The economic landscape is rapidly becoming less hospitable for Canada’s housing market. With inflation touching four-decade highs—and threatening to climb even further in the near term—the Bank of Canada is now embarked on a more aggressive course that we believe will take its policy interest rate to restrictive levels by the fall. This will send more buyers to the sidelines, especially in British Columbia and Ontario where affordability is extremely stretched.

The first signs of a market correction emerged soon after the Bank initiated its rate liftoff in March. We expect the downturn will deepen in the coming months with both resale activity and home prices reaching lower levels than we previously anticipated. We project home resales to fall nearly 23% this year and 15% next year in Canada, and the national benchmark price to drop more than 12% from peak to trough by the second quarter of 2023. We expect local outcomes to vary widely with the priciest, more interest-sensitive areas facing larger declines, and relatively affordable markets showing greater resilience.

Bank of Canada ‘frontloads’ its rate hiking campaign

The outsized 100 basis-point rate increase our central bank delivered on July 13 will no doubt speed up the market’s cooling phase in the near term. While the move won’t necessarily result in a higher terminal point—we still expect the overnight rate will reach 3.25% by October—it’s a big bite for borrowers to swallow that will spoil or delay homeownership plans for many buyers. The hike took variable mortgage rates roughly up to par with fixed rates, effectively shutting the last window of super cheap borrowing costs available to buyers.

Affordability getting crushed

Rising rates are squeezing housing affordability hard. By the time the Bank of Canada is done, RBC’s aggregate affordability measure could easily be at it worst-ever level nation-wide, with Vancouver, Toronto, Victoria and other expensive markets leading the way. We see demand coming under increasing downward pressure in Ontario and parts of British Columbia as a result. Things will get more challenging in other parts of Canada too, albeit to a lesser degree thanks to relatively favourable affordability starting points and weaker interest rate sensitivities. Higher mortgage stress test’s qualifying rates will hamper stretched-out buyers in every region of the country. And higher client rates will reduce the size of a mortgage—and maximum purchase price—qualifying borrowers can get from coast to coast.

Historic correction underway

We expect home resales will fall another 17% in Canada by early next year after dropping 19% in the second quarter and 13% between the first quarter of 2021 and first quarter of 2022. Cumulatively, this 42% plummet (from record-high levels) since early 2021 would exceed the peak-to-trough declines of all four previous national downturns (-33% in 1981-1982, -33% in 1989-1990, -38% in 2008-2009 and -20% in 2016-2018).

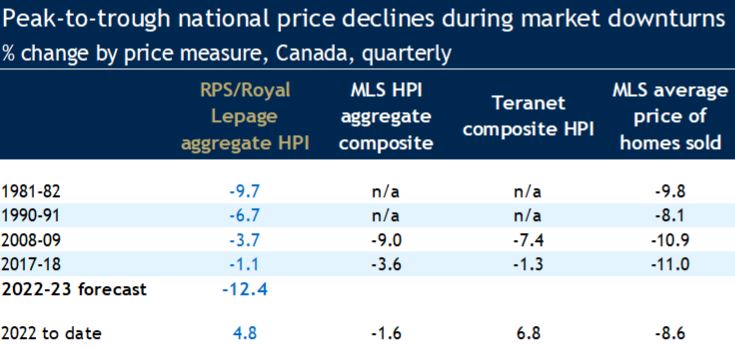

With demand weakening significantly and affordability exceptionally stressed in parts of the country, we believe prices will have to give. We project RPS’ national aggregate home price index will slump more than 12% by early 2023. This would also rank as the steepest correction of the past five national downturns.

The size of the correction is likely to be larger for other price measures. The average price of homes sold in Canada, for example, could tumble by 17% or more (on a quarterly basis) in part due to a shift in the composition of sales toward lower-priced markets and housing categories—as buyers seek more affordable options. The average price is already down 8.6% between the first and second quarters of this year, with notable declines in Ontario (-7.6%) and British Columbia (-4.9%).

BC, Ontario will be the epicentre

Buyers in high-priced markets are especially sensitive to interest rates and we believe will struggle the most in the period ahead. Our forecast has home resales in British Columbia and Ontario cumulatively sagging 45% and 38%, respectively, in 2022 and 2023, setting the stage for a home price index drop exceeding 14% from quarterly peak to trough in both provinces. The magnitude of the downturn would rival that of the early-1990s in Ontario (when resales fell 41% and prices 15%) though come well short of the early 1980s’ episode in British Columbia (when resales slumped 62% and prices 27%).

While we project resale activity to cumulatively decline more than 20% in every other province (from all-round record levels) this year and next, we think prices will be more resilient in the more affordable regions of the country. We project prices to slip less than 3% in Alberta and Saskatchewan, and between 5% and 8% in the majority of other provinces by the first half of 2023.

A correction, not a collapse

The Bank of Canada’s more aggressive course has clearly dimmed the outlook for Canada’s housing market. We think both activity and prices are set for a material correction. Still, we’d argue the unfolding downturn should be seen as a welcome cooldown following a two year-long frenzy that put a huge financial burden on many new homeowners and made ownership dreams harder to achieve. While a more severe or prolonged slump cannot be ruled out, we expect the correction to be over sometime in the first half of 2023—lasting approximately a year—with some markets likely stabilizing faster than others. Solid demographic fundamentals (including soaring immigration) and a low likelihood of overbuilding should keep the market from entering a death spiral.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More