Calling Canada’s housing market ‘hot’ is an understatement. Prices have passed the boiling point in many parts of the country as eager buyers outbid one another amid low single-family home inventories. In the past six months alone, single-family homes surged $100,000 (or nearly 15%) in value in Canada. This was by far the steepest increase for the national benchmark price on record. The country’s most expensive markets, Vancouver and Toronto, recorded above-average gains of $143,000 and $139,000, respectively. Yet it was markets in the periphery that led the way. Single-family home prices soared $147,000 in Barrie and $145,000 in the Fraser Valley since August. Hamilton-Burlington (up $137,000), Kitchener-Waterloo (up $114,000) and London-St. Thomas (up $104,000) weren’t far behind. Single-detached homes also got a lot more expensive in other BC markets, virtually all of southern Ontario, and parts of Quebec and the Atlantic Provinces.

A mix of exuberance and haste

Clearly homebuyers continue to be a force to be reckoned with a year into the pandemic. Rock-bottom interest rates, changing housing needs and high household savings seem to have motivated many to make a move—or take the investment plunge. But there’s more at play here. Rapid property appreciation has opened the door to speculation, and instilled buyers with a sense of urgency—fearing they might miss out on buying a home they can afford if they wait any longer. A recent uptick in longer-term interest rates might also be dialing up the eagerness to act with some seeing the increase as a turning point for interest rates. In short, self-reinforcing price dynamics have taken hold in many parts of Canada, and are poised to keep things boiling in the near term.

Condos bucking the trend but for how long?

Downtown condo apartments are the main exception. So far, that is. Condo price increases (about $12,000 in Canada over the past six months) have been relatively subdued. Toronto and Edmonton even recorded declines. A strong pick-up in condo activity and firming demand-supply conditions since December, however, point toward stronger condo prices later this year. We expect this category’s affordability advantage to generate increasing buyer interest as vaccinations against COVID-19 reach critical mass and authorities further ease restrictions.

How will this end?

Signs of overheated market conditions of course raise the risk of a price correction down the road. Our base case scenario, though, remains that prices will continue to appreciate in the year ahead, albeit at a slower and slower pace as we get closer to 2022. A creeping-up of longer-term interest rates, deteriorating affordability, the resumption of office work and possible policy intervention will eventually cool homebuyer demand and set the stage for a soft landing. We think modest outright price declines could be in the cards over the medium term, perhaps by the latter stages of 2022 when interest rates rise more broadly.

February market highlights

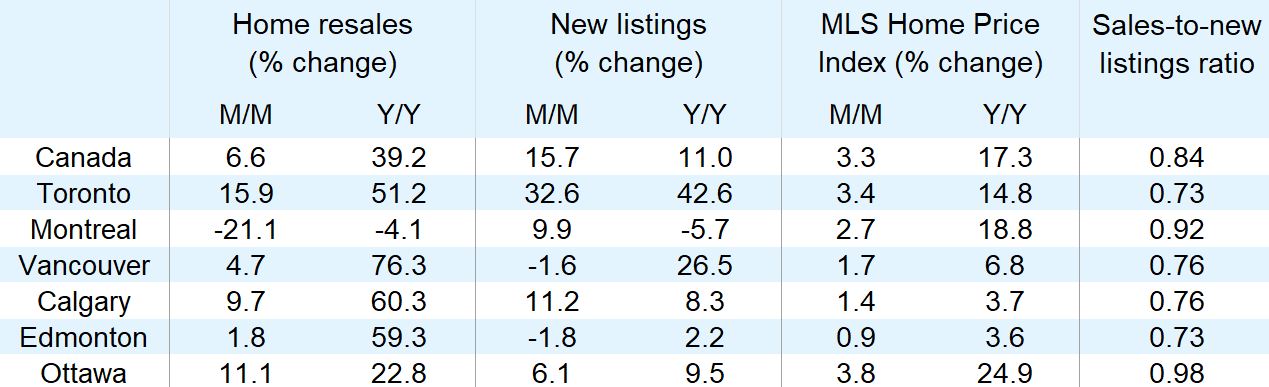

- Home resales climbed one more step into record territory: Sales increased 6.6% from January to 783,600 units (seasonally adjusted and annualized) in Canada, or 39% above the year-ago level. Activity was especially strong in Ontario where a majority of markets notched sizable gains, including London (up 24% m/m), Kitchener-Waterloo (up 20%), the Niagara region (up 16%) and the Greater Toronto area (up 16%). Western Canadian markets also recorded solid advances, with Saskatoon leading the way (up 19% m/m) followed by Calgary (up 10%), Winnipeg (up 7.1%) and Vancouver (up 4.7%). Montreal bucked the trend with a sharp 21% m/m drop—though the level remained historically high.

- Sellers returned to the market: After stepping away in January as lockdown measures were reintroduced in many parts of the country, sellers made their way back in February. New listings rebounded a solid 15.7% m/m in Canada. Ontario markets saw some of the stronger increases though significantly more sellers also showed up in many markets in Quebec and Atlantic Canada.

- Demand-supply conditions eased but were still very tight: The sharp increase in new listings helped loosen what had been the tightest conditions ever in January. The sales-to-new listings ratio in Canada fell from 0.91 in January to 0.84 in February—still far above the 0.60 threshold giving sellers the stronger hand in setting prices. The ratio is above that threshold in all markets covered by the Canadian Real Estate Association.

- Home prices soared further… and faster: Canada’s aggregate MLS Home Price Index jumped 17.3% y/y in February, marking a sharp acceleration from rates of 13.6% in January and 9.4% in August last year. The single-family home index blasted through the 20% line for the first time ever, with the annual increase coming in at 22.1%. The condo index increased more modestly by 4.2%— though this represented the first acceleration in seven months. Properties in many markets in Ontario, Quebec and parts of Atlantic Canada appreciated at rates exceeding 20% y/y, with some surpassing 30%.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More