Monthly Housing Market Update

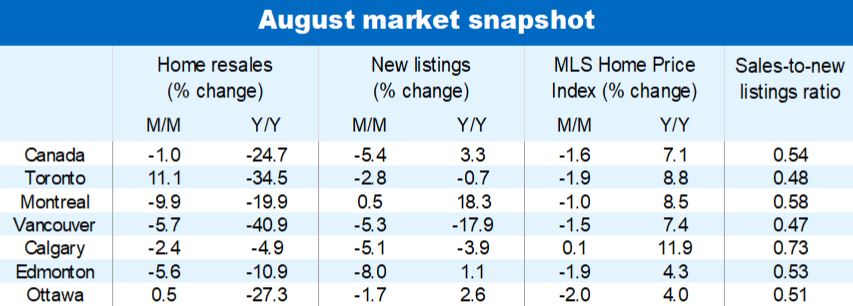

The Bank of Canada’s rate hiking campaign keeps home buyers on the defensive. Resale activity in August was the quietest in three and a half years, falling for a six-straight month to 443,000 units (seasonally adjusted and annualized). Fewer—and more budget-constrained—active buyers in the market are taking steam out of prices. The national composite MLS Home Price Index fell a further 1.6% m/m in August. It’s now down 7.4% since February’s peak, within striking distance of the 8% peak-to-trough decline recorded during 2017-19 downturn. We see that trend continuing in the near term with the Bank of Canada poised to stay in tightening mode until the end of this year. We have updated our policy rate call to 4% by December, up from the 3.5% we previously expected.

Weakness spreading outside Ontario and BC

The current softness is concentrated in Ontario and British Columbia, though it’s increasingly spreading to Quebec and parts of Atlantic Canada. Activity levels in these markets were below (in some cases, well below) pre-pandemic levels last month. Price corrections in formerly overheated markets in Ontario and the BC Lower Mainland have been especially significant. Over the past six months, the composite MLS HPI plummeted 19% in Cambridge, 16% in Kitchener-Waterloo and London, 15% in Brantford and 13% in Guelph. Chilliwack (-14%) and the Fraser Valley (-9%) also recorded outsized price declines over that period.

Prices coming down in Atlantic Canada

The weakening in property values is a more recent phenomenon in Quebec and Atlantic Canada (and some parts of the Prairies) and the pace of decline is generally more subdued. This is largely thanks to demand-supply conditions having stayed tighter for longer compared to Ontario and BC. Montreal’s composite MLS HPI is down 3.3% in the past three months or a little more than half the 5.8% drop recorded in the Greater Toronto Area. Still, downward pressure is intensifying in Eastern Canada. This is particularly the case in Halifax where the index is off 6.3% in the last three months, including a 3.9% drop in August alone. Saint John recorded an even larger 4.2% fall last month. Prices in some Atlantic markets such as Prince Edward Island and St. John’s, however, are holding up so far.

Prices still above year-ago levels

Despite the widespread depreciation since spring, property values (as measured by the MLS HPI) are still above year-ago levels virtually everywhere in the country. Only Kitchener-Waterloo is showing a decline (-1.7%) at this stage. In many cases—especially in Atlantic Canada—prices remain significantly richer. For many potential buyers, home purchasing prospects remain grim. The partial reversal of earlier massive price increases is small comfort at a time when sharply higher interest rates cut deeply into affordability.

Correction isn’t over yet

The likelihood the Bank of Canada will take its policy rate deeper into restrictive territory by year-end is poised to keep buyers on the defensive in the coming months. Higher interest rates will disqualify more buyers from obtaining a mortgage and shrink the size of a mortgage others can qualify for. We project home resales to fall 23% in Canada this year and a further 15% next year.

Expecting the bottom next spring

We think the market will adjust to higher interest rates by early 2023. Any recovery will likely take a few months to tighten demand-supply conditions, placing the bottom for prices around spring time (overall for Canada). We expect benchmark prices will be down approximately 14% from the recent peak nationwide. On a provincial basis, we project Ontario and British Columbia to record the largest peak-to-trough declines at -16%, and place Alberta and Saskatchewan at the other end of the scale at -4%.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More