Services-sector to lead decline

We expect all provincial economies to contract substantially this year. None will be immune to the COVID-19 shock. The shock will hit every province no matter how many infection cases each has. Draconian containment measures such as social distancing orders are being applied from coast to coast and will have a sizable impact across the country. We expect the services sector—usually among the more resilient parts of the economy during a recession—to lead the fall and subtract between 1½ and 2ppts from each province’s growth rate in 2020. This will be a huge swing from traditionally contributing ½ to 2 ppts.

Double whammy for oil producers

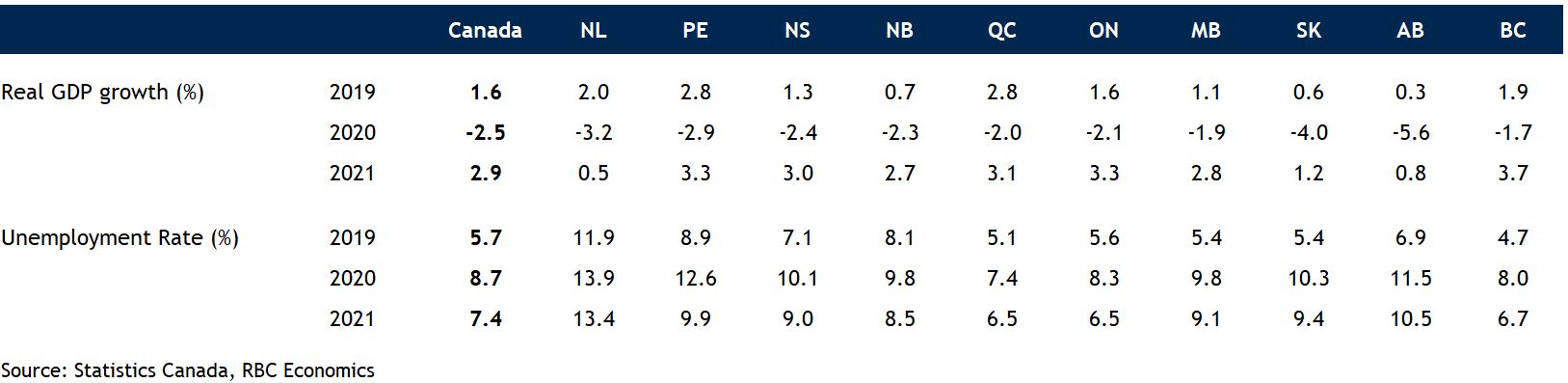

The collapse in oil prices will be another massive blow to oil-producing regions of the country—most of which had not fully recovered from the previous collapse in 2014-2016. It will drastically reduce cash flows in the energy sector and slice government royalty revenues. Oil producers are responding by slashing their capital spending plans for the year (by more than 50% in some cases) and trimming their production levels. The slump will spill over to other sectors of the economy, further weakening consumer spending and business investment. We now project Alberta’s economic contraction—at -5.6%—to be the most severe the province has ever experienced in a single year and the largest in Canada. Saskatchewan and Newfoundland and Labrador won’t fare much better with contractions of -4.0% and -3.2%, respectively.

Lower gasoline prices and the decline in the Canadian dollar’s value in part resulting from the oil price plunge will bring some partial relief to oil-consuming, export-dependent provinces like Ontario and Quebec. We see this being more of a factor during the recovery.

Revised provincial forecast

The upcoming summer tourism season will be awful. We expect Prince Edward Island’s economy to suffer most from it given its strong dependence on the sector. This is a main reason why we project the contraction being larger than most other provinces.

Support measures, fiscal stimulus and low interest rates won’t shield any province from the initial shock though they will contribute to the recovery.

Historic job losses across all provinces

Job losses will be massive. The labour market hit from the spread of COVID-19 will be deeper and faster than any of the provinces have seen before. Peak-to-trough, job losses are expected to be almost 3 times as large as they were during The Great Recession on average. In Alberta and Saskatchewan, even the oil-price crash in 2014-16 will prove milder in terms of its effect on the labour market – we are expecting employment losses 2-4 times larger. The combined losses in these two provinces are likely to be in the order of 200,000 – 20% of the overall hit to employment in the country. The bigger hit to employment this time is due to the fact that social distancing orders affects the services side of the economy (which employs almost 80% of working-age population) most directly. Industries like hospitality, tourism and airlines are seeing massive layoffs. Some provinces (including Ontario and Quebec) have decreed “non-essential” businesses to shut down. Others will likely follow. Oil-producing provinces will see additional job losses in the energy sector on the back of weak oil prices. We expect the hit to employment to be worst in Alberta and Saskatchewan..

Fiscal support aimed at helping provinces manage through crisis

Provincial government finances will take a drubbing. In times of crisis such as these, governments must focus on the health issue first and foremost. They must also ensure the stability of our economy, and provide financial support to Canadian households and businesses in need. Balancing the books is a consideration for another day when calm has returned. Expect every province to run a budget deficit this year as coronavirus-related spending and revenue hits escalate. Several provinces—including BC ($5 billion), Quebec ($2.5 billion), and Saskatchewan ($10 million)—have already announced measures to support individuals and businesses weather the crisis. Alberta is reportedly considering a $3 billion package. Ontario is poised to offer additional financial support in its March 25 fiscal update. These actions are unlikely to be the end.

Read report PDF

This report was authored by Senior Economist, Robert Hogue, and Economist, Ramya Muthukumaran.

RBC Economics provides RBC and its clients with timely economic forecasts and analysis.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More