Monthly Housing Market Update

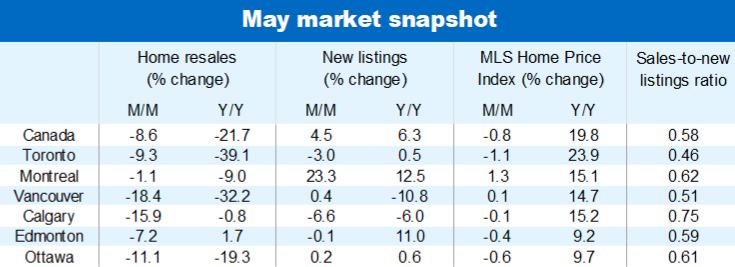

Rapidly rising interest rates are having a definite chilling effect on housing market activity across Canada. Home resales fell for a third-straight month in May—down 8.6% from April—with nearly all local areas seeing some moderation. Earlier super-tight demand-supply conditions are rebalancing quickly. This marks a dramatic shift from the exuberance that prevailed through most of the pandemic. For now, home prices are softening mainly in Ontario and British Columbia but there are emerging signs of weakening in Alberta markets as well. We expect bearish sentiment to build and spread further as the Bank of Canada forges ahead with a ‘forceful’ monetary policy normalization. We think this will set the stage for broad-based property depreciation in the period ahead.

Activity below pre-pandemic levels

Home resales dropped to 512,000 units (seasonally adjusted and annualized) nationwide last month. This was the first time activity slipped below the 525,000 units recorded in February 2020 since the pandemic-era rally began in the summer of 2020. The situation varies vastly across the country though. Despite declining in May (and in several cases, April), activity remains strong—and well above pre-pandemic levels—in the Prairie and Atlantic Provinces. The Canada-wide softening entirely reflects trends in British Columbia, Ontario and Quebec where buyers are now clearly on the defensive.

Sellers losing their grip on Ontario and BC markets

At the same time that demand is cooling, more properties are coming to market. New listings rose 4.5% m/m in Canada last month. This accelerated the rebalancing process that began in March. The starkest developments are taking place in Ontario and British Columbia where sellers are rapidly losing their (previously strong) grip on the market—although demand-supply conditions aren’t putting buyers in the driver’s seat quite yet. Sellers however still hold firm positions in other regions of the country. Atlantic Canada markets, in particular, continue to be exceptionally tight.

Home prices coming down in Ontario and British Columbia

The MLS Home Price Index declined for the second-straight time in May, falling 0.8% m/m Canada-wide. Ontario and British Columbia accounted for most of the softening. Cambridge (-4.6%), North Bay (-4.0%), Woodstock-Ingersoll (-3.9%), Huron-Perth (-3.6%), London-St. Thomas (-3.5%) and Chilliwack (-3.0%) recorded the more notable drops from April. The MLS HPI fell modestly in the Greater Toronto (-1.1%) but was largely flat in the Greater Vancouver Area (up 0.1%). We expect downward price pressure to build further in Ontario and British Columbia as these markets are more sensitive to interest rate increases.

Property values peaking in Alberta?

There were signs that prices may be peaking in Alberta. The MLS HPI fell slightly in both Calgary (-0.1% m/m) and Edmonton (-0.4%) last month. In the case of Edmonton, this took place amid demand-supply conditions swinging sharply out of seller’s market territory in the past two months. We think recent developments point toward more stable price trends, and not necessarily a material correction. We believe the relative affordability of Alberta markets will keep demand solid in the near term.

Prices keep escalating in Atlantic Canada

While the pace generally slowed, MLS HPIs continued to appreciate last month. Moncton (up 2.5% m/m), Saint John (up 2.2%) and PEI (up 1.4%) led the way with the bigger monthly gains. With demand-supply conditions still very tight across the Atlantic region—and favourable affordability relative to other parts of Canada—we expect prices to face milder headwinds in the period ahead.

A cooldown of varying degrees

The highly atypical synchronization of local market cycles since the start of the pandemic is gradually coming apart. Rapidly rising interest rates—we expect the Bank of Canada to hike its policy rate by another 125 basis points by the fall—apply uneven pressure on home buyers across Canada with those in the most expensive markets facing the bigger challenges. We believe the cooling trends that have emerged in the last three months will intensify in the coming months, leading to widespread price corrections—especially in Ontario and British Columbia. Peak-to-trough, we think benchmark prices could decline around 10% nationwide, and closer to 13% in Ontario and British Columbia. Corrections in other provincial markets are likely to be more modest.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More