Highlights

After an impressive turnaround, Alberta’s 2023 budget included more optimism for the province. Accompanied by another balanced budget, the government delivered a new fiscal framework to ensure its positive fiscal situation will last. With promises to balance budgets every year moving forward (subject to certain exemptions), the government has taken new measures to offset risks associated with volatile revenues – something the province has long struggled with. As part of its new framework, expenditures will now be set to grow in line with population and inflation – roughly 2% per year. But this rule will not come into effect until next year. With an election coming up, expenditure growth is forecast to push up to 4% this fiscal year, with the majority of funding increases allocated to healthcare and education.

Despite contracting slightly from the FY 2022 – 23 forecast, the Alberta government is still expected to rake in royalties from resources. At the same time, a comeback in employment is projected to top up revenues from personal income and corporate taxation. The increase in expenditures and shrinking of revenue growth have kept the province from reporting the same astounding surplus as those projected in FY 2022 – 23.

Expenses: Petrodollars fund pre-election spending plan

Following last year’s revenue windfall, the Alberta government has more funding than ever to appropriate. And with an upcoming election, it’s no surprise Budget 2023 had a few goodies baked into it. Planned expenditures for FY 2023 – 24 (including contingencies) totalled $68.3B – a $2.6B increase (+4.0%) from the FY 222 – 23 forecast. The increase kept Alberta’s per capita program expenses among the highest in Canada at just over $14,000 per person in FY 2023 – 24.

Growth in expenditures came largely from healthcare and education spending, accounting for $24.5B (36%) and $14.4B (21%) of total expenses respectively. After boasting the largest number of in-migrants of all provinces last year (85,625), the investment in vital services such as health and education are certainly noted as welcome improvements. Despite its low debt load and high revenues, Alberta’s 2023 budget doesn’t include plans to spend every penny of its projected revenues. In keeping with the province’s new fiscal framework, the outlook has limited expenditure growth to maintain its fiscal surplus through the end of the budget outlook.

Revenues: Raking in the royalties

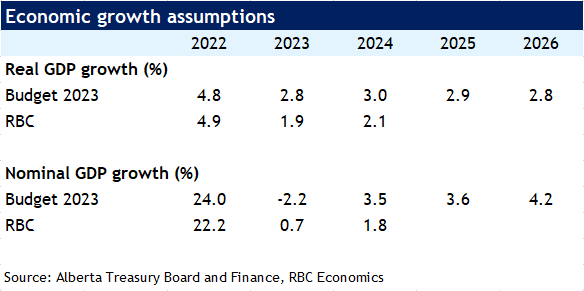

Although moderating from last year’s high, the government is anticipating revenues that far exceed pre-pandemic levels. Supported by high levels of in-migration and a real GDP that will top the charts for Canada this year, the budget has planned for an uptick in revenues from taxation on personal and business income compared to longer-term averages. But stronger jobs growth isn’t where the real goldmine sits. Revenues from the province’s natural resource sector continue to make all the difference for Alberta.

Accounting for more than a quarter ($18.4B) of revenues from oil and gas royalties, funding for provincial operations and capital plans are still largely dependent on the energy sector. As such, plans included in the 2023 budget continue to be subject to the same degree of volatility as the price of West Texas Intermediate oil. Nevertheless, Alberta’s conservative oil price assumption (at US$79 per barrel for WTI) leaves plenty of room for an upside to revenues. If our own RBC Economics assumption (of US$82.90 per barrel) in FY 2023 – 24 is correct, the province’s surplus could more than double.

And a massive revenue windfall (thanks to higher commodities) puts Alberta in a position to deliver on its Affordability Action Plan just in time for the 2023 election. The plan includes indexing personal income taxes to inflation and a promise to pause the 13% fuel tax until June of this year, amounting to $1.7 billion in foregone revenues. But as the province with the highest surplus as a share of GDP, Alberta can support these measures…at least, for now.

Capital Plan: Investing in infrastructure healthcare services

Alberta’s capital plan includes an investment of nearly $23B over three years. Notable investments include those allocated to municipal infrastructure ($6.5B) including grants and funding for Light Rail Transit systems. Together with capital maintenance costs of $3.5B to preserve existing facilities, and $3.1B for the development of new healthcare facilities, these priorities account for the bulk of Alberta’s capital spending.

Debts: Alberta maintains lowest provincial debt burden

Safeguarding its position, Alberta is on track to maintain the lowest debt-to-GDP in the country at 10.2% in FY 2023 – 24. With a commitment to maintain its surplus position, the province’s debt profile is projected to come down to 9.1% by FY 2025 – 26. Debt servicing costs are forecast to represent 4.2% ($2.8B) of the province’s total expenses next year (excluding contingencies). Although the province has introduced new fiscal prudence measures, without diversification, big spending plans can only move forward so long as the province’s energy sector continues to boom.

Read report PDF

Rachel Battaglia is an economist at RBC. She is a member of the Macro and Regional Analysis Group, providing analysis for the provincial macroeconomic outlook and budget commentaries.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More