MONTHLY HOUSING MARKET UPDATE

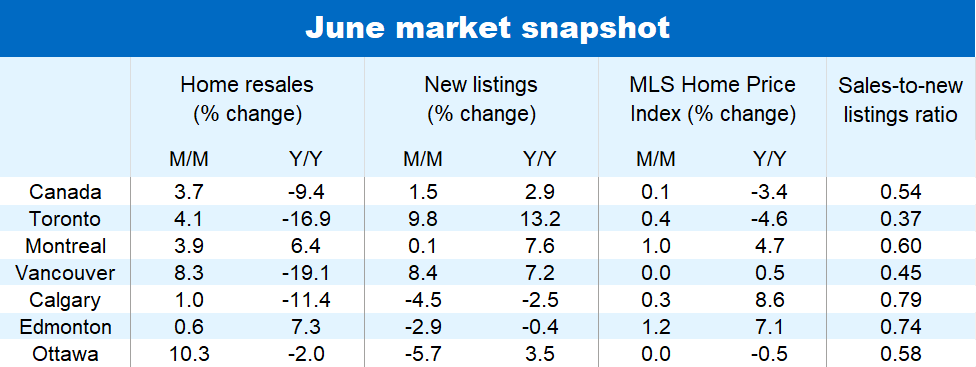

The first Bank of Canada interest rate cut in four years brought some energy to Canada’s housing market in June but it came well short electrifying activity—which remains generally soft. Home resales last month were still within the range they’ve been in since the spring of 2023 despite picking up 3.7% from May. It’s still 9% below pre-pandemic levels nationwide.

The modest bump in sales was widespread with just a few markets (Winnipeg, Trois-Rivières and St. John’s) bucking the trend. In most cases, the rise wasn’t sufficient to reverse earlier monthly declines, leaving current activity weaker than a year ago.

Encouraging news on interest rates may not have been the only factor motivating buyers. Rising inventories have provided more purchasing options. Sellers have come to market in greater numbers this year, including in June. New listings rose sequentially for the fifth time in the past six months across Canada. There were notable increases in the Fraser Valley (12.1% from May), Toronto (9.8%) and Vancouver (8.4%).

The rebalancing of supply and demand from previously tight conditions is stabilizing prices. The national aggregate MLS Home Price Index has essentially flattened this spring—below levels from a year ago. The HPI benchmark was $717,700 (seasonally adjusted) in June, up a marginal 0.1% from May and little changed since March.

Prices in many Prairie markets continue to outpace the national average owing to strong demand and scarce inventories. Explosive population growth in Calgary, and to a lesser extent Edmonton, in particular, puts tremendous pressure on local housing stocks, driving up property values.

Price trends are largely stagnant in Ontario and British Columbia. Buyers in some of these markets are the most severely challenged by the affordability crisis. Property values continue to appreciate—albeit just barely—in both Toronto and Vancouver. However, they have come down more than 5% in the Fraser Valley since September.

The price picture is one of sustained modest gains in most of Quebec and the Atlantic provinces. Supply-demand conditions generally remain tight in these markets despite inventories gradually increasing from historically low levels.

Slow recovery in view

Additional interest rate cuts are poised to stimulate homebuyer demand across the country. But the boost will likely be incremental. We believe rates must come down materially before they make a meaningful dent in ownership costs, especially in Canada’s most expensive markets. For this reason, we expect the housing market recovery to be slow through the remainder of this year before accelerating somewhat next year once both short and long-term rates are materially lower.

We see the same for prices though some markets such as Toronto could experience renewed downward pressure in the near term if inventories build up more significantly.

See PDF with complete charts

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.