Highlights:

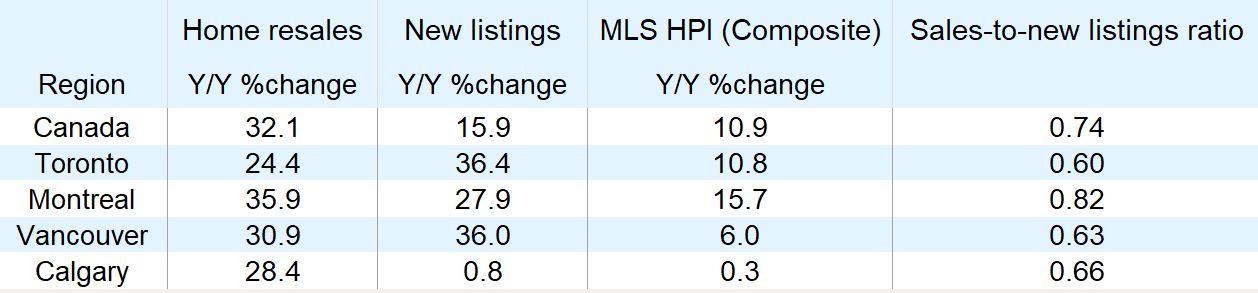

- Home resales recorded a monthly high for October: Sales were up 32.1% from a year ago. On a seasonally-adjusted basis, the number of transactions slipped just 0.7% from September—an all-time high for any month—to 674,000 units (annualized). All major markets posted very strong increases (ranging from 24% to 59%) relative to October 2019, while half of them exceeded their (seasonally-adjusted) September sales count, including Calgary (up 3.7%), Edmonton (3.4%), Winnipeg (1.2%), Montreal (4.3%) and Halifax (2.6%). Vancouver (-4.1%), Regina (-1.9%), Hamilton (-9.8%), Toronto (-4.0%) and Ottawa (-3.6%) were among those recording month-to-month declines in October though the level of activity remained exceptionally high in most cases.

- More properties listed for sale during the month: New listings increased 2.9% in Canada from September and were up nearly 16% from October 2019. These numbers mask diverging trends between housing categories though. Local real estate boards earlier reported the rise primarily reflected surges in downtown condos for sale. Supply of detached homes and other low-rise categories remained limited in most markets.

- Tight demand-supply conditions persist across the board: Developments in October eased market tensions only marginally with the sales-to-new listings ratio inching 0.03 points lower nationwide. At 0.74, the ratio still pointed to intense upward price pressure. Sellers were in the driver’s seat in virtually all major markets, holding commanding sway over prices in Central Canada and most of the Atlantic region. The main exceptions were in downtown condo segments of some of Canada’s largest cities where supply has soared.

- Prices accelerated further overall but not for condos: Canada’s composite MLS Home Price Index (HPI) rose at its fastest rate (+10.9%) in more than three years in October. Ottawa (up 22.4%), Hamilton (16.6%) and Montreal (15.7%) led the way among the larger cities, though most markets east of Manitoba posted double-digit increases. The strength was generally concentrated in single-detached homes, with this category’s HPI rising 12.9% y/y nationwide. This was more than double the 5.7% rate for condo apartments. Condo prices have flattened in Vancouver, Toronto and Hamilton relative to pre-pandemic levels.

- How long can the market defy cooling expectations? Aside from some bumps in downtown condo markets, this summer’s broad market rally remained largely intact so far this fall. Still, with earlier pent-up demand now entirely exhausted and tight supply poised to become more of a constraint on activity, we expect things to slow down in the coming months.

October a carbon copy of September

Anyone looking for a turning point in Canada’s housing market will need to keep watching. October brought more of the same: strong all-round demand, generally tight supply, prices climbing at faster rates, single-detached homes attracting stronger interest, especially in the suburbs and smaller markets, and more downtown condo owners selling their units. Call it a carbon copy of September. There were no signs the exhaustion of pent-up demand has cooled activity down—the 0.7% m/m decline in home resales barely registers against the historic 232% rally over the previous five months.

Work from home drawing more buyers to the suburbs and smaller markets

Clearly exceptionally low interest rates are keeping the market’s wheels well greased at this stage. They make it easier for many first-time homebuyers and move-up buyers to jump into the market. Yet work-from-home is possibly an even more powerful driver of activity. The pandemic altered work arrangements for millions of Canadians—potentially permanently for many of them—prompting a large-scale re-evaluation of housing needs. A number of current owners are opting to move, something they wouldn’t have contemplated had it not been for COVID-19. With commuting to work less of a factor, many Canadians are drawn to more affordable suburbs and smaller markets away from core urban centres—driving up home resale activity significantly in these more distant areas. And with travel abroad likely restricted for some time to come, other Canadians are looking to buy vacation properties to get away from it all. Cottage country and other smaller markets have recorded some of the stronger resales gains so far this year. These areas are also seeing some of the steeper property values appreciation.

Tight supply to restrain activity but keep the heat on prices

We expect the covid-induced market churn to fade over the coming year. As it does, supply will become even more of a constraint on overall activity. The persistence of tight overall demand-supply conditions will maintain strong upward pressure on prices—bringing affordability issues back into the fore. These factors, in our view, will slow down the pace of home resales across Canada.

Outlook for downtown condos more challenging

The downtown condo market is currently the weak spot in Canada’s housing picture. Many condo investors have been hit hard by the downturn in the rental market (both long-term and short-term) in Canada’s largest markets and are offloading their units. Soaring supply is tipping the scale in favour of buyers. Condo prices have plateaued since spring in the Greater Toronto and Vancouver with signs of decline now emerging in downtown locations. We expect prices to decline further in the near term. With immigration largely stalled and unemployment remaining high among lower-income Canadians, we see little that will boost rental demand in short order.

There are upside and downside risks

Much of about Canada’s housing market remains unprecedented—who would have thought the worst economic recession in generations would set the stage for record-high activity and accelerating prices? More surprises could be in store in the coming months. We see both upside and downside risks depending on how work-from-home trends, interest rates, immigration, mortgage payment deferrals and COVID-19’s second wave pan out.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More