Canada job growth jumped higher, but details are soft

- Employment jumped by 47k in September and the unemployment rate unexpectedly edged lower for the first time since January (to 6.5% from 6.6% in August)

- Full time employment jumped 112k with partial offset from a 65k drop in part-time work. But details beyond those headlines are substantially more mixed, and still consistent with a further underlying softening in labour markets.

- Despite the favourable full-time/part-time job mix, total hours worked declined by 0.4% (consistent with still soft GDP growth trends)

- The tick lower in the unemployment rate was driven by a drop in labour force participation among 15-19 year olds that may have reflected difficulties seasonally adjusting the data around the end of the typical summer jobs work period.

- Overall population growth continued to run well in excess of employment growth at 110k, and the unemployment rate for 25-54 year olds (which make up the bulk of the labour force and should not be as impacted by summer seasonal trends) actually rose to 5.5% in September from 5.4% in August.

- And wage growth showed further signs of slowing, easing to 4.7% from 5.1% in August. Pressure on wage growth should remain downward given persistently falling job openings, higher unemployment (even with the tick lower in September) and weak post-pandemic productivity growth trends.

- Bottom line: Our own base-case forecast assumes 50 basis point cuts from the BoC to the overnight rate in each of October and December, and those moves would still make sense after today’s labour market data. Details behind the September job numbers were far more mixed than the headline employment and unemployment rate readings alone would imply. Hiring demand (job openings) have continued to move sharply lower, increasing the odds that the unemployment rate will continue to rise, and a pullback in hours worked leaves GDP growth in Q3 still tracking in line with our own 1.0% (annualized) forecast and well below the BoC’s latest 2.8% forecast from July. Combined with slower inflation, interest rates still look clearly higher than they need to be with a softer economic backdrop still leaving risks tilted to price growth slowing to below the BoC’s 2% target in the year ahead.

See previous versions:

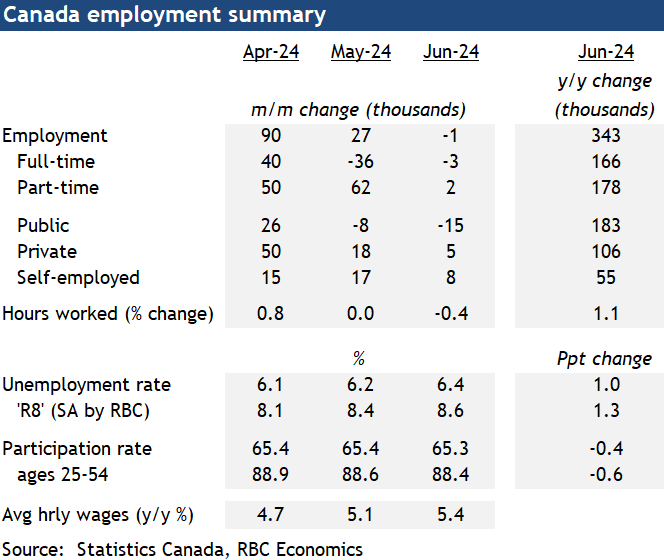

- Employment was little changed in June – edging down 1k with a 3k drop in full-time employment offsetting a small 2k rise in part-time work. Hours worked declined by 0.4%.

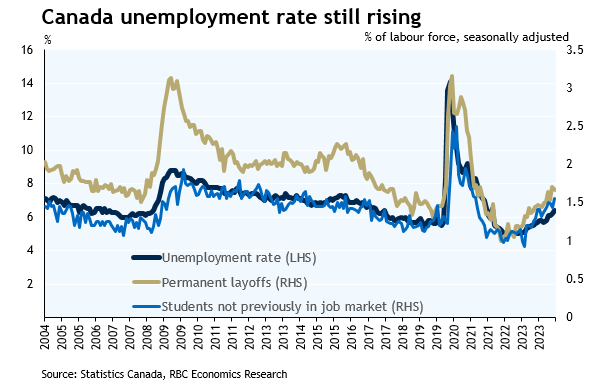

- But with population and labour force still surging that pushed the unemployment rate up to 6.4%, the highest reading outside of the pandemic shock since October 2017.

- A large share of the rise in the unemployment rate is still coming from students, in part due to a softer summer jobs market. But the rate of monthly layoffs has also continued to creep higher, and was up 20% from a year ago in June.

- Average hourly earnings remained firm, rising 5.4% from a year ago. Still, other wage measures derived directly from business payrolls (and typically viewed as a more reliable indicator) have been slower and are still running below the rate of inflation growth versus pre-pandemic levels.

- The BoC will be watching the potential inflationary impact of wage growth closely, but slowing hiring demand and rising supply of unemployed workers means that wage growth is most likely to move lower.

- Bottom Line: The dip in employment in June is small but layoffs are creeping higher under the surface. The unemployment rate is now up 1.6 percentage points from its post-pandemic lows (a larger increase than in some historical ‘recessions’) and a downtrend in hiring demand (lower job openings) has shown no sign of ending. The BoC will still be watching the next round of inflation data and their own Business Outlook Survey closely ahead of the next interest rate decision later this month (July 24th) but with interest rates still at restrictive levels, the bar to at least easing off the monetary policy brakes further in the near-term is lower. The June labour market data increases the odds that the central bank will cut rates in July.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More