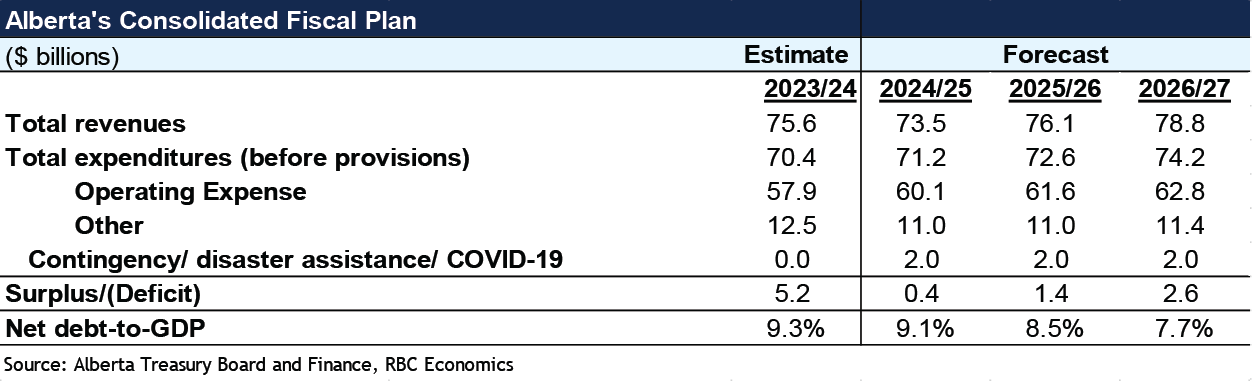

- Alberta’s government announced its fourth consecutive budget surplus, predicting $367 million in fiscal 2024-25.

- Expenditure growth is set to moderate by more than half (3.8%) from last year’s pre-election budget, narrowly outpacing population growth in the province (3.7%).

- Revenues are expected to shrink for a second straight year, dipping down to $74 billion (-2.8%).

- The province announced new deposits to the Heritage Savings Trust Fund ($2 billion in 2024-25) and renewed fiscal prudence measures announced last year to combat revenue volatility.

- Net debt-to-GDP ratio was adjusted lower, below any other province at 9.3% in 2024-25. It is now set to reach 7.7% by fiscal 2026-27.

Alberta delivers on new fiscal anchors

Alberta’s United Conservative Party isn’t planning for any deficits over the fiscal planning horizon—sticking to the new anchors laid out in last year’s budget. Instead, Budget 2024 put surpluses between $367 million in fiscal 2024-25 and $2.6 billion in fiscal 2026-27 on the table (after accounting for a $2 billion annual contingency fee).

The budget also includes a $2 billion deposit into the Alberta Heritage Savings Trust Fund as part of the province’s continued effort to mitigate revenue reliance on volatile resource royalties. This should bring the fund up to $25 billion, inching closer to Premier Danielle Smith’s target of at least $250 billion by 2050.

Expenditure growth will also be restrained amid a weakening outlook for resource revenues, preserving a modest surplus.

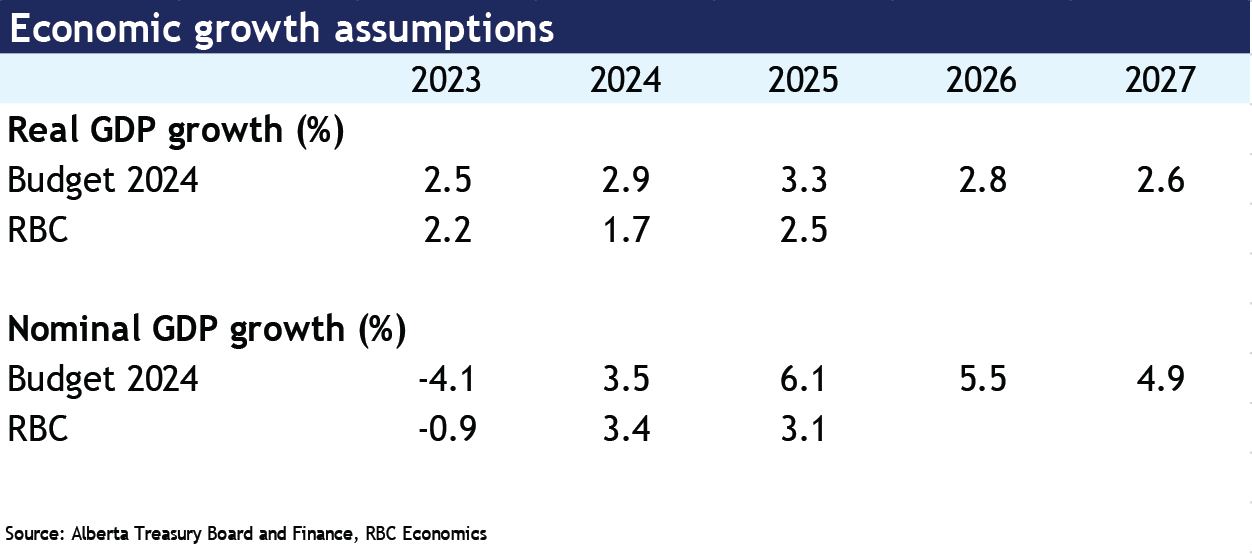

Optimistic growth assumptions partially offset some fiscal prudence measures

The government’s assumptions on economic growth negate some of the fiscal prudence measures in this year’s budget. Notably, the province is expecting real GDP growth to ramp up in 2024 from 2.5% to 2.9%. This assumption is contrary from our view (as we expect growth to further moderate in 2024) and more than twice the growth rate predicted by major private sector forecasters this year (1.3%).

The province also sees employment growth at 3% in 2024, which is a notable divergence from consensus (+1.8%) and above our own projection of 2.3%. An overly optimistic employment outlook could threaten provincial revenues in the year ahead, given the direct impact employment growth has on personal income tax.

Still, Alberta’s West Texas Intermediate crude oil forecast of US$74 per barrel came in relatively conservative relative to consensus among major private sector forecasters. This should help balance out the downside risk to revenues posed by an optimistic employment and GDP outlook.

Expenditure in line with new fiscal anchors

Budget priorities were refocused from spending to fiscal restraint in 2024-25 after a pre-election budget in 2023. Healthcare remains the largest line item and among the fastest growing expense at 5.1%. Large increases are set for physician compensation and development (including the Dynalife buyout), drugs and supplemental health benefits and community care, particularly for seniors.

Education accounted for another $412 million (4.4%) of the increase with more than half of the additional funding going to capacity enhancements for early childhood service to Grade 12 and post-secondary operations.

But not all services will see a funding boost. Public safety and emergency services (-15%), children and family services (-8.5%), and seniors community and social services (-0.3%) will see spending cuts of $351 million in 2024-25 despite record population growth and a more turbulent economic environment.

The budget also announced the introduction of the Alberta is Calling attraction bonus—a one-time $5,000 refundable tax credit to individuals in eligible occupations, who move to Alberta after the program start date (April 2024). The program is set to cost $14 million over the next three fiscal years and is intended to address critical labour shortages in the province.

Personal income tax among few revenue sources to keep growing

Resource royalties—a major source of revenue for the government—are set to drop 11% this fiscal year (-$2.1 billion) due to a weakening commodity markets outlook. Even though a continued increase in revenue from personal and corporate income tax (2.4%) should partially mitigate this loss, a deterioration in almost all other revenue sources is expected to keep total revenue growth in negative territory in 2024-25 (-2.8%).

The budget did address the pre-election promise of providing cuts to personal income tax through the introduction of a new 8% tax bracket on the first $60,000 of income. This is set to cost the government an estimated $1.4 billion annually once fully implemented in 2027 and is contingent on the province having sufficient capacity to maintain a balanced budget.

However, the tax plan wasn’t exclusively comprised of cuts. In addition to reinstating the fuel tax, the Alberta government will be releasing details of a new electric vehicle tax later this year. EV owners will be taxed $200 annually starting January 2025 to offset greater “wear and tear” on provincial roadways due to the heavier make of these cars. The new EV tax is set to generate $1 million in revenue in 2024-25, growing to $8 million in 2026-27.

The province also announced a new land title registration levy of $5 per $5,000 of the value for property transfers and mortgage registrations. This is intended to replace the current variable charges for each transaction. The measure is expected to come into effect spring 2024 and is set to generate $45 million and $91 million respectively in additional revenue in fiscal 2024-25 and 2025-26.

Investing in infrastructure and healthcare services

Alberta’s capital plan includes an investment of $25 billion over three years, $8.3 billion of which is to be spent in fiscal 2024-25. Notable investments include allocations to municipal infrastructure support ($7.2 billion over three years), capital maintenance and renewal ($3.7 billion over three years), and healthcare ($3.6 billion over three years). The majority of these investments will be for capacity enhancements to accommodate the province’s rapidly growing population.

Alberta maintains lowest provincial debt burden

Budget 2024 renewed last year’s plan to keep the province’s net debt-to-GDP on a downward trajectory, reaching 7.7% of GDP in fiscal 2026-27. The lighter debt load will also keep debt servicing costs from growing much faster than what the province has recorded in the past while safeguarding Alberta’s position as the province with the lightest debt burden in the country.

Though we generally applaud fiscal restraint—especially during periods of high interest rates—expanding service capacity to accommodate a growing population is essential to ensure Albertans have access to timely medical care and education, among other services. This is especially important during slower periods of economic growth when individuals and businesses tend to struggle most. Investing in the Alberta fund is a great tactic to combat resource revenue volatility, but this strategy would be best done in conjunction with greater revenue diversification.

Rachel Battaglia is an economist at RBC. She is a member of the Macro and Regional Analysis Group, providing analysis for the provincial macroeconomic outlook and budget commentaries.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More