Welcome to the first edition of Trade Zone. It’s in beta testing, so please let us know what you think. Every week, our team at RBC Thought Leadership will share what we’re hearing from governments, learning from clients and seeing in our research. We’ll also give you a cheat sheet on the week, to help you keep pace.

Notebook

By John Stackhouse

-

If Mark Carney’s Liberals are re-elected on Monday, as polls are suggesting, expect them to shift their focus South and West by the end of the week.

-

To the South, expect a crew of newbies across the bureaucracy, as well as PMO, with experience in the U.S. A call with Donald Trump will top the To-Do list, with more than trade on their minds. “Comprehensive partnership” is one term floating about—to cover border security, immigration, Arctic and defence issues. And yes, trade, even if USMCA may not be long for this world in its current form.

-

Expect to see a highly structured and strategic Canadian approach, colliding with a highly unstructured American approach. The Trump team had been telling Canadians to avoid working groups or outside “experts.” Side note: American negotiators are driving the Mexicans batty with demands for them to control tomato shipments before any deal is reached.

-

The Trump team has been losing in the courts and in the markets. If that continues, Canada may opt for the long game, following Napoleon’s advice: “Never interrupt your enemy when he is making a mistake.”

-

To the West, watch for outreach from Ottawa to Alberta and Saskatchewan, with a focus on diversification of exports. That will take a lot more than a new pipeline (which may be on the table), as our resource-driven provinces think about new markets. Dow Chemical’s bombshell decision this week to delay its Alberta plant is just the latest trade warning. (I wrote about the Big Pivot on our Trade Hub, drawing on conversations this week at Public Policy Forum’s annual Growth Summit, which is a bit of an Olympics for policy wonks.)

-

Caught between the Potomac and the Prairies is Ontario, but not for long. Doug Ford stole the show at the PPF Summit with a feisty attack on Trump (“Sometimes the cheese seems to fall off the cracker with that guy”) and a passionate shout-out for Progressive Conservatives. Ford seems ready to play bad cop to the next PM’s good cop. He may be warming up for another role, too.

-

Get ready to hear more about Europe as a new (old) partner, for military procurement, AI standards and, yes, trade. Those conversations will grow ahead of the G7 summit in Alberta in June, when we’re expecting LNG and data centres to be front and centre. If the Trump team shows up—no bets there—they’ll want to ensure some alignment on LNG finance, especially for emerging markets, and access to gas-powered electricity for their hyperscalers (the latest euphemism for Big Tech).

-

Climate is creeping back into the trade conversation, although not in North America. Europe is marching ahead with border carbon adjustments (just don’t call them carbon tariffs). Japan is also advancing an emissions trading system, including cross-border carbon credits and a surcharge on fossil fuels (just don’t call it a carbon tax). Expect Canada’s Balkanized industrial carbon pricing system to be part of a likely discussion on the G7 sidelines. (Did we tell you that will be in Alberta?)

-

Indigenous equity will be an important aspect of any new trade relations, much more so than even five years ago. We’re part of the big First Nations Major Projects Coalition conference in Toronto next week and expecting both Ford and possibly a new PM to use the platform to advance their investment strategies. (No investment, no trade.) Other key guests will include Indigenous leaders from Alaska and Utah— hello, Republicans—who may offer a different kind of cross-border relationship.

Need to know

➔ We estimate that $125 billion is at risk for Canada as U.S President Donald Trump eyes 5 strategic sectors.

➔ In a bid to escape tariffs and wait out the trade war, third-party sellers on Amazon and Walmart are shifting stock from China to tariff-free warehouses in Canada.

➔ Not a single new IPO was completed on the TSX or Venture Exchange in Q1. Trade war is scaring companies south of the border, too.

➔ Coke vs. Pepsi: Who’s the winner of the ultimate taste, er, tariff test?

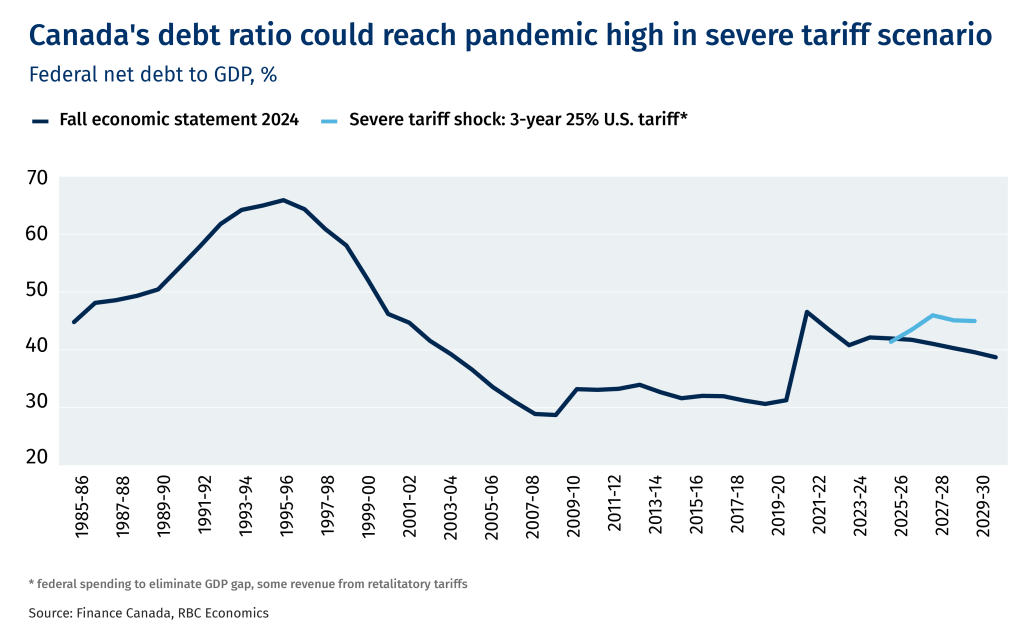

➔ Where we see Canada’s debt ratio headed over the next three years in a worst-case tariff

Final Word(s)

“All eyes right now are on the Arctic. We are the gateway to the Northwest passage and at the forefront of the conversation when we’re talking about security and sovereignty.”

—P.J. Akeeagok, Premier of Nunavut

“People are not going to race to build manufacturing in America. With the policy volatility, you actually undermine the very goal you’re trying to achieve.”

—Ken Griffin, Citadel CEO

“The renegotiation of the USMCA included a very forward-looking digital-trade agreement. I think there is meaningful opportunity there, and that’s in contrast with what you have seen in some other countries, where data sovereignty has been more restrictive.”

—David Schwimmer, CEO of the London Stock Exchange

“The EU is working on a targeted and measured response in case we cannot reach a deal [with the U.S.] rapidly.”

—Eric Lombard, France’s Minister of Economy, Finance and Industry

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.