Why we wrote this

Last fall RBC partnered with BCG’s Centre for Canada’s Future and Arrell Food Institute at the University of Guelph. We set out to explore what we believe is Canada’s moonshot: to produce 26% more food by 2050 (enough to maintain our contribution to the global population as it grows) with fewer emissions. The result was The Next Green Revolution: How Canada can produce more food and fewer emissions.

Throughout the past year, here’s what we learned:

- Canada is uniquely placed to lead: Our assets are unparalleled, but we need to do more to maximize them. Other nations are allocating substantial funding to promote climate-smart agriculture. Canada can proportionally match those investments while establishing new market mechanisms to help finance agriculture’s sustainable transition.

- Nothing will happen without accurate measurement technology: Tools to monitor emissions accurately (especially carbon sequestration in soil) are essential to building markets and helping producers take advantage of them.

- Cross-sector collaboration is key: A successful transition to Net Zero demands a new approach. It requires public-private actors across the fragmented agriculture supply chain to work together, as one sector, toward a single vision.

- Private sector R&D is insufficient: Canada has invented some of the most important agricultural technologies globally. But private sector funding for innovation is at an all-time low. To remain leaders in this space, we’ll need private actors to invest.

- Skills gaps are limiting growth: The sector requires more workers to drive the Net Zero transition. From on-farm managers to data analysts, qualified workers and advisors are desperately needed on Canadian farms, but post-secondary funding is insufficient.

- Early adopters should be rewarded: A significant number of producers across Canada have engaged in climate-smart agricultural practices for years—if not decades. These pioneers could be left out as programs develop to financially incentivize farm operators making their first transitions to better soil health methods. To continue growing current carbon stock levels, early adopters must receive a financial benefit for their continued contributions.

- The world needs Canada more than ever: With global supply chains under stress from the Ukraine-Russia War and extreme climate events, many countries are facing food shortages or unstable supply lines. As a politically stable country, and a reliable supplier of safe, high-quality food, Canada has an opportunity to become the world’s sustainable breadbasket.

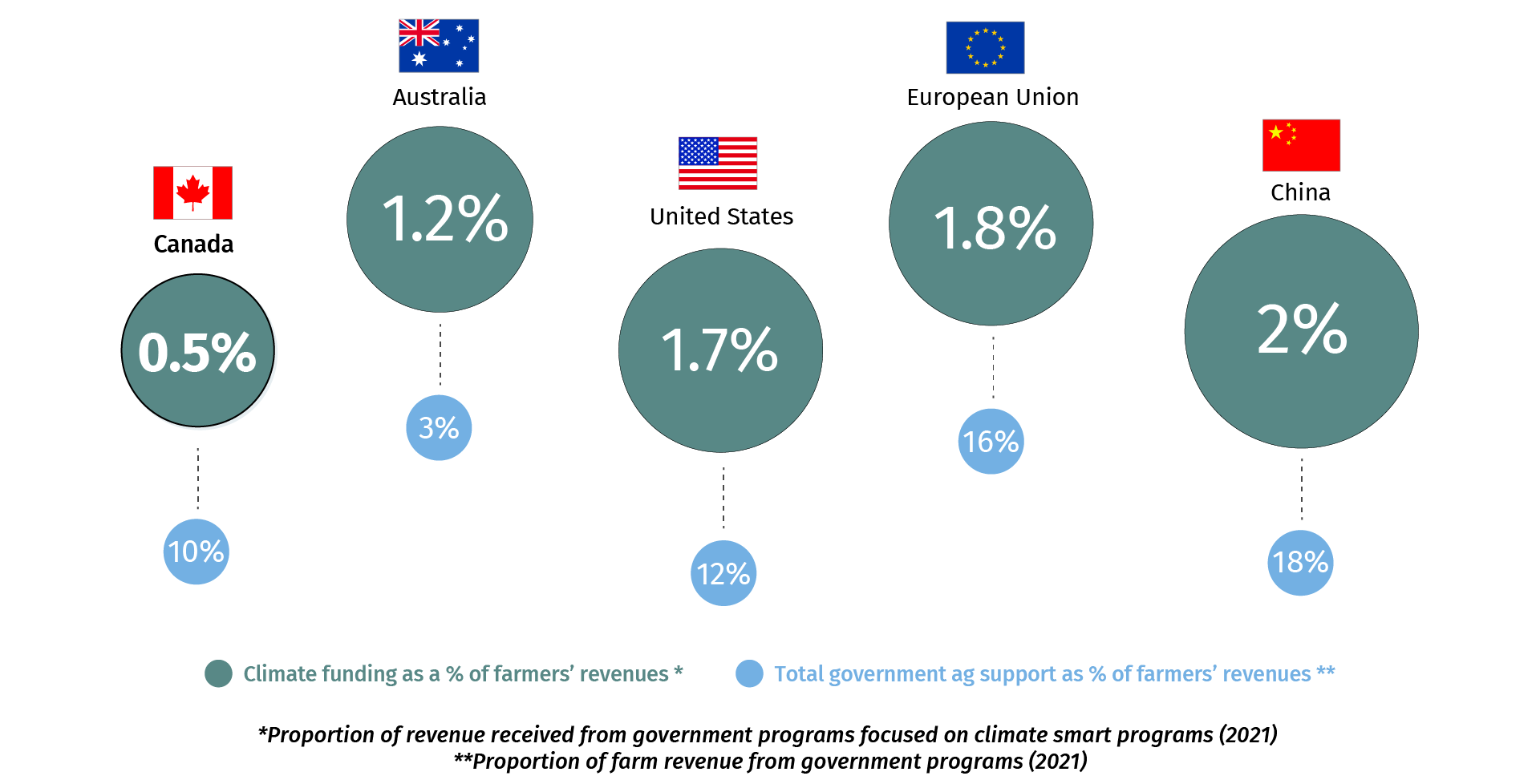

Canada’s investment in climate-smart agriculture lags global peers

Source: BCG analysis, RBC analysis, USDA, and OECD

Brazil and Indonesia were not included due to climate-related funding directed to financing programs

The world’s top food producers are on the move. Making sustainable agriculture a strategic priority, Canada’s peers are laying the foundations for formidable climate-smart food supply chains backed by sizeable funding and bold policy measures.

Amid these dramatic investment and policy shifts, a pivotal moment is emerging for Canadian agriculture. The sector risks falling behind if Canadian governments don’t match their competitors in supporting producers with the funding and policy tools to grow more food with fewer emissions.

Canada is already falling behind. The agriculture sectors in the U.S., EU, Australia and China get roughly three times the climate funding that Canada provides to its industry. Yet the expectations placed on our farmers are growing: to produce more (in increasingly adverse weather conditions), to cut emissions and to help boost global food security.

We began to explore the opportunities around climate-smart agriculture last year, in the midst of twin global crises over food shortages and climate shocks. Since then, our research teams have spoken with more than 500 farmers and food producers, to gain a better understanding of what practical policies could make a difference now.

The right policy measures will help strengthen our economy, soften geopolitical threats and accelerate emissions reductions.

Ottawa and the provinces will need to transform their approach to agriculture policy to protect a sector that accounts for 7% of national GDP—with huge potential for further growth.

This report lays out nine polices across five areas—soil, methane, fertilizers, talent & technology, and consumers—that can slingshot Canada’s agriculture sector to the forefront of the next green revolution and compete globally.

The nine-point plan could serve as a powerful response to IRA’s ambition, and lays the ground for a prosperous, expanded, and sustainable food powerhouse.

Currently, Canada’s ag policy and funding falls well short of the US$19.5 billion in incentives and tax credits embedded in the Inflation Reduction Act to support ag-tech, conservation and other measures. Even before Washington rolled out its signature climate program, U.S. climate funding as a percentage of total farmers’ revenues stood at 1.7%—more than three times the level in Canada. The proposed US$1.5 trillion Farm Bill could further extend America’s advantage.

China, meanwhile, is revitalizing farmland through an annual US$7 billion investment, while the European Union is dedicating US$224 billion to “climate-relevant initiatives” through 2027.

The farmers we spoke to suggest agriculture is already ahead of other economic sectors in fighting climate change, and in deploying technologies, innovations and methods that have reined in emissions. But soaring global and national emissions mean there are new expectations—from domestic and global markets—on Canada’s major sectors to raise the bar.

Our proposed policies will reduce agriculture sectors’ emissions, which currently account for more than 10% of the nation’s total greenhouse gas emissions.

A climate-era agriculture business model involves farmers to provide demonstrable proof of emissions reduction to meet challenging government and investors targets and growing consumer expectations.

The good news: Canada is already a vital contributor to global food security and has a head start in climate-smart farming.

Canada is already a top food exporter, with a food system ranking among the highest in sustainability, according to the Food Sustainability Index. Over 65% of Canada’s farmers have adopted at least one practice to improve their farm’s resiliency to adverse soil, water or biodiversity challenges.I

Now is the time for Canadian governments to build on our farmers’ successes. The nine-point plan could serve as a powerful response to IRA’s ambition, and lays the ground for a prosperous, expanded, and sustainable food powerhouse.

Soil As An Asset Class

A corn farmer near the township of Elmira, Ontario, recently shared his excitement with us about the prospect of boosting his bottom line by integrating carbon credits into his farming practices.

He’s not alone. Thousands of Canadian farmers are also eyeing the carbon credit market, which promises fresh sources of revenue and recognizes their efforts to remove carbon from the atmosphere.

However, stories and experiences of unsuccessful pilots that didn’t ultimately pay out, unclear guidelines on access, and limited data and knowledge is dampening enthusiasm. In addition, producers that implemented practices to sequester carbon at a higher rate years ago feel left behind and rue their timing.

Canadian governments could pursue three policy measures to create thriving carbon markets.

1. Build Standards To Support Carbon Markets

Opportunity

A $4B carbon market by 2050

Challenge

No clear standards

Serving as a powerful carbon sink, active farmland in Canada can sequester between 35MT to 38MT of carbon by 2050, around 40% to 45% of the oilsands’ current annual emissions.

Currently in a nascent stage, Canadian voluntary carbon markets could emerge as a $4 billion behemoth by 2050, our research shows. An active market could mean tens of thousands of dollars in fresh revenues streams for some operators—and over a $1 million for larger operations.

But the building blocks of a viable carbon inset or offset carbon market in Canada will rest on a solid system for measuring and reporting soil carbon and emissions.

Agriculture and AgriFood Canada (AAFC) and Environment and Climate Change Canada (ECCC) have done extensive work in this space, but more can be done collaboratively.

Here’s how we can build a vibrant Canadian carbon market:

- Based on the private sector’s work, the federal government can publish methodologies on the most credible approaches to creating offsets and insets (see box).

- To receive any carbon credit payment, the impact must be measured scientifically. Working with farmers/ranchers and agribusiness and through regional pilots across the country, AAFC and ECCC could introduce publishing standards for a preliminary measurement, reporting, and verification (MRV) framework for different climate-smart practices. This would work in tandem with the soil database detailed in the next section. It will be tricky, though. Finding a consistent and cost effective MRV methodology to measure the impact of climate-smart agricultural practices (including cover cropping and no-tillage) on soil carbon sequestration and emissions remains challenging.

- An MRV framework would guide producers on earning credits in an affordable way, and enable buyers to confidently purchase those credits or incorporate them in an inset program.

- Governments should explore viable ways to ensure market prices are stable and farmers and investors can secure a consistent and substantial return.

- The U.S.’s 8-year, US$300-million investment in MRVs could serve as a template for Canada. The investment will enable improved data collection mechanisms and build algorithmic models to establish current and future emission baselines. It will also determine the protocols needed for soil testing, identify scalable and affordable remote sensing and soil sampling technologies, and establish a nationwide network of research to improve on-farm practices. Canada will need to match this funding proportionally to ensure producers can compete.

Insets

Organizations directly avoid or reduce emissions within their own supply chains. The process helps companies avoid or reduce Scope 3 emissions in their supply chains and better prepares for them for future regulations that may be more stringent.

Offsets

Companies or individuals purchase tradeable credits generated by renewable energy or other emissions-reducing projects. This credit negates or offsets the same amount of carbon emissions created by their operations.

2. Create A Climate-Smart Database To Help Farmers

Opportunity

A data-smart ag sector to manage risks and boost productivity

Challenge

Lack of accessible knowledge

The federal government, in cooperation with provinces, can address these challenges and accelerate the adoption of efficient methods by developing the framework for a national soil database:

- Building on years of work by the AAFC and provinces, a national soil database can collect data through a common system. This is critical to understanding the current health of various soil classes across Canada, particularly since some soil maps have not been updated since the 1950s. It’s also key to understanding soil’s impact on nitrous oxide emissions (which is especially damaging to crops and human health), carbon sequestration and organic carbon stock patterns.

- Established and funded by the AAFC, the database could serve as a portal delivering real-time and downloadable economic intel to producers, experts, and decision makers.

- The slew of data, from provinces, soil laboratories, ag-machinery providers and remote-sensing operators, will create real-time regional and national baseline emissions. It will also help in charting regional crop modelling, establishing ways to improve nutrient management, encourage biodiversity and water conservation practices.

- Armed with insightful data, farmers could reduce the risk of adopting climate-smart agricultural practices by understanding potential economic impacts of adopting new practices. The database could also serve as an invaluable tool for companies and research firms looking to develop export-ready agricultural technologies.

3. Develop A Fair System That Ensures Market Equity

Opportunity

A system that incentivizes early-adoption of sustainable technology

Challenge

Little recognition for first movers

The first two pieces of our soil policy package are aimed at incentivizing future behaviour. This final segment recognizes past actions.

Canadian farmers have been ahead of the curve, with many implementing climate-smart practices that pre-dates the Paris Accord, sometimes by decades. But these early adopters’ worry their carbon stock may not have been documented consistently over the years. After all, to be rewarded in a carbon market, producers must demonstrate an increase in carbon absorption over time.

Early adopters who can demonstrate they have increased carbon stock could be compensated in the following ways:

- An expanded capital gains exemption could be created for qualifying farmland. Currently, there is an exemption of $1 million of property value that is not taxed on qualified property during intergenerational transfers. The new policy would entitle producers to the total value of organic carbon in their soil based on latest market prices (in addition to current exemptions). It would be associated with the value of the farmland at the time of transfer and exclude the exemption received. Through back-casting, a modelling process where past changes in soil-bound carbon are estimated, we can chart the evolution of soil organic carbon stock over several years. This method can be used to determine baseline estimates to compensate farm operators.

- Producers could receive a pool of tax credits, based on scientifically proven carbon stock on their farms, that can be used toward paying taxes. An allotment of credits can be spread over 10 years with producers choosing the year they want to pay business taxes.

- Parts of the Scientific Research and Experimental Development (SR&ED) can be simulated to encourage environmentally beneficial on-farm investments. A new program would issue investment tax credits to farm operators that invest in projects promoting ecosystem services. If an investment matches an activity from a list of appropriate on-farm investments, producers can submit a claim to receive a tax credit.

Methane As A

Growth Opportunity

A dairy farmer just south of Ottawa told us he was eyeing a biodigester, but worried about its substantial price tag and economic viability. The biodigester will help break down organic materials (such as manure) at his farm to produce biogas, mostly methane. But he, and other farmers we spoke to, believe Canadian policies are not attractive, even under the supply management program. This made the biodigester hard to justify, despite its role in cutting costs and managing emissions.

It’s a different story south of the border. Under IRA, American farmers are well positioned to benefit from 30% tax credits from the production of biogas through at least 2025. In addition, the U.S. Department of Agriculture’s Rural Energy for America Programs have provided US$2 billion in loans and grants to increase energy efficiency and renewable energy like biogas.

Canada will need to match the U.S.’s investment in biogas to tap its improved sustainability benefits, waste-to-energy conversion and lower energy costs.

4. Promote Ways To Make Methane Cuts Profitable

Opportunity

Create a robust value chain for biogas

Challenge

Investments are not profitable

While Canada needs to produce more food, it must do so with fewer emissions. Crops and livestock production currently generates more than 10% of Canada’s greenhouse gas emissions, with methane among the most potent sources.

As a signatory to the Global Methane Pledge, the federal government acknowledged that agriculture is responsible for 31% of the country’s total methane emissions. Enteric fermentation, the digestive process of ruminant animals, accounts for 86% of that total with manure responsible for the rest. While manure contributes to methane emissions, it can also emerge as a source for renewable natural gas, or biogas.

The technology and tools to tackle methane are ready, but successfully deploying them will require both financing and a broad system approach. We recommend the following approaches:

- The federal government could co-ordinate with provinces to create a nationwide blend mandate to incentivize utilities to purchase renewable natural gas (RNG) from digesters. Provinces such as Quebec and British Columbia mandate natural gas providers have a blend of over 10% minimum renewable content within their supply by 2030, motivating utilities to purchase RNG. It has encouraged farm operators to install biogas-producing digesters that can then be converted into RNG at an upgrader. Through a nationwide mandate, provinces would be expected to establish a minimum blend requirement.

- Support more proposals for the construction of digesters through the Strategic Innovation Fund (SIF). Though SIF currently accepts agrifood proposals, this is not a core feature of the program.

- Credits can be granted to producers through the Clean Fuel Regulations (CFR) for biofuels used in the transportation market. To ensure the program is effective, ECCC could review the program after a year to ensure all participants are receiving appropriate financial compensation and that obstacles to installing biodigesters are reviewed and fixed in a timely manner.

- Installation cost of digesters and pipes could be included in the Cleantech Investment Tax Credit. IRA provides a tax credit of up to 50% of project costs to businesses that install digesters. A similar tax credit will be needed for Canada to compete and develop a market that will use the RNG produced from this technology. Accelerating RNG production investment will lead to a greater supply of ultra-clean fuel for the transportation market.

- Create agile regulations and government policies for methane-reducing feed additives to reduce methane emissions. These feed additives currently can’t enter the Canadian market due to stringent regulations. A permanent and independent panel of experts could advise regulators on the abatement potential and productivity benefits of low-emission livestock feed technologies. This panel could be empowered to work with regulators at Health Canada and the Canadian Food Inspection Agency (CFIA) to review regulations, collect data, and provide technical guidance on policies related to the new additives. As many feed additives are considered veterinary drugs, the panel will review and update regulations to ensure innovation and competitiveness are key criteria. The panel could also collaborate with key trading partners to develop standards that recognize producers who use methane reducing feed additives.

Supply Chains As

Strategic Drivers

A potato producer in Lethbridge, Alberta, acknowledged the efficiencies of the 4R Nutrient Stewardship program—the right fertilizer source, at the right rate and time, and in the right place.

But he believes the government can do more in the fertilizer space to ensure the security of inputs vital for safeguarding the national food supply-chain.

Worrisomely, Canada does not have enough agricultural inputs to support the entire industry if it’s cut off from external suppliers, especially major exporters such as Russia.

Promoting a domestic industry of fertilizers and other agricultural inputs would reduce costs and ensure a steady supply of innovative solutions to farmers across Canada.

A domestic push on sourcing agriculture inputs will also create jobs in rural regions, as the raw resources for many innovative fertilizers, like biostimulants, originate in rural areas and are processed close to their source.

5. Strengthen Canada’s Domestic Fertilizer Portfolio

Opportunity

Ensure Canada is food secure

Challenge

Insufficient support for new biological companies

Beyond focusing on revenues, farmers need to ensure the supply of fertilizers and agriculture solutions, is affordable and accessible.

Fertilizers are made of three vital components: nitrogen, phosphorus, and potassium. They ensure plants have the right access to nutrients to grow and increase yields. While Canada is the world’s largest producer of potash (a common form of potassium) and supplies 31% of global demand for this commodity, the country is reliant on other nations for nitrogen and phosphorus.

This has become a major pain point in light of the Russian invasion of Ukraine and Canada’s dependence on Russian nitrogen fertilizer. Before 2022, farms in central and eastern Canada used over 660,000 tonnes of nitrogen fertilizer imported from Russia annually (representing over 85% of total nitrogen fertilizer used in the region). With the government issuing steep tariffs on fertilizers to punish the Russian economy, Canadian producers have been left paying the bill.

Biological products, such as biocontrols, biostimulants and biofertility (see box), can emerge as critical add-ons or substitutes to traditional agricultural solutions. Biostimulants can be blended with traditional fertilizers to promote healthier soils and increase efficiencies and currently represent a US$12 billion global market.[i] Canada is in a unique position to lead in this space given the raw resources required to create these solutions are found in rural regions. Firms making these products are often headquartered in rural communities and can ensure that local demand for organic nitrogen fertilizers is met while creating high-paying jobs.

The following steps can help build a resilient, home-grown agriculture value chain:

- CFIA, which is tasked with registering biological products, should streamline approval processes. CFIA should also seek further funding for additional staff, as it currently takes the agency more than 380 days to approve new registrations–-not including potential delays.

- The federal government, in conjunction with provinces, should bolster supply chains by improving transportation networks such as roads, railways and ports. Governments should also continue their support and expansion of carbon capture, utilization, and storage projects and research and development initiatives for domestic nitrogen fertilizer production.

- Provide funding from the federal government to biological companies to improve domestic and foreign market development. Biological products can help reduce soil erosion, which is costing Canadian and American farmers over $3 billion annually, according to research. Research grants should be awarded for on-field trials for marketing purposes. While many fertilizer programs will continue to use chemical products, farmers can blend biological options to improve soil health.

- The seaweed extract opportunity, often used as a biostimulant, can generate 30,000 jobs in rural British Columbia alone, the industry estimates.

- Establish biological products as a lucrative made-in-Canada product. Several Canadian companies are currently providing innovative biological solutions, and many markets, including Europe and South America, are adopting them. In 2021, half of Canadian fertilizer retailers had a positive view of biostimulants while over 80% sold a biostimulant product. Common biostimulants include enzymes that promote nitrogen fixing, seaweed extracts, or beneficial bacteria and fungi.

Types of biological solutions

Biocontrol:

Assists plants in biotic stress and prevents further damage from pests, pathogens, and other organisms.

Biostimulant:

Supplies plants with support during abiotic stress to improve overall crop quality by increasing nutrient use efficiency.

Biofertility:

Promotes crop growth through the application of living organisms to soil, seeds, or plant surfaces to colonize internal plant tissue and encourage growth.

Technology & Talent As

Competitive Advantages

On the outskirts of Saskatoon, Saskatchewan, a canola producer told us he won’t bother posting a “Help Wanted” sign this year after recent efforts to find talent had failed. Like other farmers, the Saskatoon producer believes sourcing talent is about more than getting labourers to participate during harvest. Farms need on-site specialists and a network of advisors to identify key requirements. These specialists need to communicate quickly with data collected from machines to boost efficiencies.

Farmers are also concerned about cost of critical technology and new innovations that could eliminate time-consuming tasks remain cost prohibitive. On-farm specialists and technology that can help manage droughts and weather episodes are going to be central to their success.

Yet, investment in the space has been declining over the past few years. To guarantee operators’ access to technology and talent, the federal and provincial governments could increase their support of research and development to decrease the cost of new innovations, advisory networks, and education.

The following policy package could help hone talent and drive innovation:

6. Nurture An Innovation-Driven Ag Sector

Opportunity

Find the next wave of Canada’s ag-tech giants

Challenge

Minimal investment in ag-tech

The launch of a thriving carbon market and growth of big data analytics will sow the seeds for the next crop of tech-savvy Canadian agriculture companies.

However, ag-tech investment in Canada is lagging global peers, stymying innovation. In 2021, over US$6.9 billion in venture capital funding went to American ag-tech companies. By comparison, only US$270 million went to Canadian ag-tech firms. More public and private research and development (R&D) funding is needed to scale Canadian ag-tech companies.

Here’s how Canada can fine-tune its funding mechanisms:

- The private sector and Innovation, Science and Economic Development Canada, could invest in the creation of a network, similar to the Clean Resource Innovation Network (CRIN) for oil and gas projects that promote research and development. The public-private partnership would include farm operators, smart farms, research institutions, investors, and companies (small, medium, and large) throughout the agriculture supply chain.

- Hold competitions (similar to CRIN) to develop and commercialize sustainable technologies. For instance, a call for proposals focused on reducing harmful nitrous oxide emissions could spur innovation in the genetics of nitrogen-fixing crops, enhanced efficiency fertilizers, or other technologies that allows plants to take nitrogen directly from the atmosphere, reducing the need for energy-intensive fertilizers.

- Allow innovative companies to showcase their solutions and finance their innovations. Participating farm operators and smart farms in the network can evaluate innovations directly through on-field trials at minimal cost. Researchers can also initiate studies that companies can use for marketing purposes, gaining access to investors at different levels. Corporations involved in the network can have priority access to investments and can pair their R&D teams with the ag-tech firms participating in the challenges.

- Increased private sector R&D in agriculture will ensure that current obstacles to on-farm labour are eliminated in the future. Technologies can automate processes, enable farm operators to focus on management, decrease inputs and grow yields.

7. Revive Canada’s Knowledge-Sharing Network

Opportunity

Build a Canadian ag knowledge portal

Challenge

Insufficient infrastructure

Agriculture extensions—a network of agriculture experts dotted across provinces— and Canadian universities have historically supported farmers with guidance. Agronomists and experts in these networks often offered advice to producers on the most suitable strategies and technologies. But over the years most universities have stepped back, while provincial extension services diminished due to funding cuts. The U.S. witnessed the reverse, with many land-grant universities providing a series of programming initiatives to help producers.

Here’s how Canada can revive these networks:

- Farmers can acquire information and knowledge from privately funded experts, but greater provincial involvement is needed as the urgency of climate challenges build. Indeed, on-farm demonstrations are the most effective tools for increasing adoption of new management practices and innovation. Farmers have also identified a lack of access to experts, on-farm demonstrations and knowledge as the main barriers to further adoption.

- A new approach to extension service programs should consider a collaborative approach involving public, private, and institutional actors. A new blended approach would encourage provinces to partner with agricultural colleges and post-secondary institutions through increased federal and provincial investment in research facilities on campuses. It would also promote in-house consultancies in provincial agricultural departments (as in Nova Scotia) that can drive further recruitment.

- The private sector has a powerful role to play, too, with in-house agronomists offering farmers real-time recommendations to boost productivity.

8. Boost Investment In Post-Secondary Education

Opportunity

Grow and deepen the ag sector’s talent pool

Challenge

Difficulty in attracting diverse set of skills

Here’s how we can ensure future generations of producers and a network of advisors and consultants are on hand to provide expertise:

- Agricultural colleges and universities should continue creating programs that welcome students from different educational backgrounds and micro-credential programs. Creating programs that blend the expertise of different faculties will help increase students’ exposure to agriculture.

- A carbon management program could invite students from different faculties to understand how greenhouse gas emissions are tracked, ways to create corporate objectives to decrease emissions, and effective methods to monitor progress.

- Eliminating barriers to foreign credentials (for example for veterinarians) can help bridge labour gaps and bolster productivity in the agriculture sector.

Consumers As Drivers

Of Market Change

An apple farmer from Quebec posed a question to us at an Ottawa event: why is the government not proactively procuring climate-smart food from domestic producers. While acknowledging that procurement should respect trade deals, she believes governments should lead by example and purchase locally as a sign of support.

Incentivizing consumers can be a challenge and the government has a role to play in leading by example. Research from Fertile Ground, another report in our Next Green Revolution series, found that few consumers are willing to pay more for sustainably made food due to its higher cost.

To stimulate the market, different levels of government should make a concerted effort to remunerate producers who are implementing climate smart agricultural practices.

9. Influence purchasing patterns through procurement

Opportunity

A “green premium” government program

Challenge

Government not optimizing procurement levers

Here’s how public-sector buying policies can support climate-smart farming practices:

- To improve sustainability across federal departments, Public Works and Government Services Canada should establish a green procurement program to purchase food produced through climate-smart agricultural practices. According to available figures, the federal government purchases over $400 million in food annually to cater its facilities. Directing these funds to sustainable food purchases will guarantee a buyer for growers and potentially reduce food waste.

- By setting clear and broadly recognized standards and certifications, producers can sell their goods to government. Measures could include improved soil health, 4R management, livestock partnerships, effective grazing and pasture practices, efficient water use, restoration of native grasslands, and fuel and energy efficiency. Metrics should be accessible to every farmer in Canada.

- This should be directly administered by commodity groups and farm organizations. On-farm interviews by these groups will verify the practices performed on farms and inform producers on their status. Results will be reported to government before a designation is assigned. These groups should receive additional funding to cover the cost of verification. Due to their expanded role, the organizations should receive further resources for on-farm demonstrations of leading-edge land management practices.

- To ensure government accountability, a review mechanism should exist to track Ottawa’s progress in expanding adoption of climate-smart agriculture practices.

Conclusion

The Canadian producers we spoke to over the past year are positioned for growth. The sector has punched above its weight, serving as a rich source of jobs, trade, and economic gains, even during periods of crisis.

But producers believe that the ambition of recent government budgets has been less ambitious than peer nations that are implementing generational programs.

Canadian governments have an opportunity to step up their commitments and create a robust policy environment that recognizes the sector’s economic potential, its global role as a reliable food exporter and as a climate-smart leader.

This is Canada’s moment.

For more, go to rbc.com/climate.

Download the Report

Contributors:

Lead author: Mohamad Yaghi, Agriculture & Climate Policy Lead, RBC Climate Action Institute

RBC

Yadullah Hussain, Managing Editor, RBC Climate Action Institute

Naomi Powell, Managing Editor, Economics and Though Leadership

Darren Chow, Senior Manager, Digital Media

Shiplu Talukder, Digital Publishing Specialist

Caprice Biasoni, Graphic Design Specialist

Myha Truong-Regan, Head of Research, RBC Climate Action Institute

Gwen Paddock, Director of Sustainability, Royal Bank of Canada

Arrell Food Institute

Evan Fraser, Director, Arrell Food Institute, University of Guelph

Ibrahim Mohammed, Ph.D. Candidate

Lisa Ashton, Ph.D.

Emily Duncan, Ph.D.

Boston Consulting Group

Kilian Berz, Managing Director and Senior Partner

Keith Halliday, Director, Centre for Canada’s Future

Sonya Hoo, Managing Director and Partner

Chris Fletcher, Managing Director and Senior Partner

Thomas Foucault, Managing Director and Partner

Taylor Whitehouse, Project Leader

Chris Kornas, Project Leader

- Erin Doherty, Arrell Food Institute, University of Guelph

- Alice Raine, Arrell Food Institute, University of Guelph

- Rene Van Acker, Dean, Ontario Agriculture College, University of Guelph

- Lenore Newman, Director, Food and Agriculture Institute, University of Fraser Valley

- Rickey Yada, Dean, Land and Food Systems, UBC

- David McInnes, Founder and National Coordinator of the National Index on Agri-Food Performance

- Kim McConnell, Strategic Partner, AdFarm

- Keith Currie, President of the Canadian Federation of Agriculture

- Peggy Brekveld, President of the Ontario Federation of Agriculture

- Tyler McCann, Managing Director, Canadian Agri-Food Policy Institute

- Barbara Swartzentruber, Senior Fellow & Program Director Agriculture & Food Systems, SPI/Natural Step

- Cameron Charlton, Vice President, Corporate Client Group, RBC

- Scott VanEngen, Financial Planning Specialist, RBC Dominion Securities Inc.

- Karen Proud, President & CEO, Fertilizer Canada

- Catherine King, Vice President of Public Affairs, Fertilizer Canada

- Cassandra Cotton, Director of Sustainability, Fertilizer Canada

- Fawn Jackson, Chief Sustainability Officer, Dairy Farmers of Canada

- Fiona McNeil-Knowles, Sustainability Specialist, Dairy Farmers of Canada

- Adam Hayter, Hayters Farm

- Wayne Cantelon, Cantelon Farms

- Dana Dickerson, Market Development and Sustainability Manager, Grain Farmers of Ontario

- Michael Williamson, CEO and Co-Founder of Cascadia Seaweed

- Nick Harsulla, Manager of Government Relations, United Farmers of Alberta

- “Canada’s 2021 Census of Agriculture: A story about the transformation of the agriculture industry and adaptiveness of Canadian farmers,” Statistics Canada, last modified May 11, 2022.

- Stratus Ag Research, “Tracking biostimulants: Retailers – USA and Canada 2022.”

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More