Monthly Housing Market Update

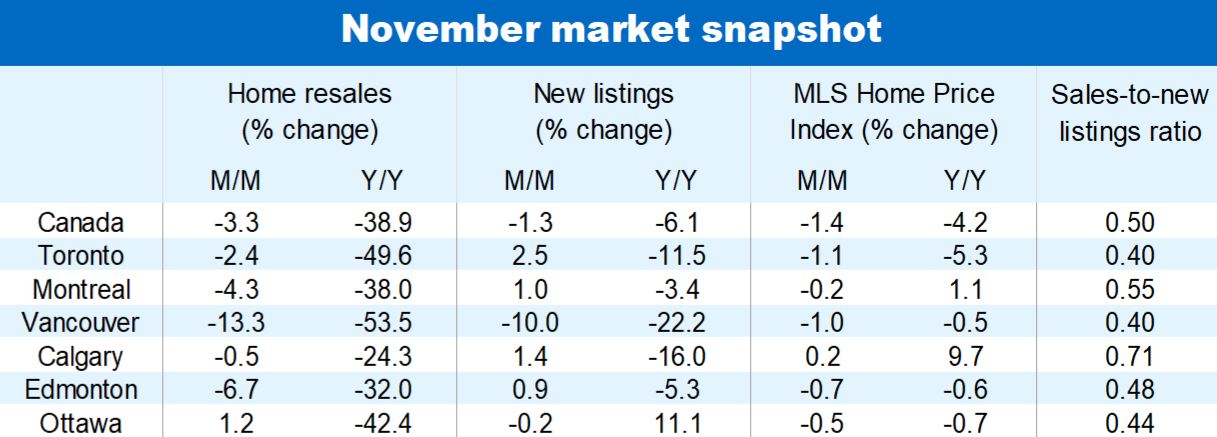

The pace of decline may have slowed in recent months but Canada’s housing market is still firmly in correction mode. Home resales fell another 3.3% m/m and prices a further 1.4% in November across Canada. We think the massive interest rate hikes and loss of affordability over the past year will hold back buyers into 2023, keeping prices on a downward trajectory in the near term.

Ontario, BC markets are especially soft

The market’s slide remains widespread. Very few markets bucked the weakening trend last month—Ottawa and Gatineau were among them activity-wise though just barely. The number of homes changing hands is running below pre-pandemic levels in most regions of the country. Activity is especially soft in Ontario and BC, where sales in many markets have slumped to their lowest levels in a decade or more (excluding the pandemic shutdown period). This group includes Victoria, Vancouver, the Fraser Valley, Guelph, Kitchener-Waterloo-Cambridge, London, Hamilton, Niagara, Toronto and Ottawa. The deep correction is largely payback for overshooting earlier in the pandemic. Other markets in Quebec (e.g. Montreal) and Atlantic Canada (e.g. Halifax) also currently operate at historically low levels.

Prairies down but far from out

Despite downshifting materially, activity in many Prairie markets is still quite robust. Resales remain well above pre-pandemic levels in Calgary, Edmonton, Saskatoon and Regina. Those markets likely benefit from stronger provincial economies and migration flows, after a long challenging period in the years preceding the pandemic.

Buyers hold a stronger hand in Ontario and BC…

While demand-supply conditions look reasonably balanced nationwide—the sales-to-new listings ratio, at 0.50, is right in the middle of ‘balanced territory’—this is not the case across many markets in Ontario and BC. Conditions are favourable to buyers or on the cusp of becoming so in Victoria, Vancouver, the Fraser Valley, Hamilton, London, Niagara, Toronto and Ottawa. The sales-to-listings ratio in each of these markets is close to 0.40 (the threshold below which buyers historically have had more sway on prices).

…and are wielding it to extract further price concessions

Its no surprise then to see some of the larger price declines taking place in these markets. Since the peak earlier this year, the MLS Home Price Index has plummeted in Cambridge (-21%), London (-19%), Kitchener-Waterloo (-19%), Brantford (-18%), Hamilton-Burlington (-18%), Kawartha Lakes (-17%), Barrie (-17%), Chilliwack (-16%) and the Fraser Valley (-13%). Property values also fell markedly in the Greater Toronto Area (-12%) and to a lesser extent in the Greater Vancouver Area (-6%). We expect buyers will succeed in further reversing some of the earlier outsized price gains in Ontario and BC in the near term.

Steady but moderate price erosion elsewhere

Relatively tighter demand-supply conditions temper the pace of depreciation in the rest of Canada. The MLS HPI is down by single digits in the majority of markets in the Prairies, Quebec and Atlantic Canada since the cyclical peak. Calgary and St. John’s are two exceptions where the index has only plateaued so far. Halifax, on the other hand, has recorded a double-digit drop (-10%) as local buyers deal with a sharp deterioration in affordability during the pandemic. Montreal’s price correction to date has been moderate (-5.5%).

Cool conditions likely to persist for some time

While we interpret the slowing of the pace of decline as a sign the market downturn has run most of its course, we don’t expect things to heat up again in short order. Higher interest rates and stretched affordability will continue to challenge buyers for some time. This will keep activity quiet for a while longer even if it stabilizes near current levels. We think benchmark prices will keep trending lower until spring.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More