Canada’s housing market downturn spread further in November. Most markets are now in correction mode with high interest rates, the loss of affordability, and mounting economic uncertainty holding back homebuyer demand, and supply-demand conditions having significantly eased since spring.

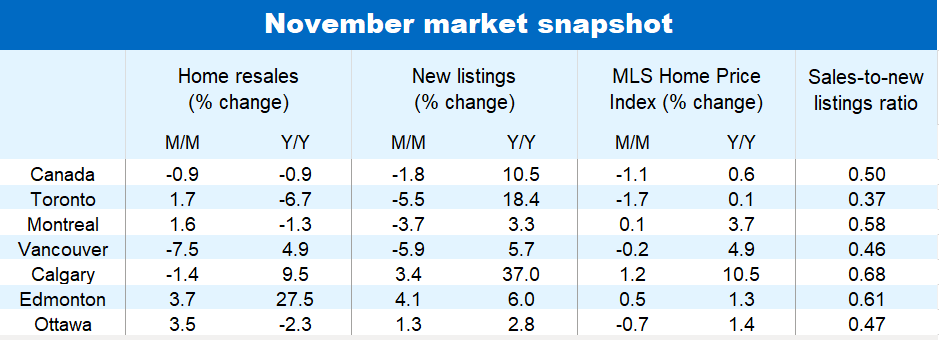

Though home resales (-0.9% m/m) were off just slightly from October in Canada, the lagged impact of market softening in prior months continued to weigh on home prices. The national MLS Home Price Index dropped for a third consecutive month (-1.1% m/m) in November, representing the largest month-over-month drop in nearly a year.

Affordability issues keep sales activity muted

Home resales have now declined 13% since June—reversing almost entirely the spring rebound. Activity has contracted in most markets west of New Brunswick in the past two to three months, led by steeper drops in parts of B.C.

Resilience has finally waned in the Prairies too with resale activity down in all three provinces (though still up markedly from pre-pandemic levels in Alberta and Saskatchewan).

While stable, activity in the Maritime region remains below pre-pandemic levels overall.

Market conditions have shifted to favour buyers across more regions

An influx of supply has contributed to the softening in demand-supply conditions, though the rebound in new listings hasn’t been excessive. In fact, new listing fell-back-to-back in October and November in Canada, staying within the 2019 range.

Nevertheless, softening demand-supply conditions have kept buyers in the driver’s seat in almost all Ontario markets that we track and in parts of B.C.

Market conditions have loosened in Manitoba as well. With softer sales setting over the Prairie region, we think supply-demand conditions will ease in Alberta and Saskatchewan too in the coming months.

Property values under pressure

Property values are coming under increasing downward pressure across large parts of Canada. This is particularly the case in Ontario (-1.7% m/m) where the MLS price index has been declining since August, falling at accelerating rates on a month-over-month basis.

Similar softening dynamics are developing in other provinces, albeit with a slight lag. Price declines accelerated for a second consecutive month in B.C. (-0.4% m/m) and Manitoba (-0.9%) in November. And, for the first time since March, prices in Nova Scotia succumbed to the downturn (-2.0% m/m) as well.

Price gains in Quebec and New Brunswick have ground to a halt, leaving few markets bucking the weakening price trend. Though price growth remains strong in Calgary, we think it’s only a matter of time before easing supply-demand conditions and changing market sentiment rein in price gains there as well.

Sluggish activity to linger into 2024

With interest rates likely to stay high in the near term, we expect elevated ownership costs to remain a deterrent for homebuyers. That should keep activity very soft in Ontario and B.C. – where affordability is most stretched.

But with high rates impacting buyers from coast to coast, we see activity in other regions continuing to gradually moderate—triggering price declines in more markets in the months ahead.

See PDF with complete charts

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More