Canada’s housing market’s downturn has longer to run. September data gave few indications the bottom is near. Both activity and prices continued to trend lower in the vast majority of local markets. Demand-supply conditions generally eased some more. And with further interest rate hikes likely on the way in the coming months, we expect more of the same in the period ahead across the country. That said, activity in Ontario and British Columbia may be closer to stabilizing (though not so much for prices due to persisting affordability issues).

Home resales keep sliding…

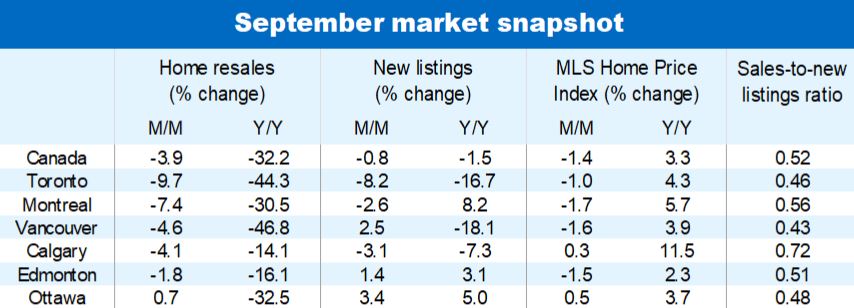

September marked the seventh-straight monthly decline in home resales in Canada (down 3.9%). This puts the correction at -36% since February. While Prince Edward Island (-10.8%), Nova Scotia (-8.1%) and Manitoba (-6.6%) saw the largest drop last month, it’s been British Columbia (-47%), Ontario (-41%) and Alberta (-41%) that fell the most in the past seven months. Activity is now below pre-pandemic levels in all provinces except Alberta, Saskatchewan, and Newfoundland and Labrador. Home resales in Canada (at 419,900 units on a seasonally adjusted and annualized basis) are the softest in a decade and likely to stay that way for a while longer.

…and so are prices

Property values similarly have declined in each of the last seven months nationwide and in most of Ontario (including Toronto), and the past six months in key BC markets (including Vancouver). Canada’s composite MLS Home Price Index fell 1.4% m/m in September, and is now down 8.8% since the February peak. Leading the price correction have been smaller markets in Ontario that saw tremendous appreciation earlier during the pandemic: Cambridge (-20%), Kitchener-Waterloo (-18%), Brantford (-16%), London (-16%) and Hamilton (-16%). Chilliwack (-13%) and the Fraser Valley (-11%) in British Columbia also recorded outsized declines since the peak.

Larger markets under heavy unaffordability pressure

Prices in larger markets are down significantly too—just not quite as much. Toronto’s MLS HPI has declined 9.2% (or $118,000) since February, including a 1% drop last month. The correction now ranks as the second largest in the area since the inception of the index in 2000, and is rapidly closing in on the downturn that took place in 2017-2019 (-10.9%). Vancouver’s index is off 5.7% (or $71,000) since March. We think it has much further to go given the intense unaffordability pressures currently in place. Our latest Housing Trends and Affordability report noted Vancouver buyers face the highest ever ownership costs anywhere in the country. Falling prices are a more recent phenomenon in Montreal where the MLS HPI crested in May. The correction is picking up steam, though. September saw the biggest drop (-1.7% m/m) so far, deepening the downturn to -4.7% (or -$25,600).

Softness reaching Atlantic Canada

After holding firm through late spring-early summer, property values are now coming down in much of Atlantic Canada. Halifax to date has seen the sharpest price correction in the region with its MLS HPI falling 6.8% over the past five months. Saint John isn’t far behind, recording a 6.4% drop over three months. Fredericton (-2.6%), Moncton (-2.0%), and for the first time last month, Prince Edward Island are also past their peak prices. St. John’s remains one of the few markets bucking the broad softening trend but this may not be for much longer as demand-supply conditions are easing.

Prairies a pocket of resilience

The erosion of prices is modest in many Prairie markets. This reflects stronger provincial economies, the resumption of in-migration and relatively affordable properties. Regina’s MLS HPI is off just 1.6% since its April peak. Saskatoon’s index fell 0.6% in September for the first time this year. Calgary’s index even edged higher by 0.3% last month after levelling off through the spring and summer. Edmonton (down 5.3% since peak) and Winnipeg (down 6.0%) were two markets that had similar trends than the rest of the country. Winnipeg had seen some of the larger price increases of the Prairie region earlier in the pandemic.

Quiet period to persist

We expect home resale activity to stay quiet in the coming months from coast to coast. The sharp interest rate increases to date and likelihood of additional hikes in the coming months—we anticipate the Bank of Canada will take its policy rate deeper into restrictive territory to 4% by December—will continue to hold back buyers. We see this depressing demand further though some markets may have more limited room to fall. We think resales have plummeted to such low levels in many BC and Ontario that they will soon reach a floor.

Prices to trend down until the spring

Rising rates will intensify affordability issues in the near term and sustain heavy downward pressure on home prices. We expect benchmark prices will fall approximately 14% nationwide by next spring from the recent peak, with steeper declines (-16%) in Ontario and British Columbia, and milder corrections in Alberta and Saskatchewan (-4%).

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More