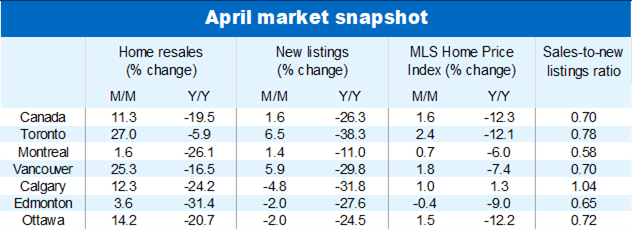

Spring 2023 increasingly looks like the turnaround point for Canada’s housing market after a year-long slump. April home resales spurted 11.3% m/m nationwide, marking the strongest monthly advance almost three years. Prices rose in back-to-back months (including a 1.6% gain in April for the MLS Home Price Index) for the first time since early 2022—with the vast majority of local markets contributing. And perhaps more importantly, demand-supply conditions suddenly appear tight. Resurging demand and low inventories have put sellers back in the driver’s seat in most major markets, including Toronto, Vancouver, Calgary and Halifax.

Activity is still running (11%) cooler than just before the pandemic but possibly not for long, especially if more sellers enter the market. The latter have so far remained hesitant to make a move. New listings significantly lagged resales, rising just 1.6% m/m in April on the heels of a sharp 13.6% decline between January and March.

Rising prices could spur more sellers into action. We suspect many have been waiting out the correction until conditions turned in their favour. A rise in supply would help unlock more of the pent-up demand that built over the past year.

Spring fever hits buyers in Toronto and Vancouver…

Earlier tentative signs of a turnaround in Toronto and Vancouver were confirmed in a big way in April. Home resales jumped 27% and 25% m/m, respectively, rolling back roughly one-quarter of the correction in one go. It appears buyers are quickly regaining confidence in both markets now that the Bank of Canada has paused its aggressive rate hike campaign.

…and turns up the heat in other markets

The mood is becoming more upbeat in many other markets too. Resales also picked up solidly in Victoria (up 13% m/m), Calgary (up 12%), Hamilton (up 18%), Kitchener-Waterloo (up 16%), London (up 15%), Ottawa (up 14%) and Halifax (up 17%). These advances occurred despite further declines in homes listed for sale in most cases.

Price correction is over: property values are rising across the country

Demand-supply conditions have tightened in the majority of places in April, giving sellers more pricing power. And they wasted no time using it. By our count, the MLS HPI increased in over three-quarters of local markets from March levels. Some of those gains were sizable. The index jumped 5.4% m/m in Hamilton, 5.1% in Cambridge and 3.9% in Kitchener-Waterloo for example. In Toronto, a 2.4% rise was the second in as many months, adding more than $35,000 to the benchmark price in the process (now sitting at $1.11 million). It was a similar story in Vancouver where the benchmark price is up $23,000 (or 2.0%) over the last two months. The rebound was more subdued in Montreal, though, with the MLS HPI appreciating just 0.7% ($3,500).

Upside risk to our forecast

April’s widespread vigour is a surprise to us. While we did expect the market to reach its cyclical bottom this spring, we thought it would take a while for the heat to return. Our view was—and remains—that the significant loss of affordability in the past year would keep buyers timid for some time. First-time buyers, in particular, continue to face major hurdles. Perhaps soaring immigration and a boiling hot rental market are becoming the primary driving forces fueling homebuyer demand. In which case, we could see prices extending April’s gains—possibly materially.

See PDF with complete charts

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.