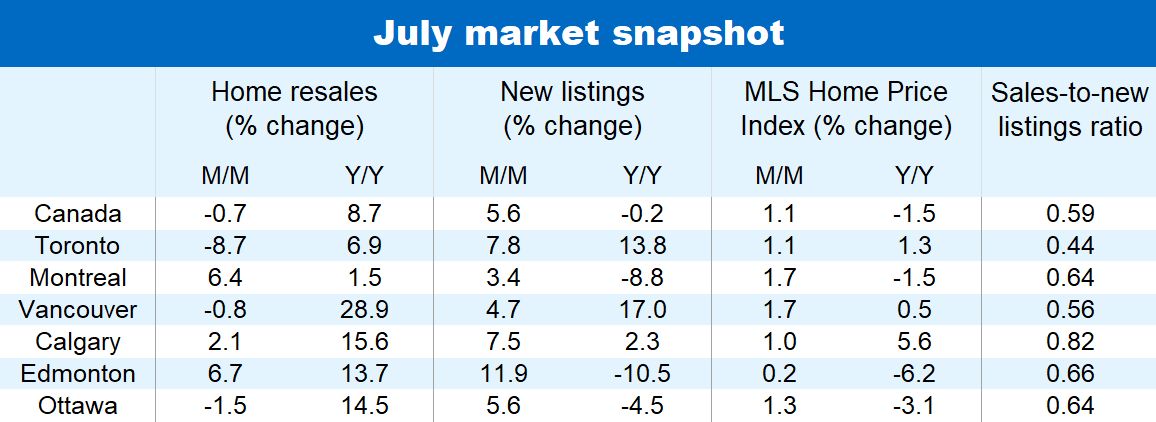

The Bank of Canada’s latest back-to-back hikes have put a damper on the housing market’s rebound this summer—extremely hot weather and massive forest fires also possibly impacted activity in some regions. Home resales edged lower (-0.7% m/m) nationwide for the first time in six months in July.

This dip occurred despite a further solid increase in new listings (up 5.6% m/m), which should be helping unlocking supply. New listings have now surged 24% since April—fully reversing declines earlier this year.

Market developments over the last two months have brought overall demand-supply conditions in Canada back into balance after tightening surprisingly fast this spring.

Property values are still generally appreciating at a vigorous clip at this stage though the pace eased noticeably in July. The MLS Home Price Index rose 1.1% m/m, down from an average 1.9% rate in the previous three months. We expect price gains to continue moderating in the months ahead as better balance between demand and supply reduce upward pricing pressure, and higher interest rates trim buyers’ purchasing budgets.

Sales momentum slowing in BC and parts of Ontario

Notable sales softness was reported last month in BC—particularly the Fraser Valley (-11.1% m/m) and to a lesser extent Vancouver (-0.8%). Ontario was more of a mixed bag with Toronto (-8.7%) and surrounding areas—like Hamilton(-3.7%) and Kitchener-Waterloo (-5.9%)—posting sizable drops. But sales increased in Ontario’s more affordable markets to the west (e.g. London, Niagara and Windsor). Activity also continued to rebound in Quebec (including Montreal), the Prairie provinces (including Calgary, Edmonton, Regina, Saskatoon and Winnipeg), and parts of Atlantic Canada (including Saint John).

More homes put up for sale from coast to coast

Sellers are stepping out of the sidelines in every region of the country, significantly driving up new listings in the process in some markets. This was the case in Victoria (+9.5% m/m), the Fraser Valley (+9.5%), Edmonton (+11.9%), Calgary (+7.5%), Regina (+6.9%), Hamilton (+15.2%), Kitchener-Waterloo (+21.2%), London (+19.9%), Toronto (+7.8%), Ottawa (+5.6%) and Saguenay (+28.2%) last month. While striking, these increases are from exceptionally low levels at the start of this year. They merely reset the bar closer to normal in most instances.

Home prices still rising solidly in most regions

The spring tightening in demand-supply conditions is unwinding rapidly in BC and Ontario. Softer sales and increasing new listings returned most markets in these provinces to balance, with Toronto the closest it’s been to a buyer’s market since January. Nonetheless, price appreciation remains generally brisk—running above 1% m/m (based on MLS HPI) in the majority of cases, including Vancouver (1.7%), Hamilton (1.8%), Toronto (1.1%) and Ottawa (1.3%).

It’s a similar story in Quebec and most of Atlantic Canada where prices generally remain on an upward trajectory. The MLS HPI even accelerated its ascent in July in Montreal (up 1.7% m/m) and Halifax (up 2.2%).

Interestingly, price gains were comparatively subdued last month in the Prairies. Edmonton’s MLS HPI was up just 0.2% m/m, Calgary 1.0%, Regina 0.8% and Saskatoon 0.4%. This may reflect the fact property values in these markets did not decline as much—or at all in Calgary’s case—during the recent correction.

From unexpected strength to stagnation?

The path ahead for Canada’s market is likely to be bumpy. We expect higher interest rates to keep curbing buyers’ enthusiasm for months to come, while possibly forcing the hand of some current owners to sell. A recession would further generate headwinds as rising job losses and economic uncertainty undermine market participants’ confidence.

We see this summer’s cooling as evidence the surprisingly strong rebound in the spring wasn’t sustainable. Our view had been—and remains—the recovery will be slow until interest rates are cut. What the spring rebound did, though, is bring forward the bottom of price cycle that we earlier anticipated around the fall. With prices rising sooner, the magnitude of the correction turned out to be smaller than expected. We think the resulting higher trough (in level terms) will restrain the pace of future price gains.

See PDF with complete charts

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More