If the pandemic’s second wave caused potential home sellers to pause, no one told buyers. Buyers were out in force—again—in January, driving up home resales to yet another record-high level in Canada. Rock-bottom interest rates, changing housing needs, high household savings and perhaps nervousness that accelerating prices will crush affordability down the road continued to fuel huge buyer interest. For now, buyers are largely picking from existing inventories. New listings fell more than 13% nationwide last month. With demand consistently exceeding homes put up for sale since summer, inventories are running very low in many parts of the country, especially for single-family homes. We expect the dearth of supply—including in smaller markets—will soon restrain activity but keep the heat intense. Condo sales in Canada’s largest cities could buck the trend, though, given relatively ample supply.

Intense market heat steams up prices

With so few units to fight over, bidding wars are commonplace, and likely to remain so in the near term. Strong competition between buyers in January propelled prices at the fastest rate since mid-2017 nationwide (the MLS Home Price Index was up more than 13% y/y). We see prices accelerating further in the coming months. Some of the stronger increases are taking place in smaller markets in Central Canada and the Atlantic region, which are receiving a significant influx of buyers from larger markets.

FOMO: covid-style?

The pandemic has clearly boosted outside (or big city) buyers’ attention in smaller markets. Work-from-home is making it possible for many big-city office workers to venture further afield in search for an affordable home. With smaller market prices appreciating rapidly, though, this search has looked more like a rush lately. We believe a fear of missing out on smaller markets’ relative affordability has developed. This may set a feedback loop in motion whereby FOMO-motivated buyers push prices higher, which in turn cranks up the urgency to buy now before it becomes unaffordable. It’s worth remembering such dynamics often attract speculators who heat things up further.

Odds of policy intervention increases

With prices rising more than 20% from a year ago in virtually every small southern Ontario market, parts of Quebec and Atlantic Canada—and most still on an accelerating path—affordability issues will soon confront many Canadian communities. Pressure will build on policymakers to “do something about it”. While the longer-term solution largely lies on growing the supply of housing (especially more affordable units), we see the odds of some form of policy-induced cooling of demand increasing over the coming months. Policymakers will weigh any intervention against the risk of derailing one of the stronger sectors of the economy in the middle of a pandemic.

January market highlights

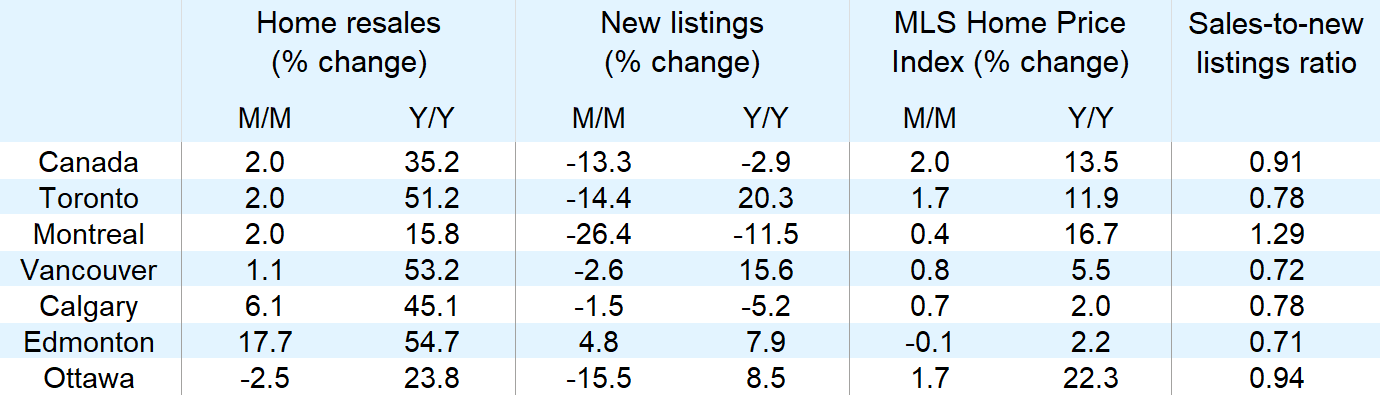

- Home resales set yet another record high: Sales rose 2.0% m/m to 736,400 units (seasonally adjusted and annualized) in Canada in January, an astonishing 35.2% above the (solid) year-ago level. Activity increased in a majority of local markets, led by Edmonton (up 17.7% m/m) and Calgary (6.1%). Greater Toronto (up 2.0% m/m), Montreal (2.0%) and Greater Vancouver (1.1%) posted modest increases from high levels in December.

- Potential sellers took a pass in January: The reinstatement of lockdown measures in many parts of the country made it an inopportune time to put a property on the market. New listings fell 13.3% m/m in Canada—the biggest drop since April last year. Saint John (down 46% m/m) recorded the largest decline, though new listings also plummeted in Halifax (down 35%), Hamilton (down 32%), Montreal (down 26%), Regina (down 20%) and Toronto (down 14%).

- Demand-supply conditions are the tightest they’ve ever been: At the current pace of sales, for-sale inventories in Canada would last just 1.9 months—the shortest period on record. The sales-to-new listings ratio surged further to 0.91—also a record. All but one major markets (Saskatoon) had a sales-to-new listings ratio well above 0.60 last month, indicating sellers had the upper hand in setting prices across virtually the entire country.

- Home prices keep accelerating: The rate of increase in Canada’s aggregate MLS Home Price Index was 13.5% y/y, having nearly doubled over the past six months. The strength remains concentrated in single-family homes where prices ran 17.4% above year-ago levels. Condo apartment prices were up a more modest 3.5%. Property values are appreciating most in Ontario and Quebec—especially in smaller markets and around Toronto and Montreal—as well as parts of Atlantic Canada.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More