Highlights

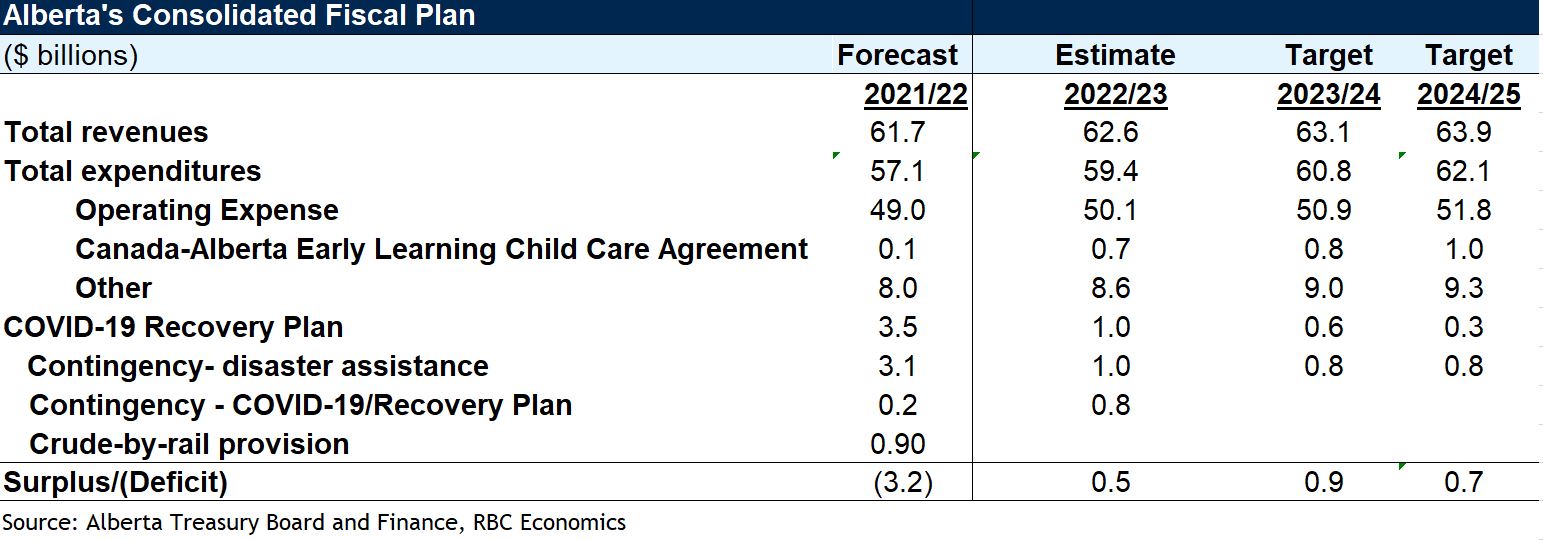

Budget Day 2022 was a momentous occasion for Alberta’s Minister of Finance Travis Toews. On February 24th, Minister Toews had the honour (and good fortune) to deliver Alberta’s first balanced budget in seven years. In fact, he projects a small $500 million surplus in FY 2022-23. If realized, this will be a spectacular turnaround from last year’s record $17-billion deficit. His government can largely thank a tremendous rebound in the energy sector—and especially soaring oil and gas prices—for this turn of event. Resource revenues will contribute nearly $11 billion more to the province’s coffers than in FY 2020-21. A stronger provincial economy will also contribute more tax revenue for the province. Minister Toews expects small budget surpluses and diminishing indebtedness over the medium-term, positioning Alberta as the province with lowest debt burden.

Expenses: Resource upswing leaves room to spend

Budget 2022 outlined expenses totaling $59.4 billion in FY 2022-23 excluding provisions and allowances, up $2.3 billion (+ 4.0%) from FY 2021-22. The growth in base expenditure is largely in line with the pre-pandemic average.

In addition to program expenditures, Alberta earmarked $2.8 billion in contingencies (pandemic-related and disaster assistance contingencies). Total contingencies are expected to fall $4.9 billion next year, as pandemic-related expenditures and drought assistance wind down. When highlighting the province’s program spending, Minister Toews prioritized record health care investment, with $22 billion in operating expenditures devoted to health care. This includes allocations to expand health care capacity on a permanent basis (by developing new ICU beds) in addition to a $750 million contingency to address pandemic-induced surgical backlogs. Also notable, Alberta will devote $666 million in FY 2022-23 (as a portion of a broader total of $2.6 billion by FY 2024-25) to the new Canada-Alberta Early Learning and Child Care agreement to expand affordability and accessibility of childcare.

The province also introduced a novel Alberta at Work program, which allocates $600 million to create career pathways for Albertans. The funding is targeted to reach various goals including creating a program for non-repayable support for low-income Albertans in high-demand programs, supporting skills development and training for employment, investing in reskilling and upskilling, and attracting workers to Alberta.

Revenues: Prudent assumptions pose upside risk to revenues

Revenues are projected to rise to $62.6 billion in FY 2022-23, an increase of $974 million (1.5%) from FY 2021-22. Higher resource revenues, corporate tax receipts and government transfers are largely responsible for this projected revenue growth. Bitumen royalties are forecast to surpass $10 billion next fiscal year, driving up non-renewable resource revenues to their second-highest level of on record. A stronger economy is projected to boost corporate income tax revenues by nearly $700 million (up 21%). And federal transfers are expected to rise close to $750 million thanks to re-profiled infrastructure transfers, a one-time fiscal stabilization payment to address lower-than-expected revenues in FY 2020-21, as well as payments to support the new Canada-Alberta early Learning Child Care Agreement. The winding down of one-time COVID-related funding will provide a partial offset to rising revenues. Over the following two years, revenues are forecast to grow at an average rate of 1%, and will approach $64 billion by FY 2024-25.

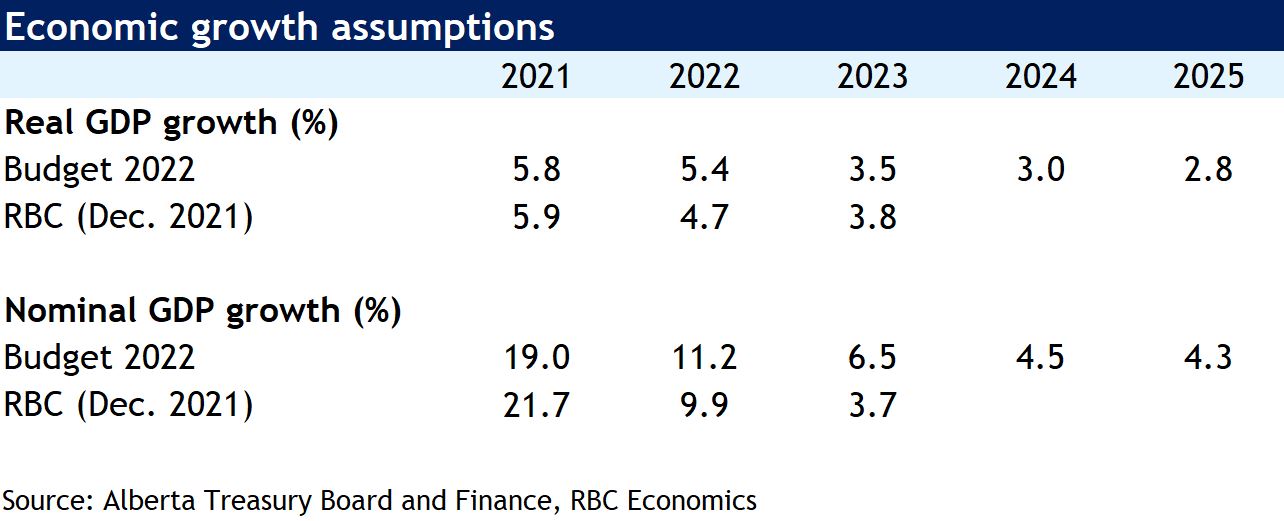

Alberta’s oil price assumption looks conservative for FY 2022-23. The government assumes an average of US$70 a barrel for WTI, which pales in comparison to RBC commodity strategists’ latest forecast of US$98 a barrel. The province thus could be looking at a further revenue windfall (of potentially up to $14 billion) if RBC’s forecast proves correct. The budget estimates that $1 increase in the price of oil generates $500 million in additional provincial revenues. Alberta may well face a much higher surplus than anticipated.

Capital Plan: Investing in health care capacity and economic growth

Alberta’s Capital Plan includes an investment of $20.2 billion over three years ($7.5 billion in FY 2022-23) mostly allocated to municipal infrastructure ($5.8 billion over 3 years), capital maintenance and renewal ($3.2 billion) and to expand health care capacity through health facilities ($2.2 billion), notably the re-development and expansion of hospitals.

Debts: Debt-to-GDP currently the lowest in Canada

Taxpayer-supported debt in Alberta is projected to fall to $94.7 billion in FY 2022-23, down $3 billion from FY 2021-22. With Alberta moving into a surplus position, the debt profile has come down significantly from that shown in Budget 2021 (-4%). At $2.7 billion, debt servicing costs are forecast to represent 4.5% of the province’s total expenses next year (excluding contingencies). Alberta’s net debt-to-GDP ratio will fall to 16.7% at the end of FY 2022-23, the lowest level among the provinces.

A remarkable turnaround justifies a word of caution

Minister Toews described Budget 2022 as a blueprint for strength, prosperity, and hope. After a challenging seven years, Albertans will certainly welcome the remarkable turnaround that is taking place in their province’s finances. For sure, they owe a big thanks to the energy sector’s rebound—and the revenue windfall it generates—and the broader economic recovery. For this to last, though, it will be important for the provincial government to maintain a firm hand on spending. High dependency on a volatile revenue source (non-renewable resources) makes the provincial books inherently vulnerable to unexpected swings in commodity prices. The government would be wise to consider more stable sources of revenue while conditions are favourable.

Read report PDF

Carrie Freestone is an economist at RBC. She is a member of the macroeconomic analysis group and is responsible for monitoring key indicators including consumer spending, labour markets, GDP, and inflation. Carrie produces economic analysis that she delivers to clients and the public through publications and presentations. She holds a Bachelor of Arts in Economics from Queen’s University and a Master of Arts in Economics from the University of Ottawa.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More