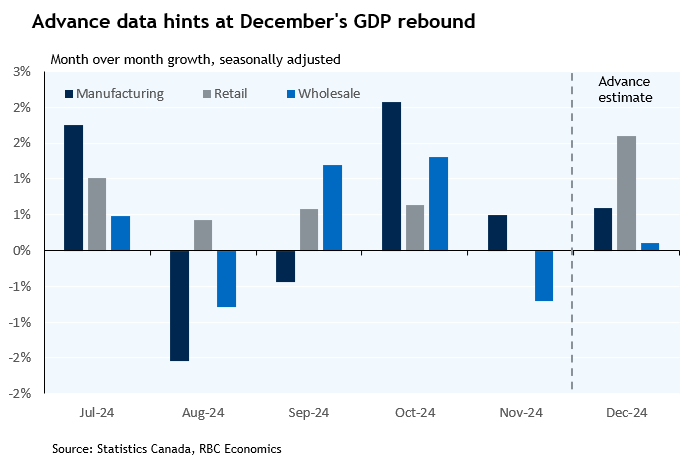

The contraction in Canadian GDP in November was largely as-expected, and the advance estimate that output increased in December is consistent with the Bank of Canada’s updated forecasts released earlier this week.

-

We continue to think that the BoC will need to cut interest rates further to support a Canadian economy that is still underperforming other advanced economies with the timing and magnitude of potential U.S. tariffs representing a significant additional downside economic growth risk.

The Details:

-

Economic activity retreated (-0.2%) in November, following a 0.3% expansion in October, slightly below both our projections and StatsCan’s preliminary estimate of a 0.1% decline.

-

Much of the November slowdown stemmed from reduced non-conventional oil extraction in Alberta.

-

Utilities output contracted by 3.6% as mild weather throughout central and eastern Canada reduced heating requirements.

-

The manufacturing sector posted a 0.3% decline, partially erasing the previous month’s gains. While December’s preliminary manufacturing sales data indicates a modest upturn (+0.6%), downside risks persist, particularly given the sector’s vulnerability to potential U.S. trade measures.

-

Services industries demonstrated less weaknesses than goods-producing sectors but still declined by 0.1% in total.

-

Activity in the hospitality sector increased, coinciding with Taylor Swift concerts in Toronto. Though retail GDP dipped -0.4% in November, a December rebound appears likely, fueled by the GST/HST tax break coinciding with peak holiday shopping season.

-

Transportation activity fell 1.3% in November, largely reversing the gains from September to October. The decline stemmed from the Canada Post labour disruption, which began mid-month and extended into December, suggesting continued drag on December’s figures.

-

Real estate activity continued to strengthen in November, echoing the solid performance seen in home resales. This momentum in housing activity shows signs of continuing as previous interest rate reductions filter through the economy.

By Abbey Xu

The Bottom Line:

-

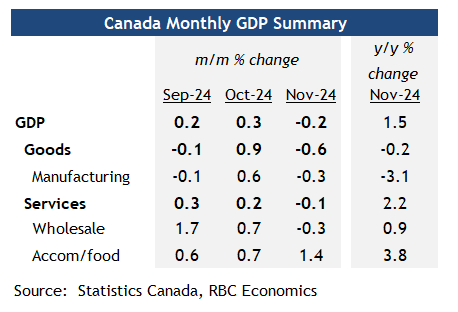

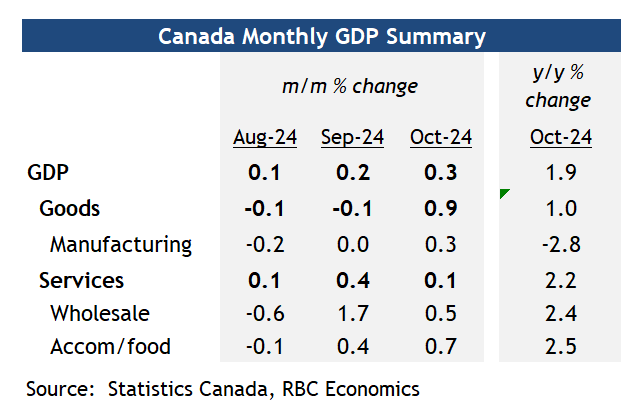

Today’s GDP report shows Canadian economic growth accelerated in October from September; however, the early estimate points to a contraction (-0.1%) in November, consistent with preliminary reports showing softer wholesale sales, declining manufacturing volumes, and flat retail sales.

-

The Bank of Canada’s December messaging pointed to a more gradual approach on rate cuts going forward than the 50 bp reductions in each of October and December, but we continue to expect that interest rate cuts down to a net stimulative 2% overnight rate (below the BoC’s estimated neutral range of 2.25% to 3.25%) will be warranted to allow economic growth to strengthen and prevent inflation from falling significantly below the central bank’s 2% target.

The Details:

-

Canadian GDP expanded 0.3% in October following a revised 0.2% increase in September (upgraded from an initial reading of 0.08% to 0.24%). October’s growth exceeded Statistics Canada’s preliminary estimate of 0.1%.

-

The advance estimate pointed to a 0.1% contraction in November. These preliminary figures are typically subject to significant revision, but the pullback in November is consistent with softer looking wholesale and manufacturing sale advance estimates for the month, and a pullback in consumer spending in our own tracking of card transactions.

-

At current trajectory, Q4 GDP growth appears to be tracking closer to, but still slightly below, the Bank of Canada’s 2% forecast.

-

The goods-producing sector registered its strongest performance since January 2023, expanding 0.9% in October. This growth was primarily driven by the mining, quarrying, and oil and gas extraction sector, which surged 2.4%.

-

Other goods sectors also showed improvement. Mining support activities rose 1.3% in October, partially reversing declines from the previous two months. Manufacturing output increased 0.3%, breaking a four-month streak of weak readings. StatsCan reported that non-durable manufacturing posted particularly strong growth (+1.2%), boosted by petroleum refineries resuming operations following scheduled maintenance.

-

Growth in the services sector moderated to 0.1% from September’s 0.4% pace. While retail trade output remained flat, wholesale trade advanced 0.5%. The real estate sector maintained its strong momentum (+6.3%), supported by robust home resale activity during the month.

By Nathan Janzen

The Bottom Line:

-

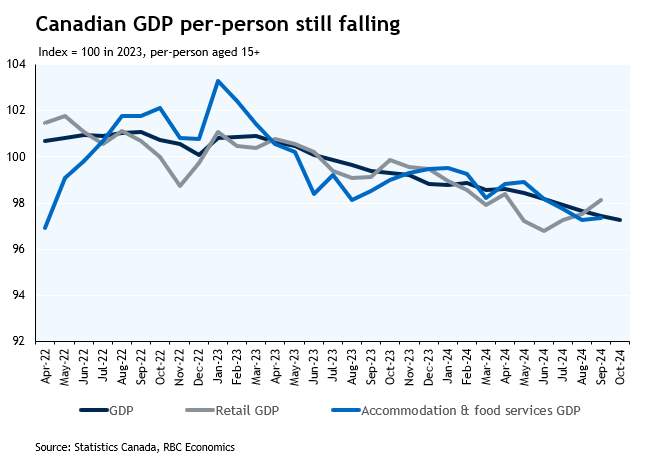

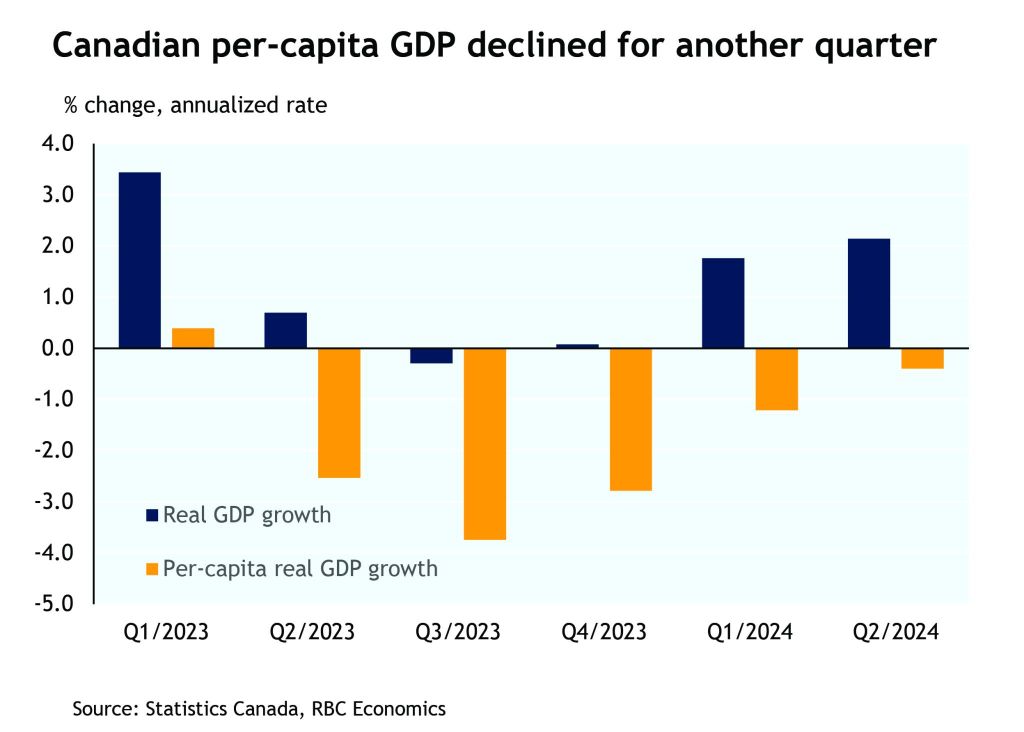

Some interest rate sensitive sectors (residential investment, consumer spending) showed signs of life in Q3 following the start of BoC interest rate cuts in June. But per-capita GDP was still down for a 6th consecutive quarter, with soft growth momentum extending in monthly estimates into early Q4.

-

The GDP numbers should help to reinforce that interest rates are higher than they need to be to maintain inflation sustainably at a 2% rate. The BoC will also be watching next week’s labour market data closely, but our own base-case assumption is for another 50 basis point cut to the overnight rate in December.

The Details:

-

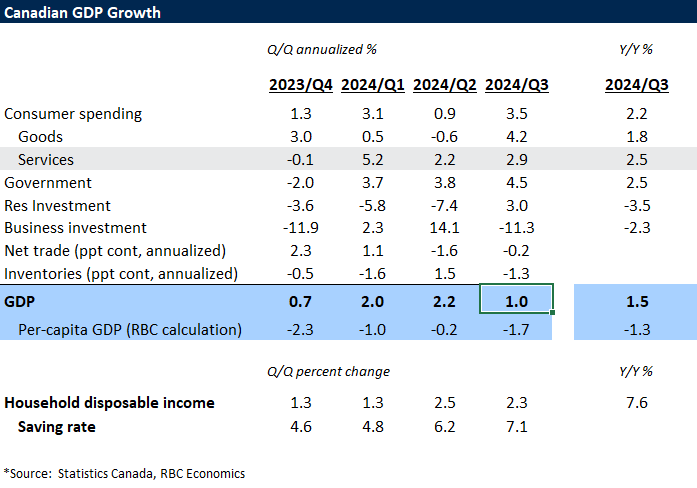

GDP rose 1.0% (annualized rate) in Q3 – broadly in line with expectations ahead of the report, but softer than the BoC’s latest 1.5% forecast and slower, again, than the pace of population growth.

-

Per-capita GDP fell for a 6th consecutive quarter, and 8th out of the last nine.

-

Details were mixed, but on balance still are pointing to a broadly softening economy.

-

Another jump in government expenditures accounted for 1.2 percentage points of GDP growth (ie. GDP would have declined outright without it) — and half of the 2.4% increase in final domestic demand.

-

Consumer spending jumped by 3.5%, and residential investment increased for the first time in four quarters (3.0%.)

-

But business investment plunged 11% on a sharp drop in equipment purchases, and exports fell for a second consecutive quarter despite still resilient economic activity in the United States and a weaker Canadian dollar.

-

Early momentum into Q4 remains soft. On a monthly basis, GDP edged up just 0.1% in September (below the 0.3% prelim estimate from Statistics Canada a month ago) and the early estimate for October was for another 0.1% increase. Those early estimates have been highly revision prone, but that leaves the monthly data tracking in line with our projection for a 1% Q4 increase – and about half the BoC’s 2.0% forecast.

-

Consumer-sensitive sectors strengthened in September (retail +1.0%, accommodation & food services +0.4%) but are still down sharply from a year ago on a per-capita basis.

By Claire Fan

-

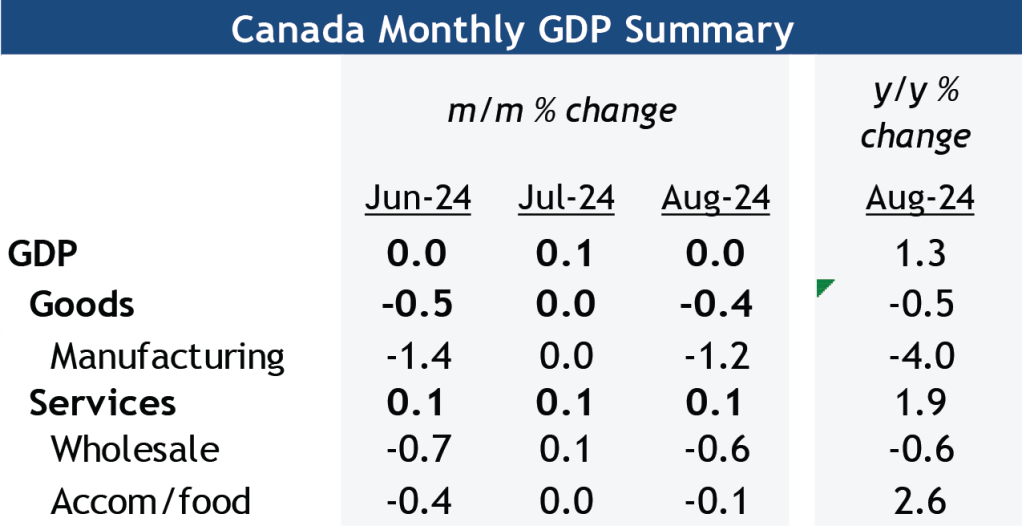

GDP data in Canada continues to paint a soft picture of the economy, with output growth stagnating in August and downward revisions to June and July growth.

-

Q3 GDP growth is tracking right around our own 1% forecast (annualized). That would still leave per-person GDP contracting again, or for the eighth time out of the past nine quarters.

-

We expect economic conditions will continue to look soft in the near term. Rate cuts from the Bank of Canada impact the economy with a lag and the level of interest rates is still high.

-

Soft GDP growth is reinforcing that inflation is more likely to drift (broadly) lower rather than higher, and is consistent with our base-case that the BoC will cut the overnight rate by another 50 bps in December.

Impact to Our Forecasts:

-

A flat reading in August, combined with a smaller 0.1% growth in GDP July (after downward revisions) but a larger 0.3% increase as per StatCan’s prelim estimate for growth in September will leave the Q3 growth at 1% (quarter over quarter annualized), right in line with our forecast

-

We think there are downsides to StatCan’s advance 0.3% estimate for September’s GDP growth. Similar to August, high levels of trading activities in the financial markets likely supported growth again, alongside gains in construction and retail sales as highlighted by StatCan. Other advance indicators however are more mixed.

-

Indeed, manufacturing sales volume contracted in September and hours worked fell by a larger 0.4%. Advance estimates for retail and wholesale sales (nominal) were both higher but our own tracking of RBC card data pointed to weaker consumer spending also in September.

-

We look for softer trends in the near-term to be sustained before activities pick up more significantly over the second half of 2025. Recent changes in population growth will also subtract from growth in the years ahead, adding downside risks to both our and the BoC’s latest forecasts.

The Details (August Canadian GDP recap):

-

The flat reading for August was with gains in services sectors (+0.1%) offset by losses in the goods-producing sectors (-0.4%).

-

Manufacturing activities fell significantly, by 1.2% thanks to declines in pharmaceutical and medicine manufacturing (-10.3%) and auto manufacturing (-1.9%), latter was impacted by extended maintenance shutdown in August.

-

Outside of manufacturing, activities also contracted in rail transportation (-7.7%)as workers went on strike and utilities as cooler weather in August brought demand for electricity lower.

-

Offsetting those declines were growth in finance and insurance (+0.5%), public administration (+0.5%), retail sales (+0.6%) and oil and gas extraction (+1.5%).

-

Finance and insurance have seen higher levels of growth in output since June, driven by higher volume of trading activities amid heightened market volatility driven in part by U.S. economic data.

By Nathan Janzen

-

The 0.2% increase in GDP in July was stronger than the “essentially unchanged” advance estimate a month ago, but still leaves growth in Q3 as a whole tracking below the BoC’s 2.8% forecast in July, and down on a per-capita basis for a sixth consecutive quarter.

-

The increase in July output was despite some negative impact from wildfires that will reverse in coming months. But the early estimate for August output was still ‘essentially unchanged.’ Those early estimates have been exceptionally revision prone, and early reports on wholesale and manufacturing sales for August are pointing to some early downside risk.

-

For Q3 GDP growth as a whole, the monthly GDP numbers are still tracking broadly in line with our own 1.0% (annualized) assumption – still below the pace of population growth and implying yet another decline on a per-capita basis.

-

Details behind the July GDP increase were mixed – growth in direct government administration has accounted for roughly a quarter of GDP growth over the last three months (by our count), with a third consecutive 0.4% increase in public administration in August propping up services output growth.

-

Retail trade also expanded by a full percentage point but output in accommodation & food services was little changed (+0.1%), broadly in line with our own tracking of card transactions.

-

Manufacturing output edged up by 0.3%, retracing little of a 1.3% pullback in June. And construction spending fell by 0.4%

-

Bottom line: Slowing inflation has allowed the BoC to shift focus to downside economic growth risks – with Governor Macklem reiterating after cutting the overnight rate earlier this month the need to ” increasingly guard against the risk that the economy is too weak and inflation falls too much.” Even with a tick higher in July, GDP is tracking another per-capita decline in Q3 and below the BoC’s prior forecast. The unemployment rate has continued to drift higher and inflation lower. The case for additional interest rate cuts against that backdrop is clear – we continue to expect further gradual interest rate reductions (at a 25 basis point per meeting pace) down towards a 3% overnight rate with risks tilted to larger/faster cuts should the economy deteriorate significantly further.

By Abbey Xu

-

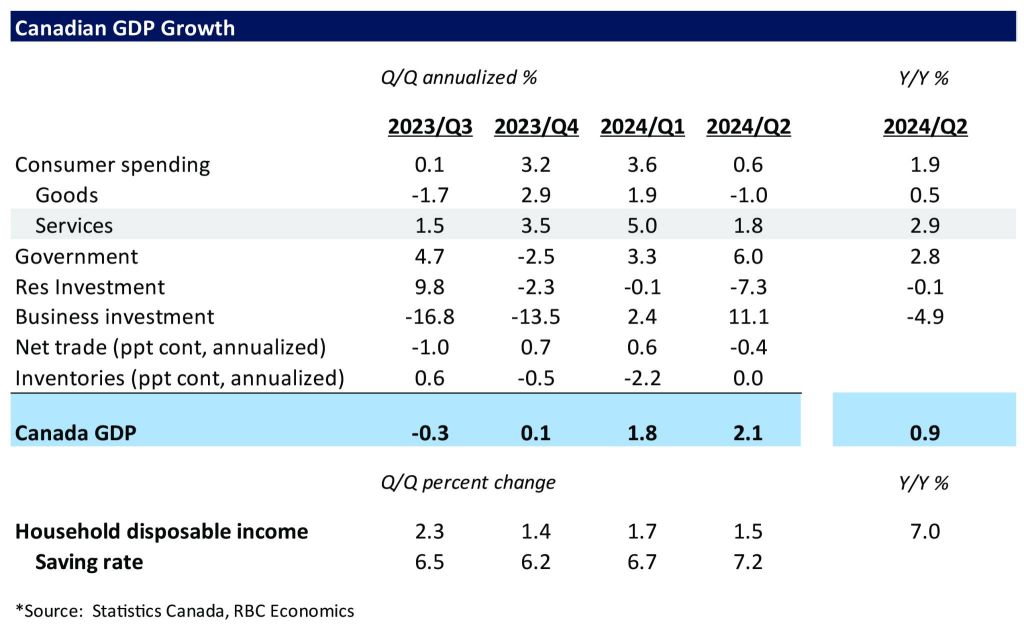

Q2 2024 GDP growth was reported at 2.1%, following a slight upward revision to the Q1 figure of 1.8% (previously 1.7%). This result is above both our expectation and the consensus before the data release.

-

Details are not as strong as the headline number, by our count a surge in government spending accounted for 80% of the Q2 GDP increase. And controlling for rapid population growth, per-capita output continued to decline for the 5th consecutive quarter (and 7th of the last 8).

-

Consumer spending edged up 0.6%, with diverging trends in spending on goods and services. Services spending continued its positive trajectory, increasing by 1.8% in Q2, but the pace has slowed more than half from Q1. Meanwhile, spending on goods declined by 1%.

-

Residential investment dropped (-7.3%) for another quarter, and at a much faster speed, in line with weaker home sales.

-

Business investment kept expanding into Q2, jumping by 11%, but boosted by a spike in imports of aircraft and transportation equipment that is unlikely to be repeated.

-

A closer look at the monthly data reveals that April (+0.4%) recorded the strongest growth within the quarter, followed by a smaller gain (revised to +0.1% from +0.2% previously) in May, and flat reading in June. StatCan’s advance estimates indicated output growth was unchanged in July. These estimates are subject to revision, but the monthly data is reinforcing a loss of growth momentum towards the end of Q2.

-

Household disposable incomes rose solidly again (+7%), and the household savings rate increased to 7.2%. However, these savings are likely still heavily concentrated among higher-income households and are unlikely to be spent in the near term.

-

Bottom line: Although slightly above expectations, the details behind the Q2 GDP increase are softer than the headline growth rate and per-person output continues to decline. Employment has declined for two consecutive months, and the latest unemployment rate is up almost 1% from a year ago. Recent economic data indicates that inflationary pressures have broadly eased, with breadth of goods impacted by abnormally high inflation narrowing to pre-pandemic levels, and the softening economic backdrop should reinforce the Bank of Canada’s view that the economy has softened enough to keep inflation on a downward trajectory. We continue to expect the BoC to follow up cuts to the overnight rate by another 25 bps in September.

By Abbey Xu

-

Canadian GDP expanded another 0.2% in May after a 0.3% increase in April. The May increase was slightly higher than both Statistics Canada’s preliminary estimate of 0.1% growth released last month, and our own expectations of a flat reading.

-

The advance estimate indicated that GDP edged up 0.1% in June, although these estimates are often subject to revisions.

-

On a quarterly basis, that rounds to a GDP increase of ~2% in Q2, which is higher than our tracking of an 1.4% annualized increase but would still leave per person GDP tracking another quarterly decline.

-

In May, growth in the goods-producing sector (+0.4%) outpaced that of the services-producing sector (+0.1%), with most of the growth driven by higher output in manufacturing sector (+1%). StatCan attributed part of the strength in non-durable manufacturing (+1.4%) to a rebound in petroleum refineries after scheduled maintenance in the prior month, although durable manufacturing output also rose (+0.7%).

-

Among other goods sectors, GDP for potash mining jumped 7.1% in May, following four consecutive monthly declines. And supporting activities for mining were up again in May, by 1.6% but were partially offset by a pullback in oil and gas extraction (-3.5%).

-

In the service sector, in line with earlier industry reports were contractions in output among retail (-0.9%) and wholesale sales (-0.8%). Educational services (+0.5%), and health care and social assistance (+0.3%) – two sectors that have been growing since the beginning of the year continued their expansions into May.

-

Bottom line: Today’s GDP report reveals that Canadian GDP grew slightly faster than expected in May, and was on balance stronger in Q2. Still, early indicators for June, including wholesale sales (-0.6%), manufacturing sales (-2.6%), and retail sales (-0.3%) all suggested that the momentum is waning towards the end of the quarter. Importantly, the higher than expected quarterly print would still on balance suggest another decline in per-capita GDP in Q2. We think the economic backdrop should give the Bank of Canada room to deliver another interest rate cut in their next meeting in September. We expect a total of 100 basis points of cuts to the overnight rate this year (including the 50 basis points cuts already delivered in June and July).

Canada Monthly GDP Summary

M/M % Change

Y/Y % Change

| 24-Mar | 24-Apr | 24-May | 24-May | |

|---|---|---|---|---|

| GDP | 0.0 | 0.3 | 0.2 | 1.1 |

| Goods | 0.0 | 0.4 | 0.4 | 0.1 |

| Manufacturing | -0.9 | 0.5 | 1.0 | -2.1 |

| Services | 0.0 | 0.3 | 0.1 | 1.4 |

| Wholesale | -1.2 | 1.4 | -0.8 | -0.1 |

| Accom/food | 0.6 | 1.1 | 0.9 | 3.2 |

Source: Statistics Canada, RBC Economics

By Abbey Xu

-

Canadian GDP grew by 0.3% in April from March, with the gain evenly distributed between goods-producing and services-producing industries, both were up by a similar amount.

-

The advance estimate was that GDP growth slowed to 0.1% in May. Other early indicators have been softer, including a small 0.2% increase in manufacturing sales (much of it came from aerospace that doesn’t get captured in manufacturing GDP), a 0.6% decline in retail sales and a larger 0.9% decline in wholesale sales (ex-petroleum) all in May.

-

It’s worth noting that the GDP advanced estimates have a spotty record at predicting actual monthly changes in output. Still, taking it at face value, Canadian GDP as of May was tracking 1.8% (annualized) growth in Q2 from Q1, similar to but slightly above our forecast of 1.4% annualized growth in Q2 as a whole.

-

Back to April, stronger production growth was seen in wholesale sales (+2%) and support activities for oil and gas extraction (+6.9%). The prior was boosted by a surge in auto and parts wholesaling and the latter was ahead of the start of TMX pipeline operations in early May.

-

Outside of those sectors, output also grew more for manufacturing (+0.4%), finance and insurance and arts (+0.4%), entertainment and recreation (+0.9%). StatCan (again) attributed the rise in financial investment services to unusual levels of market volatility given geopolitical uncertainties and pending Bank of Canada interest rate announcement at the time. The growth in arts and entertainment output was linked to the NHL playoffs that started in the second half of April.

-

Construction was among the handful of sectors that subtracted from growth in April, dropping by 0.4% thanks mostly to lower residential building activities. StatCan pointed out that activity in that sub-sector was almost a quarter lower comparing to its peak level three years ago.

-

Bottom line: Today’s GDP report showed widely based gains in output among Canadian industries in April but with that momentum quickly fading in May. Growth in Q2 to-date would still leave output per-capita falling for the seventh quarter out of the last eight. And the economy as it stands is still in excess supply, leaving it room to grow without adding to inflation pressures. That’s why we think the BoC will carry on with cutting interest rates, with 100 basis points of cuts to the overnight rate (including the 25 already done in June) expected this year. Even then, interest rates will still remain at levels high enough to restrict growth in the economy for some time, and we don’t expect per-capita GDP will return to positive territory until Q4 this year.

Canada Monthly GDP Summary

M/M % Change

Y/Y % Change

| 24-Feb | 24-Mar | 24-Apr | 24-Apr | |

|---|---|---|---|---|

| GDP | 0.2 | 0 | 0.3 | 1.1 |

| Goods | 0.2 | -0.1 | 0.3 | -1.1 |

| Manufacturing | -0.5 | -0.8 | 0.4 | -2.4 |

| Services | 0.3 | 0 | 0.3 | 1.8 |

| Wholesale | 0.3 | -1.2 | 2 | 4.0 |

| Accom/food | 0.6 | -0.3 | 1.2 | 2.2 |

Source: Statistics Canada, RBC Economics

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.