Highlights:

- Home resales set a record high—again: They rose 6.2% from July to 672,000 units (annualized) nationwide. This came on the heels of very strong increases in the previous three months that more than made up for the sharp decline in March and April. Activity continued to pick up in the vast majority of local markets, including Vancouver, Edmonton, Winnipeg, Toronto and Ottawa.

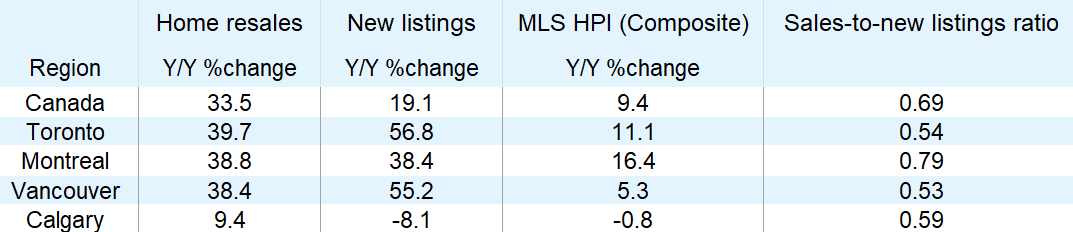

- Large influx of sellers helped ‘unlock’ pent-up demand: New listings jumped 10.6% m/m across Canada, led by surges in Vancouver (up 20%), Toronto (up 29%) and Ottawa (up 23%). Calgary and Regina were among the few markets where new listings fell—restraining the number of transactions that took place last month. Demand-supply conditions remained tight overall in Canada despite the rise in supply. The slight easing in the sales-to-new listings ratio (from 0.74 in July to 0.69 in August) did little to loosen sellers’ grip on prices. Markets in Ontario and Quebec continue to be among the shortest on supply in the country.

- Prices getting hotter fast: Persistent market tightness has intensified upward pressure on prices. Canada’s MLS Home Price Index (HPI) rose 9.4% year over year last month, marking a material acceleration from 8.0% in July and 5.7% just before the pandemic in February. Prices grew faster in most markets, led by Ottawa (up 19.9% y/y) and Montreal (up 16.4%), with Toronto (up 11.1%) and other southern Ontario markets now rising at double-digit rates. Calgary’s HPI (-0.8%) is still below its year-ago level though Edmonton (up 0.2%) is now positive for the first time in more than three years.

- Market rally to lose momentum this fall. The pandemic completely disrupted normal seasonal patterns by shifting activity from the spring to summer. With pent-up demand now largely exhausted, we see activity cooling later this fall. This should let some of the steam out of prices though not to the point of causing outright declines on a large scale.

Supercharged activity this summer reversed covid-induced plunge

Even the worst economic shock in generations couldn’t derail Canada’s housing market. The dramatic plunge in activity in March and April turned out to be just a temporary pause. Buyers and sellers came running back this summer, and quickly made up earlier declines. By August, the number of transactions to date in 2020 was back above year-ago levels (up 0.8% nationwide). The recovery has been uneven for sure, with some hard-hit markets (e.g. Calgary and Edmonton) still well behind. Yet this summer’s broad-based vigour has been undeniable. The pent-up demand created this spring proved a powerful driver of activity. Question is: how much longer can it be such a dominant factor? We think there’s probably little pent-up demand left to satisfy in most markets. Perhaps just enough to keep the heat on in September but not much beyond that.

Pandemic generates higher turnover

We expect things to generally cool down later this fall but stay well out of the deep-freeze zone—provided the public health situation continues to allow the market to operate openly. Rock-bottom interest rates will provide substantial support. And the pandemic itself will generate higher-than-usual turnover in the market by altering the housing needs of many current owners—who are opting to move, something they might not have considered just a few months ago. In recent months we’ve seen buyers expressing a stronger preference for single-detached homes and other types of low-rise dwellings. We expect this trend to persist. A higher turnover will stimulate both the supply and demand of housing.

All signs point to still-higher prices in the near-term

Tight demand-supply conditions in the majority of markets keep the balance tilted toward faster price increases (or slower price declines in Calgary’s case) in the coming months. The effect of any cooling in demand will be felt several months later. Prospects for further acceleration are concerning in Ottawa and Montreal, where the MLS HPIs soared at annual rates of 20% and 16%, respectively, in August. They risk undermining affordability in a material way in both markets. Similar concerns are brewing in much of southern Ontario—including the Greater Toronto Area—where prices are accelerating at double-digit rates.

What to watch: diverging price trends by categories

In the coming months, we’ll be closely watching pricing trends across housing categories. Much of the market strength this summer has been concentrated in the single-detached home segment. Existing condo supply has surged in Canada’s largest urban areas—in part reflecting concerns about living in smaller, more crowded spaces. The growing penchant for single-detached homes is supporting stronger price increases. We expect single-detached and condo valuations to continue to diverge in the period ahead, with lower immigration and increased condo supply in core urban areas weighing on the high-rise condo segment.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More