RBC Economics has followed the small business sector closely since the publication of our June report.

Government programs helped many small business owners keep their lights on—even as their doors closed—during the first lockdown. But ongoing support will be vital as local economies across Canada have shut down for a second time.

Below, is a set of updated data that help paint a picture of this vital sector, and the opportunities and challenges they face heading into a new year and very different world.

Small businesses were hit hard in the early stages of the pandemic

- Small business employment fell 30% year-over-year in April, while overall private sector employment was down 22%

- Statistics Canada analysis shows hours worked at small firms fell by 9.4% in Q1/20, significantly more than the 5.6% decline for the business sector as a whole

- Real output of the small business sector fell by 2.1% in Q1/20, compared with a 1.7% decline across all firm sizes

- Nearly 1/3 of CFIB survey respondents were fully closed in early-April, and only 20% were fully open

- According to a Statistics Canada survey, 61% of large businesses remained fully operational throughout the pandemic, compared with just 40% of smaller firms

Easing restrictions allowed for a partial recovery over the summer

- Small business employment rebounded to 4% below year-ago levels by November—roughly in line with the shortfall in overall private sector employment

- According to a CFIB survey, 2/3 of small businesses were fully open as of late-October and 43% had returned to full staffing

- Business insolvencies were down 24% year-over-year in Q3

Some industries are still struggling

- The latest CFIB survey showed re-opening rates remained low in the most heavily-impacted industries, including hospitality (31% fully open as of late-October) and arts and recreation (37%)

- The same survey indicates 18% of businesses are still operating with less than half their usual staff and 1/4 are making less than half their usual revenue

- Less than 1/5 of businesses in the most impacted industries have returned to full staffing and only 10% have returned to normal revenue

- Nearly 40% of businesses said they were losing money every day they were open, and 14% were actively considering bankruptcy or winding down operations—the latter is closer to 1/4 in the most impacted industries

The second wave will hurt small businesses

- As of late-October, half of businesses surveyed by CFIB—and as many as 3/4 in the most impacted industries—reported a drop in sales due to the second wave

- 3/4 of businesses said “uncertainty around a second wave” was one of their top concerns

- A Statistics Canada survey from mid-September to late-October showed that, relative to larger firms, small businesses are less likely to be prepared financially for a second wave of COVID-19

Ongoing government support will remain crucial

- That Statistics Canada survey also showed small businesses were more likely to report financial constraints, or challenges maintaining sufficient cash flow or managing debt, compared with larger firms

- Fewer small businesses had the cash or liquid assets they need to operate, and more small businesses said they couldn’t take on more debt

- Among reasons for not accessing funding, small businesses were more likely to report application requirements or complexity or lack of awareness

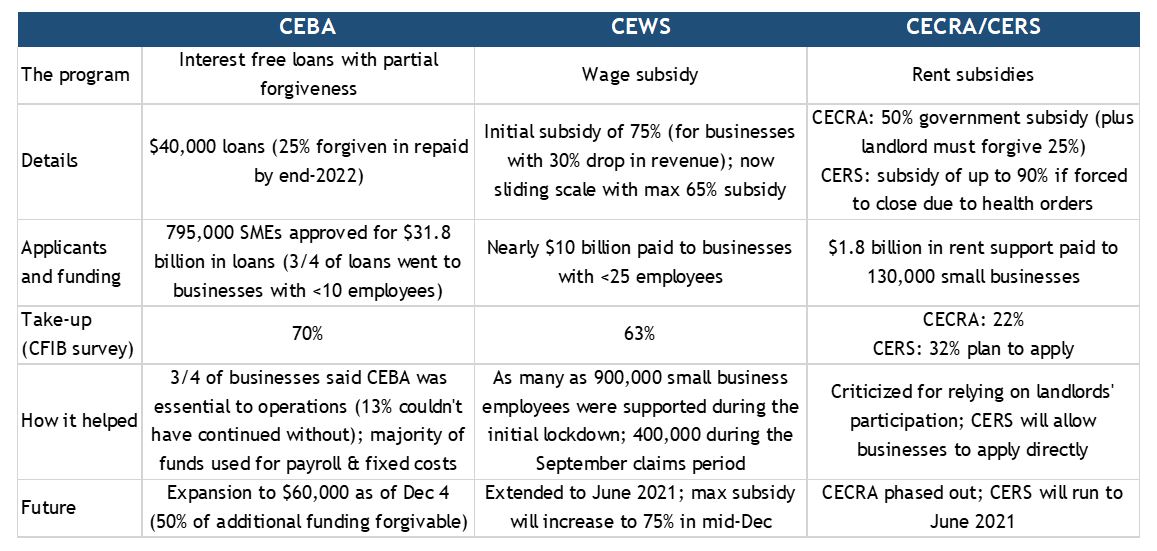

- In the CFIB’s survey, 64% of businesses strongly agreed or somewhat agreed that the updated suite of federal relief programs (CEWS, CERS and CEBA) offer their business “the lifeline it needs to survive”

- The federal government says it will launch a new Highly Affected Sectors Credit Availability Program (HASCAP) offering 100% government-guaranteed, low-interest loans of up to $1 million with maturities of up to 10 years for businesses in sectors like tourism, hospitality, hotels, arts and entertainment

Some small businesses are adapting to the pandemic and new normal

- Relative to larger firms, small businesses were less likely to have some e-commerce sales pre-pandemic

- According to a CFIB survey, 20% of small businesses were selling online pre-pandemic, 8% started selling online since and another 5% are in the process of setting up e-commerce

- Businesses in hardest-hit industries are among the top e-commerce adopters

- The same survey showed 22% of small businesses—as many as 1/3 in retail and 1/4 in hospitality and arts and recreation—will increasingly rely on online sales to survive COVID-19

But others face challenges pivoting to e-commerce

- Of the 17% of small businesses that had no web presence in 2019, 30% cited barriers like lack of technical expertise or said setup and maintenance costs were too high

- According to a Statistics Canada survey, relative to larger firms, fewer small businesses reported plans to increase sales through e-commerce channels and fewer planned to permanently increase online sales capacity post-pandemic

- A CFIB survey showed the top reasons businesses aren’t adopting e-commerce are lack of knowledge of how to apply e-commerce to business model, lack of technical expertise or resources, and additional costs

- Sectors including hospitality and health and personal services reported limited ability to quickly pivot to online or phone sales

- 1/4 of businesses surveyed said selling online has been a struggle, generating little or no revenue

- According to a BDC survey, 30% of entrepreneurs have not yet found a way to make online sales profitable, and 33% of those relying on online sales said they need to gain expertise and knowledge in the field

References:

BDC, How Entrepreneurs Are Adapting to the Pandemic

Canadian Federation of Independent Business (CFIB), COVID-19: State of Small Business (various survey dates)

Canadian Federation of Independent Business (CFIB), Small Businesses’ Experience with eCommerce during the Pandemic

Gu, Wulong (Statistics Canada), Economic Impact of the COVID-19 Pandemic on Canadian Businesses across Firm Size Classes

Office of the Superintendent of Bankruptcy Canada, Insolvency Statistics

Statistics Canada, Canadian Survey on Business Conditions

Statistics Canada, Labour Force Survey (microdata)

Statistics Canada, Survey of Digital Technology and Internet Use

Originally published on June 11, 2020

“Too big to fail” was the guiding principle for policymakers as they shored up systemically important banks, insurers and supply chains during the 2008-2009 global financial crisis. As Canada navigates an urgent route through the current COVID 19 pandemic, the emerging policy motto must be “too small to fail.”

The small enterprises that are crucial to the Canadian economy – representing 42% of GDP and 48% of new jobs – are also those at greatest danger in this unique recession. Tending to be “digital novices” –a significant number are without a website, or the ability to facilitate online payments – small firms were ill-prepared for the rapid economic shift that has emerged in the pandemic’s wake, an abrupt lurch to a virtual marketplace that has caught many off guard.

This crisis may be the moment for these companies to reboot and reposition themselves for a new economy that will be more digital, more virtual and more mobile than anything we’ve seen.

The ability of our nation of small businesses – the local barber shops, health food stores, software startups and greenhouse operations – to pivot to this new reality will be critical to Canada’s overall recovery.

In short, Canada’s rebuild depends on small business’s rebound.

In a new report from RBC Thought Leadership, Small Business, Big Pivot, we lay out a five-part plan to help Canadian small businesses thrive in a post-pandemic economy.

Read the full report and recommendations

What we found:

- Small firms have recorded almost double the rate of job losses as mid-sized and large firms.

- Small firms in five sectors—accommodation and food services; arts and entertainment; non-essential retail; mining and oil & gas services; commercial real estate leasing—are most vulnerable; potentially affecting 1.2 million workers.

- Small firms in sectors like technology, wholesale trade and administrative services face a relatively lower risk; their fixed-cost burden is lighter and they can deliver products and services with little to no physical contact.

- Women and youth face the greater job risk from small-business woes; they’ve suffered outsized employment declines already.

- We expect GDP in some of our hardest-hit sectors to remain around 25-50% below February levels at the end of the year, even as the recovery takes hold.

- The pandemic is creating new economic trends and accelerating others, offering roadmap for an altered economy: more digital delivery; more domestic procurement; less market concentration; more consumer caution.

Charting a course out of the pandemic won’t be as easy as flicking a digital switch, nor can it mean a reversion to practices that worked in the past.

Fiscal support and a rebound in consumer spending will ensure an overall recovery. But its scale and speed will depend on how small firms reimagine themselves to confront the challenges and opportunities of the post-pandemic business landscape.

Here’s how the country can help:

1. Streamline relief programs. As we shift to a recovery, the government has an opportunity to refresh and streamline its business relief programs. Most immediately, those options could include:

- a topped up Canada Emergency Business Account (CEBA) and modified Business Credit Availability Program (BCAP) with greater forgiveness to cover a protracted recovery and help owners retrofit facilities for social distancing

- changing the Canada Emergency Response Benefit (CERB) to allow for a sliding scale to be paid to those going back on payroll;

- offering a brief tax holiday for small businesses to spur the recovery of local shopping and tourism.

2. Invest in capacity for safe reopening. Provincial governments should consider investing in broad-based programs to help employers restart their businesses. These could include:

- a nationally-coordinated program to certify public-facing facilities as COVID-safe;

- provincially-led and funded coalitions of business groups and chambers to provide personal protective equipment to small companies;

- an initiative to remotely connect students with small businesses to help them gain work skills and mentorship opportunities.

3. Build digital networks. Small firms will not only need tools for a post-pandemic economy, they’ll need to form alliances to compete in the global platform economy. A recovery plan needs to incorporate a digital strategy that could include:

- tax credits for small firms to invest in Canadian designed software and hardware to enable digital growth;

- a national program to create virtual farmers’ markets and virtual Main Streets;

- an acceleration of the Budget 2019 commitment to provide high-speed Internet to every Canadian and business by 2030.

4. Set new economic strategies to help scale. Governments and large enterprises have an opportunity to invest in sectors that leverage Canadian supply chains and fuel small business growth including:

- coordinated procurement efforts to designate preferred small business suppliers with a special focus on PPE, testing and tracking technologies and health care;

- Canada 2020-21 tourism campaign to spur domestic travel;

- a renewed provincial commitment to lower interprovincial trade barriers for small firms in 2021.

5.Create a more strategic approach to globalization. In a world that is likely to be more fragmented, Canada will need a more focused approach to trade. We may need:

- a “Go Global” program using trade accelerators to boost exports to countries more open to Canadian goods;

- a coalition of governments, banks and other institutions to form a “Brand Canada” platform for small firms;

- expanded expat networks to connect knowledge-based industries with global Canadians.

To learn more about how small businesses are transforming for the virtual economy, listen to our podcast episode.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More