Highlights:

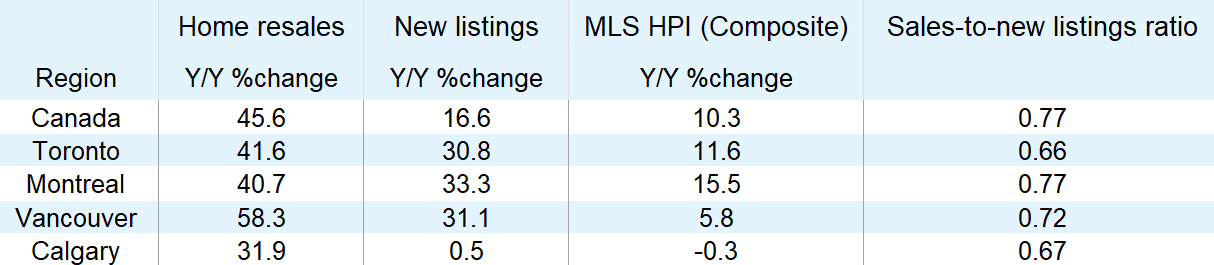

- Home resales were the strongest ever: This summer’s rally continued last month across Canada, rising a further 0.9% from August to 677,000 units (annualized) nationwide—an all-time high and 46% above the September 2019 level. Activity increased in the majority of markets, with Ottawa (up 19.9% m/m), Vancouver (up 10.5%) and Calgary (up 9.4%) leading the way. Winnipeg (down 4.5% m/m), Toronto (down 5.3%) and Montreal (down 6.5%) recorded declines though the level of activity remained exceptionally high.

- Fewer sellers came to market: Nationally new listings fell for the first time in five months dropping 10.2% from August. Tighter availability of supply no doubt restrained the pace of resales in September. Homes newly listed for sale plummeted 24% m/m in Vancouver, 23% in Toronto and 16% in both Halifax and Hamilton. Calgary (down 1.6% m/m), Winnipeg (down 1.8%) and Montreal (down 2.5%) recorded more modest declines. In most cases, last month’s drop followed outsized increases in the previous four months.

- Tightest demand-supply conditions in nearly two decades: Sellers held the upper hand virtually everywhere in Canada except a few pockets in the Prairies, and Newfoundland and Labrador. Nationally, the sales-to-new listings ratio—a reliable gauge of price pressure—reached an 18-year high of 0.77. Supply was especially short of demand in Ontario, Quebec and parts of Atlantic Canada.

- Prices keep on rising but condo values are levelling off in a few places: Canada’s MLS Home Price Index (HPI) accelerated to a rate of 10.3% y/y—the first time it’s been in double-digits in three years. Most markets east of Manitoba saw double-digit annual gains, led by Ottawa (up 22%), London (up 19%) and Montreal (up 15%). The strength was generally concentrated in single-detached homes, with this category’s HPI rising 12% y/y nationwide. This was almost double the 6.2% rate for condo apartments. Condo prices have flattened in Vancouver, Toronto and Hamilton relative to pre-pandemic levels.

- The market has fully recovered—expect some cooling ahead: We believe the spectacular rally over the past five months has exhausted pent-up demand created earlier this spring. This, and tight supply will restrain activity this fall.

September could be a turning point for supply

While the full-scale return of buyers to the market gathered much of attention this summer, the surge in sellers has been as impressive. Rapid growth in supply (from depressed levels in March and April), in fact, was crucial for ‘unlocking’ pent-up demand and driving home resales to record highs. But September could be a turning point with the first drop in new listings in five months signaling the wave of sellers is receding. If sustained, a lack of supply will increasingly restrain activity again. Remember all the talk about lack of supply pre-pandemic? Expect some of it to come back—even if pent-up demand is fading. This isn’t good news for buyers hoping for fewer bidding wars in most market segments.

Strength concentrated in low-rise categories

Market trends diverged across the housing spectrum. Real estate board level data earlier this month showed that activity has been universally stronger for single-detached and other low-rise homes than for condos. And the number of condos put up for sale has risen much faster than the number of low-rise homes this summer. This means the tightness between demand and supply observed in the aggregate predominantly reflects the reality of low-rise categories. Market conditions for condos are relatively looser—especially in core urban areas. The penchant for low-rise properties with more living space (and a yard) has also fueled activity in suburbs, exurbs and cottage country markets. Some of the stronger resales increases in September in Ontario were recorded in smaller markets such as Niagara Falls-Fort Erie, Muskoka-Haliburton and Orillia.

Home prices expected to rise further but condo values face some headwinds

Current demand-supply conditions support further overall price increases in the near term. But we expect trends to differ between low-rise and condo categories. We see single-detached property values far outpacing downtown condo apartment values. Condo prices, in fact, have already stagnated over the past six months both at the national level and in some of Canada’s largest markets (including Vancouver, Toronto and Hamilton). This contrasted with a solid 7.3% increase for single-detached homes nationwide over that period. Growing interest in living outside major metropolitan areas is also heating up prices rapidly in smaller markets. In Ontario, for example, Woodstock, Bancroft, London and Brantford recorded some of the larger gains in the MLS HPI in September. We expect this to continue as strong demand exerts intense pressure on these markets’ relatively small housing stocks.

Many questions should be answered in the coming months

The coming months should provide more precise clues about the market’s direction in the year ahead. We’ll see whether low interest rates and changing housing needs can keep demand boiling hot, or whether the exhaustion of pent-up demand and plummeting immigration will cool things down. We’ll also learn how many current homeowners will be in trouble once mortgage payment deferrals expire and are forced to sell. And of course, we’ll get a better sense of the broader economic and market impact of the second wave of the coronavirus in many parts of the country. While we are generally positive on Canada’s housing market outlook, answers to these questions should tell us what kind of risks—both upside and downside—threaten to emerge.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More