Key findings

-

Canada’s greenhouse sector is a hotbed for growth. Greenhouses specializing in fruits and vegetables in Canada have increased in farm gate value for the 11th consecutive year, up 9.2% to $2.5 billion in 2023–doubling in size from a decade ago.1

Canada’s greenhouse sector is a hotbed for growth. Greenhouses specializing in fruits and vegetables in Canada have increased in farm gate value for the 11th consecutive year, up 9.2% to $2.5 billion in 2023–doubling in size from a decade ago.1 -

Infrastructure limitations could stunt future growth. Greenhouse production in Ontario is expected to more than double in acreage over the next 10 years, but the industry faces key barriers in accessing energy, water, waste management, and labour2. The Windsor-Essex and Chatham area peak demand is projected to rise from 500 megawatt (MW) in 2023 to approximately 2,100 MW by 2035, driven primarily by growth in advanced and electric vehicle battery manufacturing and greenhouses.3

Infrastructure limitations could stunt future growth. Greenhouse production in Ontario is expected to more than double in acreage over the next 10 years, but the industry faces key barriers in accessing energy, water, waste management, and labour2. The Windsor-Essex and Chatham area peak demand is projected to rise from 500 megawatt (MW) in 2023 to approximately 2,100 MW by 2035, driven primarily by growth in advanced and electric vehicle battery manufacturing and greenhouses.3 -

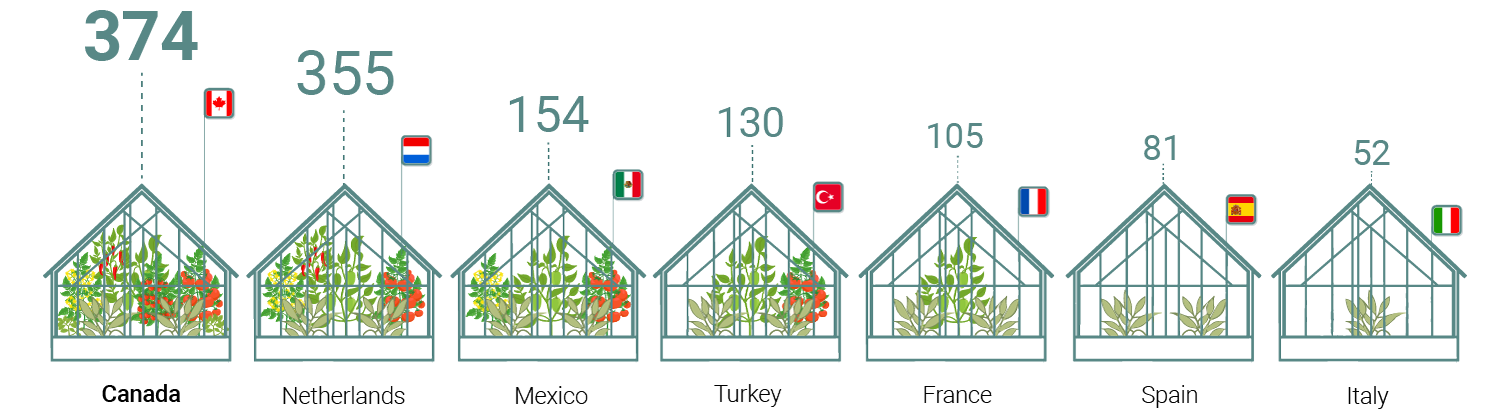

Canada’s global greenhouse strengths lie in productivity and land-use efficiency. The country’s greenhouse production boasts the highest yields per area of land among top greenhouse nations. Canada produces 4.6 times more per area of land than Spain, is slightly more productive than the Netherlands, and 2.6 times more than Mexico4,5. The challenge over the next decade for Canada will be to continue to lead on land-use efficiency, while scaling production to meet domestic and trade demands.

Canada’s global greenhouse strengths lie in productivity and land-use efficiency. The country’s greenhouse production boasts the highest yields per area of land among top greenhouse nations. Canada produces 4.6 times more per area of land than Spain, is slightly more productive than the Netherlands, and 2.6 times more than Mexico4,5. The challenge over the next decade for Canada will be to continue to lead on land-use efficiency, while scaling production to meet domestic and trade demands. -

A key market for export growth is the western United States. Greenhouse vegetables account for 39% of Canada’s fresh produce exports, 99.5% of which are U.S.-bound. Canadian greenhouse fruit and vegetable products are consumed in the east from New York to Florida. Canada could also tap into the U.S. Midwest’s 68-million-strong market, if it can build relationships, branding, and cold chain logistics.

A key market for export growth is the western United States. Greenhouse vegetables account for 39% of Canada’s fresh produce exports, 99.5% of which are U.S.-bound. Canadian greenhouse fruit and vegetable products are consumed in the east from New York to Florida. Canada could also tap into the U.S. Midwest’s 68-million-strong market, if it can build relationships, branding, and cold chain logistics. -

Greenhouses must solve their energy trilemma—of demand, emissions, and bills—to expand. Energy costs for Canadian greenhouses have surged 55% between 2013 and 2023, while natural gas-sourced power is driving the industry’s carbon footprint.6,7 Reducing natural gas demand and the green premium for alternatives including renewable natural gas, hydrogen, and clean electricity would enable Canadian greenhouses to thrive in a low carbon economy.

Greenhouses must solve their energy trilemma—of demand, emissions, and bills—to expand. Energy costs for Canadian greenhouses have surged 55% between 2013 and 2023, while natural gas-sourced power is driving the industry’s carbon footprint.6,7 Reducing natural gas demand and the green premium for alternatives including renewable natural gas, hydrogen, and clean electricity would enable Canadian greenhouses to thrive in a low carbon economy.

Opening the doors to the possibilities

Globally, population growth is expected to rise to 9.7 billion in 2050, with food demand rising around 56% by 2050 from 2010 levels8,9. Meeting future demand is a daunting task amid rising food insecurity. In Canada, more than 20% of households experience food insecurity, while food prices in stores have increased 21.6% from February 2021 to February 2024 due to several factors, including poor growing conditions, supply chain issues, and high input costs10. These factors present a challenge for the agriculture sector to innovate and advance climate resilient, efficient systems that bring more of the food produced to people’s plates at an affordable price.

Canada’s greenhouses are well positioned to help meet the challenge because of their high land use and input efficiency, potential to shorten supply chains for Canadians, and a strong history of growth and innovation.

Doubling down on these achievements over the next decade would require overcoming energy, water, and waste infrastructure challenges, while addressing regulatory constraints, labour shortages, and shortcomings in supply chains.

Greenhouses’ innovation advantage is growing in controlled environments. Enclosed spaces mean operators can design dynamic systems of lighting, fertigation, and heating to optimize plant growth and improve efficiency of resource use. For example, greenhouse operators can adopt low-tech innovations such as horizontal curtains to keep heat closer to plants, and high-tech innovations in early genetic testing to combat disease and pests that risk wiping out an entire crop’s growing cycle. Controlled environment agriculture also presents an opportunity to innovate in climate adaptation. By growing fruits and vegetables in enclosed structures and in controlled growing mediums, production can be more resilient to extreme weather events, changes in precipitation, and seasonal shifts, safeguarding a consistent supply of food. With climate change already disrupting supply and markets, there are economic costs to inaction—there is no time to create a false dilemma between choosing climate action or food supply12. Instead, food production and supply chains can advance their efforts in converging economic, production, and climate goals.

Canadian Greenhouses energy use is primarily powered by natural gas, which means high energy use equates to high greenhouse gas (GHG) emissions13. Canada needs to expand clean and renewable energy options, while also bringing down bills and reducing energy consumption to help the sector successfully decarbonize. Options in development include renewable natural gas (RNG) production from agriculture biowaste and neighbouring landfills, investments in regionalized hydrogen production, and exploring deployment of industrial sized electric heat pumps.

Disruptions and volatility in markets are to be expected from now until 2050, but so too is rising demand for fruits and vegetables produced in Canada. North America’s population is estimated to steadily grow during this period, and as incomes rise, consumer preferences are likely to shift to selecting more nutritious foods like fruits and vegetables for health reasons and complementary measures such as sugar taxes. Supply needs to be available to meet changing tastes, but projections suggest that the land used for fruits and vegetable production in North America will shrink over the next decade14. These multifaced issues present new growth challenges for Canada’s greenhouse sector.

What is CEA?

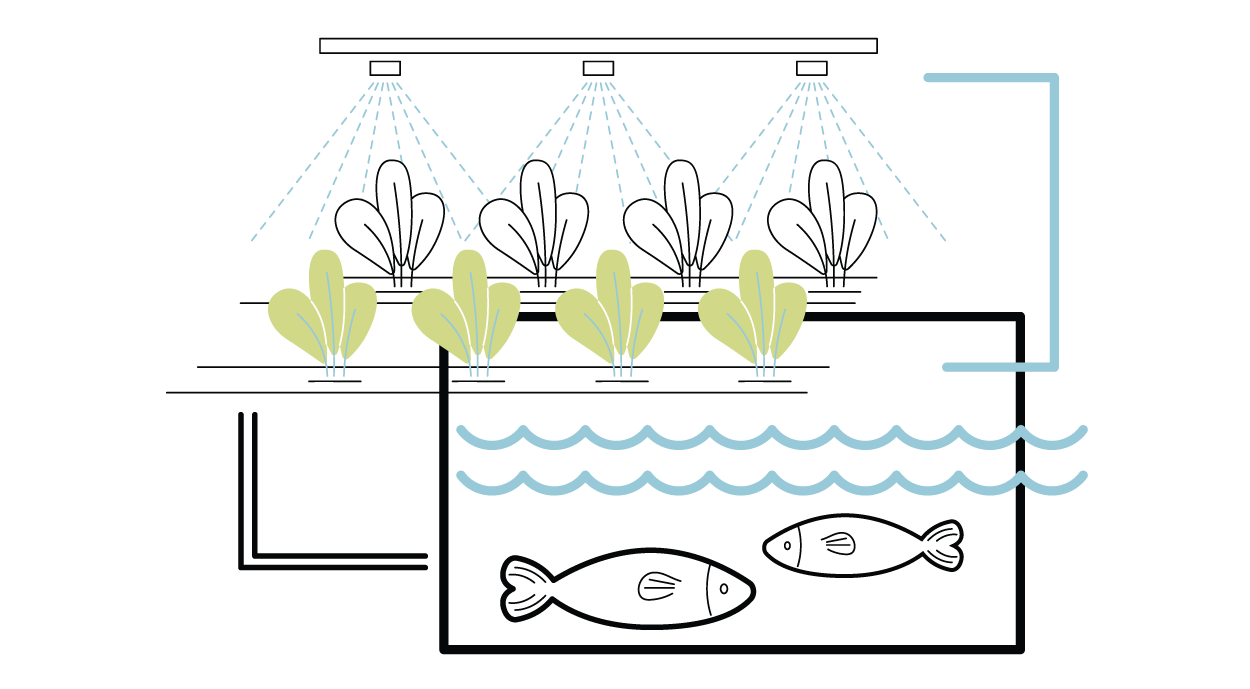

Controlled environment agriculture (CEA) is a continuum of growing systems from low tech to high tech that allows growers to have more control over the environment that crops are grown in.

CEA growing infrastructure

Glass or poly greenhouse:Enclosed structure made from glass, polycarbonate, or

Glass or poly greenhouse:Enclosed structure made from glass, polycarbonate, or

polyethylene. Low-tech plastic hoop house:Plastic film tunnel-shaped structure that are often low-tech with limited climate control systems.

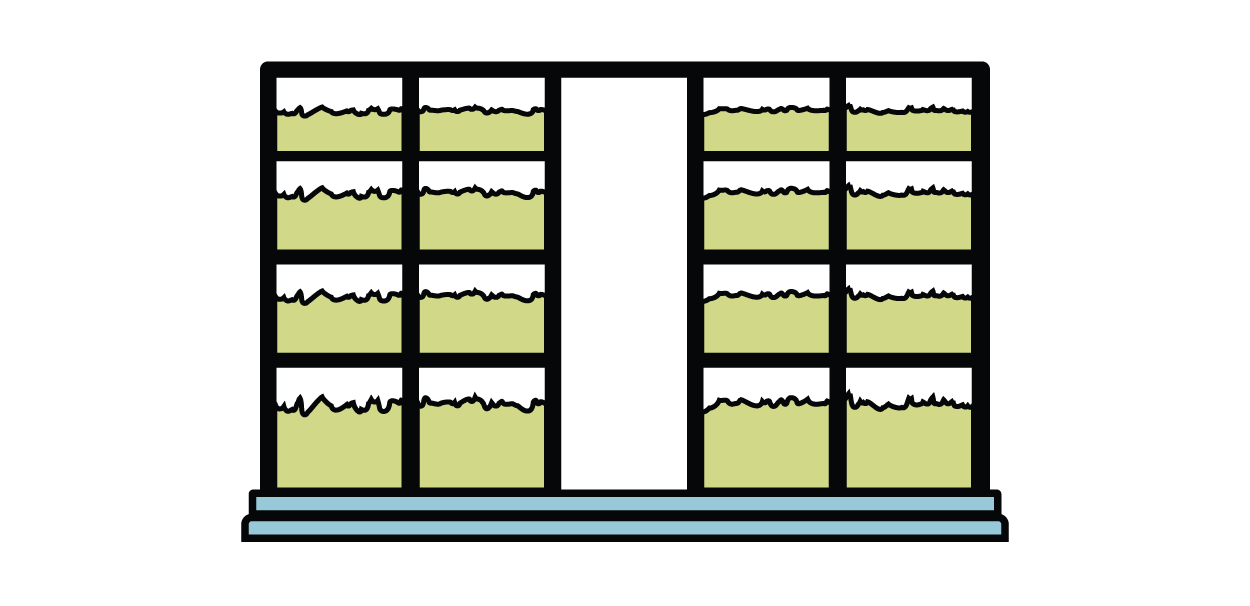

Low-tech plastic hoop house:Plastic film tunnel-shaped structure that are often low-tech with limited climate control systems. Indoor vertical farm:Enclosed room such as warehouses with stacked growing units that often use artificial lighting and soilless growing mediums.

Indoor vertical farm:Enclosed room such as warehouses with stacked growing units that often use artificial lighting and soilless growing mediums. Other indoor farm:Enclosed, opaque structures such as retrofitted buildings using different growing systems, from aeroponics to deep-water culture.

Other indoor farm:Enclosed, opaque structures such as retrofitted buildings using different growing systems, from aeroponics to deep-water culture.

CEA growing medium

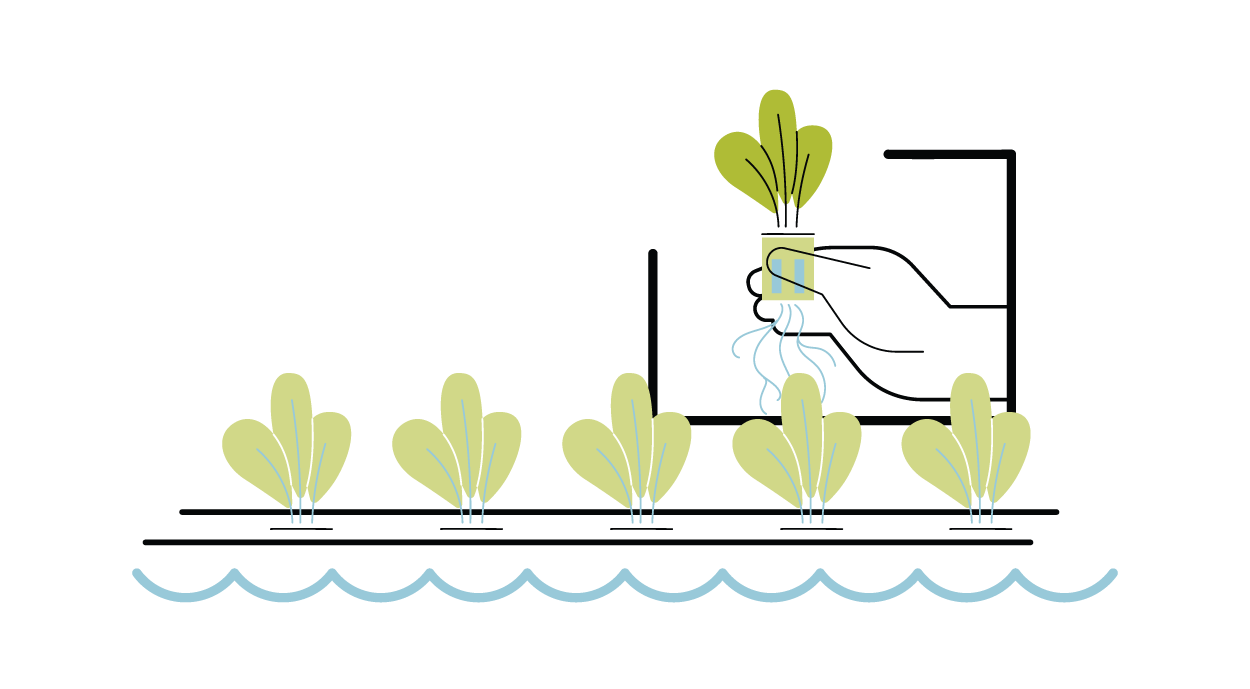

Hydroponics:Plants are grown in water-based mineral nutrient solutions.

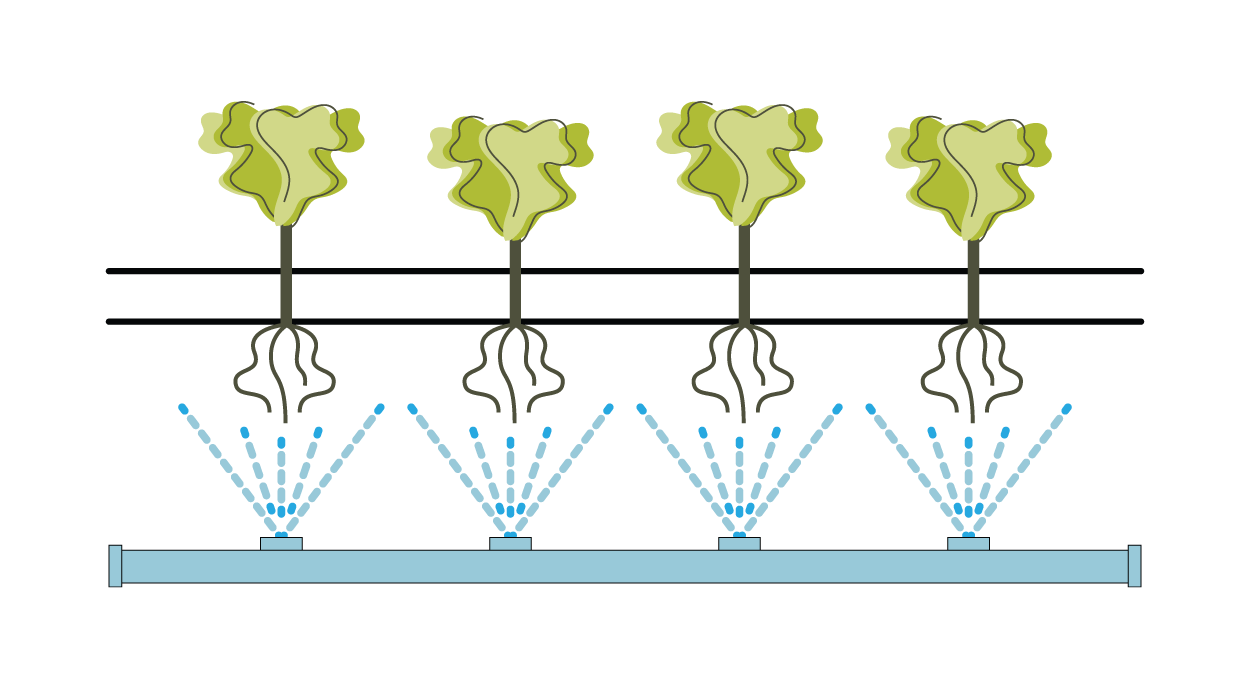

Hydroponics:Plants are grown in water-based mineral nutrient solutions. Aeroponics:Plants are grown by suspending their roots, receiving nutrients through misted solutions.

Aeroponics:Plants are grown by suspending their roots, receiving nutrients through misted solutions. Aquaponics:Plants are grown in water in a symbiotic environment with aquatic organisms.

Aquaponics:Plants are grown in water in a symbiotic environment with aquatic organisms. Soil-based:Plants are grown in soil.

Soil-based:Plants are grown in soil.

A glimpse into current Canadian greenhouse production

In Canada, there are 920 greenhouses specializing in fruits and vegetables, spanning more than 5,000 acres15. These greenhouses produce more than 800,000 tonnes of tomatoes, cucumbers, peppers, lettuce, strawberries, and other produce, and are mainly made of glass, polycarbonate, or polyethylene, with different growing mediums depending on the crop16. Canada is also home to greenhouse production for flowers and cannabis. There are more than 1,500 operations growing flowers and plants generating a farm gate value of $2.1 billion in 202317. This report is focused on fruit and vegetable greenhouse production given Canada’s opportunity and challenge ahead to expand agri-food production and trade, while decarbonizing and adapting our food system to climate change.

Two-thirds of greenhouse production of fruits and vegetables in Canada takes place in Ontario and is mostly concentrated in Essex County in the province’s southwest. Leamington, Ontario, or the “Sun Parlour” of Canada, is in Essex County and home to North America’s largest concentration of greenhouses growing fruits and vegetables.

Essex County benefits from warmer temperatures, long sunny days, a Great Lakes-induced microclimate that creates ideal growing conditions, and is under an hour away from the U.S. border. The region has also benefitted from family farms that have invested locally and innovated in greenhouse construction, research, and cogeneration of energy and heat, making it a unique greenhouse hub. For example, the Center for Horticultural Innovation in Leamington trials the production of fruits and vegetables and new technologies such as bug-zapping drones to identify what can be scaled in Canadian greenhouses, keeping the industry moving forward. Ontario’s broader greenhouse sector is also supported through a variety of means including innovation funds such as the Greenhouse Competitiveness and Innovation Initiative (GCII), energy efficiency incentives, numerous research projects under the Ontario Agri-Food Research Innovation Alliance, and energy expansion projects underway to support regional growth.

Canada: A Greenhouse Powerhouse

Source: Statistics Canada

British Columbia, Quebec, and Alberta follow in production with smaller slices of the pie, but each have a growing greenhouse sector, in part, because of strategic regional development.

-

Quebec is actioning its ‘2020-2025 Greenhouse Growth Strategy’ through mechanisms such as rebates on energy consumption to double the size of the province’s greenhouse operations to approximately 620 acres by 2025.

Quebec is actioning its ‘2020-2025 Greenhouse Growth Strategy’ through mechanisms such as rebates on energy consumption to double the size of the province’s greenhouse operations to approximately 620 acres by 2025. -

Alberta is scaling innovation in agri-tech in greenhouses through research on novel strawberry and tomato seed varieties and efficiencies in lighting and energy. There is also support in the province to develop cross sector collaborations between the energy and greenhouse sectors to install transparent solar panels within greenhouses and facilitate the use of waste heat and CO2 from the production of natural gas to feed plant growth.

Alberta is scaling innovation in agri-tech in greenhouses through research on novel strawberry and tomato seed varieties and efficiencies in lighting and energy. There is also support in the province to develop cross sector collaborations between the energy and greenhouse sectors to install transparent solar panels within greenhouses and facilitate the use of waste heat and CO2 from the production of natural gas to feed plant growth. -

British Columbia is leveraging agriculture technology to advance its greenhouse sector through the creation of the B.C. Centre for Agritech Innovation at Simon Fraser University—part of the StrongerBC Economic Plan.

British Columbia is leveraging agriculture technology to advance its greenhouse sector through the creation of the B.C. Centre for Agritech Innovation at Simon Fraser University—part of the StrongerBC Economic Plan.

Canada’s greenhouse vegetables account for 39% of all fresh produce exports, valued at over $1.4 billion. Ontario is responsible for 88% of this export value, predominantly to the U.S. (99.5%), but also to Japan, France, and Taiwan18 .

The U.S.’s demand for fresh fruits and vegetables exceeds its production capacity, making it a key market for Canada to expand exports. For example, greenhouse tomatoes represent around 65% of the U.S.’s total fresh tomato import volume and value, and make up a significant chunk of its domestic consumption19. Canada is second to Mexico in U.S. imports of greenhouse tomatoes by some distance. Building upon innovation and energy solutions, Canada could market its products as high-tech and low-carbon to capitalize on consumers’ rising preference for sustainable products20.

Delivering on domestic and export demands requires highly efficient and productive growing systems.

In Ontario, the top producers of greenhouse tomatoes, cucumbers, and peppers had gross margins of approximately 80 to 90% between 2017 and 2021, growing in greenhouses sized at approximate 29, 117 and 49 acres on average, respectively21.

Natural and artificial lighting, CO2, heat, water, nitrogen, phosphorus, and companion plants all contribute to a dynamic growing system for greenhouse fruits and vegetables. The balance across inputs varies depending on the produce. Cucumbers are mostly made up of water and therefore require substantial amounts of water to grow. In greenhouses, water is recirculated, and cucumbers’ water needs are approximately 800 to 1,200 litres per square metre per growing season. The exact amount of water needed depends on different factors, including the light source used. Inputs for tomatoes can slightly vary depending on the variety, but the outputs highlight the key differences. For example, a beefsteak tomato requires similar lighting, water, energy, CO2, and fertilizer to cherry tomatoes, yet beefsteak yields are more than double of the cherry variety22.

Greenhouses use energy, primarily from natural gas, for heating, lighting, and CO2 production. Natural gas is often used to heat water using boilers, which is pumped into greenhouses via piping that runs along the ground like a grid network and serves a dual purpose in creating tracks that harvesters can move along like a train to pick the produce. The flue gas from the boilers is often scrubbed and converted into CO2 for plant food.

Natural gas, electricity, heating oils, and other types of fuels are rising in cost for Canadian greenhouse operators, and have increased by 55% from 2013 to 2023, to $406 million23. Energy use in greenhouses can also be costly for the environment with the use of natural gas often the main source of emissions in a greenhouse’s carbon footprint24. Some greenhouse operations have developed co-generation energy and heat facilities that power production in greenhouses and is integrated in the electric grid to help optimize efficiencies and meet peak energy demands. For example, Leamington-based Under Sun Acres operates four combined heat and power gas engines adjacent to their greenhouse used for pepper production. The engines supply the Ontario electricity grid with 13 MW of electricity, and the waste heat recovered from the engine exhaust and jacket is utilized to heat the greenhouse25.

Greenhouse’s role in energy production can help meet regional demands, such as the Windsor-Essex and Chatham area’s projected rise from 500 MW peak demand in 2023 to approximately 2,100 MW by 2035, primarily driven by greenhouses, advanced manufacturing, and electric vehicle battery production.

Land is also a hot commodity, but efficiency per area of land relative to field production is a keystone in greenhouse’s sustainability story, freeing up land for other uses. In Canada, greenhouse tomatoes, peppers, cucumbers, lettuce, and strawberries together produce around 8.5 times more per area of land compared to Canadian field production, demonstrating strong productivity. However, yields over the past decade have plateaued26,27. Innovations underway to surpass historic yields include dynamic lighting systems, reconfiguring growing infrastructure to optimize space and light, and genetics to overcome stagnation.

Labour is necessary but costly, accounting for 29% of Canada’s greenhouse operating expenses28. Farmer 4.0 highlights that greenhouses have far less returns on labour expenditure relative to other agriculture sectors such as beef. While the harvesting process remains primarily human-powered, promising innovations such as conveyer belt harvesters and robotics transporting and packaging in warehouses, can cut the time it takes produce to reach store shelves.

Greenhouses have benefitted from government and industry support, but their policy and regulatory environment can also be an impediment. Controlled environment agriculture is often caught up in a no-man’s land of regulations, where it does not fit neatly into agriculture or industrial categories for development and access to resources. It can also take years to get approval for new projects. Canadian greenhouses face higher taxes and barriers in accessing affordable energy relative to some of their U.S. counterparts, hurting their competitiveness. The sector also comes up against regulatory barriers in accessing sufficient water, leading operators to choose between a few options, including making large upfront investments to build irrigation ponds and storm water collection systems, paying hefty development charges, or enduring lengthy processes to obtain easements and permits to access water.

The Big 5

Canadian fruit and vegetable greenhouses are highly specialized. The five big staples in Canadian greenhouse production include:

-

Tomatoes: Tomatoes are the king of greenhouse production in Canada, covering more than 1,800 acres, producing around 315,000 tonnes and $869 million in farm gate value29.

Tomatoes: Tomatoes are the king of greenhouse production in Canada, covering more than 1,800 acres, producing around 315,000 tonnes and $869 million in farm gate value29. -

Cucumbers: Cucumbers represent the largest share of Canadian greenhouse vegetable exports at 34% of the value30.

Cucumbers: Cucumbers represent the largest share of Canadian greenhouse vegetable exports at 34% of the value30. -

Peppers: With nearly 170,000 tonnes, produced in 2023, peppers are the third largest greenhouse product in volume and value, but second in land use31.

Peppers: With nearly 170,000 tonnes, produced in 2023, peppers are the third largest greenhouse product in volume and value, but second in land use31. -

Lettuce: Lettuce is a distant fourth in greenhouse production, led by Quebec. There is an opportunity to boost domestic production as lettuce represents the highest share of field vegetables imported into Canada by value at 18%, with the U.S. and Mexico combined accounting for around 99% of imports32.

Lettuce: Lettuce is a distant fourth in greenhouse production, led by Quebec. There is an opportunity to boost domestic production as lettuce represents the highest share of field vegetables imported into Canada by value at 18%, with the U.S. and Mexico combined accounting for around 99% of imports32. -

Strawberries: Strawberries are the star fruit in greenhouse production, but currently account for only 3% of Canadian fruit and vegetable space33. This household favourite has runway to grow as Canadian greenhouse operators continue to modify their approach to protect strawberries from pest and diseases.

Strawberries: Strawberries are the star fruit in greenhouse production, but currently account for only 3% of Canadian fruit and vegetable space33. This household favourite has runway to grow as Canadian greenhouse operators continue to modify their approach to protect strawberries from pest and diseases.

Five to watch

Canadian tastes are evolving and diversifying and Canada’s access to highly consumed items such as bananas and coffee could become more challenging over time amid concerns about climate change, supply chain disruptions, and geopolitical shifts. This context creates opportunities to innovate in the types of commodities grown in Canada.

-

Berries beyond strawberries: Raspberries and blueberries are among the top five fruit imports by value in Canada, presenting a large domestic demand for greenhouses to meet if production of these delicate, high-value products can be mastered34.

Berries beyond strawberries: Raspberries and blueberries are among the top five fruit imports by value in Canada, presenting a large domestic demand for greenhouses to meet if production of these delicate, high-value products can be mastered34. -

Spinach: Canada is a net importer of spinach, but efforts are underway to improve yield in greenhouses, speed up and automate the cultivation process, and improve cold chain logistics35.

Spinach: Canada is a net importer of spinach, but efforts are underway to improve yield in greenhouses, speed up and automate the cultivation process, and improve cold chain logistics35. -

Bananas: Bananas are the largest fruit import into Canada by volume, and have experienced global yield increases since the 1960s. But the next 50 years may not be as fruitful, opening an opportunity for greenhouses to grow bananas36,37.

Bananas: Bananas are the largest fruit import into Canada by volume, and have experienced global yield increases since the 1960s. But the next 50 years may not be as fruitful, opening an opportunity for greenhouses to grow bananas36,37. -

Coffee: While it may be hard to imagine Canadian coffee production, research is underway to explore development of greenhouse coffee beans and address the multifaceted issues causing cocoa bean shortages and soaring prices38.

Coffee: While it may be hard to imagine Canadian coffee production, research is underway to explore development of greenhouse coffee beans and address the multifaceted issues causing cocoa bean shortages and soaring prices38. -

Okra: Okra is a key ingredient in many international cuisines and is steadily climbing year-over-year as a vegetable imported into Canada. Currently representing 1% of vegetable import value, it has grown more than 50% from 201839.

Okra: Okra is a key ingredient in many international cuisines and is steadily climbing year-over-year as a vegetable imported into Canada. Currently representing 1% of vegetable import value, it has grown more than 50% from 201839.

Canada leads on land use efficiency

Canada’s strength in greenhouse vegetable and fruit production relative to its international competitors lies in its productivity per acre. Canada produces 4.6 times more per area of land than Spain, is slightly more productive than the Netherlands, and 2.6 times more than Mexico40,41,42.

Productivity per area of land

Estimated yield per hectare (tonnes)

*Global comparison of top greenhouse producing nations in 2022. Estimates include combined annual greenhouse production of tomatoes, cucumbers, peppers, lettuce, and strawberries.

Source: Statistics Canada, Government of Mexico, EuroStat.

These high-producing regions have their own strengths, thanks to a variety of factors including the technology they’ve adopted, geographical location, and climatic conditions. While Canada can’t compete with Mexico’s heat—at least not in the near-term—, it can learn many lessons from its competitors.

- Climatic conditions

- Labour availability

- Proximity and access to North American markets

Mexico has access to a large and productive labour force that will be challenging to replicate in Canada. Canadian greenhouse operators are actively exploring approaches to integrate the use of artificial intelligence (AI) in greenhouse operations to centralize data and optimize growing conditions in real-time. The use of AI and other efficiency disruptive technologies are not expected to replace humans, but can improve Canada’s competitiveness. Complementary to a productive labour force and favourable climatic growing conditions, Mexico has also benefitted from open and free trade with the U.S. supported earlier by the North American Free Trade Agreement (NAFTA) and now the Canada-United States-Mexico Agreement (CUSMA). Simultaneously, Mexico fostered investments in large scale greenhouse facilities, improving its competitiveness overtime in providing fresh produce year-round that can reliably fulfill the U.S. demand. However, a growing trade imbalance between the U.S. and Mexico on fresh fruits and vegetables means there is pressure within the U.S. to explore legislative options that support its fresh produce industry43.

- Proximity and access to European markets

- Regional concentration

- Climatic conditions

Spain’s ability to scale centralized greenhouse production within a short period of time and optimize regional market access and trade is certainly a model to learn from. Centralization of production has enabled Spain to emerge as a greenhouse exporting leader. The southeast city of Almeria accounts for 72% of greenhouse vegetables in the country, spanning 98,000 acres—the largest concentration of greenhouses anywhere in the world44. Spurred from strategic development and a lack of land use planning, Almeria is a centralized hub market that accounts for more than 80% of Spain’s greenhouse vegetable exports to the European Union45. However, Almeria’s expansive network of greenhouses has created negative externalities for the environment and those working and living within the region, such as depletion and salinization of water supply and even changes to the microclimate of the region46. Mitigating negative impacts on local communities, pollution, and the workforce from expanding highly concentrated areas of greenhouse production requires an inclusive and strategic lens to planning and development.

- Investment in decarbonization

- Land-use efficiency

- High-skilled labour matches hi-tech industry

The Netherlands has a head start over Canada in navigating the complex landscape of producing more on less land, while mitigating GHG emissions. The country has limited land availability and has set GHG targets specifically for the greenhouse sector of 1Mt CO2 eq reduction by 2030 from 2016 levels, primarily from reducing emissions from energy47. The Netherlands’ target is coupled with enabling mechanisms such as the Energy Efficiency in Greenhouse Horticulture scheme, Green Label greenhouse certification, and demonstration projects to promote knowledge development and exchange. Packaging GHG targets with mechanisms designed to support the sector to grow and innovate while transitioning to a low-carbon system is a model that could be replicated by governments in Canada through initiatives such as the Sustainable Agriculture Strategy.

- Climatic conditions

- Labour availability

- Proximity and access to North American markets

Mexico has access to a large and productive labour force that will be challenging to replicate in Canada. Canadian greenhouse operators are actively exploring approaches to integrate the use of artificial intelligence (AI) in greenhouse operations to centralize data and optimize growing conditions in real-time. The use of AI and other efficiency disruptive technologies are not expected to replace humans, but can improve Canada’s competitiveness. Complementary to a productive labour force and favourable climatic growing conditions, Mexico has also benefitted from open and free trade with the U.S. supported earlier by the North American Free Trade Agreement (NAFTA) and now the Canada-United States-Mexico Agreement (CUSMA). Simultaneously, Mexico fostered investments in large scale greenhouse facilities, improving its competitiveness overtime in providing fresh produce year-round that can reliably fulfill the U.S. demand. However, a growing trade imbalance between the U.S. and Mexico on fresh fruits and vegetables means there is pressure within the U.S. to explore legislative options that support its fresh produce industry43.

- Proximity and access to European markets

- Regional concentration

- Climatic conditions

Spain’s ability to scale centralized greenhouse production within a short period of time and optimize regional market access and trade is certainly a model to learn from. Centralization of production has enabled Spain to emerge as a greenhouse exporting leader. The southeast city of Almeria accounts for 72% of greenhouse vegetables in the country, spanning 98,000 acres—the largest concentration of greenhouses anywhere in the world44. Spurred from strategic development and a lack of land use planning, Almeria is a centralized hub market that accounts for more than 80% of Spain’s greenhouse vegetable exports to the European Union45. However, Almeria’s expansive network of greenhouses has created negative externalities for the environment and those working and living within the region, such as depletion and salinization of water supply and even changes to the microclimate of the region46. Mitigating negative impacts on local communities, pollution, and the workforce from expanding highly concentrated areas of greenhouse production requires an inclusive and strategic lens to planning and development.

- Investment in decarbonization

- Land-use efficiency

- High-skilled labour matches hi-tech industry

The Netherlands has a head start over Canada in navigating the complex landscape of producing more on less land, while mitigating GHG emissions. The country has limited land availability and has set GHG targets specifically for the greenhouse sector of 1Mt CO2 eq reduction by 2030 from 2016 levels, primarily from reducing emissions from energy47. The Netherlands’ target is coupled with enabling mechanisms such as the Energy Efficiency in Greenhouse Horticulture scheme, Green Label greenhouse certification, and demonstration projects to promote knowledge development and exchange. Packaging GHG targets with mechanisms designed to support the sector to grow and innovate while transitioning to a low-carbon system is a model that could be replicated by governments in Canada through initiatives such as the Sustainable Agriculture Strategy.

What Canadian greenhouses need to grow

Canada’s greenhouse sector is a success story in growth and productivity, but it’s now time to consider steps that can sustain and expand the sector. A pan-Canadian greenhouse growth strategy that maps out production, trade, value, and GHG targets could enable the sector to still experience year-over-year growth by 2035 and beyond. In conjunction with mapping the possible, considering infrastructure, skills, policy, investment, and research needs are essential to address the challenges the sector will need to navigate.

Natural gas is the primary energy source powering the sector, but continued use could challenge Canada’s GHG reduction targets. Reducing production carbon footprints would require greenhouses to scale alternative energy sources such as RNG, electric powered heat pumps, and hydrogen. RNG makes up only 0.36% of natural gas distribution in Canada, but has the potential to halve the carbon intensity of gas use relative to natural gas, depending on the type of feedstock (e.g., manure) used48 49 50. However, green premiums for such alternatives are high. For example, in Ontario RNG is cheaper than electricity, but five times more expensive than natural gas51. Creating awareness and financial mechanisms that appropriately compensate farmers and greenhouse operators for biowaste suitable for RNG production is vital to ensure Canada builds a consistent supply of feedstock for biodigesters.

Fully electric systems are also being explored. But operators considering switching to electric heat pumps to improve energy efficiency and reduce their carbon footprint, must also consider the source of electricity. Nationally, GHGs associated with public electricity and heat production are down 56% as of 2022 from 2005, which is Canada’s baseline year for its 2030 GHG emissions target52. However, the level of GHGs associated with electricity substantially differs between provinces as the power sources vary between fossil fuels and renewables, equating to different carbon intensities. In 2021, Alberta electricity generation’s carbon intensity was 510 times more than Quebec53. This variability emphasizes the need for regionalized strategies and targeted commitments and action to clean grid expansion and enable industrial processes to decarbonize.

Natural gas is the primary energy source powering the sector, but continued use could challenge Canada’s GHG reduction targets. A steady and consistent supply of feedstock is required to scale RNG. Greenhouses produce biowaste that could be used as a feedstock for RNG production, but would likely need to be supplemented with other waste to make supply consistent as greenhouse waste dips during growing seasons and peaks when they end. Due to biosecurity concerns and plastic tags and twine in greenhouse biowaste, the safest and common option is to dispose of the biowaste at a landfill. Close to Canada’s greenhouse hub, Enbridge is developing an RNG project at Waste Connections of Canada’s Ridge Landfill in Chatham-Kent, which is expected to offset 110,000 CO2eq tonnes from the landfill and produce 1.591 petajoules per year54.

Landfills like Ridge Landfill are at capacity or expanding to meet waste disposal demands. To alleviate waste disposal pressure and complement landfill RNG production, agriculture biodigester hub- and- spoke models could present new revenue streams within highly productive agriculture regions, collecting farm biowaste from multiple agriculture systems, from crop to livestock to greenhouses. That would create circularity and promote rural access to RNG.

The increasing cost and competition for land among housing, retail, agriculture, and industry, especially within densely populated regions such as the Windsor and Montreal Corridor, has strained land resources. Canadian greenhouses have demonstrated their global leadership in productivity per area of land, but innovations that lead to leaps in yield are needed to maintain Canada’s global lead. Producing more with less is one of the agriculture sector’s biggest challenges. Greenhouses’ contribution to addressing this challenge for growth, should be more explicitly included and supported through sector-wide sustainability policy, especially the forthcoming federal Sustainable Agriculture Strategy.

Like land, water access is also being pinched in some regions for greenhouse operators. Development charges introduced by municipalities on new developments using public water in Chatham-Kent, Ontario, highlight the changing landscape. Investments in rural infrastructure is needed from different levels of government given the rising demand for food production and the competing pressures and rising costs of natural resources. Alignment across municipalities and provincial infrastructure development plans and growth targets for the sector could help rural Canada address future shortcomings.

Greenhouses can emit bright lights around the clock, which can be a nuisance to rural residents. Municipalities in regions such as Leamington that have a high concentration of greenhouses have regulations that require operators to mitigate light pollution by using curtains or turning lights off in the evening. Ensuring greenhouse operators comply with local regulations and expansion plans consider the implications for community well-being is critical to its sustainable growth and ability to attract high-skilled labour.

Advancements in automation in greenhouses can result in greater efficiency and create demand for more high-skilled jobs. But is Canada ready to fill them? The sector is already struggling to address its labour shortage, with one in every three agriculture jobs expected to be vacant by 2030 without significant action55. Convincing more Canadians to move to rural regions is increasingly challenging with rural population growth 15 times slower than in urban areas56. Further, recent policies that impact foreign students’ pathways to stay in Canada can shrink enrollment in post-secondary programs, further limiting access to high-skilled individuals. As these challenges mount, greenhouse operators continue to rely heavily on temporary foreign workers from Mexico and Central America. Agriculture needs to rebrand to attract job seekers and promote itself as a place for highly skilled, tech-driven, and ambitious individuals that want to make a positive impact in Canada and globally.

Becoming a global center for sustainable and efficient greenhouse production would require exploring the policies and regulations that leave Canada at a disadvantage compared to global competitors. A key place to start is by identifying and modernizing regulations that put greenhouses and other forms of CEA in regulatory no-man’s land and delay development.

A blueprint for greenhouse fruit and vegetable exports could help stakeholders chart a course on possible actions Canada needs to expand. Targeting the U.S. Midwest is a key expansion opportunity and could serve as a foundation of a trade blueprint. Co-led industry and government trade promotion missions can serve as means to collect information on cold chain logistic needs, size up the market opportunity, build relationships and a Canadian brand. Expansion to in new areas should also consider climate impacts of extending refrigeration and food miles, as well as key competitors in the region such as California’s field production.

The greenhouse sector is primed for a made-in-Canada carbon intensity calculator. Not knowing the carbon intensity of greenhouse production is a blind spot for Canadian climate policy and for the industry in developing solutions and marketing its sustainability progress. Governments have a role in investing in and collaborating on the development of user-friendly tools for Canadian greenhouse operators to identify, understand, and reduce their carbon footprint. Calculating the carbon intensity of products is increasingly important to meet market demands, overcome trade barriers, and empower the industry to make informed decisions on new developments and retrofits.

Canada is not only a leader in greenhouse productivity but also in innovation. Yet, funding programs are fragmented, and knowledge translation is siloed. These challenges come from Canada operating on a reactive model, whereby industry and universities might work collaboratively with individual operators on projects to address a specific issue, but lack overarching alignment on research priorities, funding, and goals. This patchwork presents an opportunity for an umbrella research framework to bring projects and stakeholders together to advance research in a targeted and coherent fashion. Stakeholders could agree upon research priorities such as automation, genetics and breed, Net Zero goals, and agronomy, which can then be used to facilitate coordination and partnerships across relatable projects. A research framework with priorities, committed funds, and timebound objectives can also ensure research institutions are better aware of their relative speed of travel, aligning industry needs and research projects.

The next 10 years

Greenhouses can emerge as a pillar of Canada’s agri-food growth and sustainability ambitions over the next decade and towards 2050. The sector is set to double in acreage over the next 10 years, deliver more diversity of products, and improve yields. The real challenge for Canadian greenhouses in meeting demands in growing markets and overcoming rising resource constraints will be developing infrastructure that spurs growth and decarbonization, and enables rural communities to thrive.

Related Reading

For more, go to rbc.com/climate.

Download the Report

Contributors:

Lead author: Lisa Ashton, Agriculture Policy Lead

Myha Truong-Regan, Head of Research, RBC Climate Action Institute

Yadullah Hussain, Managing Editor, RBC Climate Action Institute

Shiplu Talukder, Digital Publishing Specialist

Caprice Biasoni, Graphic Design Specialist

- Alesandros Glaros, Food and Agriculture Institute, University of the Fraser Valley

- Aaron Coristine, Ontario Greenhouse Vegetable Growers

- Gordon Stock, Ontario Fruit and Vegetable Growers’ Association

- Evan Fraser, Arrell Food Institute at the University of Guelph

- Lenore Newman, Food and Agriculture Institute, University of the Fraser Valley

- Goretty Dias, School of Environment Enterprise and Development, University of Waterloo

- Matt Korpan, Center for Horticultural Innovation

- Peter Quiring, Nature Fresh Farms

- Chris DelGreco, Under Sun Acres

- Gary Toupin, Royal Bank of Canada

- Mohamad Yaghi, agriculture expert

- Alycia Van der Gracht, QuantoTech Solutions Ltd.

- Peter Van der Gracht, QuantoTech Solutions Ltd.

- David Arkell, 360 Energy Inc.

- Lisa Brodeur, 360 Energy Inc.

- Subject matter expert, Ontario Ministry of Agriculture, Food and Rural Affairs

- Statistics Canada. (2024a). Production and value of greenhouse fruits and vegetables.

- Ontario Greenhouse Vegetable Grower’s analysis.

- Ontario Ministry of Energy. (2023). Powering Ontario’s Growth Ontario’s Plan for a Clean Energy Future.

- Government of Mexico. (2023). Statistical Yearbook of Agricultural.

- EuroStat. (2024). Crop production in EU standard humidity.

- Statistics Canada. (2024b). Greenhouse producers’ operating expenses.

- Dias et al. (2017). Life cycle perspectives on the sustainability of Ontario greenhouse. tomato production: Benchmarking and improvement opportunities. Journal of Cleaner Production.

- United Nations. (2022). World population to reach 8 billion this year, as growth rate slows.

- Van Dijk et al. (2021). A meta-analysis of projected global food demand and population at risk of hunger for the period 2010–2050. Nature Food.

- Statistics Canada. (2024c). Consumer Price Index, February 2024.

- Statistics Canada. (2024a).

- Deloitte. (2022). The turning point: A new economic climate in the United States.

- Statistics Canada. (2024b).

- Organisation for Economic Cooperation and Development (OECD). (2022). OECD-FAO Agricultural Outlook 2022-2031

- Statistics Canada. (2024a).

- Statistics Canada. (2024a).

- Statistics Canada. (2024d). Estimates of specialized greenhouse operations, greenhouse area, and months of operation.

- Agriculture and Agri-Food Canada (AAFC). (2022a). Statistical Overview of the Canadian Greenhouse Vegetable and Mushroom Industry.

- United States Department of Agriculture (USDA). (2024). Vegetables and Pulses Outlook: April 2024.

- McKinsey & Company. (2023). Consumers care about sustainability—and back it up with their wallets.

- Open Government. (2024). Ontario farm financial analysis data.

- Ontario Greenhouse Vegetable Grower’s crop analytics.

- Statistics Canada. (2024b).

- Dias et al. (2017).

- Under Sun Acres. (n.d.). Cogeneration.

- Statistics Canada. (2024a).

- Statistics Canada. (2024e). Area, production and farm gate value of marketed vegetables.

- Statistics Canada. (2024b).

- Statistics Canada. (2024a).

- Agriculture and Agri-Food Canada (AAFC). (2022a).

- Statistics Canada. (2024a).

- Agriculture and Agri-Food Canada (AAFC). (2022b). Statistical Overview of the Canadian Field Vegetable Industry.

- Statistics Canada. (2024a).

- Agriculture and Agri-Food Canada (AAFC). (2022c).

- Agriculture and Agri-Food Canada (AAFC). (2202b).

- Agriculture and Agri-Food Canada (AAFC). (2022c).

- Varma & Bebber. (2019). Climate change impacts on banana yields around the world. Nature Climate Change.

- Cantor. (2023). Historic coffee prices percolated after a bitter global supply crisis. U.S. Bureau of Labour Statistics.

- Agriculture and Agri-Food Canada (AAFC). (2202b).

- Statistics Canada. (2024a).

- Government of Mexico. (2023).

- EuroStat. (2024).

- Congressional Research Services. (2023). Seasonal Fruit and Vegetable Competition in U.S.-Mexico Trade.

- Organization for Economic Development and Cooperation (OECD). (2023). Policies for the Future of Farming and Food in Spain.

- Organization for Economic Development and Cooperation (OECD). (2023).

- NASA Earth Observatory. (2022). Almería’s Sea of Greenhouses.

- Government of the Netherlands. (2019). Measures to reduce greenhouse gas emissions.

- Environment and Climate Change Canada (ECCC). (2023). Pre-publication: Updated carbon intensity of natural gas and propane.

- McKinsey & Company. (2023). Renewable natural gas: A Swiss army knife for US decarbonization?

- Environment and Climate Change Canada (ECCC). (2023).

- Enbridge. (2024). Cost comparison of energy sources.

- Environment and Climate Change Canada (ECCC). (2024). National inventory report: greenhouse gas sources and sinks in Canada.

- Ontario Ministry of Energy. (2023).

- Waste Connections of Canada. (n.d.). Ridge Landfill Future Plans

- Canadian Agricultural Human Resource Council (CAHRC). (2024). Sowing seeds of change: Agriculture labour market forecast 2023-2030.

- Statistics Canada. (2022). Population growth in Canada’s rural areas, 2016 to 2021.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.