Proof Point: Surging population growth has prevented outright declines in Canadian gross domestic product, but per person output is falling, and the unemployment rate is rising like it usually only would be during a recession. Interest rate cuts from the Bank of Canada will eventually alleviate some of the pressure on households. As purchasing power is restored, we expect per capita growth will turn positive by the second half of next year.

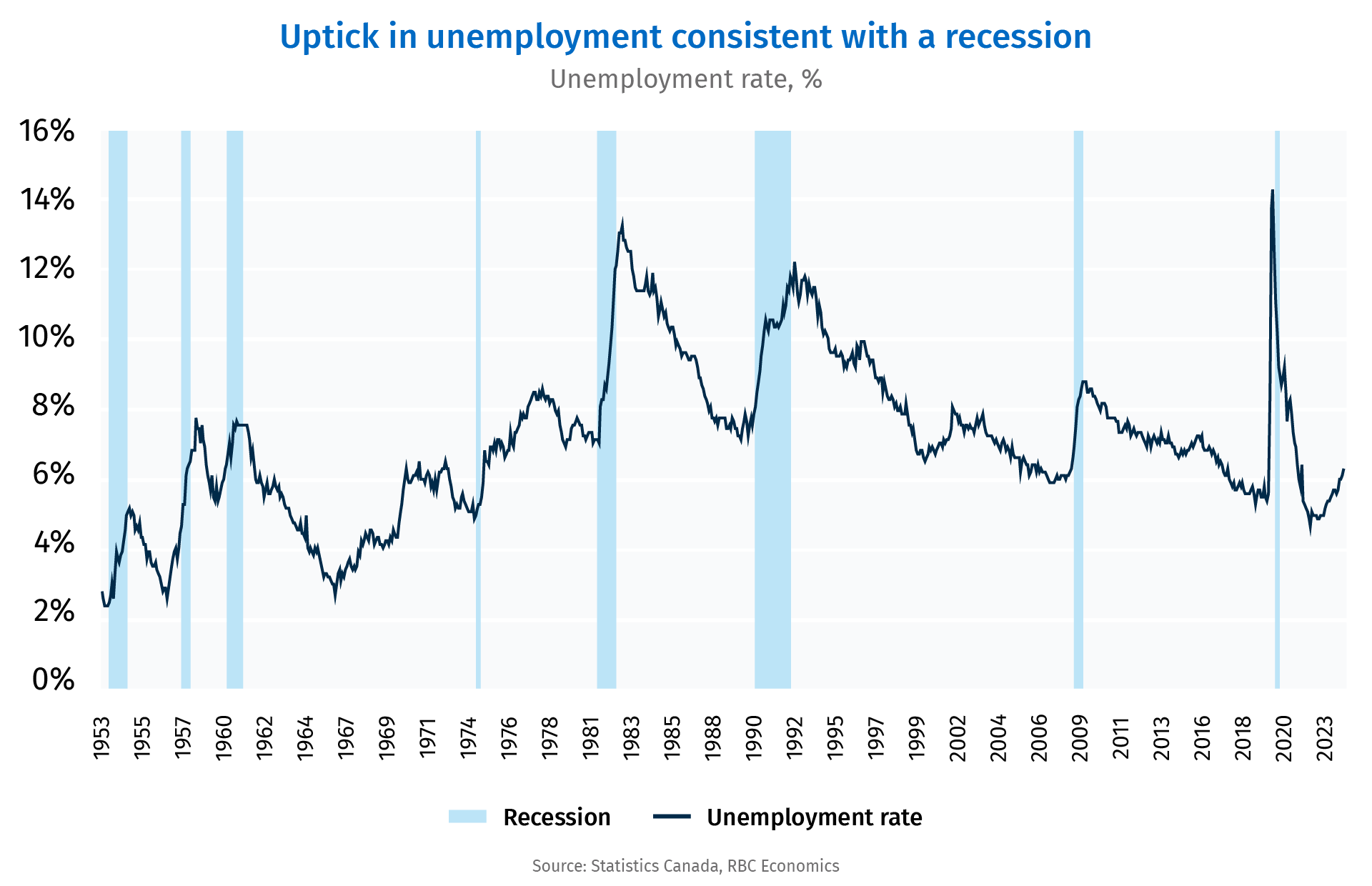

- Higher interest rates alongside decades-high inflation in 2022-23 ate away at household purchasing power. Weaker demand spurred a rise in the unemployment rate of a size that historically only happens in recessions.

- But decades-high population growth has masked this recession-like economic backdrop. Canada has added 2.1 million additional consumers since mid-2022.

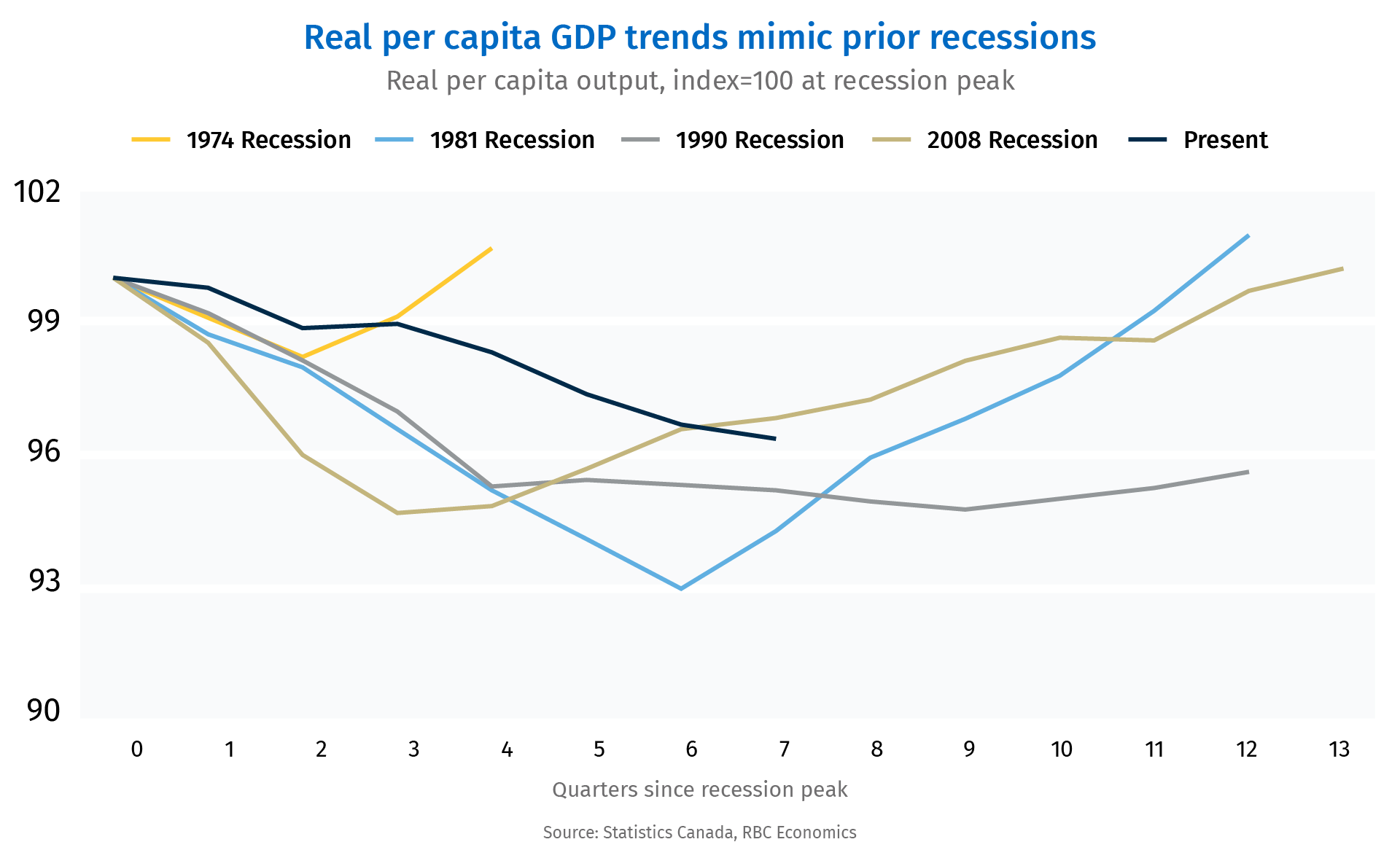

- Real per person output has declined in six of the past seven consecutive quarters and unemployment has risen at the same time.

The total size of the Canadian economy has continued to grow—narrowly avoiding the consecutive headline GDP declines that would normally qualify as a “recession” in the aftermath of surging inflation and aggressive interest rate hikes by the BoC in 2022-23. But, that’s only due to a wave of new consumers arriving from abroad. Canada’s population grew by 6% from Q2 2022 to Q1 of this year, adding 2.1 million new consumers to the economy. Consumer spending accounts for more than half of GDP, and many of those new arrivals (a larger share than the Canadian-born population) are also workers that added to the economy’s productive capacity.

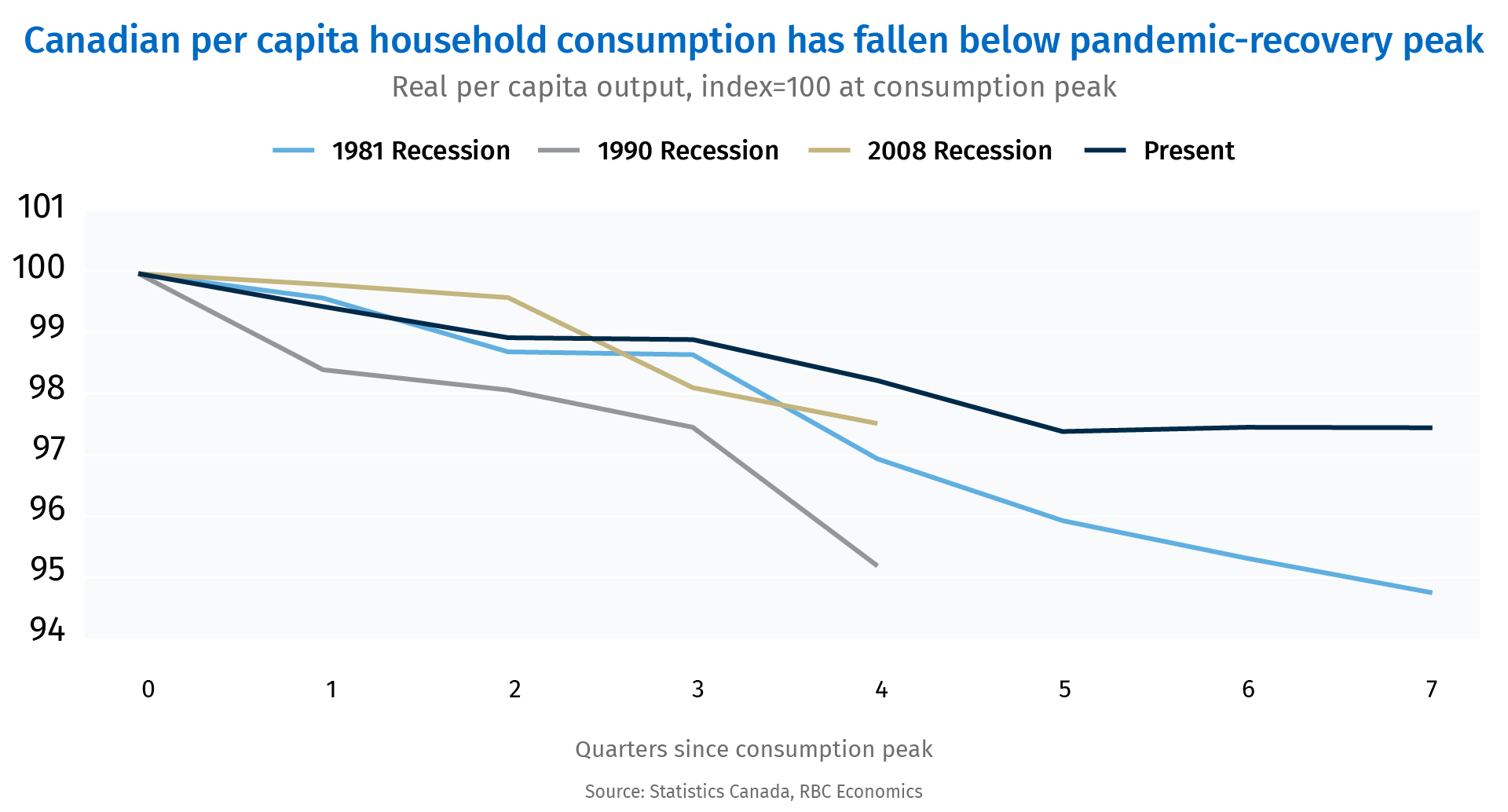

Without higher population boosting demand, the Canadian economy almost certainly would have contracted outright over last two years. Per person after inflation household spending is 2.6% below its post-pandemic peak and down 2% from pre-pandemic 2019 levels as higher prices and interest rates cut into purchasing power. Per capita GDP has declined in six of the past seven quarters to 3.1% below 2019 levels.

The 1.6 percentage point uptick in the unemployment rate is smaller than in those seen in larger recessions, and that increase is from half-century post-pandemic lows. But since the 1970s, Canada has never had a trough to peak increase in the unemployment rate of that size without the economy going through a recession. An increase following the dot-com bubble burst in 2000 maxed out at 1.5 percentage points.

About half the increase in the unemployment rate from its post-pandemic lows has come from layoffs, which are up 20% from a year ago as of June. About 40% of the uptick in unemployment is coming from students and new graduates having a harder time finding a job.

The per capita GDP decline in Canada has been milder than in more recent downturns. In 2008, real per capita output fell 5% from peak to trough, similar to the contraction in the early 90s. The drop in the 1980s was a larger 7%. But the current per capita GDP decline is larger than in earlier periods that were considered recessions.

Interest rate cuts to slowly alleviate household pressures

The BoC’s easing cycle is underway after an initial 25 basis point interest rate cut in June. We expect three additional back-to-back cuts in subsequent meetings will bring the overnight rate to 4% by year end.

The loosening of monetary policy to less restrictive levels will ease some of the pain. Mortgage renewals in 2025-26 will still challenge households, but it should be manageable as long as the slowdown in labour markets does not significantly intensify. Households with variable rate mortgages and credit market debt will feel some relief as interest rates move lower. We expect real per capita GDP will likely still be negative through the end of this year but will turn positive in the second half of 2025 as headwinds from higher interest rates continue to fade.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.