Issue #11

➔ Earth Day edition focuses on Canada and B.C.’s power struggles

➔ Green steel is coming

➔ EVs: Open road or roadblocks?

Hot takes

➔ Our power, our planet. That’s the theme of this year’s Earth Day, celebrated today, just as the world feels a little less empowered to take care of the planet. But this edition is striving to celebrate small victories in a (very) long journey to heal the planet. Despite policymakers axing or toning down several ambitious global climate policies, there are rays of sunshine: led by solar and wind, renewable energy capacity additions hit a new record globally in 2024, while renewables accounted for more than 92% of total power expansion last year. Still, IRENA forecasts, the world’s falling short of the collective goal set in 2023 to triple installed renewable energy capacity by 2030.

➔ Sault Ste. Marie, Ont., is the setting for a Canadian green power revolution. The northern Ontario-based Algoma Steel is gearing up to launch its electric arc furnace (EAF) this month—it would cut back on coke, or coal power, and slash the company’s annual emissions by 70%. That’s a feat for any sector, but a monumental one for an industry considered among the hardest to abate.

➔ Canada’s first SMR got the green light this month. The small modular reactor (SMR) at the Darlington Nuclear Generating Station in Ontario—the first in a G7 nation— has the all-clear from the Canadian National Safety Commission. Ontario Power Generation, the developer, is now awaiting the provincial okay. There is a trade twist, though: the BWRX-300 reactor was built by North Carolina-based GE-Hitachi Nuclear Energy—making Canada dependent on the American supply chain at a time when ties between the two countries are strained.

➔ Climate drops off the radar as an election issue. About 24% of Canadians believed climate was an important issue in the 2021 federal election cycle. Just under 4% feel the same way as they start voting in the run-up to election day on April 28. Predictably, U.S.-Canada ties topped the list in the non-partisan Vote Compass’s poll of 161,000 Canadians, followed by economy, affordability, social justice and healthcare. The environment did not crack the top 5. Climate change also barely got a mention in the leaders’ TV debates (read John Stackhouse’s LinkedIn post here).

Earth Day: A Clean Super-Power

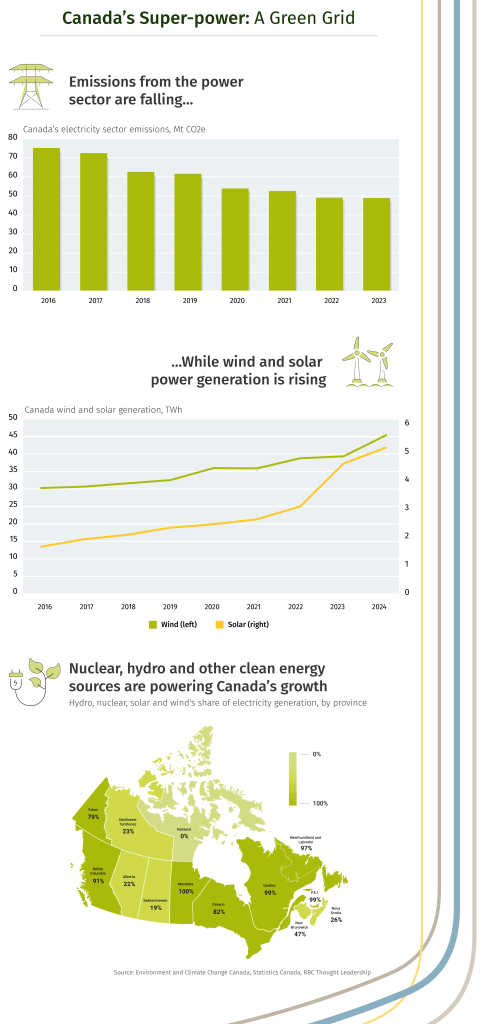

With this year’s Earth Day theme focused on tripling renewable energy by 2030, Canada can point to some victories in the electricity sector, the big one being that it’s Paris Agreement-compliant already. Alberta is coal-free, six years ahead of schedule, while Canada’s absolute electricity emissions declined by about 10% in 2024 compared to 2023.

Three charts that illustrate why electricity is Canada’s climate poster child:

There is no room for complacency, though. Here are 3 critical challenges Canadian policymakers—and a new federal government—will need to address soon.

➔ Balancing affordability with clean energy goals. New hydro dams and nuclear buildouts will be expensive, straining the ability of utilities to keep electricity bills affordable.

➔ Expanding grids cleanly. Canada needs to more than double electricity capacity by 2050—and keep it clean—, if it wants to compete for investment dollars for data centres, automotive supply chains and other heavy manufacturing.

➔ Ensuring Indigenous rights. Power and energy projects—gaining renewed urgency—require a buy-in, consent and financial involvement from First Nations. Canada has had a spotty track-record on that file, which needs to change to fast-track projects.

Ready or not

Sticking to the power theme, B.C. LNG projects now only need to be net-zero ready. That’s the distinction the B.C. government made in a new letter to the environmental regulator, widely considered a weaking of the province’s environmental rules. Or is that climate realism ? Jurisdictions are walking a fine line as they fast-tack new projects in a tariff-stricken world without abandoning their environmental commitments.

The provincial utility BC Hydro has been bulking up, but not as fast as the surge in demand, which it estimates will rise 15% by 2030. Just over 90% of B.C. grid is no-emitting, but that could drop if natural gas power.

Here’s how the province is racing to meet its economic and climate goals:

➔ BC Hydro’s updated 10-Year Capital Plan (2024/25 to 2033/34) includes almost $36 billion in community and regional infrastructure investments—a 50% increase over its previous capital plan.

➔ The Site C hydro project’s fourth unit began this month, with two more set to be switched on by the fall. Once fully operational, the project in the province’s northeast can power nearly 500,000 homes, increasing BC Hydro’s electricity supply by 8%. Given expectations for Canada’s supply needing to 2x or 3x by 2050, we need similar additions every two to three years, Energy policy lead Shaz Merwat estimates. “Policy of needing to be ‘ready’ probably adds a level of ambiguity but good to see perspectives are changing about the need to build.”

➔ In February, B.C. signed deals for 9 wind and 1 solar energy projects with a combined 4,830 gigawatt hours (GWh) projects. All projects are majority-owned by First Nations.

➔ B.C. is working to electrify Northern B.C., vital for several big-ticket energy projects including the Ksi Lsims LNG project that’s currently under regulatory review. The Indigenous-backed gas export project now faces competition for Asian markets from an Alaskan LNG development that’s gaining traction. Canada needs to move fast.

➔ The North Coast Transmission Line is a critical piece of the northern B.C. clean grid. The government is fast-tracking permits to speed up construction of the NTCL and other major high-voltage transmission lines.

➔ The B.C. government is not ruling out more hydro dams in the province.

➔ Finally, we are watching how a greenhouse gas emissions cap for natural gas utilities, as envisioned in the CleanBC Roadmap to 2030, will play out.

Four roadblocks ahead for EVs

By John Stackhouse

EVs may be one of the causalities in the trade war — or one of the winners. It’s too early to tell.

The latest quarterly assessment from BloombergNEF shows a U-turn forming in some markets, and acceleration in others, notably China. Canada is one of the markets at a turning point.

EVs, including plug-in hybrids, accounted for one in five vehicle sales last year, reaching 17.2 million new vehicles on the road, up 24% in one year. Most of that growth was in China, where close to half of new vehicle sales are EVs—a number expected to increase this year thanks to a scrappage scheme for car-owners.

Elsewhere, EVs are facing new challenges, and not just the brand war that Tesla finds itself in. European sales started to flatline in 2024, while sales growth in the U.S. tempered. And that was before Liberation Day (April 2) and Donald Trump’s decision to slap 25% tariffs on imported vehicles and parts. Higher costs are the last thing EV producers need. Other policy changes—looser fuel standards in Europe and an end to the consumer carbon tax in Canada—may further impede EV sales, as the economics of traditional car engines gain ground again on batteries.

Canadian EV sales in the past year accounted for around 15% of passenger vehicle sales. BNEF expects Canadian EV sales to rise 20% this year, amid a decline in policy supports.

If EV sales stall, it will be due to four roadblocks in the months ahead:

➔ 1. Subsidies. Fiscally challenged governments will be looking to cut spending in some areas to pay for economic supports for businesses and workers hit by the trade war. The Trump administration has its eye on generous supports introduced in the Biden years. And many governments are pulling back EV mandates for their own fleets.

➔ 2. Tariffs. The U.S. is advancing a range of tariffs and trade restrictions on batteries and battery components, while China is also restricting exports of critical minerals. Battery-specific tariff rates are projected to hit 115% this year, and 132% next year. The Trump administration is also expected to continue to explore anti-dumping measures against Chinese battery components producers, even though a number of U.S. manufacturers, including Tesla, rely on them.

➔ 3. Economic growth. If the trade war continues to be a drag on economic growth, consumers will hold back on vehicle purchases of all kinds — and the more expensive range of EVs will be especially challenged.

➔ 4. Interest rates. If tariffs stoke inflation, and keep interest rates higher, car sales will be the first consumer item to take a dent, or worse. EVs may be at the front of that line, as car-owners hold on to their old vehicles for a year or two longer.

Climate Crunch would not be possible without John Stackhouse, Myha Truong-Regan, Sarah Pendrith, Farhad Panahov, Lisa Ashton, Shaz Merwat, Vivan Sorab, Caprice Biasoni and Frances Dawson.

Curated by Yadullah Hussain, Managing Editor, RBC Climate Action Institute.

Have a comment, commendation, or umm, criticism? Write to me here (yadullahhussain@rbc.com)

Climate Crunch Newsletter

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.