Highlights

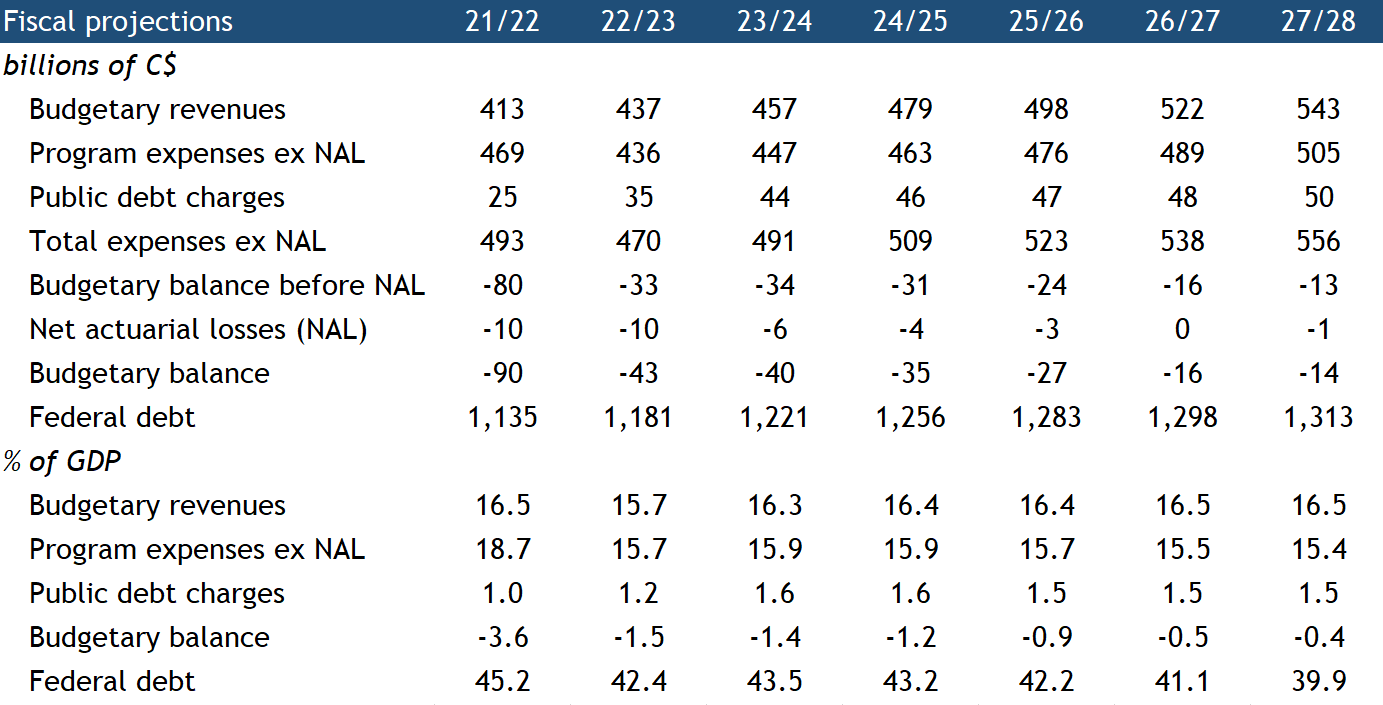

- Budget 2023 projects substantially higher deficits and a slower reduction in debt-to-GDP relative to the fall statement.

- The government will end the current fiscal year $43 billion in the red despite being in the late stages of the economic cycle.

- And a more challenging economic outlook will add to deficit pressure in the years ahead.

- Gross new spending of $70 billion includes green investment and health and dental care.

- New revenue measures and cost efficiencies are worth $24 billion over five years.

The federal government positioned Budget 2023 as a fiscally responsible plan focused on healthcare, green investment, and affordability. Significantly larger budget deficits call the first claim into question.

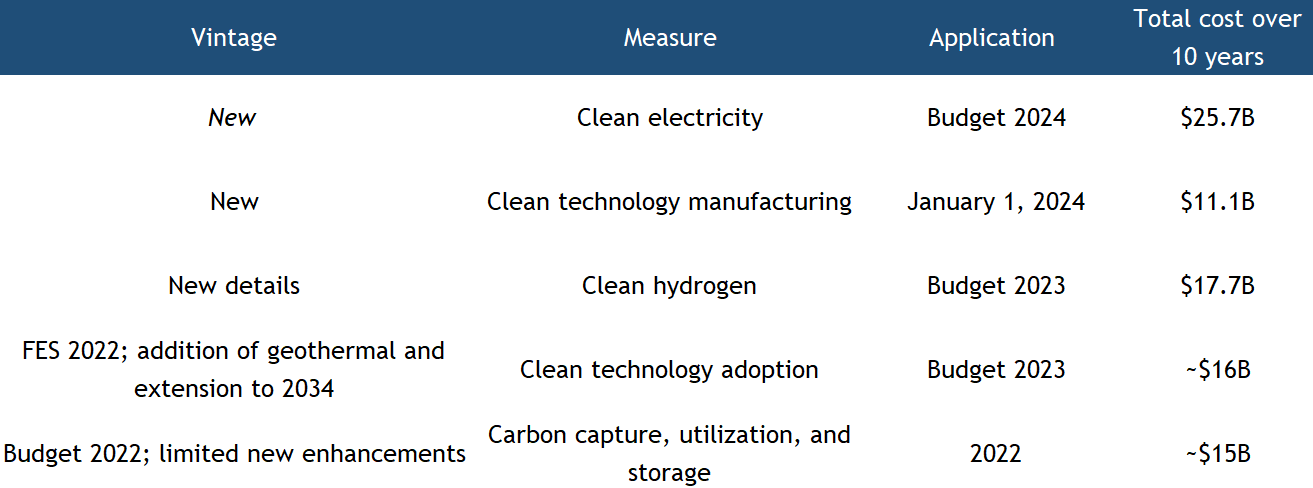

With most health care funding already announced in February and affordability measures remaining relatively narrow (as promised), today’s fiscal blueprint is better characterized as the “Red Green Show.” The government is much deeper in the red—a cumulative $69 billion deeper—than its fall statement indicated, with no balanced budget in sight. And new green spending is a key contributor, with $21 billion in support for clean growth over five years coming largely in the form of investment tax credits (ITCs). The total bill for these and previously-announced measures will come to $80 billion over ten years, making this a significant response to the U.S. Inflation Reduction Act (IRA).

New spending didn’t end there. In addition to $22 billion in recently announced healthcare funding, the expansion of the Canadian Dental Care Plan costs more than $7 billion over five years. Affordability support is largely contained to a $2.5 billion extension of the GST rebate top-up which has been rebranded as a grocery rebate. Some of this new spending is funded by cost efficiencies and new revenue measures worth $24 billion. But a more challenging economic outlook will also add to future budget deficits to the tune of $33 billion.

We cannot fault the government for spending on major priorities like green investment or healthcare, but these are exactly the kind of budgetary pressures it should have seen coming—and planned for. The starting point of a $43 billion budget deficit in FY 22/23 (up from $36 billion in the fall statement) is substantial, particularly at this stage in the economic cycle. At the very least, an economy with excess demand, record low unemployment, and high inflation calls for more neutral fiscal policy. With spending failing to right-size following the pandemic—program spending as a share of GDP is still significantly higher than before the pandemic—the government has left itself in a difficult position as it heads into an economic slowdown. With the federal government taking on a larger role in funding healthcare and promoting the energy transition, progress on reducing deficits and debt-to-GDP will be sluggish at best.

Budget 2023 by the numbers

- Cumulative budget deficits are $69 billion higher between FY 22/23 (the fiscal year now ending) and FY 27/28, relative to the fall statement.

- Net new spending totals $46 billion over six years, with roughly $70 billion in gross new spending offset by $24 billion in revenue measures and expected cost savings.

- A more challenging economic outlook adds $33 billion to cumulative deficits over the next five fiscal years.

- Debt-to-GDP falls to 40% at the end of the government’s projection, retracing less than half of the nearly 17 ppt increase seen during the pandemic.

Green priorities

The government had to do two things in this budget: drive faster investment in emissions reductions to meet 2030 targets and incentivize new clean industry to set up shop in Canada by responding to the major incentives in the U.S. IRA that are drawing investment south.

At $21 billion over the projection period, green measures are second only to previously announced health measures in new spending. But by counting the full period over which they apply and adding in other measures announced over the past year, senior Finance officials say Canada’s tax-based support for the green economy will total $80 billion over 10 years. Budget 2023 emphasizes that these tax supports are part of a tiered federal support system that includes carbon pricing at its core, along with financing supports and targeted programming.

In recent work, we called for broad-based government supports for decarbonization investment but targeted measures to attract new green industry in areas where Canada can compete globally. We’ve also suggested Canada borrow from the IRA playbook in drawing investment to the upstream energy system that can drive cross-sectoral decarbonization.

Budget 2023 delivers on the latter with supports for electricity, hydrogen, and consultations on growing the biofuels industry. The clean tech manufacturing credit is broader in application than we would have suggested—we would have liked more transparent tax tools to target sectors like critical minerals-battery supply chain—but the document still emphasizes the importance of these sectors.

The bulk of the government’s response focused on clean electricity ($7.4B), with major new investments intended to promote emissions reductions and attract electricity-intensive clean industry. A new 15% refundable clean electricity tax credit notably scopes in large-scale hydro and nuclear, equipment for interprovincial electricity transmission, and abated natural gas-fired generation. It also makes both taxable and non-taxable (public utilities) eligible. These elements were missing from the fall statement’s clean technology adoption credit, where the higher 30% credit rate will continue to be preferential for other forms of non-emitting electricity generation and non-fossil fuel-based storage. A targeted $20 billion in spending by the Canada Infrastructure Bank on clean electricity and a few other measures round out the supports.

Budget rhetoric emphasizes the role of renewables and transmission infrastructure in building out a clean grid but doesn’t yet explain how individual provincial planners will be encouraged to build the interprovincial transmission corridors that energy modelers say will lower the cost of a Net Zero grid. The government says it will consult further on this. Bloomberg NEF has estimated required grid spending at over $25 billion per year, much of which will occur within provinces. Greater support from provincial governments will be critical to plugging this gap.

Clean technology manufacturing ($4.5B) got the support it was promised with a 30% refundable investment tax credit for machinery and equipment to manufacture or process key clean technologies. Details of the hydrogen refundable ITC ($5.6B) have also emerged, with credit rates varying between 15% and 40% depending on the carbon intensity of the product, and a 15% tax credit for conversion of hydrogen to ammonia for transport. Hydrogen produced with carbon capture is likely to fall on the low end (depending on capture system efficiency) but CCUS equipment itself could qualify for the CCUS ITC.

Notably absent is a significant enhancement to the carbon capture ITC. While there are some adjustments, there are no changes to the credit rates that industry have been calling for to compete with the 45Q US tax credit recently enhanced in IRA. We think CCUS could be a growth sector for Canada, promoting decarbonization beyond oil and gas and benefiting from domestic companies, expertise, and favourable geology. The government seems to be anticipating that carbon pricing regulations—and the ability for CCS project sponsors to sell carbon credits in regulated markets—will close the investment gap. But this requires sufficient credit price certainty.

Carbon contracts for differences (one such mechanism to firm carbon pricing) are once again mentioned as part of the toolkit for the now stood-up Canada Growth Fund, which should start doing deals by the spring. The government will also consult on a “broad-based approach” to carbon contracts for differences, although how it plans to manage the likely huge contingent liability of broad-based contracts (especially if applied to credit prices rather than the carbon price itself) isn’t clear.

One notable measure missing is a broad support program for Indigenous communities to participate in green or other infrastructure projects. We’ve estimated that 56% of critical minerals development will involve Indigenous lands, for example. Indigenous organizations and project sponsors have highlighted many opportunities for Indigenous communities to be equity owners and project stewards—involvement that often brings an overall benefit to the project, but access to capital remains a barrier. Budget 2023 says the Canada Infrastructure Bank will provide support for projects it invests in, but we were looking for a broader and more transparent program, like a government guarantee program.

Other key spending announcements

Budget 2023 includes half (i.e., the first five years) of the federal government’s 10-year, $46 billion healthcare deal with the provinces, which was announced in early February. Expanding the Canadian Dental Care Plan to all uninsured Canadians with an annual family income of less than $90,000 (as of the fall statement it only applied to their children under 12 years of age) adds $7 billion to that program’s cost, which is now $13 billion over five years.

One area where the government did exercise some restraint is in new “affordability” measures. These were limited to a $2.5 billion extension of the GST credit top up (initially rolled out in the fall statement but rebranded as a “grocery rebate” in Budget 2023) and $800 million in student financial assistance. The government is also investing $1.9 billion over four years in Indigenous housing. Budget 2023 includes a further $4 billion to “invest in Indigenous communities” including a $2.8 billion settlement related to residential schooling.

New revenue and cost efficiencies

Budget 2023 includes a number of new revenue sources totaling nearly $12 billion over the government’s projection horizon. Implementing a global minimum tax for large multinational corporations (Pillar Two of the OECD/G20’s international tax reform) is expected to generate about $2.6 billion annually beginning in FY 26/27. Changes to the Alternative Minimum Tax framework (increasing the tax rate but narrowing the base of taxpayers to which it will apply) are expected to bring in around $700 million annually, while changing the tax treatment of dividend payments received by financial institutions adds roughly $900 million per year.

The government has also penciled in net cost savings of $13 billion over the next five years. It aims to “refocus government spending” across several areas, including reducing outlays on consulting, professional services and travel by 15% ($7 billion over five years) and reducing eligible department and agency spending by 3% by FY 2026/27 (another $7 billion). Relative to the historical spending impetus, this is a modest effort.

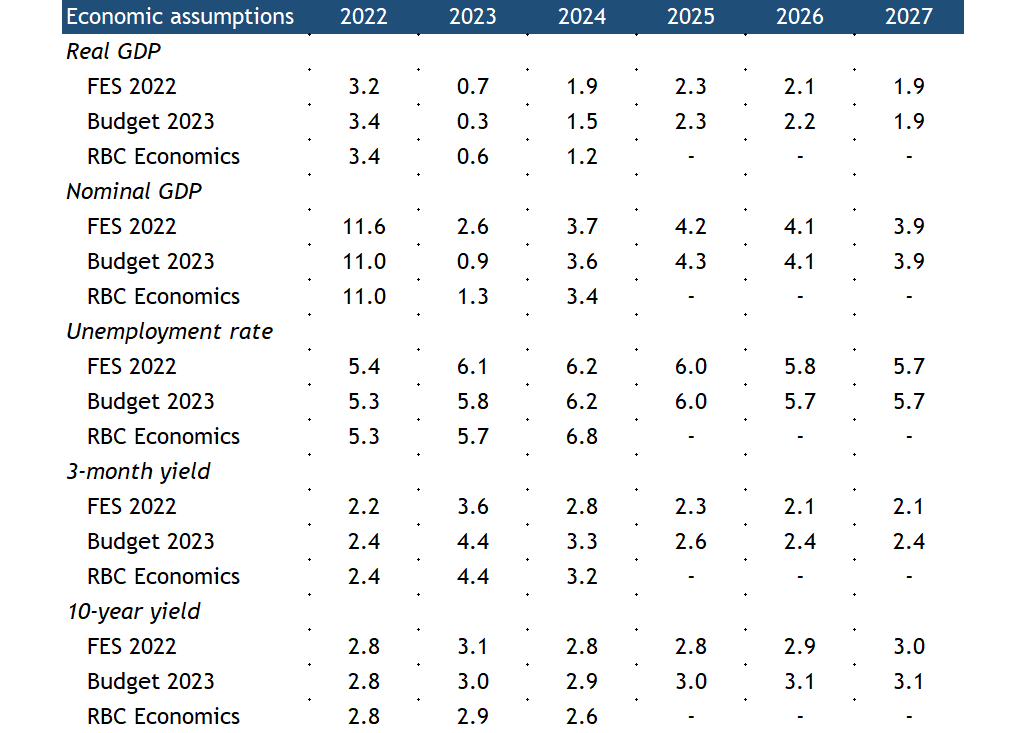

A more challenging economic outlook

Budget 2023 incorporates a more challenging economic outlook, with growth projections in 2023 and 2024 marked down relative to FES 2022. These align more closely with our own projection for a mild recession this year. RBC assumes a more significant increase in the unemployment rate next year, which would carry some additional employment insurance costs for the government. Given recent developments in the banking sector outside of Canada, we think risks around our forecast are skewed to the downside. Budget 2023 includes both positive and negative economic scenarios, with the latter making any reduction in the government’s debt-to-GDP ratio a distant prospect.

Cynthia Leach helps shape the narratives and research agenda around the RBC Economics and Thought Leadership team’s forward-looking economic and policy analysis. She joined the team in 2020.

Josh Nye is a senior economist at RBC. His focus is on macroeconomic outlook and monetary policy in Canada and the United States. His comments on economic data and policy developments provide valuable insights to clients and colleagues, and are often featured in the media.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More