Ontario’s much anticipated Fall Fiscal Review did not surprise. Like other provinces that have released fiscal updates this fall, Ontario significantly altered its projections, boosting revenues and expenditures, and slashing the deficit by a record amount. The updated $21.5 billion deficit for this fiscal year is a whopping $11.6-billion (35%) reduction from the projection made in the 2021 budget in March. Better-than-expected results in FY 2020-21—the public accounts released since Budget 2021 showed higher revenues, lower expenditures and a final deficit ($16.4 billion) less than half the size of what was forecast ($38.5 billion)—set the stage for much of the improvement. A slightly upgraded economic outlook also helped.

Revenue growth significantly boosted this year by higher tax revenues

The main highlight of this Fall Fiscal Review was the government’s huge $14.6 billion (9.5%) upward revision to revenues in FY 2021-22. Virtually all sources are now slated to come in much higher, led by personal income tax (up $5 billion or 14% from budget), corporate income tax (up $2.6 billion or 14%) and sales tax receipts (up $3.4 billion or 12%). These adjustments are based on additional information that have become available on tax returns, worker compensation, consumer spending, and housing investment. The government however took its projected revenue growth down in FY 2022-23 and FY 2023-24 despite slightly boosting its GDP growth forecast. This has resulted in a lower revenue profile by FY 2023-24 than Budget 2021 implied.

Expenditures now projected to rise this year

Changes aren’t as dramatic on the expenditure side of the ledger but are material nonetheless. The government revised up its FY 2021-22 program spending by $3.1 billion (1.8%) relative what was projected in Budget 2021. It now expects program spending to rise 4.2% from FY 2020-21 instead of declining 2.7%. This is a substantial swing. The majority of the increase in program spending is directed to supports for the pandemic recovery, including the extension of the temporary wage enhancement for personal support workers (up $922 million), top-up to the time-limited COVID-19 fund (up $500 million), and support for municipal transit ($345 million). The government also boosted program spending growth in the next two years, with the phasing out of COVID-19 time-limited funding only causing an outright decline in FY 2023-24. Budget 2021 expected program spending to fall in all three years. The updated profile results in a higher spending level by FY 2023-24.

Investing in highways

Ontario’s Capital Plan includes an additional $2.7 billion from Budget 2021, with the largest increase earmarked for transportation infrastructure, specifically for building and repairing provincial highways. The province now plans to spend $148 billion over 10 years compared to the $145 billion pledged in Budget 2021.

Economic outlook slightly improves

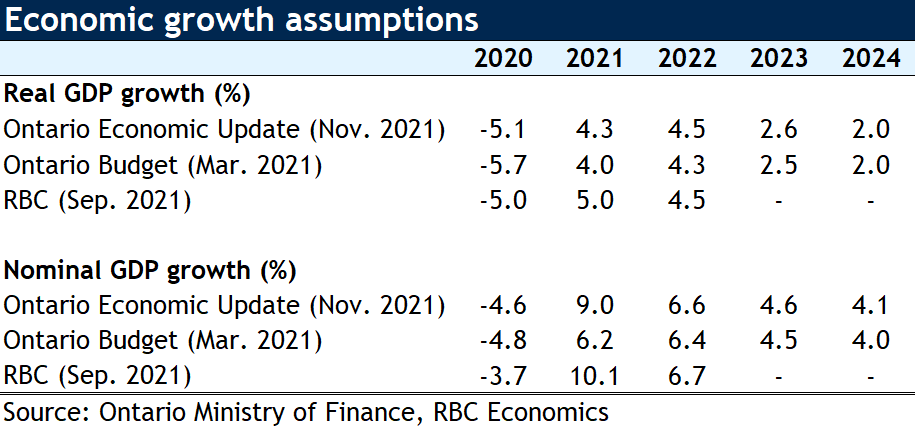

The province’s updated economic outlook shows modestly stronger real GDP growth in 2021 (up 0.3 percentage points to 4.3%) and the next two years (up 0.2 percentage points and 0.1 percentage points to 4.5% and 2.6%, respectively). This is more conservative than RBC Economics’ forecast of 5.0% growth this year but matches our view in 2022. The government’s forecast for nominal GDP growth gets a larger boost, however, to 9.0% from 6.2% previously reflecting higher-than-expected inflation. Still, it’s more conservative than the private sector average and our own forecast (10.1%). The next two years’ nominal GDP projections are closely aligned with those expected in Budget 2021.

Improving economic conditions drive debt servicing costs lower

Lower expected budget deficits and stronger nominal growth help improve Ontario’s indebtedness metrics. The net debt-to-GDP ratio, for instance, is no longer expected to jump above 50% but is instead projected to inch marginally lower from 43.9% at the end of last year to 43.6% by FY 2023-24. Debt servicing costs are also projected to stabilize at around 7.7% of revenues instead of rising to 8.5%.

The end of the tunnel may be closer than we thought

At the onset of the pandemic, Ontario committed to sparing no expense to protect Ontarians, drilling what was expected to be a “deep fiscal hole.” With restrictions easing, and 88% of the eligible population vaccinated, the economy has turned a corner and this is being reflected in the province’s fiscal picture. The sharp boost to revenues and substantial 35% cut in the provincial deficit projection this year are clear evidence that Ontario’s fiscal situation is evolving in a positive direction. If this continues, the path to a balanced budget could be shorter than we thought. We expect to find out more on this next spring in Budget 2022.

See Report PDF

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.