Higher interest rates continue to cool down Canada’s housing market following a surprising solid rebound this spring. August marked the second-straight month home resales dipped (down 4.1% from July) and home price gains moderated. Earlier tight demand-supply conditions eased further as the number of homes put up for sale climbed again (albeit slightly). The majority of local markets have sharply rebalanced by now. We think the cooling trend will extend into the fall season despite the Bank of Canada pausing its rate hike campaign.

Sales momentum slows across most major markets

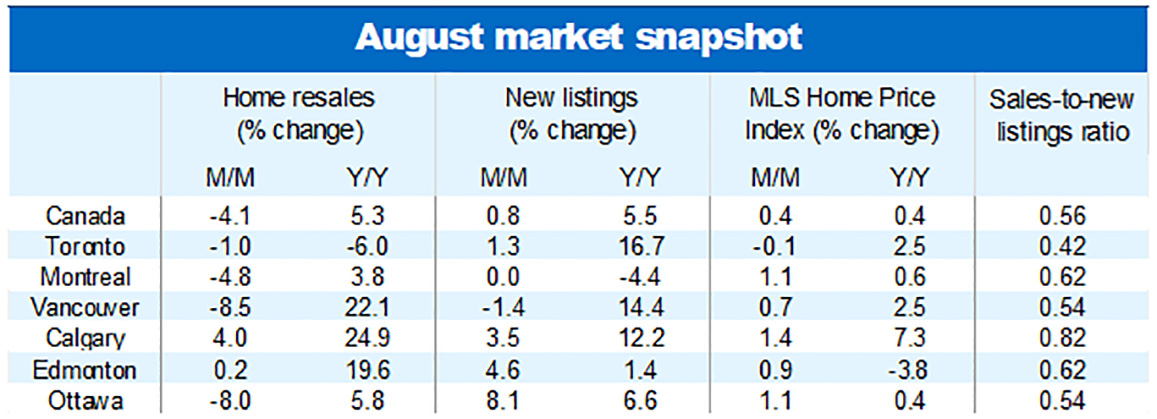

The retreat in home resales last month was sharpest in British Columbia – particularly the Fraser Valley (-12.1% m/m), Victoria (-10.8%), and Vancouver (-8.5%). A softer tone was also present in Ontario where even its more affordable markets (for example, Sudbury and Windsor-Essex) reported material declines. The Greater Toronto Area recorded a modest 1.0% drop though surrounding areas – such as Hamilton-Burlington (-11%) and Kitchener-Waterloo (-7.7%) posted more sizable drops.

Activity in Quebec also hit a soft patch. Month-over-month sales activity contracted across all CMAs except Trois-Rivières.

With the exception of Halifax (-7.5% m/m) and Saskatoon (-0.2%), markets in the Prairie and Maritime regions continued to rebound. Calgary (+4.0) remained one of Canada’s hottest markets.

Demand-supply conditions eased across most markets

The supply side of the equation was more varied across markets in August. There was about an equal number of them recording an increase in new listings as a decrease. Still, this didn’t stop demand-supply conditions from broadly easing. Most markets in British Columbia, Ontario, and parts of Quebec and Atlantic Canada are in balance territory.

Prairie markets remain generally tight though. Sellers in Calgary, in particular, hold considerable pricing power.

Home price growth reaches slowest pace in five months

More balanced conditions are lessening the degree of competition between buyers, which helps pin down price escalation. Canada’s MLS Home Price Index rose at the slowest pace in five months in August, up just 0.4% from July. That’s less than a quarter the average rate of 1.8 recorded between April and June.

Still, prices have now moved above year-ago levels. The national MLS HPI was up 0.4% y/y in August. Halifax (9.5%), Calgary (+7.3%) and Quebec City (+6.4%) lead the country among larger markets on that front.

Quiet activity expected over the back half of the year

We believe Canada’s housing market is likely to stay relatively calm in the months ahead. High interest rates and homeownership costs are expected to continue crossing the budget line for many potential buyers, and a looming economic downturn is poised to undermine the confidence of market participants. The same factors could also potentially strain existing homeowners – forcing the hand of some of them to list their property. We think more balanced will keep the pace of future price gains muted. Slight declines cannot be ruled out.

See PDF with complete charts

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More