British Columbia Budget 2021

Highlights:

- BC government projects a record $9.7 billion deficit in FY 2021-22, shrinking rapidly in the next two years

- Focus on the province’s recovery plan drives up expenses $2.8 billion (4.5%) this year

- Winding down of federal COVID-related transfers to contribute to a $2.0 billion (3.3%) drop in revenue

- Debt-to-GDP ratio to reach 26.9% by FY 2023-24, still one of the lowest among the provinces

Summary

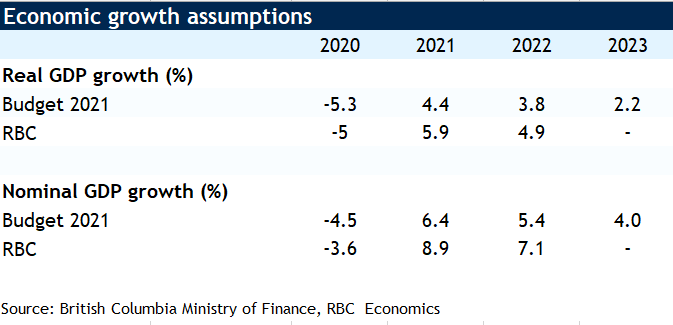

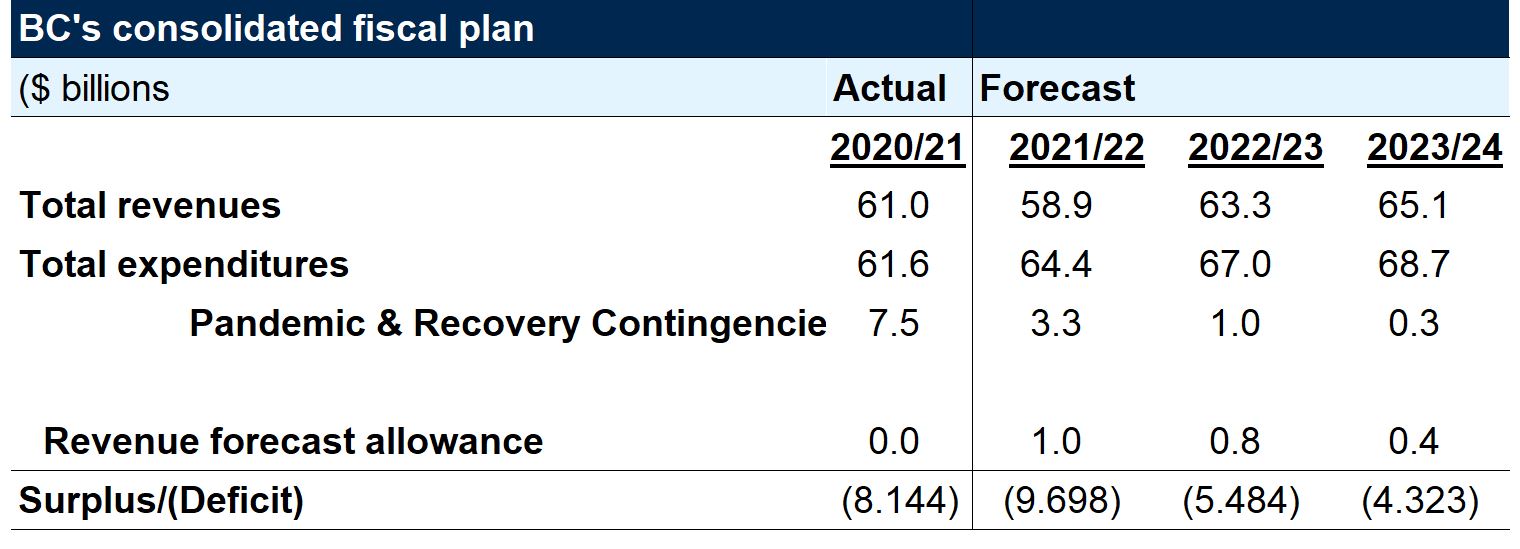

The NDP tabled their fourth budget on April 20. Despite the backdrop of a challenging third wave tearing through the province alongside harsher restrictions, the tone in BC’s budgetary address was hopeful and resolute. Finance Minister Serena Robinson presented a second-straight record-breaking pandemic deficit for the province, $9.7 billion for FY 2021-22, up $1.6 billion from the downwardly-revised $8.1 billion shortfall last fiscal year. This higher deficit reflects the winding down of one-time pandemic-related federal transfers alongside increased expenditures. Budget 2021 provides further COVID-19 response and recovery support, including for health, businesses and individuals, and boosts allocations for child care and climate. Expenses this year are set to rise $2.8 billion to $64.4 billion. Revenues are projected to decline $2.0 billion to $58.9 billion. The BC Ministry of Finance expects the deficit to unwind over the fiscal horizon and provided an approximate timeline to return to fiscal balance, likely over the 7 to 9 year fiscal horizon (by the year 2030). More details on the path to balance will be released in the fall. BC’s debt-to-GDP levels will grow over the fiscal horizon, but remain under 30% at the end of FY 2023-24. A low interest rate environment will accommodate this accumulation in the near term. “As more people get vaccinated, we can see the light at the end of the tunnel- but we’re not there yet.”

Healthy people, healthy communities, and a strong economy

Budget 2021 adds $13.2 billion in total spending over 3 years with $8.7 billion in operating (recurring) spending and $4.6 billion on COVID-related contingencies. For 2021-22, expenditures on health and safety, support for people and businesses, and preparing for the recovery will increase by $2.5 billion. Pandemic and recovery contingencies will total $3.3 billion (notable allocations being health-related COVID-19 management expenses, temporary housing, essential services, and Small and Medium Sized Business recovery grants). The former will continue to rise modestly in the next two years, while the latter will drop off rapidly as the pandemic comes under control. Relative to 2020-21, operating (recurring) expenditures will rise $2.8 billion (+4.5%) to $64.4 billion. But the $3.3 billion contingencies will represent a $4.2 billion decline from $7.5 billion in 2020-21.

Health accounts for the lion’s share of the increase in program expenses, with an additional $4 billion allotted over the three-year fiscal horizon. Over $3 billion goes to strengthening health care (urgent and primary care expansion, enhanced quality of long-term care, and addressing surgical backlogs) and mental health services, alongside a $900 million earmarked to address the COVID crisis (vaccination, testing and contact tracing).

Notable supports for British Columbians include $1.6 billion over the fiscal plan to increase income and disability assistance rates by $175 per month, which is expected to benefit over 240,000 recipients alongside a $50 increase to BC’s Senior’s Supplement. The province has also allotted $2.3 billion over the fiscal plan to child care with the intention of creating new additional child care spaces and enhance affordability. As a climate action leader, BC has earmarked an additional $506 million over the fiscal plan for CleanBC, which provides capital funding for clean transportation and energy efficient infrastructure.

And to address the limited supply of affordable housing in BC, Budget 2021 includes a $2 billion in low-cost development financing to support the construction of new affordable homes for middle income families. The province will provide low interest loans to developers who will be expected to pass these cost-savings through to prospective tenants and home owners.

Business support will continue with $800 million annual ongoing support. Budget 2021 includes targeted stimulus for agriculture, tourism, and the arts. An unallocated $1.1 billion is reserved as a contingency fund for unanticipated urgent health or recovery measures that may be necessary as the province navigates the third wave and the recovery. An additional $3.2 billion in pandemic recovery contingencies and a forecast allowance of $1 billion, a prudential measure to account for potential unanticipated costs.

Lower federal transfers will weigh on revenues

Revenues are expected to fall to $59 billion this year (-3.3%), as federal one-time COVID-related subsidies are depleted. The level of federal pandemic funding is projected to drop from $2.6 billion in FY 2020-21 to $175 million this fiscal year. Lower corporate tax revenues will also weigh on income due to lower instalments for the 2021 tax year. But a return to pre-pandemic commercial property tax rates will bolster property tax revenues after the expiration of a one-time rate reduction in 2020. An increase in the carbon tax rate and higher forestry sector royalties (elevated by growing stumpage rates alongside record lumber prices) provide a modest lift this year. As the recovery progresses, we expect that British Columbians will deploy a portion of the savings they’ve accumulated during the pandemic, which will boost sales tax receipts. Nevertheless, it will take some time for revenues to return to their pre-pandemic levels, staying 1 percentage point below FY 2019/20 as a share of GDP over the medium-term.

Record infrastructure investments

Minister Robinson announced a $3.5 billion lift to BC’s infrastructure commitment over the 3-year forecast horizon (bringing total investment to $39.5 billion), which she declared as “the strongest investment in BC history.” The government estimates this will translate into 85,000 jobs created for British Columbians. Major beneficiaries include health infrastructure spending ($7.8 billion) to build new hospitals and replace and redevelop old ones, and transportation investments ($7.5 billion) for highway rehabilitation and upgrades. A sizeable allotment of $7.3 billion will be devoted to the education sector for capital projects at post-secondary institutions and to maintain, replace, renovate, and expand K to 12 schools.

Net debt-to-GDP will stay below 30%

This fiscal year, net debt-to-GDP is expected to reach 22.8%, up 2.5 percentage points from FY 2020-21. Even though BC will reduce its deficit in the medium-term, debt levels are forecast to grow by close to $40 billion over the three-year fiscal plan. By the end of this horizon, however, the debt-to-GDP ratio will still remain below 30%, which appears to be the province’s tacit ceiling. Despite the debt increase, BC will continue to boast a lower debt burden in comparison to most other provinces.

Borrowing requirements will reach $51.9 billion over the next 3 fiscal years ($18.6 billion of which will be completed in FY 2021-22). Of course, a historically low interest rate environment is supportive of BC’s near-term levels of borrowing. Interest costs as a share of revenue are only expected to increase by 0.2 percentage points by the end of FY 2022/23, at which point, these costs will still be at their lowest level in decades.

Despite a record-breaking deficit, BC remains in a better fiscal position than other populous Canadian provinces with the deficit representing a comparatively small share of GDP (~3.3%). Prior to the pandemic, BC boasted one of the lowest provincial debt-to-GDP levels, posting a very small deficit in FY 2019-20 after 6 years of surpluses. Since BC has not witnessed a significant deficit since the early 90s, the province has greater fiscal flexibility than most. This should allow it to come back “stronger than ever.”

Read report PDF

Carrie Freestone is an economist at RBC. She is a member of the macroeconomic analysis group and is responsible for monitoring key indicators including consumer spending, labour markets, GDP, and inflation. Carrie produces economic analysis that she delivers to clients and the public through publications and presentations. She holds a Bachelor of Arts in Economics from Queen’s University and a Master of Arts in Economics from the University of Ottawa.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More