Issue #11

➔ Energy transition clashes with tariffs

➔ IRA: Scrap, slice, or save?

➔ Let’’s talk climate realism

Hot takes

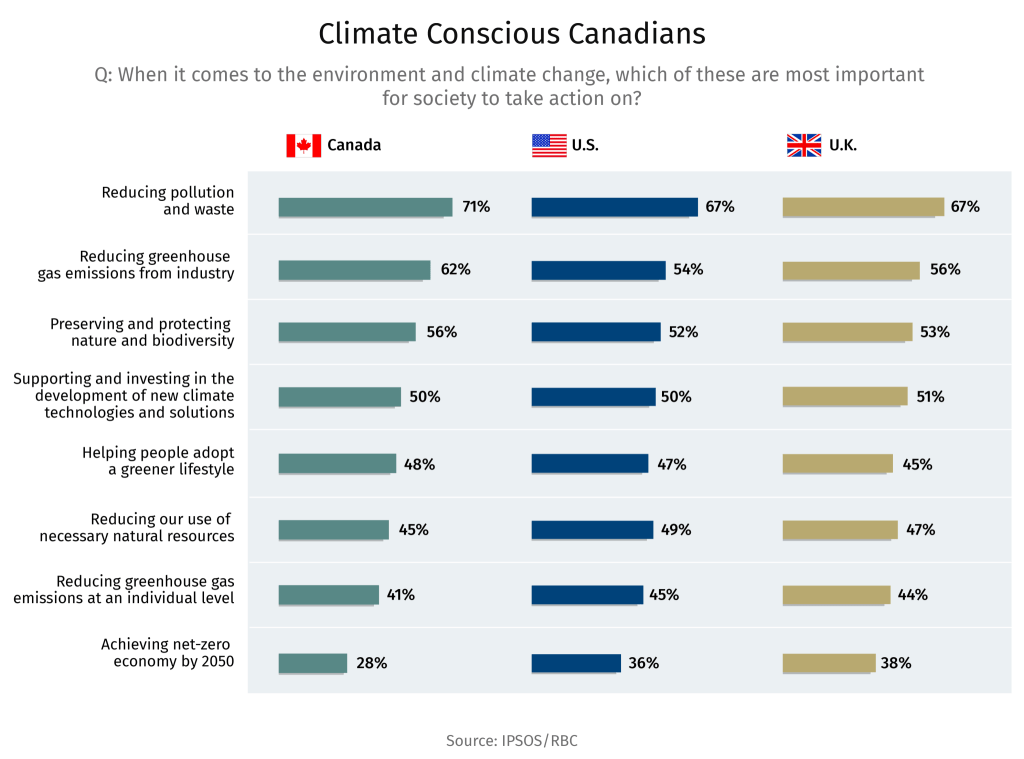

➔ Canadians remain keen on climate. Compared to their American and British counterparts, more Canadians believe reducing industry emissions is an important climate goal, according to an Ipsos survey for RBC (see chart below). However, Canadians are less likely to think that reducing the use of natural resources should be a societal goal.

➔ Let’s talk climate realism. The Council on Foreign Relations launched the Climate Realism Initiative this week, aimed at developing a new U.S. climate strategy. Myha Truong-Regan , Head of Climate Research, says five ideas from the launch event caught her attention: (1) economic and national security priorities will drive countries’ climate agenda; (2) climate can be a source of competitiveness in global trade; (3) global and national climate goals should be easy to understand, to garner widespread public support; (4) the world will need to pursue both fossil fuels and renewable energy as energy demand rises exponentially; (5) framing climate action as personal sacrificial acts rather than smart spending decisions will not resonate with the public.

➔ Major investors are hoovering up renewable assets. Companies are circling over renewable assets that have seen their valuations shrink over the past five years. Brookfield Asset Management recently bought U.K.-based National Grid’s onshore U.S. renewables business for US$1.7 billion, and its units swooped in to buy French developer Neoen SA for US$6.6 billion, and UK offshore wind farms for $2.3 billion. KKR & Co. is looking to raise US$7 billion for its first Global Climate Fund, while Copenhagen Infrastructure Partners , closed its largest-ever renewables fund, at €12 billion, in March. Deep-pocketed investors are on the prowl.

➔ A new U.S. biofuel policy may limit Canada’s market opportunities. Many Canadian farmers and biofuel producers worry they’ll be excluded from the proposed U.S. Clean Fuel Production Credit (Z45). This new credit replaces existing incentives that Canadian producers once benefited from and introduces a farmer tax credit with carbon-intensity and country-of-origin restrictions, says Lisa Ashton, Agriculture Policy Lead. U.S. farmers could be at a significant advantage if majority of Canadian farmers are ineligible for Z45 tax credits.

The climate trade wars are here

Add the humble terbium to the list of commodities caught up in the tariff turmoil. The silvery, rare-earth mineral, used in wind turbines, was one of seven minerals on Beijing’s export controls as part of retaliatory measure to the U.S.’s reciprocal tariffs this month. China, which controls 95% of the global terbium’s supply, also restricted exports of substitutes gadolinium and scandium that could impact big American tech firms.

While autos and steel are grabbing the headlines, companies involved in sectors leading the energy transition are also hit by tariffs, and scrambling for materials that make the parts, cogs and pistons that drive clean technologies.

It’s early days, but here’s what we are watching as tariffs—especially if they remain in place beyond a few months—disrupt the energy transition:

-

EV batteries will be hit hard. U.S. baseline tariffs and higher levies on China and the EU will likely roil global supply chains. BloombergNEF expects batteries and solar prices to be hit hardest.

-

Certain metals and minerals were exempted—but China had other plans. The U.S.’s exemption list includes copper and zinc, rare earths, germanium, nuclear fuel, lithium and cobalt, etc. But China is weaponizing its metal dominance to hit back. Chinese control of several key minerals would hurt Western nations at least in the short to medium term. Canada, with its abundant resources, can help allies.

-

Uranium is about to get expensive. The U.S.’s dependence on mined uranium, especially from Canada, and foreign enrichment services, such as from Russia, make the price trajectory of nuclear fuel uncertain, notes Vivan Sorab, Senior Manager, Clean Tech. Tariffs on Canadian uranium were initially set at 25%, before falling to 10%. Rather than signing new purchase contracts in early 2025, U.S. reactor operators are staying on the sidelines on tariff uncertainty, according to Mining.com . With the U.S. reliant on foreign manufacturers for certain reactor components (e.g., reactor pressure vessels), tariffs could further hike costs.

-

Renewables are no strangers to tariffs. Tariffs on renewable energy systems and components averaged twice those applied to fossil fuels, the International Energy Agency said last year—long before the U.S.’s trade war started.

-

Cleantech was getting really cheap. Many technologies had seen costs drop over the past decade. However, a 100% tariff on solar PV modules today would cancel out the decline in technology costs seen over the past five years, according to the IEA.

“A range of Chinese clean energy imports already faced high duties; these will become steeper yet,” BloombergNEF noted. -

Climate remains an emergency, btw. While equity indices vacillate day to day, the global carbon emissions index is only headed one way: higher. CO2 levels are at the highest level in 800,000 years, the UN estimates. Every roadblock, material shortage and trade barrier is delaying efforts to rein in emissions.

IRA: Scrap, slice or save?

The Inflation Reduction Act is among the legislations in the U.S. currently under scrutiny, as Washington eyes spending cuts.

The U.S. Congress has to decide how to pay for the extension of the Tax Cuts and Jobs Act, which could impact IRA tax credits. Here’s how RBC Capital Markets is thinking about IRA’s prospects:

➔ With a potential price tag of US$4.5 trillion to extended tax breaks over 10 years, Republican lawmakers have indicated that every piece of the tax code is on the table, including energy-related IRA tax credits.

➔ In a signal of some support, 21 Republican House members wrote a letter recently, arguing that developing clean energy was critical for the U.S. to meet President Donald Trump’s goal of becoming “energy dominant.”

➔ Additionally, 83% of the US$126 billion in private sector manufacturing investments made since IRA’s passage was in Republican congressional districts.

➔ While RBC Capital Markets does not foresee a full repeal of the IRA as a likely outcome, “we caution against broadly optimistic views that Republican lawmakers will hold the line to save green tax credits in the face of pressure from Republican leadership and ultimately, Trump himself.”

Trump Tracker

A veritable selection of orders and actions from Washington that are impacting climate and energy transition:

➔ Reciprocal tariffs: The big one on April 2. It sent markets plunging, nerves fraying and brows knitting tighter. Originally, baseline tariffs started at 10% but many countries faced higher tariffs. Close trading partners Canada and Mexico were spared—for now. As markets plunged, Trump retained the universal 10% on most countries, except China which now faces 125% tariffs.

➔ Upshot: “Major blow to the world economy,” is how European Commission President Ursula von der Leyen described it. China has retaliated with 84% tariffs now in total.

➔ Tariffs on imported vehicles: The blanket 25% tariffs on all foreign-made vehicles. Parts that are compliant with the U.S.-Mexico-Canada Agreement would remain tariff-free—for now.

➔ Upshot: Canada responded with matching tariffs on U.S. vehicles that are not compliant with the North American free trade deal. Stellantis shut down its Windsor assembly plant for two weeks.

➔ Boosting American critical mineral production: The order aims to streamline ways to increase production of uranium, copper and potash. Also on the list: gold and coal that are often not viewed as critical.

➔ Upshot: The U.S. is not abundant in several critical minerals vital for key technologies such as semiconductors. However, loans, and investment support for new projects through the International Development Finance Corporation (DFC), could “make it a clever candidate” to boost mining in the U.S., according to the Atlantic Council. A potential U.S. minerals deal with Congo highlights the administration’s wide push to source minerals.

Curated by Yadullah Hussain, Managing Editor, RBC Climate Action Institute.

Climate Crunch would not be possible without John Stackhouse, Myha Truong-Regan, Sarah Pendrith, Farhad Panahov, Lisa Ashton, Shaz Merwat, Vivan Sorab, Caprice Biasoni and Frances Dawson.

Have a comment, commendation, or umm, criticism? Write to me here (yadullahhussain@rbc.com)

Climate Crunch Newsletter

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.