For the week of August 25th, 2025

Canada’s Q2 GDP growth flat as household spending offsets trade weakness

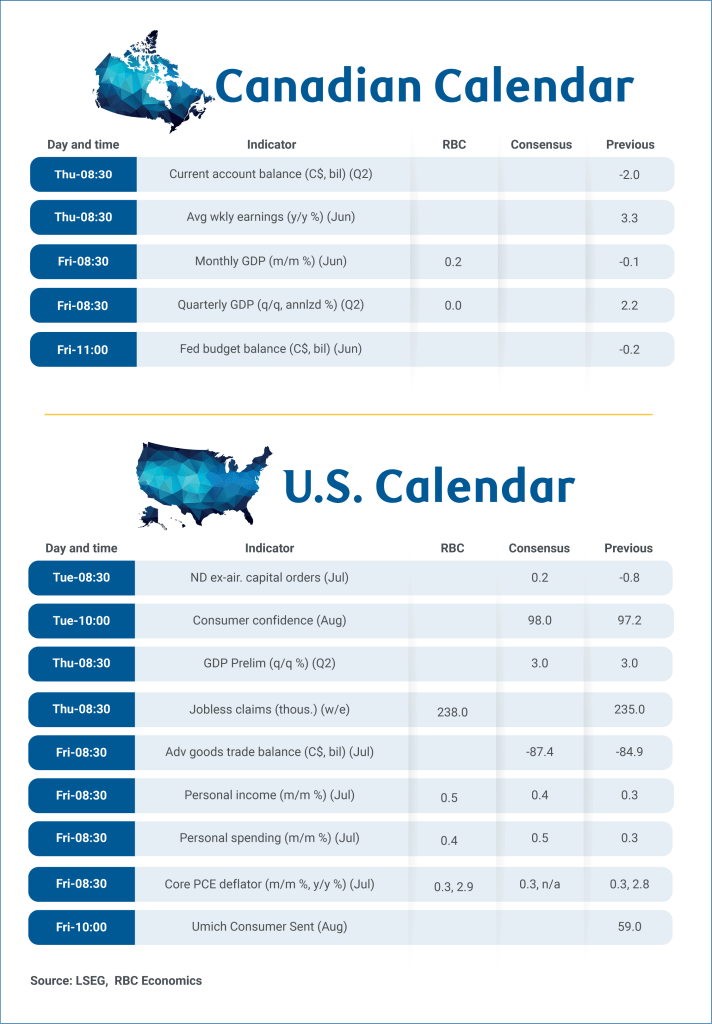

Canada’s gross domestic product report next Friday is expected to show zero growth in Q2─a sharp cooling from the 2.2% gain in Q1 this year.

Still, a flat reading in Q2 consistent with Statistics Canada’s advance estimates of monthly output through June is better than feared, given spring saw a surge in U.S. tariffs (and threats) that rattled business and consumer confidence.

These international trade disruptions have significantly impacted the economy. Canadian merchandise export volumes fell an annualized 31% in Q2 alongside a broader drop in U.S. imports as pre-tariff inventory building unwinds. Business investment likely edged down modestly and would have been substantially weaker without a large ($2 billion) one-time import of machinery for offshore oil production in June.

Household demand stays on course

Household spending, however, held steady with consumer spending tracking a similar pace to Q1’s 1.2% increase. A bounce back in home resales and housing starts also signals an increase in residential investment. Total final domestic demand, which strips out volatile swings in trade and inventories, should post a small gain─suggesting underlying momentum is not as weak as the headline implies.

We expect GDP to post a slightly stronger 0.2% month-over-month increase in June than StatsCan’s 0.1% estimate, marking the first increase in three months following small declines in April and May.

Early indicators also point to a rise in output in service producing industries in June. Retail sales rebounded strongly (+1.5%) following a 1.2% drop in May, consistent with our tracking of RBC consumer card transactions that showed spending held up in Q2 despite the sharp drop in consumer confidence. The real estate sector extended its recovery as housing resales improved through the quarter.

Oil production to boost output

The manufacturing sector continues to be among the industries more significantly impacted by international trade disruptions, and uncertainty. We expect output in the sector to be broadly consistent with flat manufacturing sale volumes reported. But oil production likely bounced back after wildfire-related disruptions in Alberta in May.

Trade uncertainty will continue to affect business investment regardless of future tariff decisions. Nevertheless, CUSMA exemptions for most Canadian exports have prevented worst case scenarios, and we anticipate subdued, but positive growth through the remainder of 2025.

Week ahead data watch:

-

U.S. personal spending in July likely increased by 0.4%, slightly higher than the previous month. Much of this growth came from stronger auto sales. Additionally, retail sales rose by 0.5% in July, following a larger 0.9% increase in June. We also expect personal income to rise from 0.3% in July to 0.5%, reflecting the higher wage growth reported in the July payroll data.

This report was authored by Assistant Chief Economist Nathan Janzen and Economist Abbey Xu.

Explore the latest from RBC Economics:

-

Podcast: The 10-Minute Take. Stagflation lite: What this means for the U.S. economy

-

Special Housing Reports. Canada isn’t in a housing starts slump—Ontario is

-

RBC Canadian Inflation Watch. Inflation pressures eased in Canada in July

Share these insights with your network:

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.