Issue #01

➔ Welcome back to the newsletter formerly known as Climate Signals, offering crunchy insights and quick takes on changing climate and energy trends.

➔ Big Apple’s Big Climate Bash

➔ What EV Sales Downturn?

Hot takes

➔ Carbon tax was seen as good climate policy—now it’s a victim of climate politics. NDP’s Jagmeet Singh and B.C. premier-in-campaign-mode David Eby’s about-turn on the once much-touted consumer carbon taxes reflects the electorate’s changing views on carbon tax. Never mind that the levy added a mere 0.15 percentage points to inflation—it’s radioactive. That leaves the Liberals with a bit of soul searching to do and perhaps even eye some course correction. With the government ruling out a pause, increased exemptions or higher rebates (as they did for some rural Canadians), could save the tax from being axed, says Shaz Merwat, our energy lead.

➔ Electricity is Canada’s decarbonization workhorse. Sector emissions have plummeted 38% since 2005, and led an 0.8% drop in overall emissions last year, The Canadian Climate Institute estimates. But can clean electricity continue to dazzle, as the grid will need to possibly triple by 2050, hydro power faces droughts and new carbon capture and nuclear projects are at least a decade away? Meanwhile, demand for power-thirsty sectors such as AI and datacentres could force some to lean on gas.

➔ Speaking of electricity, Manitoba unveiled a new plan that highlights the challenge of developing more, cleaner, power. Plan highlights include:

- refurbishment of Manitoba Hydro’s ageing plant and equipment

- provincial loan guarantee to help First Nations and Métis communities buy equity in wind power

- district heating systems to help communities shift from gas

- EV charging infrastructure

- limits on electricity for data centres

It won’t be easy in a province that’s determined to maintain low prices and keep Manitoba Hydro in government hands (check the number of mentions). But that’s no different from most provinces, where the race is on to create more electricity without costing more to taxpayers or ratepayers. Innovation, partnership and scale will be key.

➔ COP29 could be wild. It starts a week after the U.S. elects either IRA-fan Kamala Harris or IRA-non-fan Donald Trump (or some kind of a cliffhanger). A Trump victory could upend the summit as he famously quit the Paris Agreement in his first term and has threatened to do so again. There’s plenty of drama already after host Azerbaijan skipped over the issue of transitioning away from fossil fuels as a summit priority. Many had fought hard at COP28 in Dubai to squeeze those words in the final text. Expect more fights. And word play.

➔ Simon Kennedy, Canada’s high-profile bureaucrat and innovation deputy minister, has retired. Instrumental in helping craft a fitting response to the U.S. Inflation Reduction Act, he positioned Canada as a tech leader in energy transition, promoted agriculture as an economic and export priority and advanced Canada’s electric vehicle, quantum computing and artificial intelligence industries. His successor will likely have to prepare for leaner fiscal times.

➔ The ultimate insider Bill Gates has a Netflix show out called What Next? Tackling conspiracy theories with pop diva Lady Gaga, global warming with climate activists, AI with director James Cameron, and discussing with Senator Bernie Sanders whether one can be too rich (the answer is yes, Bill), the Microsoft founder leverages the famous curiosity that gave us Outlook (and Windows crashes). He sounds hopeful—as befits a billionaire—but he is right about one thing: remain engaged to find a path to progress.

➔ Bi-Weekly Climate Action Award: The Saskatchewan Research Council for starting a commercial rare earth facility last week.

➔ Bi-Weekly Climate Fail Award: Any effort to make book fonts thinner to cut their carbon footprint, making them probably unreadable—and inevitably extinct.

New Climate Capital

By John Stackhouse

Greetings from New York, the world’s undisputed capital of finance, fashion, media—and now climate.

➔ Climate Week NYC, which wrapped up on the weekend, is now centre stage for climate thinkers, overshadowing the still essential but less sizzly UN climate conferences known as COPs. Sorry Baku (host of COP29 in November), but it’s hard to compete with the Big Apple when it draws:

- 100,000 climate nerds;

- 900 events, from Central Park to Greenwich Village;

- the UN General Assembly and a double billing of world leaders (Joe Biden, Emmanuel Macron, Justin Trudeau and 130 others);

- a Broadway carpet of climate celebrities, from Elon Musk to Prince Harry.

Even environmental groups seem to be warming up to Gotham glitz, hosting after-parties on Park Avenue (yes, the city where irony doesn’t sleep).

Small wonder the Wall Street Journal called NYC Climate Week “this year’s hottest climate bash.”

So what’s been achieved?

New York is about nothing if not money, and Climate Week NYC rallied a lot of it. Sovereign wealth funds, banks, private equity firms and hedge funds used the event to mobilize more of the billions needed for Net Zero.

As positive as that may be, there were plenty of concerns about the concentration of climate capital, especially in the world’s two biggest economies (which are also the two biggest emitters):

➔ Since 2021, the U.S. has invested US$500 billion in clean energy. More than 80% of that came from the private sector, leveraging the Inflation Reduction Act;

➔ Last year alone, the U.S. added the equivalent of 40 Hoover dams in the form of solar and wind production, helping cut coal’s share of electricity production by two thirds. Falling interest rates may encourage investors to take more risks on climate projects;

➔ as big as America’s renewables boom may be, China accounts for 40% of the world’s new builds. The country is six years ahead of its goals, and may soon be on a clear path to Net Zero. One concern: Can China’s capital flows continue through an economic slowdown that’s worsening by the month?

Yes, money is honey for project proponents, but local is still vocal.

I joined one industry discussion about the shortage of transmission lines, which in the U.S. is holding up as much as one million megawatts of power. Seems everyone wants renewables; just not running through their backyards. Even the nuclear renaissance (see our item below about Microsoft and Three Mile Island) faces questions about the speed of permitting and regulation versus the speed of AI-infused demand.

So as powerful as New York can feel, it can’t rival public sentiment—across the U.S. or around the world. And on that count, Climate Week NYC was left with one big question that only Americans can answer, on November 5. Who the U.S. sends to Climate Week ‘25 may well determine the direction of everything else.

Still in the fast lane

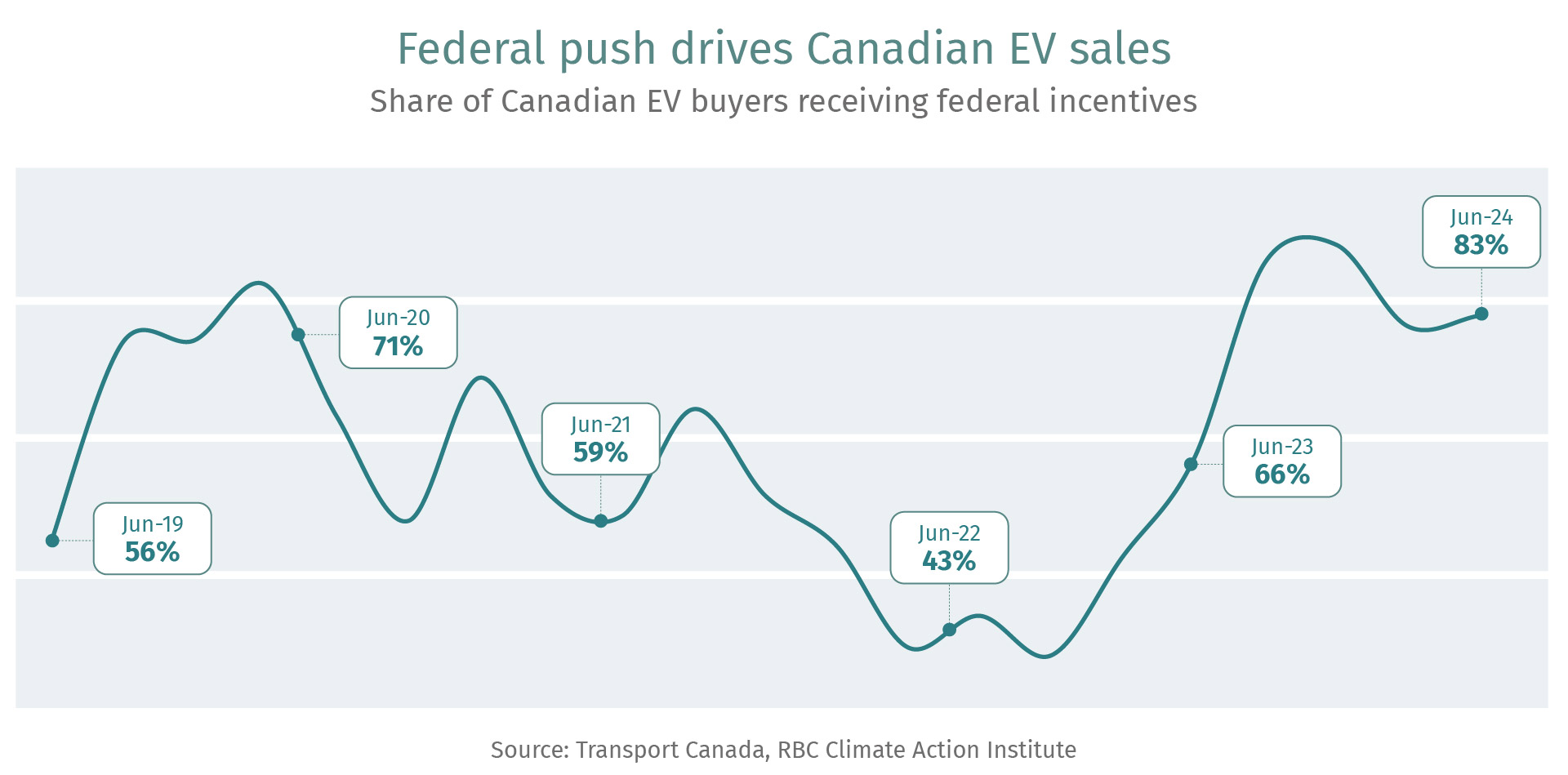

Let’s back up on the Great Electric Vehicle Reversal a bit. While EV sales whimpered in several key developed markets, they held up nicely in Canada. Let’s take a look:

➔ EVs now account for an all-time high of 12.9% of all car sales, beating Q3 2023’s record of 12.6%. That’s impressive amid an overall auto sales boom.

➔ What plug-in hybrid, shybrid surge—battery-powered cars accounted for 74% of all EV sales—similar to previous quarters. Canadians also drove their EVs 14% more on average compared to those in regular, old gas-powered cars.

➔ Eight out of 10 EV buyers dipped into the federal subsidies, while generous provincial incentives also helped bridge the price gap with gas-powered engines.

➔ Should Ontario bring back EV rebates? That could be smart given the billions of dollars the province is investing in building an EV supply chain in southwestern Ontario.

➔ Quebec now accounts for half of all EV sales, but something’s amiss in British Columbia—where EV sales have been losing steam for three straight quarters, according to Farhad Panahov, our economist and keen EV sales watcher.

➔ Farhad believes EV sales growth could be further impeded as Canadian and American tariffs on Chinese EVs kick in late in the fall, limiting the availability of affordable options.

➔ Also read RBC economist Salim Zanzana’s take on the impact of Canadian tariffs on Chinese EVs and metals.

ICYMI

➔ Critical minerals are the energy transition’s under-rated bottleneck, warns McKinsey in its sprawling Global Energy Perspective 2024. Separately, 14 Western nations are speeding things up.

➔ Gas must lean heavily on carbon capture to remain relevant, The Oxford Institute For Energy Studies warns in a report that barely touches on Canada.

➔ How a major oil producing country is struggling to be a climate champion as forest fires ravage its ecology. (No, it’s not Canada).

➔ If hydrogen gets your heart aflutter and you have 1.26 hours to spare, listen to Michael Liebreich’s Youtube chat with Germany’s hydrogen tsar Eva Schmid.

➔ The global energy transition story looks even more meh if you take China out of the equation.

➔ Three Mile Island nuclear plant, the site of the worst nuclear accident in U.S. history, is getting a Microsoft reboot.

The Institute in Action

➔ We’ll be at Energy Disruptors: Unite 2024 on Oct 1. in Calgary to discuss the future of energy transition with stakeholders.

➔ CAI’s also headed to the Canadian Climate Institute’s invite-only annual conference in Ottawa on Oct. 10 focused on sharpening Canadian competitiveness.

➔ Catch up on our latest work:

- Myha-Truong Regan: A smart heating solution for Canada’s fiscally-strained municipalities

- Lisa Ashton: How indoor farming can transform Canadian food exports

- Vivan Sorab: Small modular nuclear reactors can make a big difference

➔ What’s on the team’s reading/listening list: Elon Musk (by Walter Isaacson), Material World (by Ed Conway), How the World Really Works (by Vaclav Smil), Fire Weather (by John Vailant), Not the End of the World (by Hannah Ritchie), and Doomberg Substack.

Curated by Yadullah Hussain, Managing Editor, RBC Climate Action Institute.

Climate Crunch would not be possible without John Stackhouse, Myha Truong-Regan, Sarah Pendrith, Farhad Panahov, Lisa Ashton, Shaz Merwat, Vivan Sorab, Caprice Biasoni and Frances Dawson.

Have a comment, commendation, or umm, criticism? Write to me here (yadullahhussain@rbc.com)

Climate Crunch Newsletter

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More