Monthly Housing Market Update

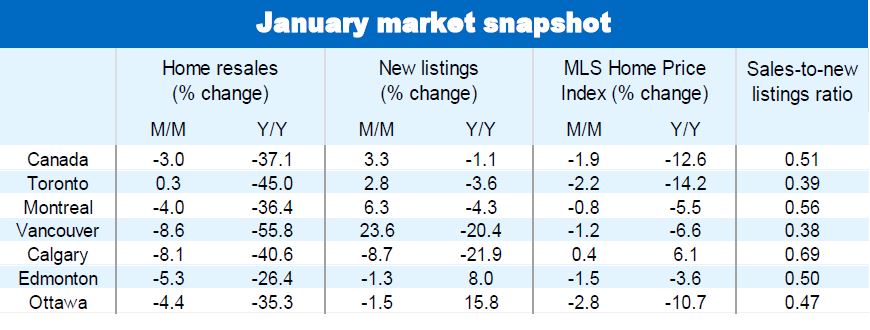

Weakening housing trends remain the central theme early in 2023 across Canada. Home resales and prices fell again nationally and in the majority of markets in January, extending nearly year-long slides. The latest data confirmed the pace of decline has slowed since the fall for resales—pointing to a nearby bottom. But so far there are few indications the price correction has run its course. The national composite MLS Home Price Index fell 1.9% m/m in

January, which represented a slight acceleration from the 1.6% average decline in the prior five months. We expect property values to fall further in the near term as buyers contend with persistent affordability issues.

BC and Ontario under pressure

The situation in BC and Ontario is particularly tense. January activity was the weakest in 14 years in both provinces. Demand-supply conditions have been soft since summer, leading to material price declines. The MLS HPI is down 12% since the cyclical peak in BC and 18% in Ontario—both exceeding the 15% drop nationally. Prices in some local markets have slumped even more, including London (-26%), Cambridge (-25%), Kitchener-Waterloo (-25%), Brantford (-24%), Hamilton (-23%), the Niagara region (-20%) and Barrie (-20%). The slide continued largely unabated in January for the most part.

Other regions feeling it too

But the price correction extends well beyond BC and Ontario. The MLS HPI is down since the cyclical peak in all but one province (Newfoundland and Labrador, where the index is still trending upward) in the rest of the country. It’s just the magnitude of the decline so far has been more muted—between -10% (Manitoba) and -1% (Saskatchewan). The vast majority of markets outside BC and Ontario recorded a further decline in January. It was in fact Quebec City that surprisingly posted the biggest monthly drop (-6.3%) in the country. Saint John (up 2.3% m/m), Saskatoon (up 1.5%), Halifax-Dartmouth (up 1.4%) and Calgary (up 0.4%) are among the few markets where prices rose from their December level.

More downside in view

Indications that activity is levelling off in Ontario and may soon do so in other regions suggest the housing market correction in Canada is likely in a late stage. Still, we see downward price pressure continuing across most of the country in the coming months. The Bank of Canada’s 25 basis-point increase in its policy rate in January—the last hike this cycle in our opinion—will keep things challenging for buyers from coast to coast. We believe prices in BC have the biggest downside at this stage given the extremely poor affordability situation in the province, high sensitivity to interest rates and soft demand-supply conditions. Massive earlier gains in Ontario also leave plenty of room for prices to fall deeper in several markets, including the Greater Toronto Area, although we think most of the correction is behind us.

Supply side watch

While climbing 3.3% m/m in January, new listings in Canada are still trending lower. We expect that trend to reverse as the end of the Bank of Canada’s rate hike campaign prompts more sellers to list their properties. Higher interest rates may also press a number of current owners to sell if mortgage payments become unmanageable. To date, mortgage delinquency rates have remained exceptionally low across Canada (at just 0.14%).

See PDF with complete charts

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.