Monthly Housing Market Update

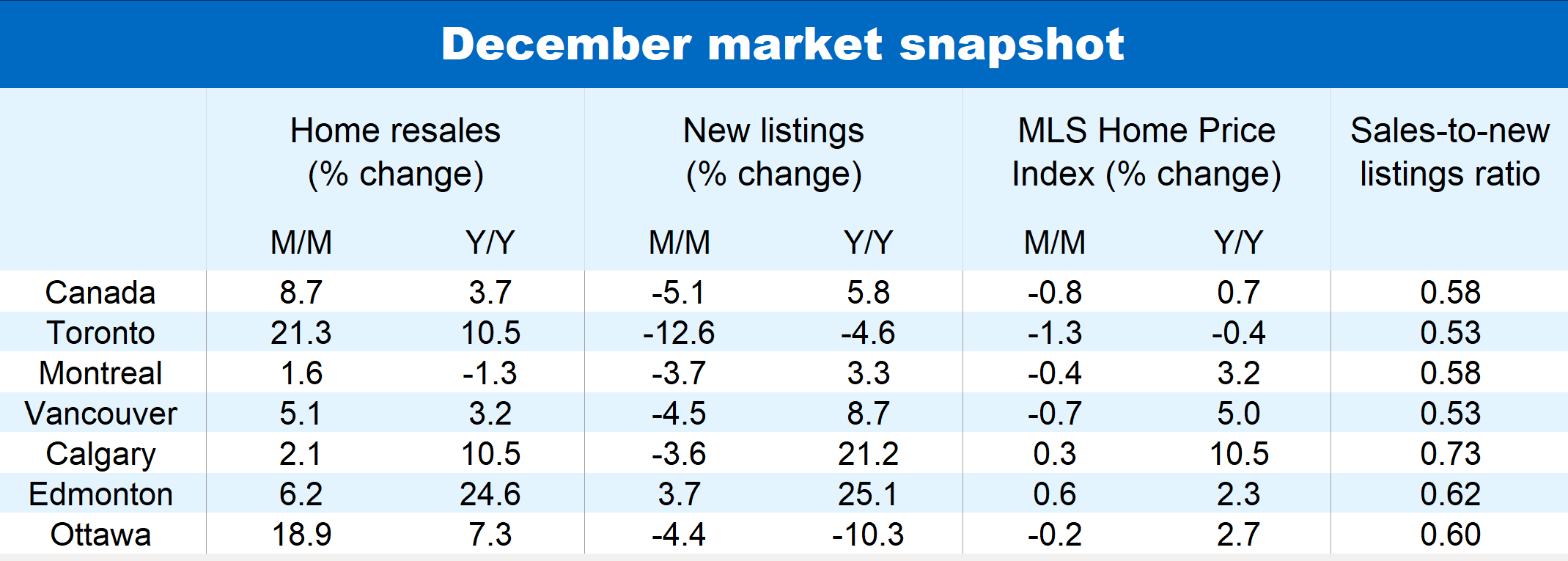

Well, 2023 had one last surprise up its sleeve: home resale transactions in Canada bucked the softening trend and rebounded a solid 8.7% m/m in December. What’s more, markets in Ontario and British Columbia—regions that cooled off the most since summer—recorded some of the larger increases.

It seems that a combination of price concessions from sellers and modest mortgage rate declines spurred more buyers into action. Transactions largely drew from pre-existing inventory as new listings fell for a third-straight month (down a significant 5.1% m/m nationwide).

Home prices continue to drift lower overall despite tighter demand-supply conditions. The composite MLS Home Price Index for Canada edged down 0.8% m/m in December, following declines ranging between -0.5% and -1.0% in the previous three months.

Activity spikes in Toronto…

The Toronto-area market woke up from its slumber as 2023 drew to a close. Home resales spiked 21% in December from a near 15-year low in November (excluding the pandemic shutdown period). The pace also picked up materially in other parts of Ontario, including London-St. Thomas (up 26% m/m), Ottawa (up 19%), Brantford (up 18%), Cambridge (up 18%), North Bay (up 16%) and Kitchener-Waterloo (up 10%)—albeit all from historically weak levels.

…and parts of British Columbia

It was a similar story in several B.C. markets. Resale transactions jumped 19% m/m in the Fraser Valley, 12% in Victoria and Chilliwack, and 5% in Vancouver, partly reversing some of the significant declines that took place in prior months.

Yet Ontario and B.C. prices still trending lower

The end-of-year sparks did little to alter softening price trends. MLS HPIs continued to decline on a month-to-month basis in all these markets, with the rate of decline generally accelerating in B.C. The tightening in demand-supply conditions in December would need to be sustained for several more months in order for prices to change course.

Prairie markets vibrant overall

Home resales picked up in Alberta, Saskatchewan and Manitoba last month, led by gains in Winnipeg (+12% m/m), Edmonton (+6.2%) and Regina (+3.1%). Transaction levels remain generally strong in the Prairie region—well above where they were pre-pandemic in Alberta and Saskatchewan, and only marginally off in Manitoba—and demand-supply conditions are tight. Property values in Alberta are up the most in the country from a year ago, led by Calgary (+10.5%).

Balanced conditions despite soft resales in Quebec and Atlantic Canada

For the most part, the housing market continues to operate well below pre-pandemic levels west of Ontario (with the exception of Newfoundland and Labrador). Home resales rose in December, with month-to-month gains recorded in Sherbrooke (+15%), Quebec City (+12%), Halifax (+3.8%), Moncton (+2.8%) and Montreal (+0.4%). But these reversed only part of the declines since early-2022. Low inventories have kept demand-supply conditions broadly balanced across Quebec and Atlantic Canada, though prices have come under downward pressure of late in some markets including Montreal (where the MLS HPI slipped 0.4% m/m in December), Saint John (-0.6%) and Fredericton (-0.6%).

One-month blip?

We’d warn against reading too much into a single month’s burst of activity, especially when it comes at a seasonal low point (December is the quietest period of the year for the housing market). Large seasonal adjustment factors in the statistics tend blow up even small month-to-month changes—up or down. January won’t bring much clarity either since it’s the second quietest month of the year. So any confirmation of a cyclical turning point will have to wait. Whether the bottom has been reached or not, Canada’s housing market remains soft in most regions at this stage with many potential buyers struggling to afford a purchase.

Not out of the woods just yet

We expect this softness will persist through the first half of this year with a market recovery gaining strength thereafter as interest rate cuts accumulate. Our view is the Bank of Canada will pivot around mid-year and slash its policy rate by 100 basis points over the second half of this year, followed by further 100 basis points in 2025. Longer-term interest rates are poised move lower ahead of the Bank’s policy though (as they already have in recent weeks). We see prices firming up after activity has turned and demand-supply conditions have tightened sufficiently—possibly sometime in the third quarter. That said, any price recovery will be restrained by lingering affordability issues.

See PDF with complete charts

Robert Hogue is an Assistant Chief Economist at RBC responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. He joined RBC in 2008.

Rachel Battaglia is an economist at RBC. She is a member of the Macro and Regional Analysis Group, providing analysis for the provincial macroeconomic outlook.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More