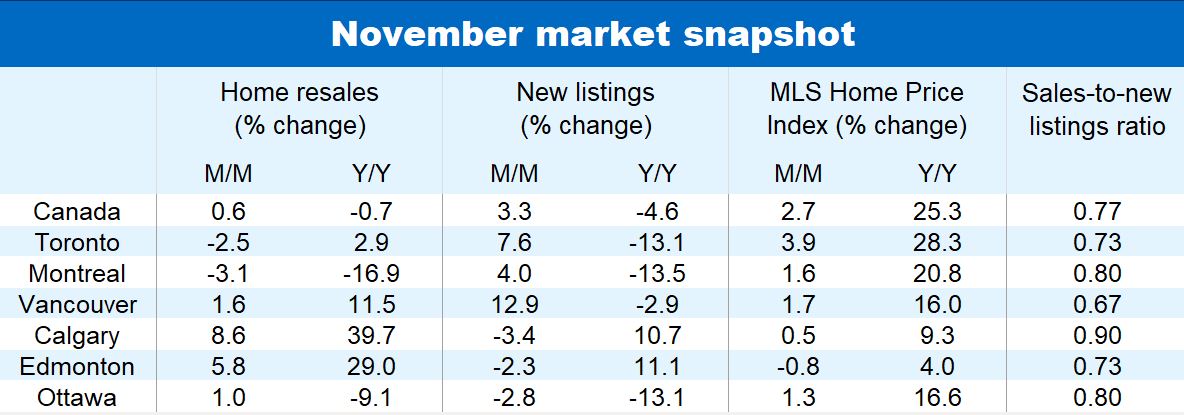

Canada’s housing market keeps on rolling. Not even growing affordability issues seem to hold back buyers (we’ll have more to say on affordability next week). Home resales picked up 0.6% m/m to 651,000 units (seasonally adjusted and annualized) in November nation-wide. They could have been higher had it not been for a dearth of homes for sale. New listings did increase (up 3.3% m/m) but not nearly enough to meet the huge demand that’s out there. Local markets across the country remain critically short of supply as 2021 draws to a close. And this keeps a raging fire under property values. The MLS Home Price Index for Canada jumped for a third-straight month, surging 2.7% from October. Relative to a year ago, the index is up an astounding 25.3%—a record high. Despite signs of cooling this past spring and summer, our housing market is ending 2021 the way it started it: scorching hot.

Home prices escalate in Ontario, BC and Atlantic Canada

This is especially true in Ontario, British Columbia and parts of Atlantic Canada where home prices continued to escalate at a blazing clip last month. More than a third of local Ontario markets recorded a benchmark price increase of 3% or more from October, led by North Bay (up 5.5%), Brantford (up 4.2%) and the Greater Toronto Area (up 3.9%). Most BC and New Brunswick markets saw prices jump more than 2% m/m. Vancouver was absent from that group with a rise of ‘just’ 1.7%. The hefty gains in these regions came on top of earlier massive appreciation. The MLS HPI is now up more than 30% from a year ago in three-quarters of Ontario markets and half of BC markets. Annual gains even exceed 40% in some markets (Bancroft, Brantford and North Bay).

Upward price pressure is present in other regions as well

Elsewhere in the country, price pressure may be less intense but are generally present nonetheless. Montreal’s benchmark price rose a solid 1.7% m/m in November, or close to 21% y/y. The monthly and annual rates were 2.2% and 12.6%, respectively in Winnipeg—both near historical highs. The pace was comparatively more subdued in Alberta and Saskatchewan but still generally positive. Edmonton was the only market in Canada where the MLS HPI fell from October (down 0.8%).

Demand-supply conditions tight, tight, tight everywhere

Low inventories and tight demand-supply conditions are endemic. The sales-to-new listings ratio—a usually reliable gauge of price pressure—remains tilted in favour of sellers (and often heavily so) in every market. Some easing in conditions took place in November with new listings rising in British Columbia (including Vancouver), Ontario (including Toronto), Quebec (including Montreal) and Nova Scotia (including Halifax). Yet this did little to rebalance markets in a meaningful way. Tight conditions are poised to keep driving prices higher in the near term.

Activity strengthened in Western Canada

Home resales are still remarkably brisk after such powerful rally since the summer of 2020. Activity even picked up further in most of Western Canada last month, as confidence in the market continued to rebuild in Alberta and Saskatchewan. Some slowing occurred in other parts of the country. Toronto, Montreal and Halifax recorded modest declines from October—though resales still generally stood well above (strong) pre-pandemic levels.

A longer-lasting passing phase?

It’s increasingly hard to dismiss this fall’s renewed vigour (and heat) in the market as just a passing phase. Yet we remain of the view that much of buyers’ current impetus has to do with looming interest rate hikes. We believe many buyers are rushing in before higher rates take purchasing budget room away from them. The latest market statistics now suggest this phenomenon might have longer to run, possibly into the first few months of 2022. We still think, though, that rapidly deteriorating affordability and easing pandemic restrictions will gradually cool demand and moderate price growth over the course of the coming year.

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More