June US Payrolls print beats consensus but services hiring (ex health care) softens under the hood

By Mike Reid and Carrie Freestone

This morning’s nonfarm payroll report came in well-above consensus in June (+147K) after an upward revision for May (+144k), showed slowing services have yet to materially weigh on hiring growth.

There are 3 core themes in today’s report

I. STRUCTURAL FORCES IN PLAY.

The nonfarm payroll number continues to be flattered by health care services jobs – it accounted for ~40% of new jobs created in June. Going forward, this sector is likely to account for a growing share of job creation and will weaken the cyclical signal of the headline nonfarm payrolls number as a result.

Related, as we highlighted in our recent report America Needs Workers, Not Jobs, at least 1.7 million retirements this year mean roles are being backfilled – and backfilled roles don’t show up as new jobs created in this payroll data even if they effectively represent one more person hired.

The unemployment rate fell to 4.1%- as US job seekers continued to leave the labor force. We still expect the unemployment rate to rise (likely to 4.5%) by year-end, as uncertainty paralysis and the impact of tariffs compound and derail hiring more materially.

II. POLICY INDUCED UNCERTAINTY PARALYSIS.

The policy-induced uncertainty paralysis shows up beneath the surface in today’s jobs report. While we saw a blowout (private and public) services number, this was largely supported by a surge in state and local government hiring. Outside of health care, on net, private services sector hiring was exceptionally weak. It is, however, still is too soon to say whether this marks the start of a broader labor market deterioration or is part of the distortions of tariff on/off policies that front-load activity.

-

Wholesale trade shed jobs while professional and business services employment (both consulting and ex-consulting) shed jobs. We also saw a pullback in Other Services employment, where grantmaking and civic workers are impacted by DOGE.

-

Surprisingly, the transportation and warehousing sector added jobs (+7.5K), but we do not expect this will last as continuing claims data after the June NFP reference week flagged higher levels of continuing claims in states with a higher relative saturation of transportation and warehousing employment.

-

Retail trade employment did add jobs this month (+2.4K)- though hiring was very weak.

III. WATCH SERVICES (EX HEALTH CARE) FOR SIGNS OF BROADENING WEAKNESS.

Despite a strong headline print, we’re zeroed in on ex-health care services consumption. Softer growth in services sector consumption (as shown in the GDP and PCE data last week) is likely a function of discomfort from uncertainty as opposed to higher prices weighing directly on consumption– that will come in several months when inventories are run down and tariffs start to bite harder. Of note:

-

Leisure and hospitality also contributed materially to headline gains (+20K) as the sector has remained understaffed since the pandemic, and more stringent immigration policy will not help.

-

Outside of health care, services sector hiring was weak, and at +9K, the pace of hiring is quite a bit below the ~50K average pace of job creation over the past two years.

-

Public sector hiring was +73K, but the federal government shed -7k jobs in June (to-date, employment is down 8.8K from January).

-

Job losses in professional and business sector employment were concentrated in temporary help services- reflective of DOGE contractor cuts.

Beneath the Surface:

-

Surprisingly, the labor force participation rate fell to 62.3% in June from 62.4% in May. In June we saw the size of the labor force contract (by 130K). The number of unemployed persons fell (-222K) as fewer people looked for work.

-

The share of unemployed workers who are now long-term unemployed is now up at 23.3%, up from 20.4% in May) suggesting job search times may be lengthening as the backdrop worsens.

-

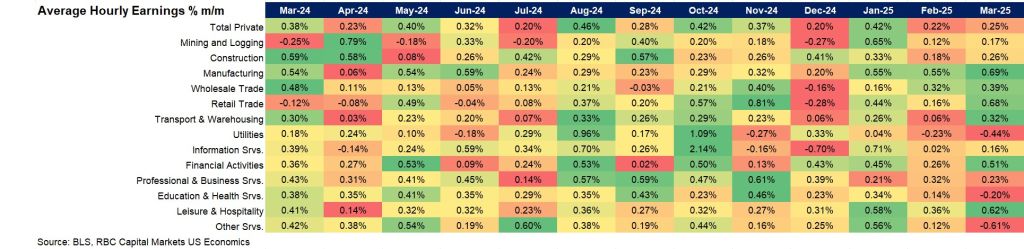

On a monthly basis, average hourly earnings rose +0.2% month-over-month vs. +0.4% in May- suggesting slowing wage growth against a more uncertain backdrop and in many places, hiring freezes.

By Mike Reid and Carrie Freestone

The Bottom Line:

This morning’s nonfarm payroll report came in above consensus for May (+139K). The unemployment rate held steady yet again in May at 4.2%. A slew of retirements resulted in a lower labor force participation rate (down to 62.4% from 62.6%).

It was evident in this morning’s print that tariff uncertainty has yet to meaningfully grind payroll growth lower, with the impact of the current policy backdrop on employment limited to trade-reliant sectors. Manufacturing and retail suffered from an environment in which businesses and consumers remain in limbo, paralyzed by uncertainty. But services activity continues to drive payroll growth forward at a pace that is supported by demographic tailwinds.

We continue to highlight the dissonance between cyclical and structural themes. While monthly trends remain robust, the current trade situation (if it remains status quo) will translate to job losses later this year, which we expect to nudge the unemployment rate up near 4.5%. At the same time, structural forces – namely record retirements – will put a ceiling on the unemployment rate. Replacements do not translate to payroll gains (since backfills do not result in net new job creation) but will help keep the unemployment rate historically low as job seekers shift into positions vacated by retirements. Still, we expect Powell will be concerned about the magnitude and direction of the uptick and this should be sufficient for the Fed to move towards more neutral territory over the next year- we continue to expect the Fed will begin a cutting cycle in September.

Here’s what stood out to us in the May data:

Sector Spotlight

-

As expected, health care & social assistance accounted for over half of the increase (+78K) – an aging population will continue to drive job creation in the sector. Leisure and hospitality added a sizeable 48K positions- which aligns with our view that services strength prevails despite trade uncertainty (as exhibited in the recent expansion of services PMI for employment).

-

We saw a pullback in professional and business services employment (-18K), but this was driven by a decline in temporary help services – this is unsurprising as temporary help is often used to backfill positions in manufacturing, which also reported job losses in May (-8K).

-

The federal government shed 22K jobs in May (down 59K since January) as DOGE cuts continue to show up in the data. State and local government hiring (excluding education) offset federal cuts in the overall government hiring figure.

Beneath the Surface

-

Unexpectedly, the labor force participation rate fell to 62.4% (from 62.6%). May marked the largest labor force exodus since December 2023 – and this has coincided with a surge in retirements in recent months. Unemployment rose by 71K but given this exodus, the unemployment rate held steady.

-

The household survey showed a 41K uptick in re-entrants, similar to last month alongside 48K permanent layoffs. Quits continued to fall drastically. Interestingly, long-term unemployment fell to its lowest level in over a year (20.4% this month vs. 23.5% last month).

-

On a monthly basis, average hourly earnings moved meaningfully higher (+0.4% m/m vs. +0.2% m/m in April), suggesting structurally tight labor markets are still supporting earnings growth for now.

By Carrie Freestone

The Bottom Line:

This morning’s nonfarm payroll report was an upside surprise for April (+177K), although following downward revised growth in both March (+185K vs. initial 228K) and February (102K vs. previously 117k).

Paradoxically, from a structural perspective, record retirements mean that a shortage of labour supply remains an issue. The unemployment rate held steady in April at 4.2%. We saw an uptick in job losers, fewer quits, and a bump in re-entrants which nudged the participation rate up by one-tenth (to 62.6% from 62.5%).

But this morning’s print drives home the point that hiring has slowed as firms grapple with significant uncertainty from tariffs, and is expected to weaken further in the back half of the year as the impact of tariffs permeates.

The Details:

-

Health care & social assistance accounted for one-third of the payroll increase (+58K), alongside a surge in transportation and warehousing hiring (+29K). This is likely reflective of tariff front-running. Leisure and hospitality (+24K) and the financial services sector also reported notable gains (14K).

-

The Federal government shed 9k jobs this month and is down 26k for the year. The ripple effects of DOGE-related cuts have begun manifesting beyond direct federal employment, and we’ve started to see early cuts to contractors in management, scientific and technical consulting services. It was too soon to see cuts to educational services employment at state and local levels show up in the NFP data.

-

The household survey showed a 60k uptick in re-entrants, against fewer new entrants. The participation rate rose by one-tenth (to 62.6%) resulting in an uptick in unemployment alongside job gains. The number of permanent job losers and those who completed temporary jobs crept up a bit this month. Interestingly, the share of unemployed who classify as long-term unemployed is now higher at 23.5% (from 21.3% last month).

-

On a monthly basis, AHE growth moved lower to at 0.2% m/m. The y/y pace is now 3.7% (from last month’s 3.8%). This is reflective of a weaker hiring environment against a backdrop of immense uncertainty.

By Mike Reid and Carrie Freestone

The Bottom Line:

The March payrolls report showed a significant upside surprise- with 228k jobs added. A surprise uptick in leisure & hospitality (after weakness in February) coupled with strong payroll growth in transportation and retail (likely spurred by a ramp up in hiring associated with an inventory build-up ahead of tariffs) accounted for the bulk of growth alongside health care & social assistance. We saw fewer job losses in the federal government this month after federal layoffs slowed in response to the OPM announcement in early March that essentially paused the government-wide probationary layoffs by shifting responsibility to individual agencies. While the unemployment rate rose, this was largely reflective of an increase in new entrants rather than layoffs. Looking ahead, uncertainty around tariffs will likely weigh on payroll growth. If this week’s tariff announcements stick, weaker demand for exports will likely weigh on goods-sector hiring.

The Details:

-

Payrolls added 228k jobs in March, below the expected 140k. The unemployment rate ticked up to 4.2% (unrounded up 4.15%), above both market and our own expectations.

-

Health care & social assistance accounted for one-third of the increase (78k), with notable gains in leisure and hospitality (43k), transportation and warehousing (23K), and surprisingly, we saw notable gains in retail (24K). A ramp up in hiring in the latter two sectors may be reflective of an inventory buildup ahead of tariff announcements.

-

The Federal government shed a fewer -4k jobs this month (compared to -11k in February). This was likely reflective of the OPM revisions on March 4th, at which point we saw federal layoffs slow. A federal government pullback was offset by gains in state and local government (total government hiring up 19k).

-

The household survey showed a 77k uptick in new entrants- this is why we saw an uptick in the u-rate at the same time that we saw significant job gains- while the number of permanent job losers (and those who completed temporary jobs) actually fell (-3k).

-

On a monthly basis, AHE were slightly stronger 0.3% m/m (following a downward revision in February to 0.2%). The y/y pace is now slightly lower at 3.8%.

By Mike Reid and Carrie Freestone

The Bottom Line:

This report is reflective of government policies weighing on growth in 2025. Health care remained the primary driver as its growth held steady (we expect to see health care continue to grow with the aging of the U.S. population). But we saw job losses in the Federal government and leisure and hospitality. While the Federal layoffs should not be a surprise given the recent layoff announcements by DOGE, what is interesting is the drag seen in Food services – a sector that is likely facing a shortage of workers due to the slowdown in immigration. Looking ahead, we expect the uncertainty around tariffs will weigh on payroll growth in trade-related sectors and look for the DOGE layoffs to continue to subtract from headline growth. This trajectory poses upside risk to our unemployment forecast, which we currently have rising to 4.2% by year-end.

The Details:

-

Payrolls added 151k jobs in February, below the expected 160k. The unemployment rate ticked up to 4.1%, in line with our expectations.

-

The payroll gains were driven by a continued rise in healthcare & social assistance (63k) as well as gains in finance (21k), and construction (19k).

-

The Federal government shed around -10k jobs this month (we do expect to see that continue in the months ahead). Leisure and hospitality shed jobs for a second consecutive month, driven primarily by a drop in Food services, suggesting the slowing in immigration is weighing on hiring.

-

The household survey showed a rise of 40k in permanent job losers and 58k in workers who completed temporary jobs – both reflective of cuts to the Federal workforce as well as the contractor workforce.

-

On a monthly basis, AHE slowed to 0.3% m/m (following a downward revision to January to 0.4%). Still, the y/y pace remains elevated at 4.0%.

By Claire Fan

The Bottom Line:

-

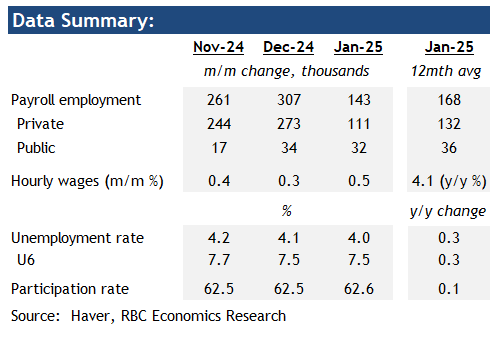

The exceptional run of U.S. labour market strength persisted in January, even with a small miss in payroll employment gain (143k vs. consensus 170k) and large and negative backward benchmark revisions to the level of payroll employment.

-

The unemployment rate dropped to 4% (and would have been 3.9% without annual adjustments to the population controls) and wage growth among private sectors remained elevated.

-

Today’s report confirms our expectations that a stable and strong U.S. jobs market does not need support from further Fed rate cuts. We continue to expect the central bank will hold Fed Funds steady at the current 4.25% – 4.5% range throughout 2025.

The Details:

-

After recoveries from strike and hurricanes pushed payroll gains higher towards the end of 2024, January saw a smaller increase of 143k. Health care (+44k) and retail (+34k) led the gain while goods producing sectors posted no job growth.

-

The annual benchmark revision (that accounts for differences in payroll levels between the initial establishment survey and the more comprehensive state fillings based on unemployment insurance coverage) was a large and negative 598k (non-seasonally adjusted).

-

That was still the second largest downward revision in the last 23 years (second only to the -902k revision in 2009) but was substantially lower than the initial estimate of 818k the BLS published in August last year.

-

On a seasonally adjusted basis, payroll employment is now reported to have increased 166k per month in 2024 comparing to the 186k before benchmark revision. That’s lower than the 216k (after revision) average monthly growth in 2023.

-

The unemployment rate in January fell further to 4.0%, slightly higher than 3.7% in January 2024 but still very low by historical standards. Labour force participation rate at 62.6% has changed very little over the last two years and was still below the level (+63%) pre-pandemic.

-

Hours worked fell in January by 0.2%, dragged by a decline in mining and lodging (-2.2%).

-

Average hourly earnings grew by a larger 0.5% from December to January, still well above the 0.25% average monthly rate in pre-pandemic 2019. On a year-over-year basis, wage growth remained elevated, at above 4%.

-

Resilience in U.S. domestic demand and labour backdrop is continuing to reduce the probability of additional Fed rates. We think the Fed will keep parsing wage and inflation data while holding back from cutting rates in 2025.

By Claire Fan

The Bottom Line:

-

U.S. labour market data continue to show strength towards the end of last year, in line with job openings data that turned around to rise consecutively in October and November.

-

Concerns over substantial weakening in the jobs market have continued to ease, leaving the Fed with much less urgency to cut interest rates.

-

The Fed already pivoted to a more gradual easing cycle in their last meeting In December. We think the odds of an additional rate cut this month are low, and the central bank will more likely be holding rates steady at the current 4.25% – 4.5% range throughout 2025.

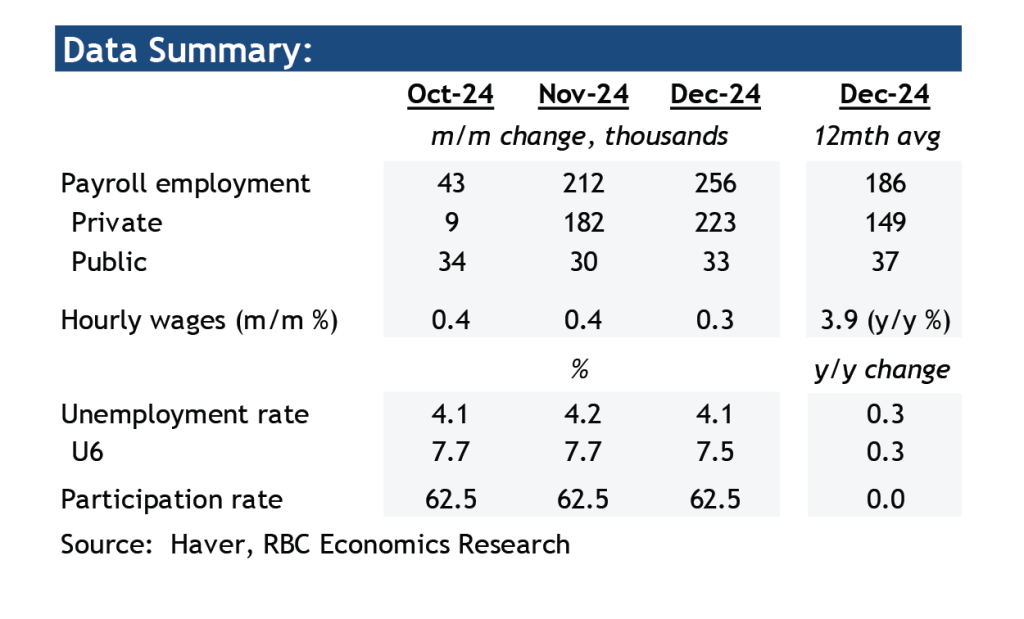

The Details:

-

Payroll employment gain (+256k) in December was well above consensus expectation (+160k), driven almost entirely by growth in the services sectors (+231k) with larger increases recorded in healthcare (+46k), retail (+43k) and leisure and hospitality (+43k).

-

The unemployment rate unexpectedly fell to 4.1%, and has now held in a tight 4.1% to 4.2% range since June (although still higher than the 3.7% rate at the start of 2024.) The labour force participation rate was little changed throughout the year, at 62.5% in December was still lower than the level (+63%) immediately pre-pandemic.

-

Among the unemployed in December there declines in the number of job losers, temporary workers, and labour market entrants. Job leavers on the other hand increased sharply to the highest since January 2022. That’s a sign of increased confidence in job market conditions among workers amidst a resilient hiring demand backdrop.

-

Hours worked ticker higher in December by 0.2% with gains in retail and transportation outweighing declines in construction and manufacturing.

-

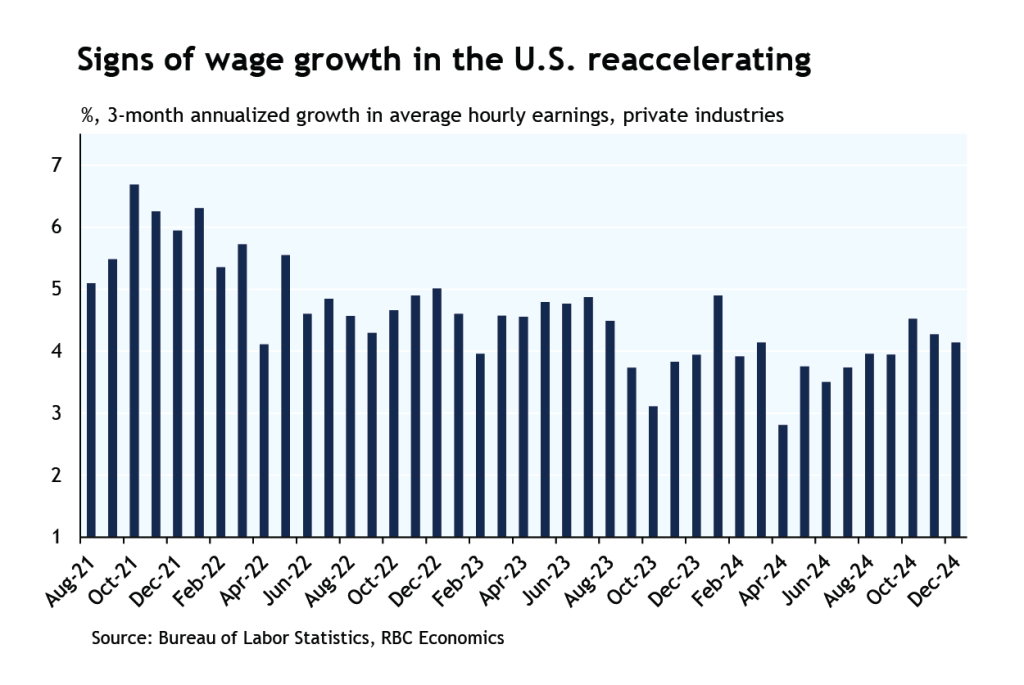

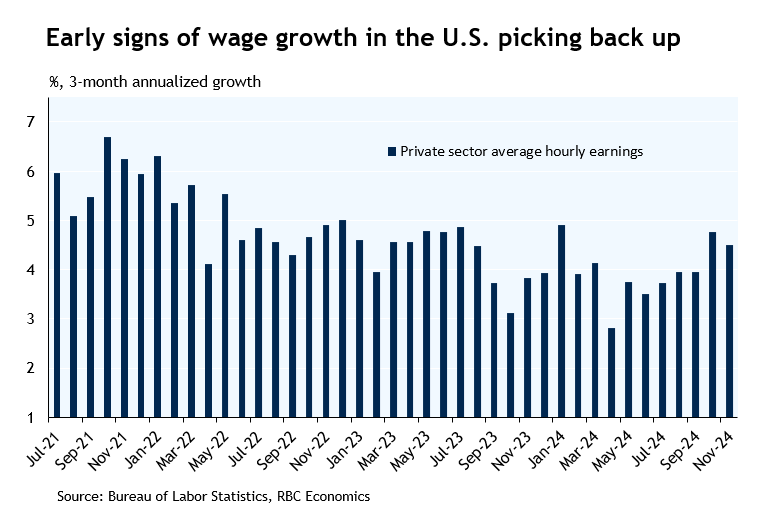

Finally, there remains evidence that recent strong hiring momentum is boosting wage growth in the U.S. Growth in average hourly earnings (on a three-month annualized basis) among private employees had slowed to below 3% in spring 2024 but started to reaccelerate, and landed above 4% by the end of last year.

-

Coupled with upside surprises in inflation data in the fall and a jump in ISM services price index in December, we think the Fed will want to be extra cautious, and pause the easing cycle as soon as January to ensure price pressures can continue to unwind.

By Nathan Janzen

Bottom line:

-

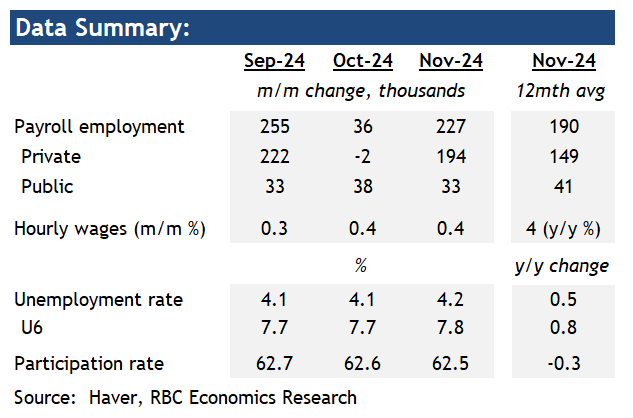

November’s U.S. labour market data was largely as expected – a gentle slowing more consistent with normalization than cyclical weakness.

-

Absent a big upside surprise in October CPI next week that could raise the odds that the Fed chooses to pause rate cuts, we think the data’s still soften enough to argue for additional rate cuts, and expect a 25-bps cut from in the December.

The Details:

-

Today’s employment report matched consensus expectations with a 227k employment gain and a tick higher in the U.S. unemployment rate, to 4.2% (consensus was for 190k employment gain and 4.2% unemployment rate).

-

Hiring demand was still strong but not enough to absorb rising labour supply – in November, there were 130k new and re-entrants to the labour market that became unemployed.

-

That was a large part behind the rise in the unemployment rate. Job losers on the other hand were roughly unchanged – a 58k rise in permanent layoffs was offset by a 66k decline in temporary layoffs.

-

In terms of the payroll gain, they were the most notable in health services (+54k) and leisure and hospitality (+53k). On a year-to-date basis, healthcare contributed about a third of the cumulative non-farm payroll gain this year.

-

Retail on the contrary continued to see job losses, of 28k in November. Over the last 6 months, employment in retail has fallen by 62k.

-

Total hours worked among private industry employees rose slightly in November by 0.1%. Durable goods manufacturing and leisure and hospitality led the increase (both were up 0.6%.)

-

There are early signs that wage growth is picking back up. Average hourly earnings in November posted another big 0.4% increase. That leaves the annual wage growth at 4% comparing to 3.6% this July.

-

Fed’s pace of easing has already slowed and recent communications from Fed speakers continue to hint at further but smaller rate cuts. We maintain our base case, and expect a 25-bps reduction in each of December and January before the Fed pauses and reassesses.

By Nathan Janzen

Bottom line:

-

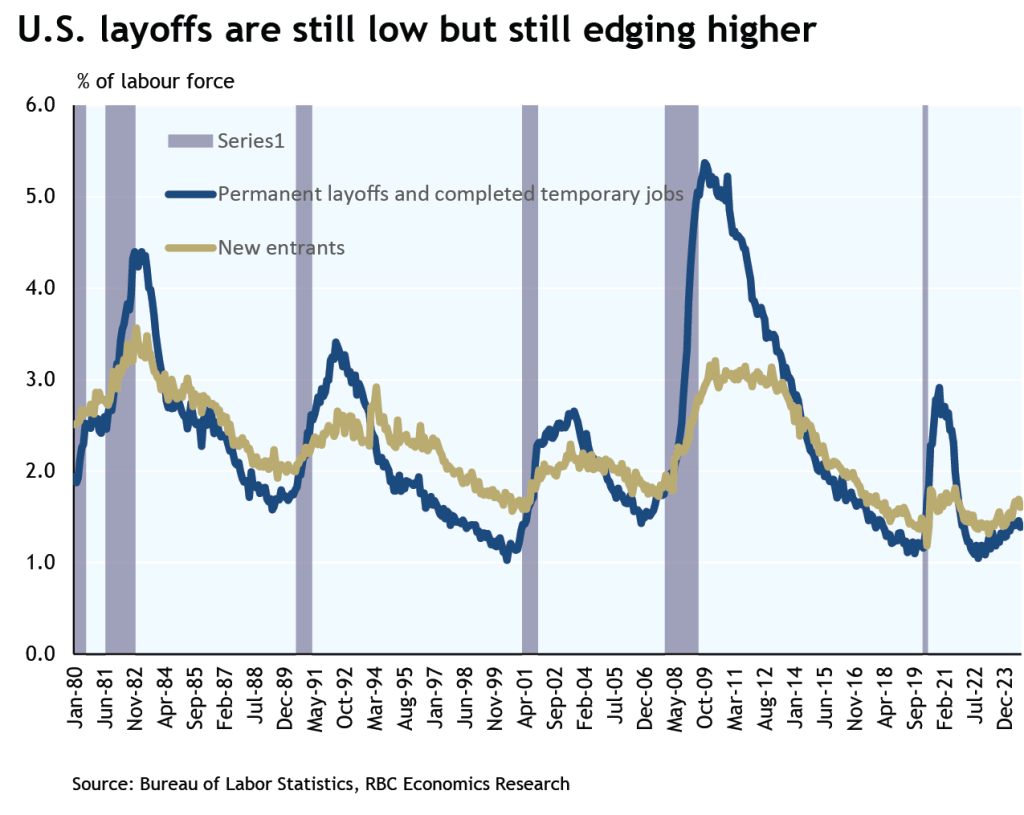

The tiny 12k payroll employment gain in October was heavily distorted by the impact of hurricanes, a large strike in the manufacturing sector, and an unusually low initial survey response rate. The unemployment rate was likely a ‘cleaner’ read on labour markets in October, and it was unchanged from September and still slightly below levels in the summer.

-

Underlying details are still consistent with a softening in labour markets – permanent layoffs rose and downward revisions knocked 112k off payroll employment growth in August and September – but still at a very gradual pace that is consistent with a ‘normalization’ from unusually low unemployment levels rather than a faltering.

-

Interest rates are still likely higher than they need to be for inflation to return fully back to the Fed’s 2% inflation target, and today’s data helps to reinforce our expectation that the Fed will cut rates by 25 basis points next week.

The Details:

-

Payroll employment rose just 12k in October (the smallest increase since the pandemic) and the private employment count declined outright (-28k)

-

But the payroll employment numbers were heavily distorted by hurricanes, striking workers in the manufacturing sector, and reportedly an unusually small initial survey response rate.

-

A decline of 44k in transportation equipment manufacturing was reportedly largely strike related, and explained most of a 46k drop in manufacturing jobs

-

Virtually all measures from the payroll employment survey were likely distorted in October, but leisure and hospitality and retail employment both edged lower and professional & business services fell 47k

-

The unemployment rate, though, is not as significantly impacted by those distortions – striking workers and those away from work due to bad weather are not counted as unemployed – and that ‘cleaner’ read of labour markets held steady at 4.1%.

-

Underlying an unchanged unemployment rate, though, permanent layoffs rose by 153k — layoffs are still very low as a share of the labour force but have been gradually edging higher.

By Claire Fan

-

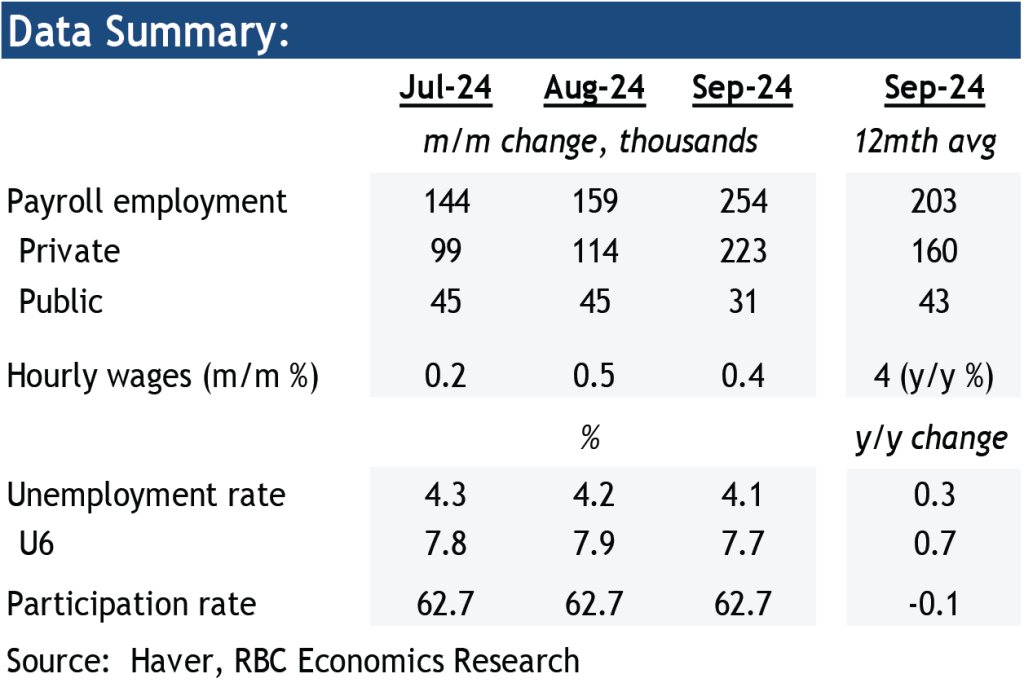

September’s U.S. employment report beat expectations by printing a solid 254k employment gain alongside a tick lower in the unemployment rate, to 4.1% (consensus was for 140k employment gain and a 4.2% unemployment rate).

-

The strong report saw dropping market odds for another 50-bps rate cut in the Fed’s next meeting in November – the payroll gain was the largest in six months. Leisure and hospitality led the increase, adding 78k jobs thanks to smaller-than-usual seasonal decline this September. Health services (+45k) and government hiring (+31k) also contributed.

-

The number of workers on both temporary and permanent layoffs were little changed in September, and 10% and 18%, respectively, higher than levels one year ago.

-

Total hours worked among private industry employees fell slightly in September by 0.1%, with gains in constructions and leisure and hospitality more than offset by losses in other services sectors including retail.

-

After a larger monthly increase in August, average hourly earnings rose by a robust 0.4% to push the yearly reading for wage growth higher to 4% in September. This was after cooling labour demand that has led yearly wage growth persistently lower from almost 6% in spring of 2022.

Bottom line:

-

If you take September’s U.S. monthly jobs report as the best gauge of the health of the U.S. economy, the most recent report says conditions are far from crumbling, but holding onto the “American resilience” theme just fine. Taken alone, the strength of the report will take the pressure off of the Fed to reduce rates by another 50bps chunk at its November 7th meeting and ups the chances of a 25bps cut, though with still plenty of data to contend with before then.

-

The story isn’t completely cut and dry, however. Other U.S. jobs market data, like job openings quit rates and various surveys still suggest momentum is trending downwards and will keep the U.S. central bank focused on downside risks, happy to be surprised to the upside as opposed to the reverse.

-

For Canada, a more aggressive downturn in the U.S. has long been a risk for the economy that’s suffering from its own set of domestic challenges. We think today’s U.S. Jobs report also take some of those worries away from the Bank of Canada as they grapple with a 25bps or 50bps cut decision on October 23rd. Although they still have plenty to contend with.

-

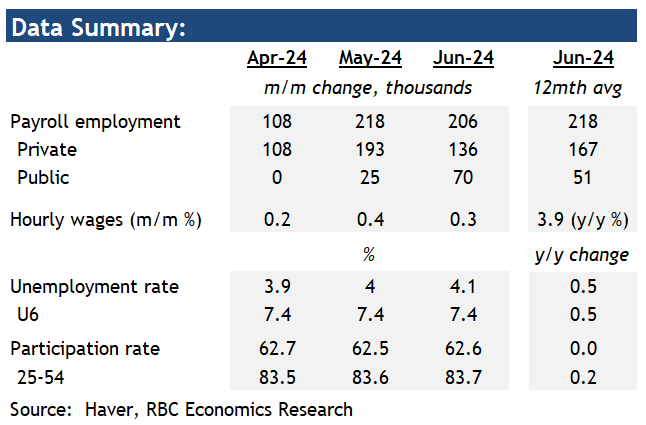

U.S. non-farm payroll gain of 206k in June was close to consensus but after downward revisions to each of April and May that shaved 111k off of employment gains in those prior months.

-

In June, it was again new hires in government (+70k) and health services (49k) that accounted for the lion’s share of job growth. All other private sector employment grew by a smaller 90k, with gains in construction (+27K) and wholesale (+14K) offset by losses in professional and business services (-17k), retail (-9k) and manufacturing (-8k).

-

The separately released household survey showed the U.S. unemployment rate ticking higher to 4.1%. That’s half a percent higher than the unemployment rate a year ago while the labour force participation rate stayed unchanged from last year, at 62.6%.

-

Among the unemployed, those that were jobless for 27 weeks and more saw a sharp rise in June, by 166k to 399k above levels a year ago.

-

Total hours worked among private industry employees contracted by 0.2% in June after a big gain in May. On a quarterly basis, private hours worked increased by about 2% (annualized) in Q2.

-

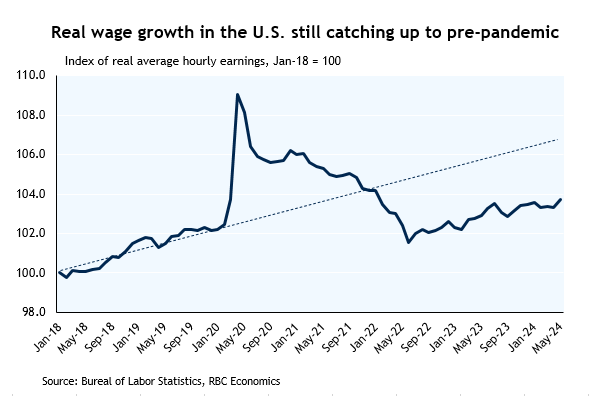

Finally, wage growth after having risen sharply in May slowed in June. Average hourly earnings rose by 0.3% or 3.9% from last year. To-date, a lot of that increase still reflects a catching up to past high inflation – real hourly earnings as of May (the last available CPI data) grew by 0.4% each year since 2019, much slower than the 1.1% trend rate in the three years pre-pandemic.

-

Bottom line: June brought another robust payroll gain in the U.S. but according to the meeting minutes, FOMC participants have begun to question if job gains in the establishment survey have been overstated with the separately calculated unemployment rate continuing to rise. Jobless claims have been broadly edging higher in recent weeks and survey data has also pointed to rising uneasiness with employment situation among consumers in the U.S. Overall, the slowdown in labour market conditions is evident but slow, just as the progress with easing inflation. That means the Fed will need more time and more data before committing to lowering interest rates. We think won’t come until December.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.