Highlights:

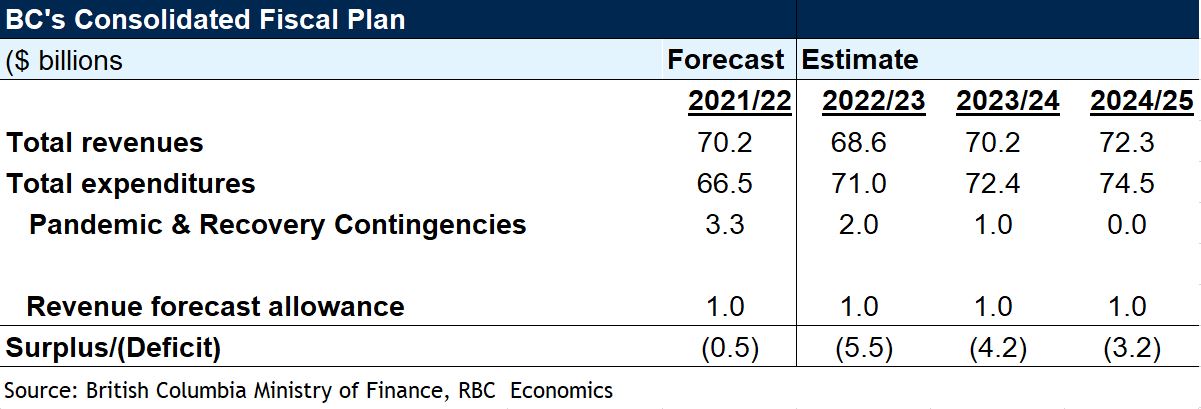

- B.C. government projects a $5.5 billion deficit, $5 billion larger than FY 2021-22

- Expenses to grow $4.6 billion (+6.9%) this year as spending on health and education ramps up

- Revenues to fall by $1.7 billion (-2.4%) as one-time federal transfers fall off the books and commodity boom dissipates

- Debt-to-GDP ratio to now expected to reach 23% by FY 2024-25, much below the prior ceiling of 30%

Summary

Finance Minister Selina Robinson delivered her second pandemic budget on February 22nd. Against the backdrop of robust economic activity and easing restrictions, the tone of this year’s budget, though still resolute, was more upbeat. Budget 2022 includes a $5.5 billion deficit in FY 2022-23, in line with the record-breaking pandemic deficit reported in FY 2020-21, though more than 10 times higher than the $483 million deficit now projected in FY 2021-22. Next year’s increase in the deficit is largely a reflection of the expiration of one-time federal supports and a forecasted fall in commodity prices, which translate to lower revenues (down $1.7 billion). At the same time, expenses will grow by $4.6 billion with funding largely targeted towards health, education, and child care. Over the fiscal horizon, the deficit is expected to shrink to $3.2 billion by FY 2024-25. Guidance on the path to balance was not included in this budget. B.C.’s debt-to-GDP level is projected to reach 17.8% at the end of this fiscal year, rising to 22.8% by the end of the fiscal plan. This represents the lowest indebtedness profile among the provinces.

Expenses- Building a Stronger Economy

Budget 2022 includes total operating expenses of $71 billion in FY 2022-23, up 6.9% ($4.6 billion) from the prior year. Additionally, the government maintains pandemic and recovery contingencies over the next two years though they are reduced by $1.3 billion to $2 billion in FY 2022-23, and further to $1 billion in FY 2023-24.

Health spending accounts for the largest share ( approximately 40%) of B.C.’s operating expenses, with nearly half of the province’s growth in expenditures attributed to health care spending. Costs associated with the province’s regional health services and Medical Services Plan will grow at an average annual rate of 5% over the fiscal horizon (to FY 2024-25). At the same time, base budget health spending will grow to $27 billion in order to accommodate population growth. Embedded in B.C.’s pandemic-related contingencies are $875 million allocated to provincial vaccine programs, personal protective equipment, and COVID testing.

The 2022 budget expands on the initial ChildCareBC plan and the province’s agreement with the Government of Canada to deliver affordable and accessible child care, allocating $3.2 billion to the program over 5 years. By the end of 2022, the province aims to reduce average child care fees for infants and toddlers by 50% (to an average of $20/day).

Additionally, Budget 2022 includes new measures to fight against, and adapt to climate change. Alongside an investment of $1.3 billion over three years through the CleanBC program (augmenting the $2.3 billion previously allocated), B.C. announced it will waive PST on electric vehicles and electric heat pumps going forward. The Clean Buildings Tax rebate will support retrofits of large rental and commercial buildings. In response to climate risk, B.C. has (prudently) earmarked $2.1 billion in Budget 2022 to prepare for and recover from wildfires and floods.

Revenues– Off the Peak Commodity Boom

In the fiscal year ahead, B.C. projects revenues of $68.6 billion, 2.4% below FY 2021/22 (a decline of $1.7 billion). The majority of this decline is attributed to lower expected natural resource revenues. As well, one-time federal transfers fall off the province’s balance sheet in FY 2022-23.

A projected decline in personal income tax revenues will be offset by higher corporate income and sales tax receipts next year. Carbon tax revenue is expected to grow at an average rate of 5.2% annually over the forecast horizon, as the tax rate increases from $45/tonne in FY 2021-22 to $50/tonne in FY 2022-23. Overall, provincial tax revenues are projected to lie flat in FY 2022-23. The absence of federal pandemic-related support payments will cause federal transfers to drop 2% next year. But, as B.C.’s proportion of the national population rises, so too will transfers to the province over the medium-term.

Natural gas royalties are forecasted to grow just shy of 22% in FY 2022-23 as production volumes rise and the usage of the province’s royalty credit program wanes. But most of B.C.’s natural resource revenue is derived from the forestry sector, whose $726 million projected revenue decline accounts for the majority of B.C.’s falling revenues. Lower stumpage rates and volumes of production are to blame, after abnormally strong pandemic-related activity in the sector.

Capital spending: Still at record highs!

B.C.’s capital spending level will grow to $13.6 billion in FY 2022-23, bringing total capital investment over the three-year horizon to total $39.4 billion, with tax-payer supported investment up 30% next fiscal year. The majority of the allotment is devoted to B.C. Hydro, B.C. Transportation Financing Authority, and Health infrastructure to expand and upgrade existing facilities.

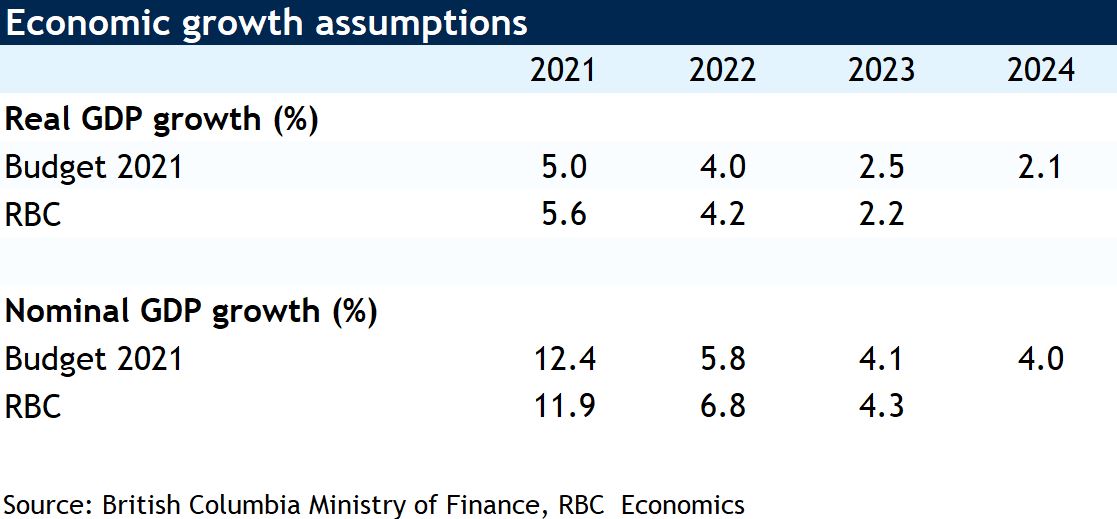

Debt-to-GDP– B.C. boasts lowest national debt burden

B.C. entered the pandemic on solid footing and benefited from the commodity price surge during the recovery. Over the forecast horizon, B.C. will stay the course and reduce the record deficit, keeping debt-to-GDP in a manageable range. B.C. has included many prudential measures in Budget 2022, including forecast allowances of $1 billion, recovery contingencies, program spending contingencies, and by assuming a GDP level 0.2 percentage points below the private-sector average. In FY 2021-22, considerable prudence meant the province’s deficit was much lower than anticipated. Considering this repeated high degree of prudence, there is a good chance that the trend will continue this year!

Read report PDF

Carrie Freestone is an economist at RBC. She is a member of the macroeconomic analysis group and is responsible for monitoring key indicators including consumer spending, labour markets, GDP, and inflation. Carrie produces economic analysis that she delivers to clients and the public through publications and presentations. She holds a Bachelor of Arts in Economics from Queen’s University and a Master of Arts in Economics from the University of Ottawa.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More