We saw a healthy number of new listings come to market this April—but even so, buyers remained on the sidelines across most major Canadian markets. Slower sales amid the influx of supply brought the available inventory back to pre-pandemic levels, relieving some of the supply-demand pressure in Canada’s housing market.

Unlike prior months, activity dropped more broadly across regions with Saskatchewan, New Brunswick, and Newfoundland the only provinces to record a month-over-month increase in activity in April. Canada’s more expensive markets, on the other hand, continued to show softness.

Sales activity remains slow in anticipation of interest rate cuts

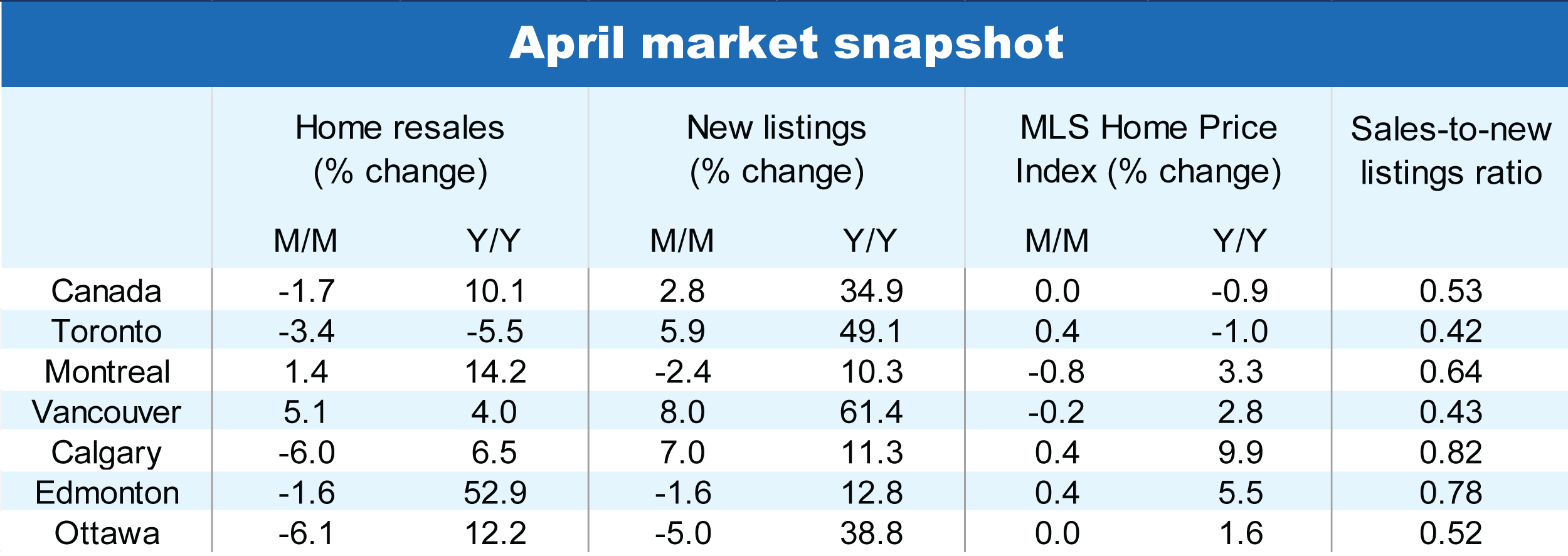

April was another quiet month for resale activity in Canada. Seasonally adjusted home resales fell 1.7% month-over-month at the national level, bringing activity down to the lowest point this year. The market softening was more broad-based in April which was a disruption from the mixed market activity observed earlier this year.

Even Alberta, where activity has been fairly strong, posted a drop in activity (-4.5% m/m). We take this reading with a grain of salt as month-over-month sales can be volatile, particularly early in the busy spring buying season. However, this could also be early indication of potential buyers tapping out after months of aggressive home price growth. We’ll look to sales activity in the coming months for a clearer picture of buyer appetite in the province.

Some markets in Quebec (-1.3% m/m) also changed course, recording weaker sales this April. A similar trend was observed in Halifax (-6.2% m/m) and Winnipeg (-4.6% m/m) as well.

As in prior months, activity was weakest in Toronto (-3.4% m/m) and its surrounding areas—including Hamilton-Burlington (-3.8% m/m)—and some major B.C. markets—like Victoria (-3.7% m/m) and the Fraser Valley (-8.1% m/m). Vancouver, on the other hand, bucked the weakening trend with a 5.1% increase (m/m). This is the second consecutive month sales growth in this jurisdiction has outperformed the national average.

More sellers come to market

We saw more sellers come out of the woodwork this April. The influx of listings helped ease some of the housing market pressure in Canada, bringing inventory back to it’s February 2020 level of 4.2 months worth of supply.

Sellers were especially active in B.C. and Ontario this April. We expect some of the increase was in response to the federal government’s change to the capital gains inclusion rate as sellers rush to list their unit(s) ahead of the June implementation date.

New listings activity increased in Canada’s tighter Alberta and Saskatchewan markets as well, though new listings activity is still materially lower than pre-pandemic levels—keeping supply-demand conditions particularly tight

Home prices remain flat

Home prices remained flat in April, following a marginal 0.2% m/m decline in Canada’s MLS home price index in March. This marks the third consecutive month where price growth has been virtually unchanged. We see this as a clearer indication that Canada’s home price correction has largely run its course. Strong activity last spring, however, means prices are slightly lower than year-ago levels again.

The acute lack of affordability is keeping prices from picking up materially in most markets. Hotter Prairie markets—like Saskatoon (+1.0% m/m) and Calgary (+0.4% m/m)—were among the few markets where prices continued to climb at a solid clip. Toronto (+0.4% m/m) also posted a third consecutive increase in it’s composite MLS Home Price Index in April, indicting a gradual recovery from the sluggish period this winter.

Notwithstanding the inflow of new listings recorded last month, we still expect prices to rise more gradually over the second half of the year and into 2025.

Budget constrained buyers keep activity subdued

Though the influx of new listings has helped rebalance Canada’s housing market, budget constrained buyers are keeping housing market activity subdued. At the margin, we could see recent tax changes prompting more investors to sell before changes to the capital gains inclusion rate take effect this June—but ultimately, we think a pivot towards rate cuts will be needed to get the wheels turning faster. For now, poor affordability appears to be keeping buyers on the sidelines.

See previous editions of Monthly Housing Market Update.

Download the Report

Rachel Battaglia is an economist at RBC. She is a member of the Macro and Regional Analysis Group, providing analysis for the provincial macroeconomic outlook. She holds a Bachelor’s degree in Economics (honours) from the University of Western Ontario and a Master of Science from the Amsterdam School of Economics.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More