Monthly Housing Market Update

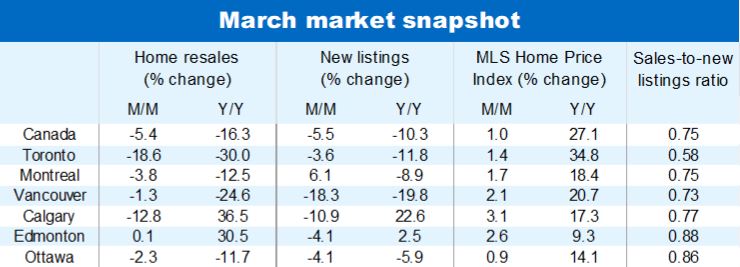

This year’s spring market kicked off on a slightly weaker note across Canada though (so far) this may have more to do with supply constraints than softer demand. Home resales and new listings both fell by similar extents in March—down 5.4% m/m and 5.5%, respectively, nationwide—keeping inventories scarce. Still, the decline in activity was just a minor blip. Resales remained brisk (at 659,000 units, seasonally-adjusted and annualized) and far above pre-pandemic levels. Any cooling effect from the Bank of Canada’s early-March interest rate hike—the first since 2018—likely was minimal.

Still tight, tight, tight for the most part

With few units to fight over, fierce competition between buyers barely let up. Demand-supply conditions in all but one market (Toronto) still strongly favour sellers, fueling further widespread price appreciation. The only hint of a market shift is a moderation in the rate of price increase. Canada’s composite MLS Home Price Index rose ‘just’ 1.0% m/m in March, or close to a third of the average monthly increase in the previous five months (2.9%). Relative to a year ago, the rate of appreciation eased from 29.2% in February to 27.1% in March.

Prices decelerate in Ontario and British Columbia

Markets in Ontario (including Toronto) and parts of British Columbia (including Vancouver) accounted for most of the price deceleration last month. Some markets (for example, Cambridge, Brantford, Hamilton and Kitchener-Waterloo) even saw outright month-to-month declines—all following historic run-ups in the prior six to 12 months. We think these could mark turning points. We expect high-flying property values to face increasing downward pressure in the period ahead as interest rates rise.

Higher interest rates and affordability issues to pose challenges

With its 50-basis point hike to 1.0% on April 13, the Bank of Canada set an aggressive course to return its policy rate to a neutral level by year-end. We believe the Bank will add a further 100 basis points over the next six months to 2.0%, or slightly above pre-pandemic levels (1.75%). Higher borrowing costs will worsen already stretched affordability conditions in many parts of the country, which we see cooling homebuyer demand in the period ahead.

From supply restraint to softening demand

We expect further moderation in activity over the remainder of this year though it will increasingly reflect softening demand rather than supply scarcity. Peak prices may be coming soon in some markets as demand-supply conditions become more balanced and extremely bullish sentiment fades.

Local trends diverging

More intense downward pressure may build in Canada’s pricier markets. That’s because they are most sensitive to higher interest rates. We expect activity and prices to be more resilient in Alberta where local markets have more catching up to do following a prolonged slump before the pandemic.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More