Canadian homebuyers did more than dip their toes in the market in October—they were on a mission to make deals happen. And many of them got it done, resulting in home resales jumping a substantial 7.7% from September—the biggest monthly gain since December 2023.

The series of interest rate cuts from the Bank of Canada—totalling a hefty 125 basis points so far—no doubt lifted the momentum. Lower borrowing costs not only improved the math for purchasing a home, but also signalled an imminent change in the direction of the market after a two-year slump.

We also suspect the solid increase in homes for sale since June set a domino effect in motion. The 8.5% rise in new listings between June and September helped unlock activity, turning many sellers with ticking clocks into buyers—eager to land their own purchase on or before the sale closing. This dynamic likely boosted market turnover in October.

However, it’s unclear whether the uptick will continue in the period ahead. New listings dipped 3.5% in October from September. Total active listings fell 2.8%.

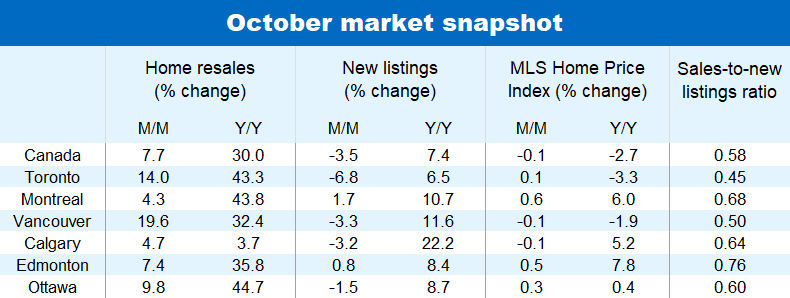

The strong resale gain and decrease in supply last month materially tightened market conditions across the country. The sales-to-new listings ratio—a measure of price pressure—surged to a 16-month high nationwide. At 0.58, the ratio is consistent with a generally balanced market and points to moderate price appreciation if sustained near this level.

But, the prior rise in inventories in major markets—especially Toronto and Vancouver—remained a dominant force in keeping prices in check in October. The national composite MLS Home Price Index benchmark was little changed at $716,800, down just 0.1% from September. The benchmark has been close to that level all year.

Supply-demand conditions now look balanced in Ontario and British Columbia after wading into buyers’ market territory this summer. This will work to stabilize prices, but more near-term declines in the Toronto condo market are likely, because a wave of new completions has created absorption issues.

The situation is much tighter in the Prairies, Quebec, and parts of Atlantic Canada. Prices in these regions continue to rise moderately for the most part. That said, strong increases in new listings since the summer have cooled prices in Calgary—leading to the first month-over-month drop in almost two years. Edmonton is now emerging as Canada’s hottest major market, with Montreal also making a run for it. Both recorded sizable price gains in October.

Canada’s housing market is back to activity levels that prevailed before the pandemic with resales reaching 520,000 units last month. Only B.C., Ontario, Quebec and New Brunswick haven’t fully recovered yet, but that may be just a matter of months.

We expect further interest rate cuts and upcoming changes to insured mortgage rules will keep housing demand on an upward trajectory and support sales momentum. Still, October’s big jump will be hard to repeat in the coming months. Housing affordability will continue to pose a major obstacle for many potential buyers for some time—especially in large, expensive markets like Toronto and Vancouver. We see prices generally drifting upward in the coming months with firmer appreciation more likely once the BoC is deeper into its easing cycle next year. Pricier markets in B.C. and Ontario could lag other provinces due to more severe affordability issues.

Download the Report

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.