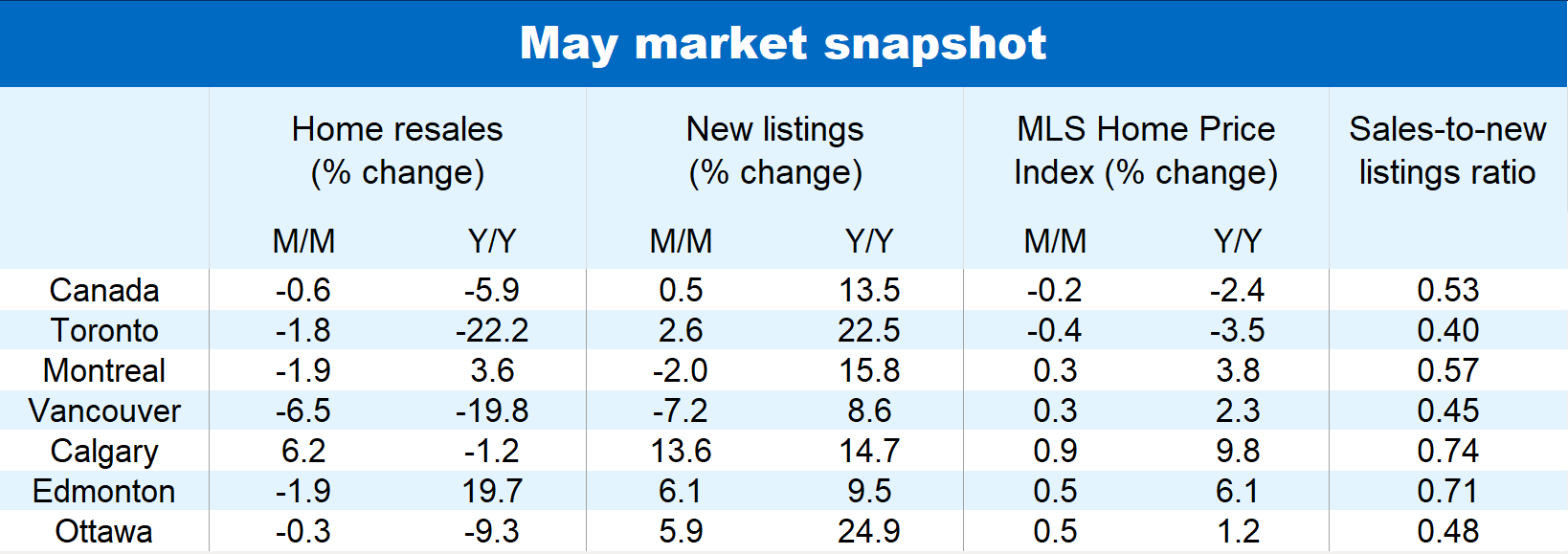

The spring-long stalemate between buyers and sellers stretched into May. Home resales and prices were little changed nationwide, edging lower by 0.6% and 0.2% from the previous month, respectively. High interest rates and poor affordability have taken the wind out of the market’s sail for some time but a looming rate cut—delivered by the Bank of Canada in early June—likely prompted some buyers to hold off on a purchase until the uncertainty cleared.

Meanwhile, inventories continue to build. Expressed in number of months of sales, they’ve rebounded to pre-pandemic levels (4.4 months) in Canada. New listings rose from a month ago for the fourth time this year in May. Broadly speaking, the increase in supply is returning the market to a balance after reaching extreme lows during the pandemic.

Soft spring in Ontario

Housing markets still vary considerably across the country. Activity got especially quiet this spring in Ontario with resales slipping successively, almost entirely reversing last fall’s mini rally. Supply-demand conditions have swung in buyers’ favour in a majority of markets and home prices eased month-over-month in a handful of them, including the Greater Toronto Area.

It’s also been a slow spring in British Columbia, Quebec, New Brunswick and Nova Scotia, though prices generally held firm. Balanced market conditions continue to provide support for property values despite a steady rise in supply. The MLS Home Price Index appreciated modestly May in Victoria (0.5% m/m), Vancouver (0.3%), Montreal (0.3%), Moncton (0.2%) and Saint John (0.9%). It fell in Halifax (-0.6%), however, following a hefty gain in April.

Hectic prairie markets

Buyers and sellers have stayed busy over the past several months in most of Alberta and Saskatchewan. The volume of home sale transactions easily surpassed pre-pandemic levels in Calgary, Edmonton, Regina and Saskatoon. That was still the case in May even though activity slipped on a monthly basis in the last three of these markets. Very tight supply-demand conditions continue to apply strong upward price pressure. Calgary leads the country with a near double-digit annual increase in its MLS HPI (9.8%).

Edmonton (6.1%) isn’t far behind. Property values appreciated further in both markets in May from April. That wasn’t the case in Regina and Saskatoon, though, where slight monthly declines were recorded.

More interest rate cuts needed to get market moving faster

The BoC’s June rate cut could potentially spur activity if it pulls in a critical mass of buyers from the market’s sidelines. However, our view is a 25 basis point reduction in the still high policy rate won’t make much of a difference for most budget-constrained buyers. Several more cuts—as well as a meaningful drop in longer term rates—would be needed to unleash the large pent-up demand that has built over the past couple of years. We think more favourable conditions will emerge later this year and into 2025. We expect the central bank to cut its rate by a further 75 basis points by the end of this year and by 100 basis points in 2025.

Steady flow of sellers to be sustained

Supply is likely to grow in the meantime. Still high interest rates will continue to sting current mortgage holders, prompting some—including investors—to sell. Mounting housing completions are also bringing more properties to market. A flurry of newly completed condo projects in Toronto, for instance, have recently contributed to growth in inventories in that market.

We expect muted demand and growing supply will keep prices largely stagnant in the near term in most markets outside the Prairies.

See PDF with complete charts

Robert Hogue is an Assistant Chief Economist at RBC responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More